Central Banks Have Pumped An Annualized $23.4 Trillion Into The Financial System

You know there is a lot of confusion in the market when even fundamental, deep-value investing bloggers legends like Howard Marks now flip-flop every single week (accompanied by one investor letter after another) from bearish to bullish and back again, as if so much has changed besides, you know, the stock market:

-

April 20: Widely followed investor Howard Marks says the stock market rebound is not reflecting reality

-

April 14: Howard Marks Bemoans Fed Help for Junk Bonds, Leveraged Debt

-

April 8: Howard Marks says it’s time to stop playing defense: ‘We’re buying today when we find good value’

-

March 16: Howard Marks says the market is ‘pricing in a bad scenario’ and there is value for investors

But while Marks may simply be talking both sides of his book – see “Howard Marks’s Oaktree Seeks $15 Billion for Biggest Distress Fund Ever“, the vast majority of traders have legitimately lost the plot, and merely follow momentum or whatever the algos are doing at any given moment.

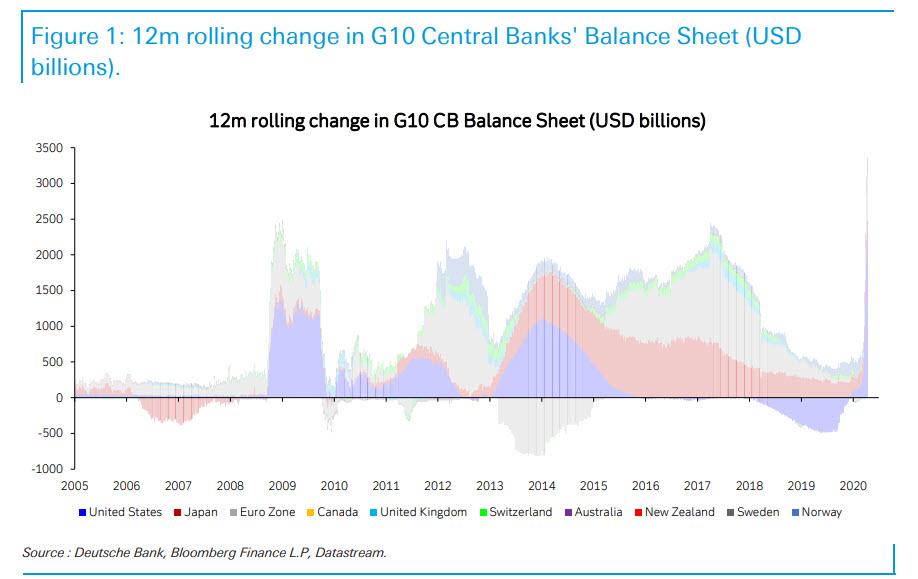

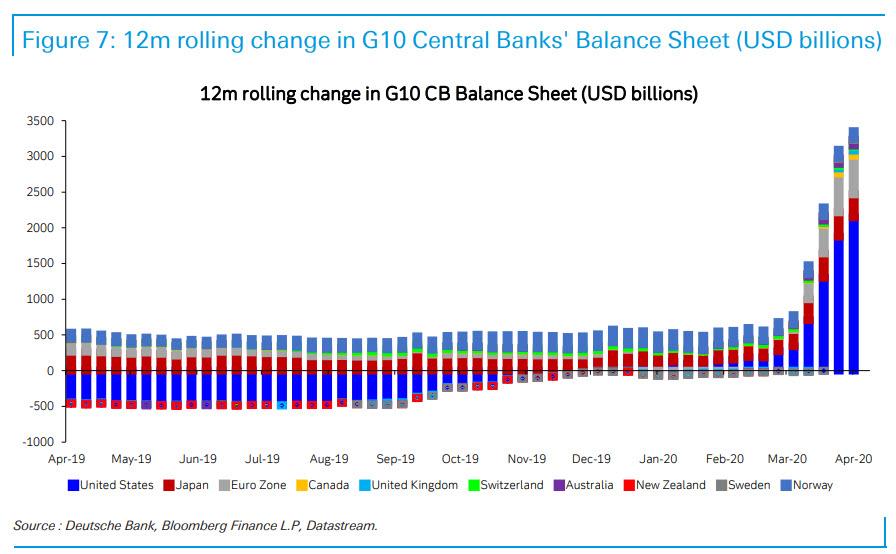

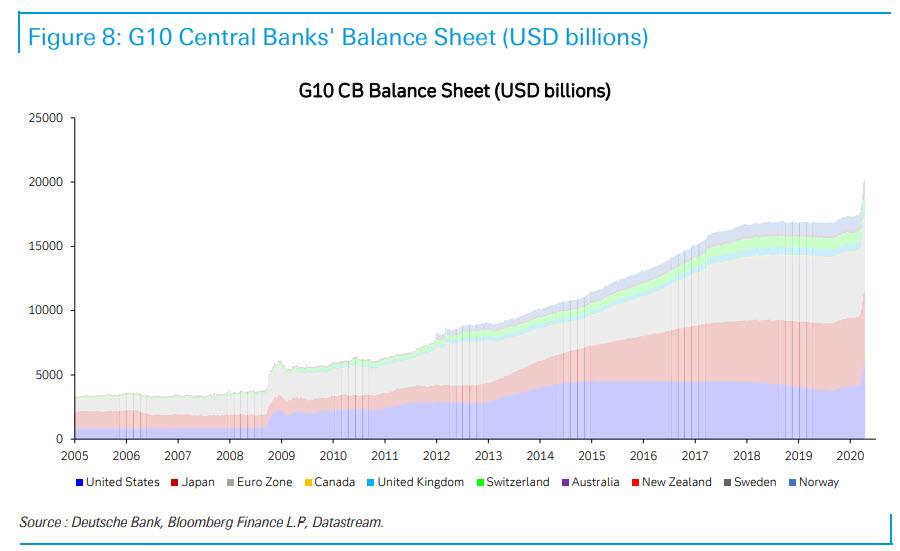

As Deutsche Bank’s Jim Reid explains, the most confusing thing in the market at the moment is the huge dichotomy between what will possibly be one of the worst synchroniszd global economic slumps in history against what is undoubtedly the largest ever intervention. On the second point, DB’s Alan Ruskin showed that global central bank balance sheet expansion has already spiked by $2.7 trillion since early March which now comfortably eclipses the full peak 12-month increase seen during the GFC (under $2.5tn). This is the same amount as the annual total GDP of either the UK or French economies. Two thirds of this increase has come from the Fed so far.

Again using Reid’s back of the envelope calculations, “given that the global economy is worth around $80 trillion dollars annually and that the IMF last week said it would fall -3% in 2020 (in real terms under the base case) that’s potentially ‘only’ $2.4 trillion of lost activity. Relative to the pre-covid trend they forecast $9 trillion of global GDP losses by the end of 2021.” And even if one thinks these numbers are a bit low, when central banks have so far pumped in an annualized $23.4 trillion into the financial system you can see how it’s hard to get a feel for where markets can go, besides eventually becoming a replica of the world’s best performing market, of course – that of Venezuela.

And while it unlikely that central banks will keep up that pace of liquidity injections unless economies fall even further but could you really have a situation in 1-2 months’ time where economies are still struggling to fully open and yet equity markets are back at record highs? While Reid doesn’t think so one certainly can’t rule it out given the ginormous liquidity injections. As he concludes “crazy times and we haven’t even mentioned the government injections.”

And speaking of Alan Ruskin, here is why the German bank’s macro strategist said that “Global QE is already on another scale.“

By almost any metric Central bank balance sheet expansion in the last few weeks has already exceeded anything seen in the 2008/9 crisis period. In the last six weeks alone, G10 Central banks have expanded their collective balance sheet by $2.7 trillion, and 2/3rds of this comes from the Fed.

The Fed has stepped up into a role sometimes seen by China, in its credit policies, and sheer scale of support.

The steep ascent of Central Bank balance sheets has of course been more than matched by the collapse in the global economy. Unprecedented QE policy accommodation will then build substantially from here, which warrants asking all the usual questions about what this might reap? The answers unfortunately belie simplicity. QE delivers very different results depending on circumstance, but in general, the marginal risk appetite gains from QE will wane with time.

The Fed appears to be working under the premise that in past crises of historic proportion, there are almost no occasions when the monetary authorities are remembered and accused of doing too much. So why not load the bazooka with the kitchen sink and go nuclear?

Theoretical models typically would see large scale QE as negative for a currency, but in this instance, the initial positive QE impact on risk (helping EM and commodity currencies) but also seen as an alternative to negative rates, is a mixed bag for the USD, enough to leave the USD choppy at elevated levels.

The experience during and after the 2008 crisis, is that markets are apt to initially support a major currency backed by an aggressive Central bank, especially when the economic morass that provoked the easing is universal. There is currently a brief window for many Central Banks to pursue QE, including EM Central Banks precisely because everyone else is doing it.

If persistent QE looks like the Central Bank is out of ideas, and, especially where the actions are enacted by a Central bank in isolation, QE will be greeted with a weaker currency. The EUR and JPY have periodically suffered this fate, and Japanization will become a more widespread phenomena in this downturn.

And here is why readers should be loading up on every bar of physical gold they can find, because once it becomes clear to everyone what the endgame is, and everyone demands delivery of their physical gold, the move in gold will be similar to what we saw in oil today, just in the opposite direction.

… when QE looks more obviously a cover for unsustainable fiscal policies and especially if the primary function appears to be long standing debt monetization, currencies will suffer. This is a story for 6 months and beyond, and is certainly relevant for EM countries, but may also be important for countries like the US, where fiscal discipline was abandoned before the crisis.

Finally, when even Deutsche Bank tells you to buy gold…

“Gold is a natural beneficiary of this latter stage QE, and looks to be already anticipating this outcome.“

… then it’s clearly time, amusing “who is the biggest goldbug sideshows” such as this one…

I spoke about this possibility on my live podcast today, which ended about an hour prior to your tweet. I also made a similar comment on my Twitter account three hours before you did. When I repeat a good point that you made, I always give you credit. https://t.co/OUEwfrRvsT

— Peter Schiff (@PeterSchiff) April 20, 2020

… notwithstanding.

Tyler Durden

Mon, 04/20/2020 – 20:55