Platts: 6 Commodity Charts To Watch This Week

Via S&P Global Platts Insight blog,

A revived agreement from OPEC+ on oil production cuts, China’s gradual restart after lockdown, and power markets in the doldrums are illustrated in charts picked by S&P Global Platts editors, in this week’s selection of trends from energy and raw materials markets.

Oil price wars

1. OPEC+ pulls a deal out of the bag, but will cuts be deep enough?

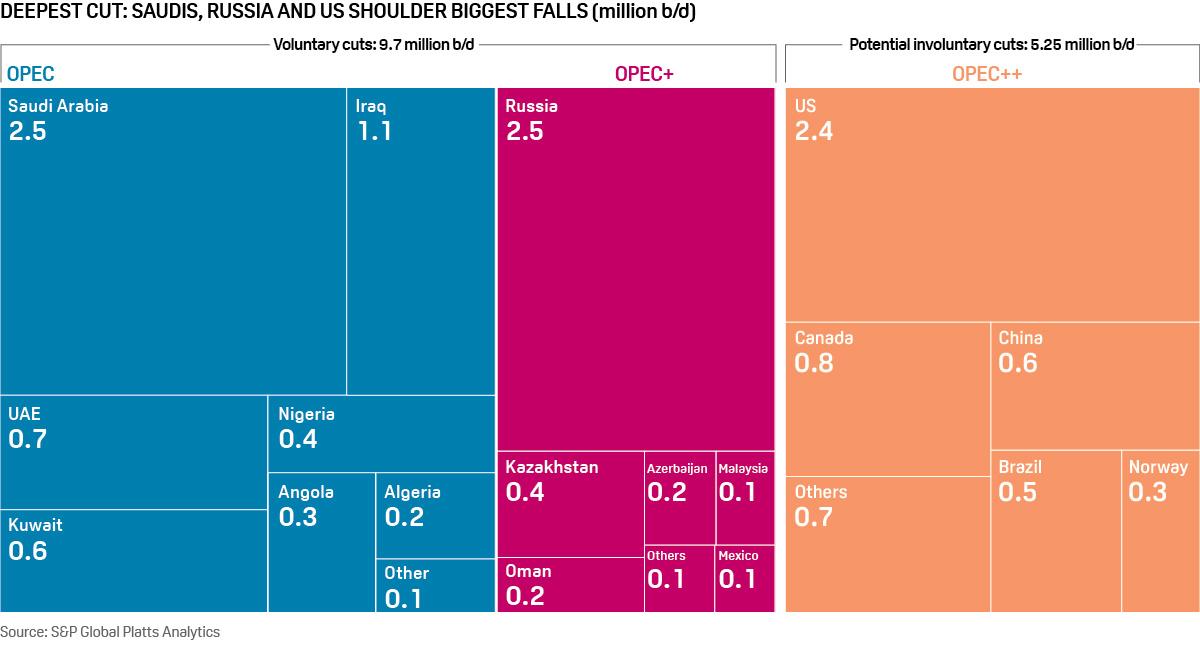

What’s happening: The 23 oil producing countries that make up OPEC+ have secured historic global support for cuts to remove around 15 million b/d from the market over the next few months. Saudi Arabia and Russia are set to lead by example by taking on a bigger share of the cuts, which come into effect from May 1 and include output reductions from countries outside the pact, including the US and Canada. The North American reductions are likely to be driven by market forces as low prices lead to production shut-ins, while India, China, South Korea and the US could also fill up their strategic reserves to take further crude off the market.

What’s next: Despite the scale of the agreement concerns remain that demand destruction from the spread of the coronavirus pandemic will still be too great to balance fundamentals and prevent global storage being exhausted. Storage could be filled up both on land and on sea by May, with few places for excess crude and oil products to go. However, the agreement could aid a quicker recovery in the second half of the year if lockdowns start easing and demand, especially for jet fuel and gasoline, begins to recover.

China’s economy and demand

2. Historic China GDP drop as country goes back to work

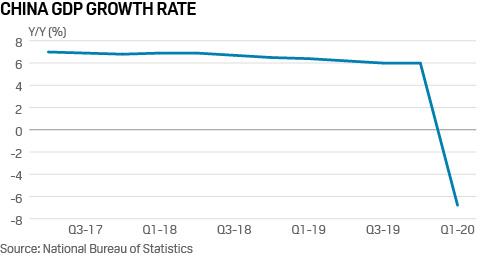

What’s happening ? China released its GDP data for the first quarter of 2020, which showed that the economy shrank by 6.8%, the first time since the mid 1970’s that China has reported negative growth. Higher frequency indicators suggest that the economy is on the rebound, with house sales and coal burn at power plants back to 80-90% of last year’s levels.

What’s next? The question is how long it will take for China to recover from this extreme short-term shock. The SME sector could be an area of concern, as many have gone to the wall over the last few months. Urban unemployment has risen and the cumulative movement of people into major cities is 20% down on last year. With external demand still weak it may be some time before this sector can rebuild itself and the economy is fully back to normal.

3. China provides some respite to crude sellers…

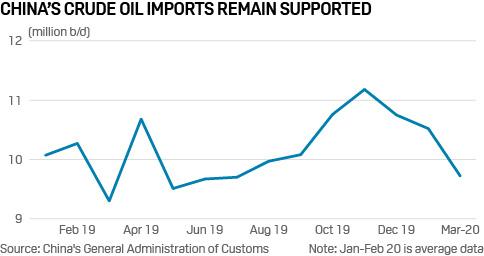

What’s happening: The loss to Chinese oil demand, at around 12% in the first quarter of 2020, outpaced the GDP fall in the same period. Kang Wu, S&P Global Platts Analytics head of Asia, said China’s oil demand took the bigger hit as strict travel restrictions drastically cut demand for transportation fuels like gasoline, gasoil, jet fuel and bunkers.

What’s next: A few key Q1 economic indicators, such as fixed-asset investment, industry production and transportation index, suggested economic activities improved in March from January-February, slightly helping a gasoil demand recovery. And China has in recent weeks emerged to be the only bright spot for crude sellers seeking to offload their cargoes, with Chinese refineries ramping up run rates as travel restrictions are eased. Notable deals include an independent refinery’s 1 million barrel purchase of Liza crude from Guyana for July delivery, and crude from crude from the Saudi-Kuwaiti Neutral Zone, which has only started production in recent months, now on its way to southern China.

4. …and upside for copper market, with caveats

What’s happening? Copper, often cited as a bellwether for the economy, has been recovering from recent lows as production curtailments kick in and China starts to return to work. Copper is currently back above $5,000/mt, having been sold down to almost $4,000/mt earlier in the year. The metal has been moving, at points, in lockstep with global equities, which are currently well bid and offering support. Before the pandemic broke copper fundamentals were starting to look fairly bullish.

What’s next? Uncertainty reigns over the economic outlook. With copper supply starting to come down, albeit at the same time as demand, some voices in the market suggest we have seen the bottom and the metal should be well supported going forward. Recent reports suggest the pandemic has delayed copper concentrate shipments to China, the globe’s largest consumer, which could affect copper smelting in the near term. A counter-argument is that those commentators are ignoring the state of play outside China, and that a world recession could see copper sold back down to recent lows.

Power problems

5. US coal plant files for bankruptcy as lockdown bites…

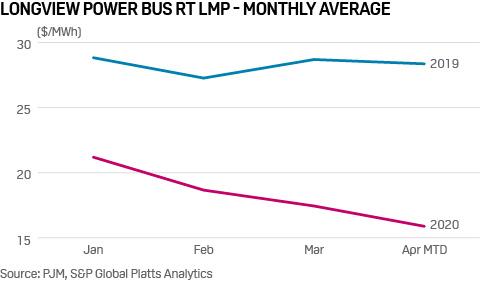

Chart shows real time power price at plant connection to grid

What’s happening? Power prices at the roughly 700-MW Longview Power coal-fired power plant’s interconnection point with the PJM system have declined steadily each month in 2020. The average April month-to-date price Longview receives for its power is around $15/MWh in 2020, down almost by half compared with nearly $28.40/MWh in 2019. Citing “unprecedented low energy prices” in the PJM Interconnection market along with coronavirus impacts, Longview filed for Chapter 11 bankruptcy protection.

What’s next? Longview is in the process of expanding the power generation facility by adding a 1,270 MW gas-fired plant that will be supplied by Marcellus Shale production, and a 70-MW solar installation occupying 300 acres adjacent to the existing coal plant. Longview expects to continue operating the coal power plant and moving forward with the new projects during the bankruptcy proceeding. However, the economics of US coal-fired power generation have been pressured by lockdown-driven natural gas and power price weakness, so it will be important to watch this space in the coming weeks. PJM is seeing weekday peak power demand down by 8%-10% due to stay-at-home orders.

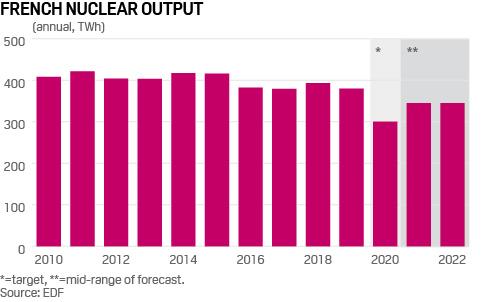

6. …while French nuclear giant slashes 2020 output target

What’s happening? French nuclear operator EDF cut its 2020 nuclear production target by an unprecedented 70 TWh on April 16 saying that may need to take a number of reactors offline this summer to save fuel for winter, as coronavirus restrictions impact annual refueling and maintenance across its fleet of 56 reactors. French Q3 power prices rebounded 27% last week after hitting record lows before Easter. The news also lifted prices in neighboring markets as the cuts call into question France’s position as Europe’s biggest power exporter, especially during the summer, and coincided with first steps to carefully restart Germany’s economy next month.

What’s next? Skipping annual maintenance and refueling for some French reactors this summer would have knock-on effects for 2021 and 2022. EDF also cut its outlook for those periods sharply, lifting year-ahead power prices across the region. Gas and some remaining coal plants could benefit if the cuts outweigh demand declines from the coronavirus crisis, increasing demand for EUA carbon allowance, and accordingly CO2 prices rose to a five-week high above Eur21/mt. Only last year saw higher carbon prices in Europe over the past decade, helping to stabilize power prices despite record-low gas prices.

Tyler Durden

Mon, 04/20/2020 – 12:10