WTI Crashes To 19 Year Low As Trading Reopens; S&P Futures Slide

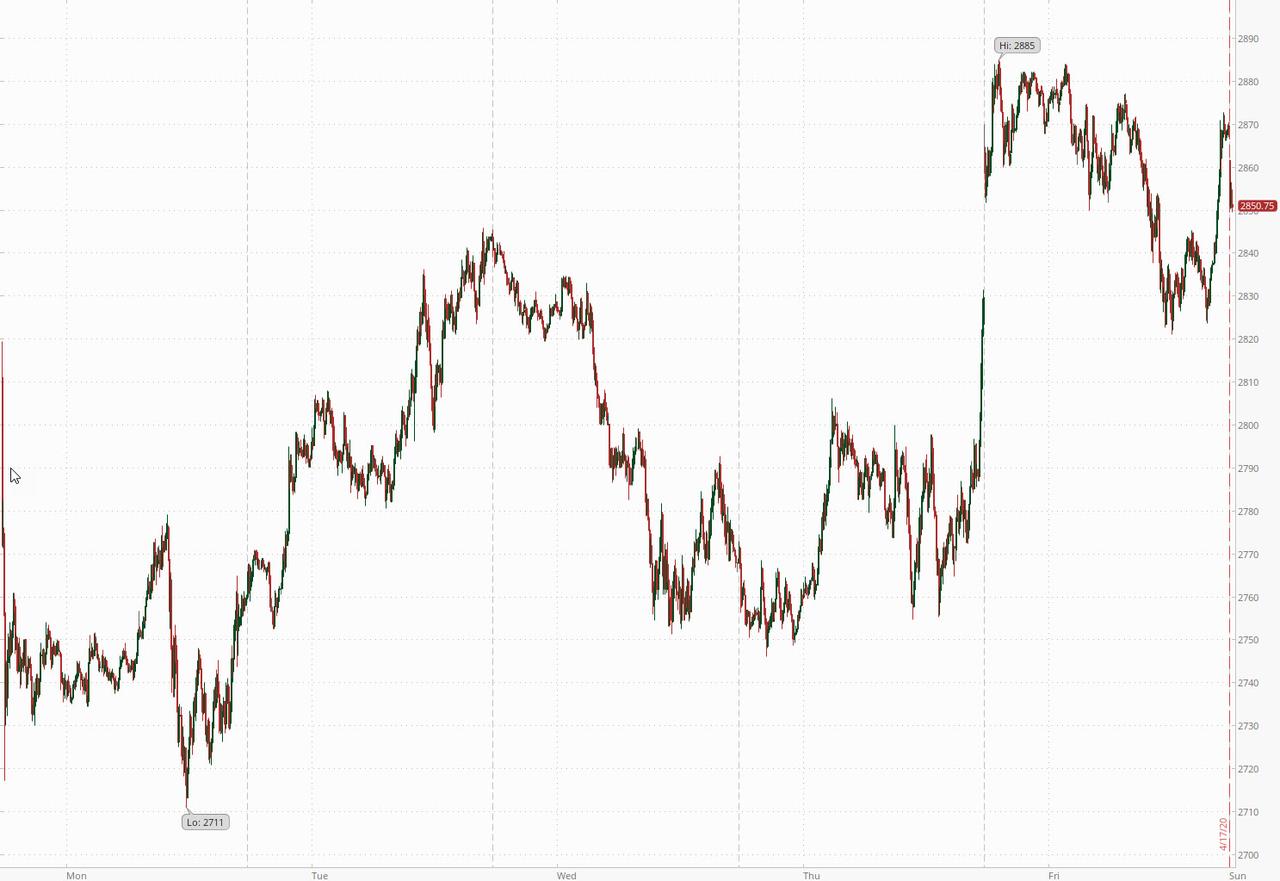

After a relatively drama-free weekend, futures have started off the new week lower by about 0.4%, trading at 2850, down 20 points from Friday’s CTA inspired and momentum-driven meltup which appears to be reversing as algos realize they have frontrun a rebound in not just 2021 earnings but also 2022 and 2023.

However, just like last week, it is commodities and specifically oil where the deflationary puke is taking place, with WTI tumbling over 5% at the open, and sliding to $17.30, down more than $10 from last Monday’s post OPEC+ kneejerk reaction higher and the lowest price since November 2001,

The ongoing crash in oil which OPEC+’s agreement to cut 9.7mmb/d in output last weekend has failed to halt, takes place as Crude prices in the US oil capital are getting dangerously close to zero. According to Bloomberg buyers bidding for crude in landlocked sections of Texas, ground zero of the shale revolution, are offering as little as $2 a barrel for some oil streams, a precipitous markdown from a month ago. And, as discussed here on various occasions, the plunging value of physical barrels is raising the possibility that Texas producers may soon have to pay customers to take crude off their hands.

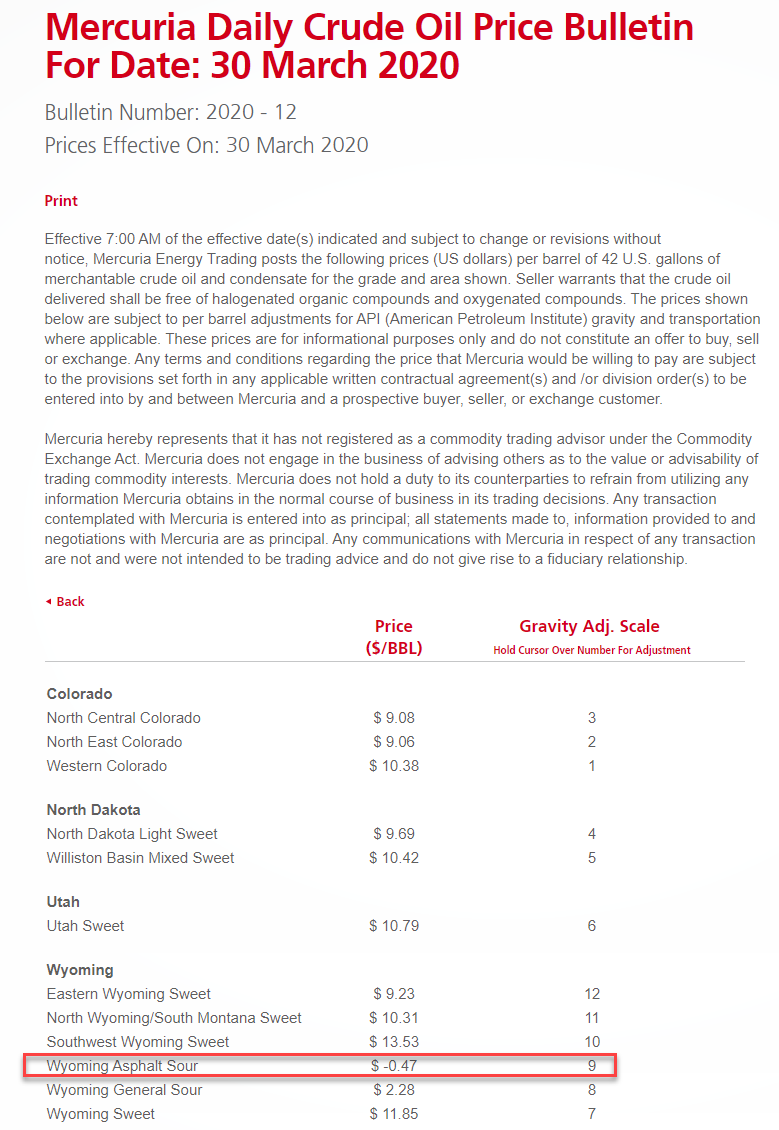

Negative prices already hit more obscure corners of the North American oil market amid a bearish trifecta of collapsing demand, swelling supplies and limited storage capacity. AS we reported at the end of March, the first U.S. grade to bid under zero was a small landlocked crude stream known as Wyoming Asphalt Sour, which went for negative 19 cents a barrel last month.

Meanwhile, in Texas prices are heading in that direction. A subsidiary of Plains All American Pipeline bid just $2 a barrel for South Texas Sour on Friday, while Enterprise Products Partners LP offered $4.12 for Upper Texas Gulf Coast crude this week, according to Bloomberg.

“I’ve never seen Texas crude oil transition to negative price” but it’s possible, said Andy Lipow, president of Lipow Oil Associates LLC in Houston. “It’s happened in the natural gas market at the Waha hub in west Texas,” Lipow added.

Fast depleting storage is still a major issue against a backdrop of unprecedented demand destruction from the coronavirus pandemic, and these could pressure prices below zero fast, Lipow added. To be sure, producers have been stashing oil both on land and at sea, with crude tankers now carrying a record 160mmb/d, double the amount two weeks ago, and there is still at least 150 million barrels of available land-based capacity. “But it’s the fill rate that is likely alarming the market, said Reid I’Anson, a global energy economist at Kpler, an industry research firm. Stocks at the key storage hub at Cushing, Oklahoma, have risen 18 million barrels in three weeks, which is 20% of shell capacity, he added.

The good news is that negative prices would be “extremely temporary,” said John Auers, executive vice president at energy consultant Turner Mason & Co. Under those circumstances, ultimately, supply will be forced to shut in. On that note, we will only remind readers that the Fed’s QE was also supposed to be temporary and instead if has since mutated into a permanent debt monetization ponzi scheme.

Tyler Durden

Sun, 04/19/2020 – 18:30