CLOs Face “Extinction Level Event” As Moodys Prepares To Downgrade A Fifth Of All CLO Bonds

Over the past month, in its quest to bailout the richest Americans and the country’s financial system, the Fed has unleashed an unprecedented array of actions meant to backstop capital markets, going so far as buying investment grade, high yield bonds and even AAA-rated CLO bonds.

It won’t be enough.

In what would mark the most draconian and widespread ratings action since the financial crisis, on Friday Moody’s warned it may cut the ratings on $22 billion of U.S. collateralized loan obligations – a fifth of all such bonds it grades – as a result of the collapse in cash flows due to the Covid-19 pandemic.

The ratings agency took action on 859 bonds from 358 CLOs that package leveraged loans into securities of varying degrees of risk and return. The step – which according to Bloomberg affects about 19% of Moody’s-rated CLOs that purchase broadly syndicated loans – comes as the underlying debt gets downgraded at a record pace.

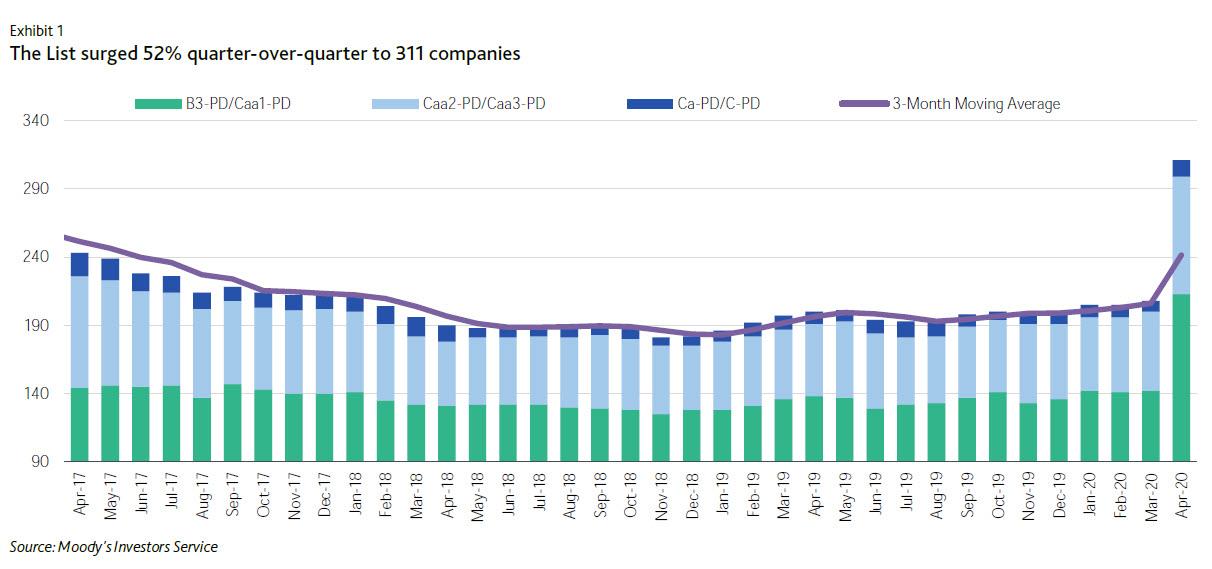

Earlier in the week, Moodys reported that its “B3 Negative and lower list” soared to its highest tally ever — 311 companies. That tops a former peak of 291 companies, reached during the credit crisis of 2009 and the commodity-related downturn in April 2016. At 20.7% of the total rated spec-grade population, the list also shot up above its long-term average of 14.8%, and closing in on its all-time high of 26.1%. This spike is the result of the confluence of a coronavirus outbreak, plunging oil prices, and mounting recessionary conditions, which created severe and extensive credit shocks across many sectors, regions and markets, the effects of which are unprecedented.

And with the underlying bonds set to suffer an unprecedented collapse in solvency, it is only a matter of time before the products where they are packaged are also hammered.

Which brings us to what some have called a possible “extinction level event” for the CLOs space, and not just the lowest rated tranches. On Friday, Moody’s warned that as a result of a surge in expected losses on the CLO securities which have “increased materially,” it could downgrade an unprecedented 20% of all CLOS, with more than 40% of the bonds on review having an investment-grade rating, with 13 rated A, and 355 rated at the Baa level. The rest have sub-investment ratings through to CCC.

While we have discussed the importance of CLOs for both the US loan markets – and Japan’s banks and insurance companies – on numerous previous occasions (here, here and here), in a nutshell CLOs are the biggest buyers in the $1.2 trillion leveraged loan market, which in recent years fueled a boom in debt-fueled buyouts and other transactions. But the loans have been particularly hard-hit in the market rout triggered by the pandemic, with a benchmark index plunging last month to the lowest level since the global financial crisis (although the index has recovered some of its losses in recent weeks when the Fed stepped in to partially backstop the sector).

As Bloomberg notes, the extent of losses that CLO bonds incur depends on the deals’ exposure to downgrades and other negative ratings actions on the underlying loans, as well as the bonds’ priority in the capital structure. How much cushion the bonds have either from asset coverage or cash flow diverted from riskier debt that sits below them is also a factor.

In any event, the more severe the downgrades, the greater the impairments for structured investors, with losses potentially stretching deep into the A-space. And while Moody’s said it usually tries to conclude its ratings reviews within 90 days, the “high degree of uncertainty” of the current environment may mean it takes longer.

Or not: in summarizing the surge in deep junk rated companies, the rating agency said that “key indicators flashing red on an alarming rise in spec-grade credit stress, increasing defaults” and added that “a wide range of industry outlooks turned negative in the first quarter of 2020, based in large part on the economic consequences of the coronavirus outbreak.” Worse, “the share of companies carrying B3 ratings is much higher than at the start of 2009, providing tinder to fuel future downgrades. These companies will find it difficult to refinance debt in deteriorating economic conditions and, once downgraded, could ultimately face a default if markets remain shut to lower-rated issuers.”

Moody’s warning comes just hours after S&P also on Friday put 155 CLO bonds on review, accounting for about 6.3% of its rated CLO securities.

And while some may say the Fed will fix it, recall that the expanded Term Asset-Backed Securities Loan Facility (TALF) announced by the Fed last Thursday only buys AAA-rated bonds of CLOs, which after the Moody’s downgrade is complete, will not only collapse in nominal size but will mean that any further attempts to stabilize the CLO space will require yet another Fed backstop of even riskier – i.e., rated AA and lower – structured products.

Tyler Durden

Sat, 04/18/2020 – 20:10