It’s Not Just Oil: Another Critical Index Turns Negative, Hinting Funding “Crisis” Has Returned

It’s not the WTI May contract that shocked investors when it traded as far negative as -$40 on the historic date of April 20: also dipping into negative territory was another benchmark indicator, arguably far more important than an oil future contract: General Collateral.

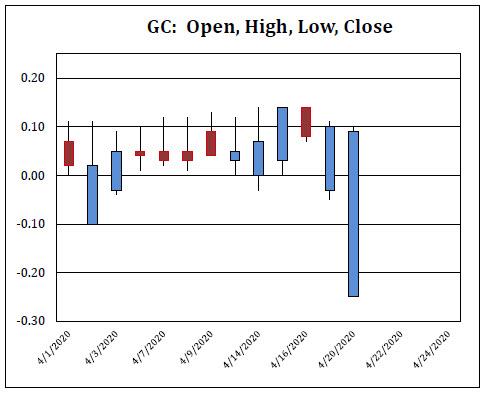

As Curvature’s Scott Skyrm writes, Repo GC rates began trading in the negatives in the morning [on Monday] and traded as low as -.25% [on Monday] afternoon. Unless there is a crisis or it’s quarter-end, it’s very rare for Repo rates to trade this negative.

So maybe there is a crisis but with equities now directly backstopped by the Fed, nobody told stock traders?

Anyway Skyrm continues:

RP operations are declining, so that means less Fed cash in the market, but with rates near zero, money funds are now giving their cash to the Fed again with $31 billion in RRP volume today. Private cash that was on the sidelines must have come back into the market over the past couple of days.

With all of the Cash Management Bill issuance, you would thing there’s plenty of short-term paper available for cash investors. However, maybe QE is starting to impact the market? Maybe the impact of QE combined with increased investor cash is what’s driving rates lower?

And visually:

While the underlying reasons for GC repo’s slide into negative remain unclear, we will remind readers that just a few days ago, repo guru Zoltan Pozsar warned that the surge in Bill issuance could become the next crisis, warning that the only way to control the short-end would be to launch yield curve control for the entire yield curve:

The Fed has done a lot and yield curve control where they peg three month Treasury bill yields at OIS rates and is the only thing the Fed has not done yet, but soon will have to. The target range for overnight rates and the OIS curve – the bottom layer of the money market cake – are the Fed’s monetary sanctum. Everything the Fed does is priced based on variables within that sanctum: the top of the band, IOR, IOR plus a spread and OIS plus a spread.

As we responded to this proposal, which we are confident will be implemented shortly, “the only thing that experts agree will avoid another crisis in the bond – and funding – markets is if the Fed effectively takes over the entire yield curve, ending capital markets as we know them, and launching “price discovery” by decree. While we have no doubt that the Fed will go the length, we can’t help but remember that such terminal central planning did not have a happy ending for the USSR.”

The drop in GC repo to negative just brought the US one step closer to attaching an SR to its name.

Tyler Durden

Tue, 04/21/2020 – 14:42