Futures Flat Despite Record Eurozone Business Collapse Ahead Of Latest Claims Shocker

US equity futures and global stock markets were surprisingly uneventful on Thursday on the back of a continued modest rebound in oil prices despite a record collapse in European business activity, as investors braced for another staggering jobless claims report as sweeping lockdown measures hammer economic growth.

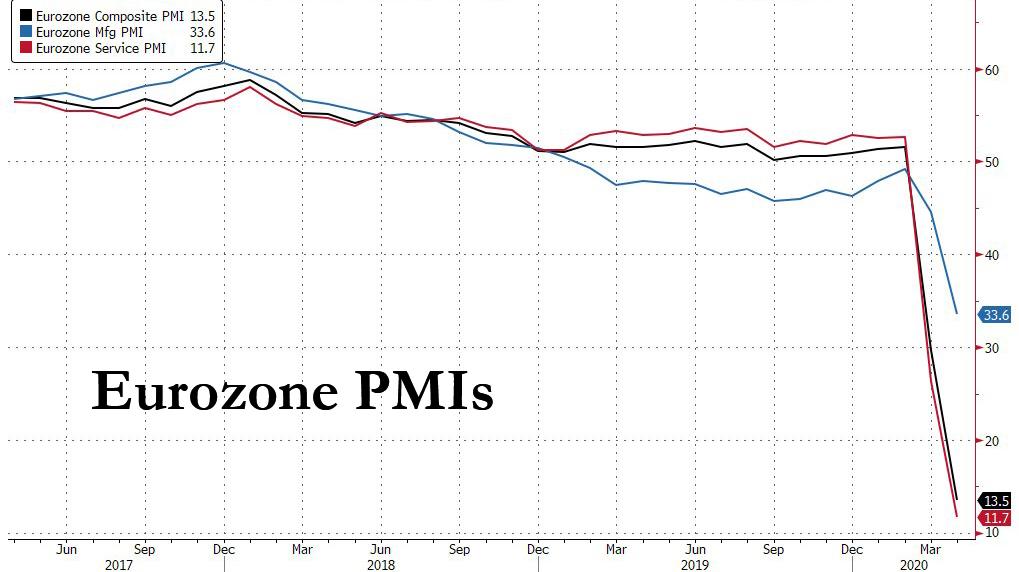

The S&P500 jumped on Wednesday on a recovery in oil prices and signs Congress was set to pass $500 billion more in relief for small businesses and hospitals. The bill is expected to clear the House of Representatives later in the day. Still, the benchmark index is 17% below its February record high as statewide shutdowns sparked layoffs and crushed consumer spending. Surveys on U.S. manufacturing and services firms are likely to mirror dismal readings from Asia and Europe issued earlier on Thursday. As noted earlier, a composite European business index plunged to its lowest print on record.

Data set to be announced shortly is also likely to show a record 26 million Americans sought unemployment benefits over the last five weeks, confirming that all the jobs created during the longest employment boom in U.S. history were wiped out in about a month.

Retailer Target Corp tumbled 7% in premarket trading despite a surge in digital sales in March and April which offset a slump in-store sales. Eli Lilly gained 1.5% as it reported a jump in first-quarter sales, boosted by its diabetes drug and also benefiting from customers stockpiling its medicines during the pandemic.

Europe’s Stoxx 600 Index drifted as the abovementioned PMI index plunged far more than economists anticipated. Credit Suisse slipped after the bank said first-quarter profitability rose but that it’s taking a greater than expected $1 billion in writedowns and provisions for bad loans after the pandemic.

Earlier in the session, Asian stocks gained, led by materials and energy, after rising in the last session. Most markets in the region were up, with Japan’s Topix Index gaining 1.4% and India’s S&P BSE Sensex Index rising 1.2%, while Shanghai Composite dropped 0.2%. The Topix gained 1.4%, with Jeans Mate and Showcase Inc/Japan rising the most. The Shanghai Composite Index retreated 0.2%, with Xinjiang Winka Times Department Store and Zhejiang Meilun Elevator posting the biggest slides.

Crude futures jumped for a second day despite a swelling global glut.

Looking ahead, investors will focus on the latest weekly jobless numbers from Washington that are estimated at 4.5 million. While governments across the world have pledged more than $8 trillion to fight the pandemic, a sharper picture of a crippled global economy is emerging from unprecedented layoffs, chaos in the oil market, poor European data and a mixed bag of corporate earnings, as Bloomberg summarizes.

There were some good news on the virus front, where New York fatalities were at the lowest rate since early April, while Treasury Secretary Steven Mnuchin said he anticipates most of the economy will restart by the end of August. House lawmakers on Thursday are set to pass another round of aid. Infections and deaths spiked higher in Spain, home to the world’s most extensive outbreak after the U.S., even amid its sixth week of strict lockdown.

The most important event today is the long-awaited European Council summit via videoconference this afternoon, where the big question will be over how the idea of a European Recovery Fund is financed. Yesterday, Bloomberg News reported that the Commission would propose a €2 trillion plan that would in part use the bloc’s 7-year multi-annual budget with a €300bn recovery fund included, but also establish a new temporary financing mechanism that would raise up to €320bn. However, this could prove controversial given the issuance of joint debt, to which the northern member states are strongly reluctant.

In rates, Treasuries steadied while commodity currencies advanced on a rise in oil prices; Spanish bonds extended an advance, leading peripheral outperformance over euro-area peers; bunds erased declines after French PMIs missed median estimates. Gilts fell then rose after the U.K. DMO announced it will raise in four months of debt sales almost as much as it did during the height of the global financial crisis.

In FX, the Bloomberg dollar index inched up, erasing losses after coming under pressure from short covering in crosses into the London open. The euro fell after much worse than anticipated German consumer confidence data. The Norwegian krone shrugged off a plunge in industrial confidence and rose versus all major peers. Australian and New Zealand dollars traded higher against the greenback as the recovery in oil futures sparked short covering among commodity currencies

Looking at the day ahead, and along with the aforementioned European Council meeting, PMIs and initial jobless claims from the US, other data releases include Germany’s GfK consumer confidence reading for May, the UK’s public sector net borrowing for March, along with the US new home sales for March and April’s Kansas City Fed manufacturing activity index. From central banks, we’ll hear from the BoE’s Vlieghe, while earnings out today include Intel, Eli Lilly and Company, NextEra Energy and Union Pacific.

Market Snapshot

- S&P 500 futures down 0.1% to 2,786.75

- STOXX Europe 600 down 0.1% to 329.81

- MXAP up 0.8% to 142.65

- MXAPJ up 0.5% to 460.76

- Nikkei up 1.5% to 19,429.44

- Topix up 1.4% to 1,425.98

- Hang Seng Index up 0.4% to 23,977.32

- Shanghai Composite down 0.2% to 2,838.50

- Sensex up 1.4% to 31,805.19

- Australia S&P/ASX 200 down 0.08% to 5,217.11

- Kospi up 1% to 1,914.73

- German 10Y yield fell 0.3 bps to -0.41%

- Euro down 0.2% to $1.0800

- Italian 10Y yield fell 7.6 bps to 1.902%

- Spanish 10Y yield fell 8.9 bps to 1.048%

- Brent futures up 7% to $21.80/bbl

- Gold spot up 0.6% to $1,724.11

- U.S. Dollar Index up 0.1% to 100.44

Top Overnight News from Bloomberg

- Confidence among European businesses and consumers is in free fall as shutdowns to contain the coronavirus push the economy into recession

- The Federal Reserve’s beefed-up swap program is having some unintended consequences, especially in Europe. It helped bring down the cost of dollars to such an extent they’re cheaper to borrow in cross-currency markets than any major currency. But that’s driving opportunistic players to tap local markets to swap into dollars, which ends up elevating domestic borrowing costs

- The effect of the U.K.’s emergency spending to combat coranavirus began to show up in public finance data for March, as a jump in spending caused the budget deficit to widen more than expected

- The U.K. government is to survey 20,000 households in a bid to track the spread of the coronavirus in Britain, five weeks after it abandoned a strategy of community testing for the disease

Asian equity markets mostly benefitted from the more constructive handover from Wall St where sentiment rebounded in tandem with oil prices amid touted bargain buying and increased US-Iran geopolitical risks after US President Trump instructed the US Navy to destroy any and all Iranian gunboats if they harass US ships at sea, with the Senate’s recent passage of the USD 480bln relief bill also adding to the bout of optimism stateside. ASX 200 (-0.1%) advanced at the open but with gains later pared after mixed data releases, as well as weakness in defensives and the largest weighted financials sector. Nikkei 225 (+1.5%) traded higher although upside was restricted by an indecisive currency and following abysmal PMIs in which Manufacturing PMI posted its worst reading since 2009 and both Services and Composite PMIs were at record lows, while the KOSPI (+1.0%) outperformed after it eventually shrugged off the largest contraction for South Korea GDP in more than 11 years. Elsewhere, Hang Seng (+0.4%) and Shanghai Comp. (-0.2%) were indecisive with price action kept rangebound amid a lack of fresh drivers and continued PBoC liquidity inaction, while Hong Kong policymakers remained focused on defending the currency peg. Finally, 10yr JGBs initially weakened amid the early broad optimism but then recovered from lows as the regional stock indices retraced some of the gains and following stronger results at 2yr JGB auction.

Top Asian News

- South Korea’s Economy Shrinks Most Since 2008 Amid Pandemic

- Singapore Traders Say They’re Healthy Amid Hin Leong Saga

- Operation Twist Returns to Send India’s Bond Yields Plunging

The optimism seen in the APAC session faded as European trade went underway [Euro Stoxx 50 -0.1%], with the deterioration attributed to a string of dismal April Flash PMIs across the region and as participants look ahead to the Eurogroup summit later today (Primer available on the Newsquawk headline feed). A meeting which could see disagreement over the rollout of the European Recovery Fund – officials touting a launched in 2021; however, Italy stated they cannot wait until June 2020 for approval. European bourses trade mixed with no standout under/outperformers, whilst broader sectors also paint a mixed picture and fail to reflect a clear risk tone – albeit the energy sector outperforms as the complex continues to post gains. The breakdown also sees a similarly mixed picture – again with Oil & Gas leading the gains. A slew of earnings were reported in the pre-market, including prelim figures for Daimler (+0.9%) and Software AG (+0.8%), whilst Renault (+2.3%), Orange (+0.5%), Pernod Ricard (+0.3%), Accor (+1.1%), Swedbank (-0.7%), Volvo (-7.0%) all reported quarterly numbers – with Renault firmer despite a downbeat earnings release on reports Renault CEO is to unveil cost-cutting measures next month, whilst Volvo is pressured after substantially missing on its EPS and adj. operating profit expectations. Moving to Credit Suisse’s (-2.2%) earnings, the group topped net income forecasts but reported a deterioration in revenue and a Q1 loan loss provision over double its expectations. That being said, market volatility saw its FICC and Equity trading and sales both higher in excess of 20% YY. Elsewhere, Wirecard (+8.0%) sees itself at the top of the DAX after an independent audit of the Co. has uncovered no substantial findings with regards to questionable accounting methods; however, the full report is yet to be published. Results from the audit are now expected for April 27th and the Co’s FY results are to be published on April 30th. Finally, Tullow Oil (+30%) opened with gains above 60% and holds its place at the top of the Stoxx 600 after divesting its stake in Uganda to reduce net debt, whilst also seeing tailwinds from favourable price action in oil.

Top European News

- Europe’s Virus Lockdown Hits Economy, Leaves Businesses Reeling

- Immofinanz Names Investor Ronny Pecik as New Chief Executive

- Orban Blinks After Decade Fighting Foreign Sway Over Economy

In FX, the single currency is languishing at the bottom of the G10 table and looking precarious under 1.0800 vs the Dollar not to mention across the board as Eur/crosses teeter over psychological or key technical levels, like Eur/Chf on the verge of 1.0500, Eur/Jpy edging towards 116.00 and even Eur/Gbp testing the 200 DMA (0.8736). Much worse than anticipated preliminary Eurozone PMIs, and particularly poor services sector prints have undermined the Euro, but Eur/Usd is holding in just above or around chart supports ahead of 1.0750 in the form of April 6’s so called reaction low at 1.0769 and a 1.0757 Fib retracement level, for now, with some additional buffers provided by option expiries extending from 1.0800-1.0790 to 1.0750 in 3.1 bn and 1.2 bn respectively.

- NZD/AUD/JPY/GBP – The Kiwi and Aussie continue to see-saw vs their US counterpart, with the former recovering from a stop-induced slide overnight after 0.5900 held and subsequently retesting resistance ahead of 0.6000, while the latter was able to withstand weak PMIs with the aid of trade data revealing a much wider surplus as exports outpaced imports nearly 3-fold. Aud/Usd has reclaimed 0.6300+ status and briefly extended gains to circa 0.6370 before fading alongside Aud/Nzd ahead of 1.0650. Meanwhile, the Yen continues to retain an underlying safe-haven bid between 108.00 and 107.50 with decent option expiry interest also keeping the pair contained (1 bn at 107.50 and 1.6 bn from 107.85 to 108.00). Elsewhere, Sterling has (somehow) taken bleak UK PMI and CBI surveys in stride and resisting Greenback advances after Cable came close to filling bids touted at 1.2300, though this could be due to the aforementioned Eur/Gbp correction from recent 0.8800+ peaks rather than anything especially or uniquely Pound positive.

- USD – The Buck may be primed for a fall after the latest US initial claims release and/or Markit PMIs, but for now the DXY is establishing a more assured base on the 100.000 handle and building momentum through 100.500, albeit with indirect traction from the Euro underperformance noted above and more pronounced Franc depreciation below 0.9700 through 0.9750.

- SCANDI/EM – The Scandi Crowns are back on the front foot as crude prices continue to stabilise and sharp falls in Swedish sentiment indicators are acknowledged, but partially taken in context when compared to the starker deterioration elsewhere in Europe. However, in contrast to crude-related recoveries for EM currencies like the Rouble, COVID-19 contagion has intensified in SA where the Rand is back under 19.0000 vs the Dollar in the run up to President Ramaphosa setting out plans to re-open the economy after rolling out fiscal stimulus representing around 10% of the country’s GDP..

In commodities, WTI and Brent front month futures trade on a firmer footing as geopolitical risks continue to be priced in following US President Trump’s tweet regarding his order to the US Navy to shoot down all Iranian gunboats that harass US vessels. Aside from that, the underlying fundamentals remain broadly unchanged. The supply glut remains, and storage space remains scarce. “Given the glut we have in the oil market, it is difficult to see this offering lasting support to the market, unless the situation does escalate further” – ING says. Elsewhere and in fitting with recent source reports, Saudi Aramco has started to implement the OPEC+ pact ahead of its inauguration on May 1st. Aramco will be lower output to 8.5mln BPD, the output level mentioned under the terms of the of the deal – markets are yet to see if other producers follow suit, with Kuwait the only other country to publicly announce their early cuts thus far. WTI resides around USD 15.5/bbl having had briefly topped USD 16/bbl in early trade ahead of yesterday’s high of USD 16.18/bbl. Brent futures meanwhile meander just above 22/bbl after printing a current intraday high at USD 23.22/bbl. Elsewhere, spot gold remains relatively steady north of USD 1700/oz thus far and briefly topped 1725/oz. Meanwhile, copper trades on a firmer footing after Anglo American’s copper production showed a YY decline, meanwhile, Antofagasta also stated it expects copper output this year towards the lower end of its guidance.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 4.5m, prior 5.25m; Continuing Claims, est. 16.7m, prior 12m

- 9:45am: Bloomberg Economic Expectations, prior 46.5; Bloomberg Consumer Comfort, prior 44.5

- 9:45am: Markit US Manufacturing PMI, est. 35, prior 48.5

- 9:45am: Markit US Services PMI, est. 30, prior 39.8

- 9:45am: Markit US Composite PMI, prior 40.9

- 10am: New Home Sales, est. 644,000, prior 765,000; New Home Sales MoM, est. -15.82%, prior -4.4%

- 11am: Kansas City Fed Manf. Activity, est. -37, prior -17

DB’s Jim Reid concludes the overnight wrap

This working from home routine is good for productivity if not my social skills. My wife won’t get too close to me at the moment as I refuse to shave off a four week old bristly beard. We’ll see who holds out the longest. On the productivity front we published two quick notes yesterday. The first ( link here ) where we rank the severity of this pandemic relative to 24 we’ve found going back over 2000 years and make some observations of where it’ll end up and also some markers for the future. Secondly we published a chart looking at 150 years of oil prices in nominal and real terms ( link here ). This week the price of oil in nominal terms was lower than it was in 1870 and at any point in history. The note shows what inflation and the S&P 500 have done over the same period for comparison. Guess before you look at the answer. At least how many figures the latter runs into in percentage terms. If anyone can think of a financial related asset that still trades today that had a lower price this week than it did 150 years ago then I will give them a virtual prize. Even if you can think of one from 100 or even 50 years ago.

We’ll come back to oil a little later but the most important event today is the long-awaited European Council summit via videoconference this afternoon, where the big question will be over how the idea of a European Recovery Fund is financed. Yesterday, Bloomberg News reported that the Commission would propose a €2 trillion plan that would in part use the bloc’s 7-year multi-annual budget with a €300bn recovery fund included, but also establish a new temporary financing mechanism that would raise up to €320bn. However, this could prove controversial given the issuance of joint debt, to which the northern member states are strongly reluctant.

Frankly, if we saw a full agreement today that would be a surprise but progress and something that Italy can sign up to will be the key. In his blog on Monday, DB’s Mark Wall said that while he expects an eventual agreement on a recovery fund, it would be a positive surprise if the important details were agreed today, since the question of burden sharing is politically complex and the ECB’s purchases are absorbing market pressure for now. Mark says that the things to watch out for are the size, speed and structure of the fund, but he thinks joint bonds are unlikely for obvious reasons due to the Northern states current lack of desire to go down that route. We’ve also seen increasing speculation around grants recently, which could be the principle means of buying solidarity, but that would also lead to tough debates around the ratio of grants to loans within the Recovery Fund and eligibility for the grants. This would fit into the idea that we shouldn’t expect a fully detailed agreement today.

Ahead of that, sovereign debt continued to sell off in Europe yesterday, though it should be noted that Italian BTPs actually outperformed, with yields falling by -7.7bps by the end of the session. Nevertheless, in the rest of southern Europe sovereign bond spreads moved wider, with the spread of Spanish (+6.3bps) debt over bunds reaching its highest level since the aftermath of the Brexit vote back in June 2016. Having said that they did complete a successful syndicated deal which would have led to pressure elsewhere in the curve – similar to Italy on Tuesday. The ECB last night said it would accept some HY bonds as collateral if they were rated IG before April 7th and stay above BB. This clearly looks designed to mainly help Italy if they get downgraded to HY over the coming weeks or months. Next stop is S&P’s review of their BBB rating due to be announced tomorrow. Finishing off on sovereigns, 10yr Treasury yields rose by +5.0bps yesterday, up from their second-lowest closing level ever the previous day to reach 0.619%.

Staying on today, we’ll also get the much-anticipated April flash PMIs this morning. For our readers who thought that the March readings were dire, today’s numbers are likely to show an even bigger deterioration. That’s because when the surveys were taken back in March, plenty of economies hadn’t actually fully locked down yet, or only did so towards the latter part of the survey. The one country that was in a full lockdown for the March survey was Italy, where the services PMI fell to 17.4, which gives you some idea of how low these could go today. Given that these are diffusion indices they lose some meaning in extreme events as they don’t give a scale of the severity of declines (and rebounds when they occur) just whether things were worse or better than the prior month for the various respondents.

We’ve already had a taste for how the PMIs look in Asia overnight where Japan’s flash services PMI slid to 22.8 (vs. 33.8 last month), a record low, while the manufacturing PMI printed at 43.7 (vs. 44.8 last month). The accompanying text highlighted that “PMI data for Japan tells us that the crippling economic impact from the global coronavirus pandemic intensified in April,” and “the decline in combined output across both manufacturing and services was the strongest ever recorded by the survey in almost 13 years of data collection.” Meanwhile, Australia’s services PMI also printed at a record low of 19.6 (vs. 38.5 last month) while the manufacturing reading came in at 45.6 (vs. 49.7 last month).

In other overnight news, Bloomberg is reporting that Germany’s government has agreed on an additional EUR 10bn stimulus package that would temporarily reduce value added taxes for restaurants and increase the amount of money paid as state wage support as part of a seven-point plan to fine-tune the government’s economic crisis response. Elsewhere, Singapore’s trade and industry minister Chan Chun Sing said that the country is bracing for a sharper economic contraction this year than an earlier forecast of as much as a -4% slump. We also got South Korea’s Q1 2020 GDP print this morning which printed at -1.4% qoq (vs. -1.5% qoq expected), the worst contraction since the GFC. Elsewhere, the US Treasury Secretary Steven Mnuchin said that he expects most of the US economy will restart by the end of August.

Asian markets are trading mixed this morning with the Nikkei (+0.74%), Hang Seng (+0.23%) and Kospi (+0.47%) all up while the ASX (-0.38%) and Shanghai Comp (-0.06%) are in the red. In FX, the Australian dollar is down -0.32% following the PMI data. Elsewhere, futures on the S&P 500 are down -0.42% while yields on 10y USTs are down -1.8bps to 0.603%.

The final expected highlight today comes from the weekly initial jobless claims in the US, which have become an important high frequency indicator over the last month. Over the last 4 weeks, a cumulative total of more than 22m claims have been made, which is around the number of jobs that were created in the decade of expansion. So it’s no exaggeration to call the scale of the declines unprecedented. For today, our US economists are forecasting claims at 5m, which would be down from last week’s 5.245m, and if realised would mark the 3rd consecutive week that the number has fallen, which would suggest we could be past the most rapid period of job losses for now. The S&P 500 rose by +0.58% last Thursday for a 4th successive positive close on multi-million claims day. The previous 3 Thursdays came in at +6.24%, +2.28% and +3.41% for the S&P 500. Will the streak extend for a 5th straight week?

With all that to come later, markets rebounded yesterday following their poor start to the week, with the S&P 500 (+2.29%), the NASDAQ (+2.81%) and the STOXX 600 (+1.53%) all moving higher. Energy stocks led the rebound on both sides of the Atlantic thanks to another day of sizeable swings in oil markets, where Brent Crude managed to pare back its losses from a 21-year low to actually end the session up +5.38% at $20.37/barrel. June and July WTI saw even larger rises, up by +19.10% and +10.70% respectively to $13.78 and $20.69/barrel. June WTI is up a further +4.28% this morning to $14.37. The catalyst seemed to be a tweet from President Trump, who said that “I have instructed the United States Navy to shoot down and destroy any and all Iranian gunboats if they harass our ships at sea.” While geopolitics has rather moved out of the headlines since the start of the year, it’s worth noting that it was only last week that the US Central Command said in a statement that 11 Iranian ships crossed the bows and sterns of US vessels at close range. So one to keep an eye on. In related news, the largest oil-ETF, USO, has altered its fund holdings further away from near-term WTI. The fund has over $3 billion in AUM and is the largest single-holder of WTI futures according to Bloomberg. The ETF will now roll exposure to August and September, while lowering June and July, in order to shield itself from the price action in near-term contracts. Oil ETFs have been a hot topic over the last couple of days given the recent turmoil. When these were structured no-one could have contemplated a negative price on the contracts they invested in. It’s fair to say it’s caused some chaos.

There wasn’t a lot in the way of data yesterday, though we did get the European Commission’s advance consumer confidence reading for April, which plummeted to -22.7, its lowest level since March 2009. Otherwise, we got February’s FHFA house price index for the US, which saw a +0.7% increase month-on-month before the impact of the pandemic began to be felt. And in the UK, the CPI reading for March fell to 1.5% as expected, down from 1.7% in February.

Corporate earnings were mixed again. Chipotle Mexican Grill (+12.44%) rose after 1Q digital sales grew over 80% yoy and EPS came in well ahead of analyst’s estimates at $3.17 vs. $3.08 expected. Heineken (-3.05%) cancelled its interim dividend, while volumes were down 14% and net income fell 69%. Kering (-4.92%) announced on its earnings call that it doesn’t expect a recovery in the U.S. or Europe before at least June or July, while sales at its brand Gucci tumbled 23% year-over-year. The company did announce that sales in mainland China turned positive this month as tourist spending rose.

To the day ahead now, and along with the aforementioned European Council meeting, PMIs and initial jobless claims from the US, other data releases include Germany’s GfK consumer confidence reading for May, the UK’s public sector net borrowing for March, along with the US new home sales for March and April’s Kansas City Fed manufacturing activity index. From central banks, we’ll hear from the BoE’s Vlieghe, while earnings out today include Intel, Eli Lilly and Company, NextEra Energy and Union Pacific.

Tyler Durden

Thu, 04/23/2020 – 08:23