Black Gold Bloodbath – ‘Paper’ Oil Plunging Everywhere

Forget Turnaround Tuesday…

Oil is a “dangerous market to trade in right now,” said Pierre Andurand, founder of Andurand Capital Management LLP, in a Bloomberg TV interview. The market needs shutins to happen now, he said.

“This has changed everything,” said Monica Malik, chief economist at Abu Dhabi Commercial Bank.

“So much of the recent recovery was based on the fact that the oil price had been above $50-$60, providing support to economic activity, and that’s just been decimated.”

This “price slump was psychologically very important,” said Eugen Weinberg, Commerzbank AG’s head of commodity research.

“There is a possibility it will change perceptions forever.”

* * *

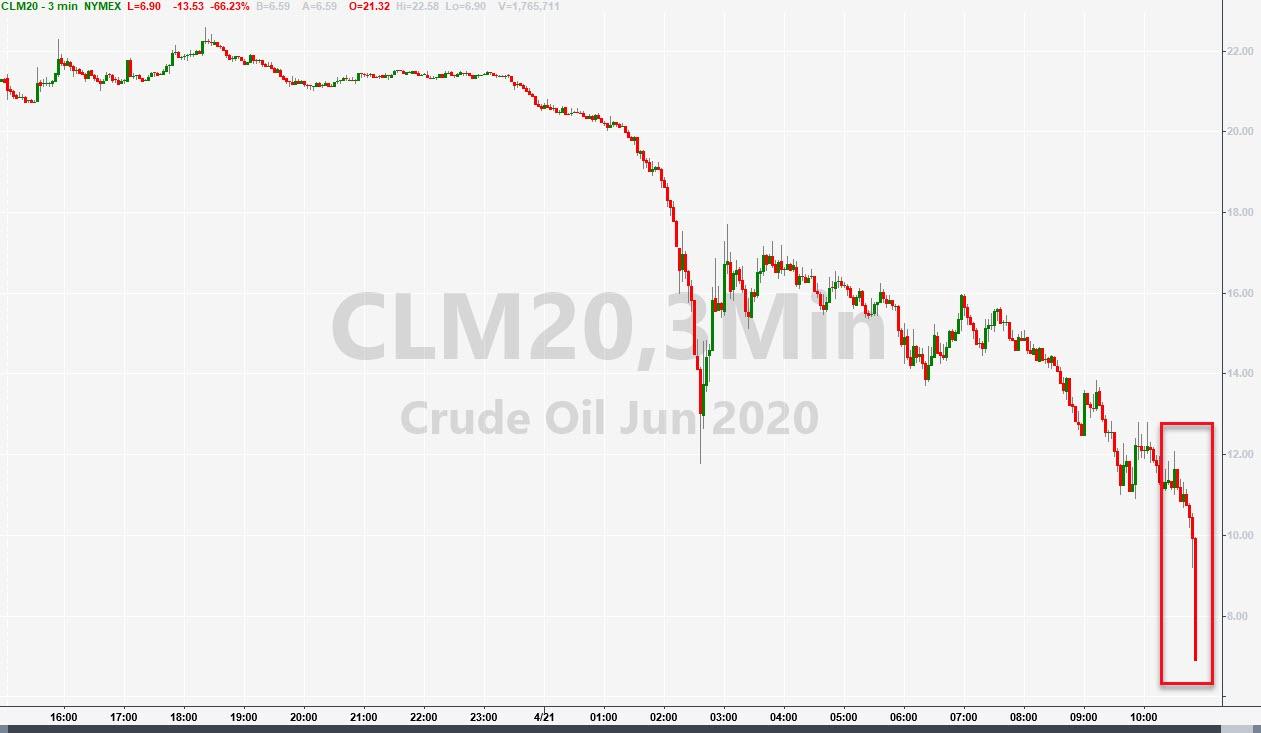

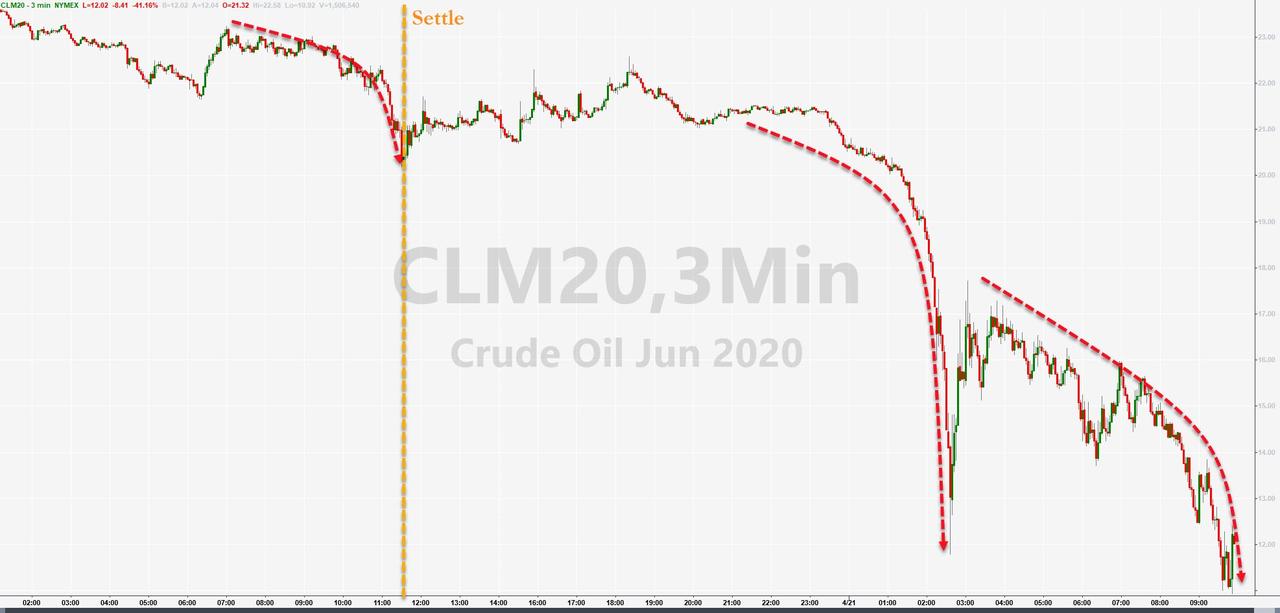

Update (1345ET): Here we go again. June WTI is now crashing – trading below $7 – down over 65% on the day…

And July is crashing, down over 30%, below $18…

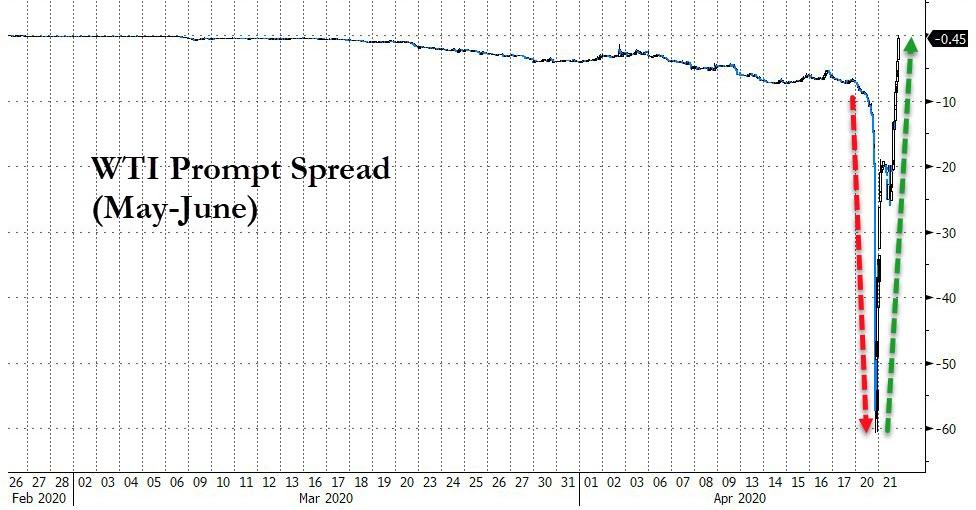

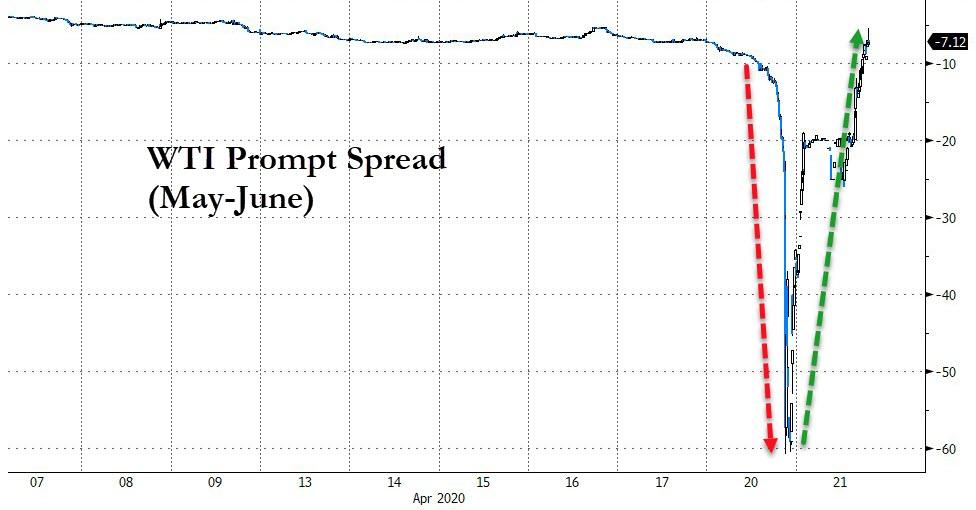

Remember the settle occurs at 1430ET (and the expiry of the May contract)… and the prompt spread (May-June) has surged back to zero…

USO is also testing pre-market lows as retail and the roll panic out…

“A lot of retailer investors are looking at it and realizing that they are losing money hand over fist,” Tariq Zahir, commodity fund manager at New York-based Tyche Capital Advisors LLC said.

“It’s undeniable that the USO is having a having a very big effect on the June contract and it wouldn’t be surprising if we go substantially lower.”

* * *

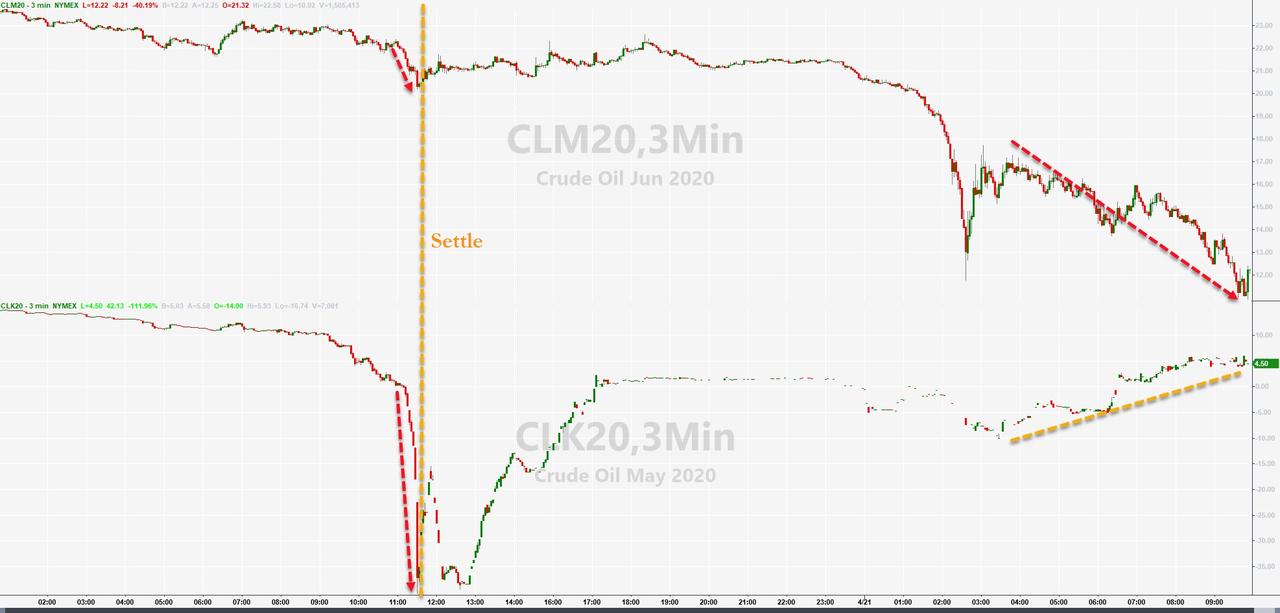

Forget Turnaround Tuesday, paper oil markets are collapsing once again with USO halted numerous times, OIL liquidated, and June futures puking hard in a repeat of yesterday’s May contract bloodbath…

May is rallying here as June crashes… (we suspect more ETF rolls)…

Sending the prompt spread soaring back…

But June is now down a shocking 45% to a $10 handle… and there is still 90 minutes until settlement.

Yesterday, the break of $10 was what sparked the waterfall in the May contract.

USO is down 30%…

Here are five analysts’ views on what’s happening in the world’s largest oil ETF…

Dave Lutz, macro strategist at JonesTrading:

“Retail investors should have a way to trade the price of oil, but USO has such problems with the roll effect that I’m not sure that’s the best vehicle. Problem is, it’s really the only one,” he said. In addition, “the fact that creations are suspended means that this is no longer going to track properly.”

Joseph Saluzzi, Themis Trading LLC partner and co-head of equity trading:

“Some ETFs are not exactly what you think they are — the rule for any investor is to know what you own. Some folks may have thought that USO was simply a proxy for the current oil price, and they didn’t really understand the mechanics of the oil futures market.”

Matt Maley, equity strategist at Miller Tabak + Co.:

“There is no question that this is a tool for investors of all sizes to bet on the price of oil. Many of these investors — again, of all sizes — have tried to pick the bottom in oil several times over the past week or two and they’ve all gotten burned. This has caused these buyers on weakness to become forced sellers. When the dust settles, it’s going to create an unbelievable opportunity for buyers. Until we get a better feeling of when the demand side of the supply/demand equation is going to improve, it tells me that the risks are still much too high compared to the potential rewards,” said Maley.

“I worry that it’s going to have a negative impact on liquidity in the oil markets, and thus have a negative impact on confidence in that market.”

Jeremy Senderowicz, a partner at law firm Dechert:

“Once creations are suspended then the arbitrage process cannot work as normal, as new shares cannot be created to meet increased demand,” he said.

“The 8-K says they are suspending creations because they’ve used up all the shares they’ve registered (they filed yesterday to register more shares but the SEC needs to declare it effective and they haven’t done so yet). That indicates that demand for the shares was quite high. If that demand continues, then until new shares can be created you can fill in the blank as to what might happen in trading…(which may be why they had the trading halt). That seems like the big takeaway to me.”

Dan Genter, CEO of RNC Genter Capital Management:

“The ETFs that are dealing with the contracts in the commodities are never going to take physical delivery, they can’t take it. There’s not a doubt the oil ETFs distorted the market. It was across the board but the ETFs, in our opinion, were the biggest problem,” he said. “The panic is because there are people invested in that commodity and in the contracts that not only have no intention of taking delivery, they have no capacity for taking delivery. All of a sudden, you’re up against a wall. They call it a contract for a reason.”

But, don;t worry, because President Trump will take the pain way… right?

Tyler Durden

Tue, 04/21/2020 – 13:49