Lloyd Blankfein Can’t Understand Why Investors Are Still Buying US Treasurys; Here Is The Answer

Former Goldman Sachs CEO Lloyd Blankfein kicked the hornets’ nest at the nexus of modern finance and socio-economics – where topics such as MMT, Helicopter Money and debt monetization all intersect and keep the US empire funded – by tweeting a question that has stumped many others, to wit:

In finance, most surprising to me is that despite the trillions the US is adding to our budget deficit and national debt, investors (many foreign) will lend the US a virtually limitless supply of dlrs for .6 pct for 10 years.

In finance, most surprising to me is that despite the trillions the US is adding to our budget deficit and national debt, investors (many foreign) will lend the US a virtually limitless supply of dlrs for .6 pct for 10 years.

— Lloyd Blankfein (@lloydblankfein) April 23, 2020

While one can write long books in response to Blankfein, there is a very simple answer, and one which conveniently fits into a chart (and incidentally one which we most recently discussed last week, namely that “For The First Time Ever, The Fed Will Monetize Double The Total Treasury Issuance“).

The answer is that what investors – plural – do, is irrelevant. All that matters is what one specific investor – the Fed – is doing and will continue to do.

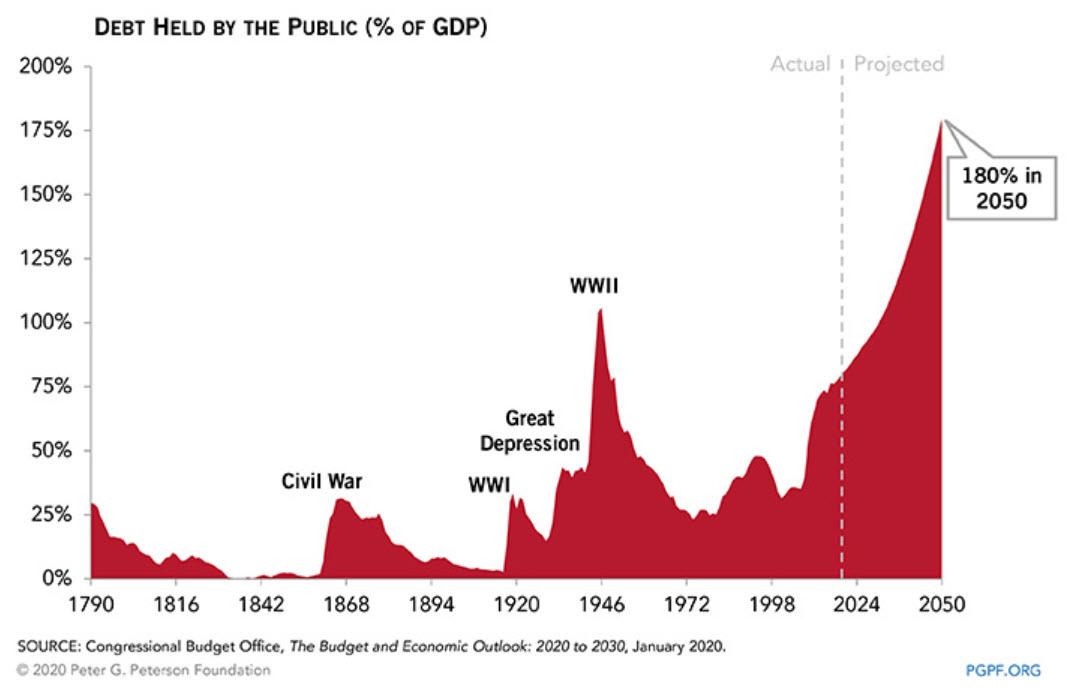

As we have explained every single year since 2009, the reason why it is not at all surprising that Treasury yields are at 0.6% even as the US Treasury is expected to sell well over $3 trillion in debt this year, next year and likely every other year until the Treasury still exists…

… is because the yield on the US debt does not reflect market supply and demand – and hasn’t reflected the market for a decade – but merely the Fed’s constant intervention, and recently, take over of the bond market.

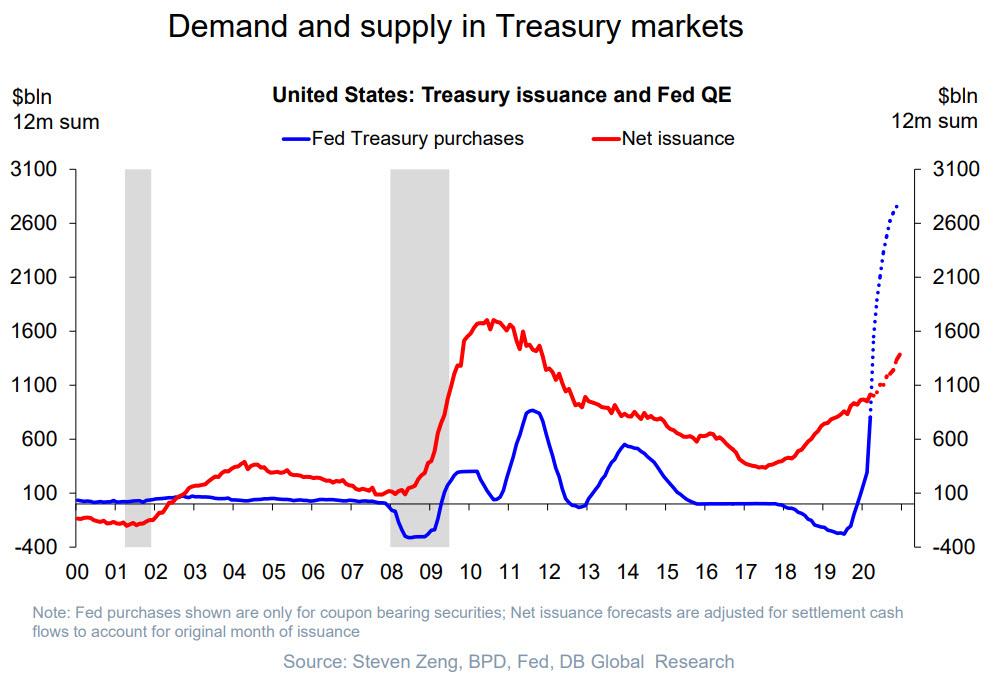

And here is the answer: as shown in the chart below, while the Treasury has issued a near record $1.5 trillion in net Treasurys in the past 12 months, over the same period, and really just in the past month, the Fed will monetize $3 trillion in debt, or – for the first time ever – the Fed will monetize double the total treasury issuance, an unprecedented development designed to achieve just one thing: avoid a selling cascade in Treasurys the kind we observed in mid-March.

And here is DB’s Torsten Slok verbalizing the threat presented by the chart above:

At the peak in late March, the Fed was buying $75bn in Treasuries every day, and we are now down to “only” $30bn per day, see also here. These enormous Fed purchases combined with rates moving sideways in recent weeks make you wonder where 10-year rates would have been if the Fed had not intervened. As the Fed gradually steps away over the coming weeks, and Treasury issuance continues to increase to finance the fiscal stimulus, the market will be focusing more and more on demand and supply in the US Treasury market.

Incidentally, Blankfein’s question is disingenuous to the point of farce for one simple reason: he knows the answer very well, after all it was under the watch of former Goldmanites Hank Paulson and Bill Dudley that the Fed unleashed QE, allowing the terminal disconnect between Treasury supply/demand dynamics and what the yield on the 10Y Treasury is.

Tyler Durden

Thu, 04/23/2020 – 12:30