Fed Cuts Pace Of Treasury QE To Just $10 Billion Per Day

From an initial $75 billion per day when the Fed announced the launch of Unlimited QE, the US central bank first reduced its daily buying to $60 billion per day, then three weeks ago announced another ‘taper’ in its bond-buying program to $50 billion per day, which was followed by a reduction to 30 billion per day, and then last week, this amount was again cut in half to $15 billion per day. Now, the Fed has slashed its daily POMO by another 33%, to “only” $10BN per day.

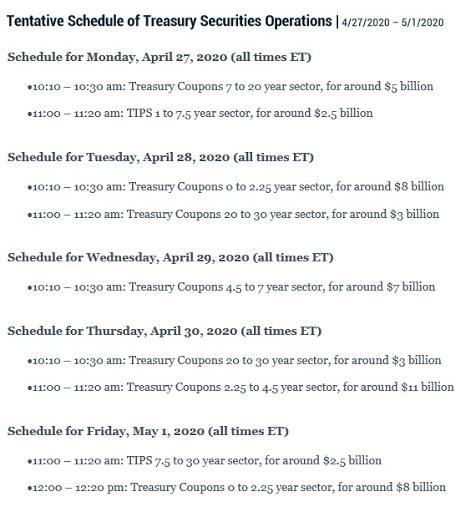

Here is the full schedule for the week ahead.

Additionally, the Fed will also taper its MBS buying from $15 billion to $8 billion on average in MBS per day next week:

- Mon: $8.213BN from $10.709BN last Monday

- Tue: $7.68BN from $8.938BN last Tuesday

- Wed: $8.213BN from $10.709BN last Wednesday

- Thur: $7.68BN from $8.938BN last Thursday

- Fri: $8.213BN from $10.7019 last Friday

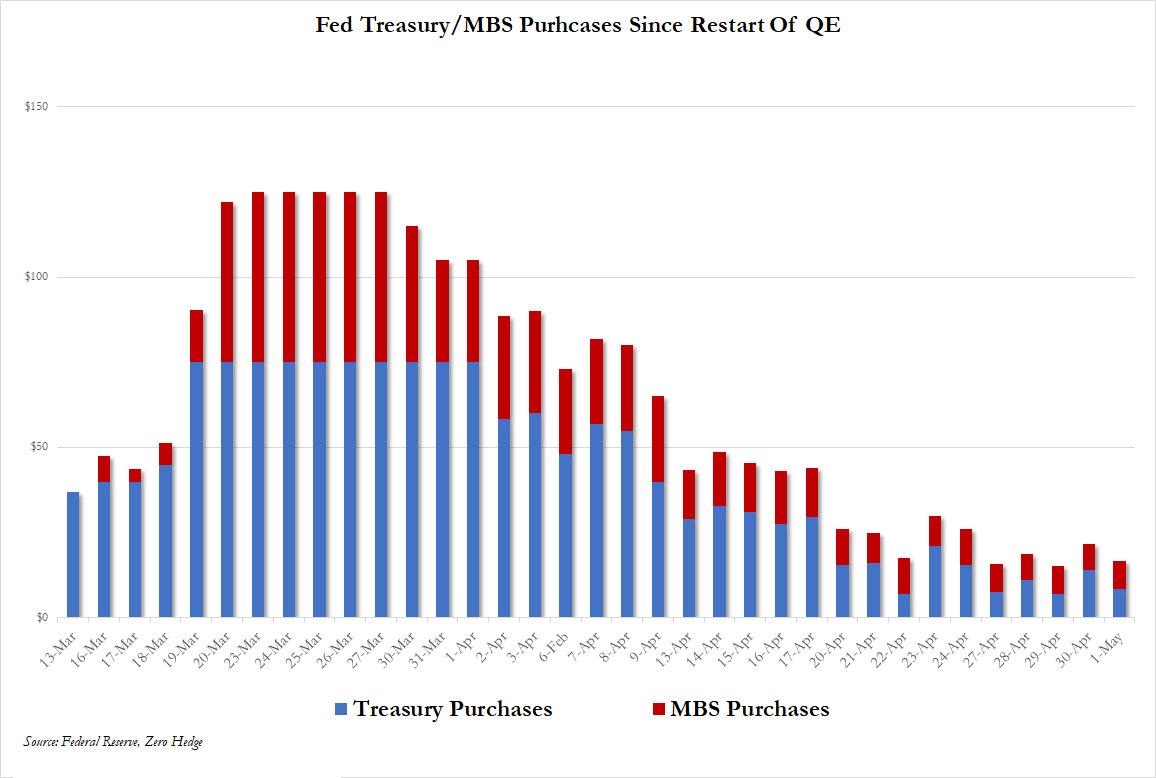

The chart below summarizes all the Fed Treasury and MBS buying completed and scheduled since the relaunch of QE on March 13:

So, in aggregate, The Fed will buy a total of $90 billion of MBS/TSYs next week, down from $125 billion but still vastly more on a weekly basis than the largest QE programs monthly totals before this crisis, if well below the $625 billion in purchases conducted in the week starting March 23, when the financial system was once again on the verge of collapse and only the Fed could bail it out… just don’t call it a bail out because nobody could have possibly anticipated an economic shock especially after banks repurchased trillions in their own stock in the past decade.

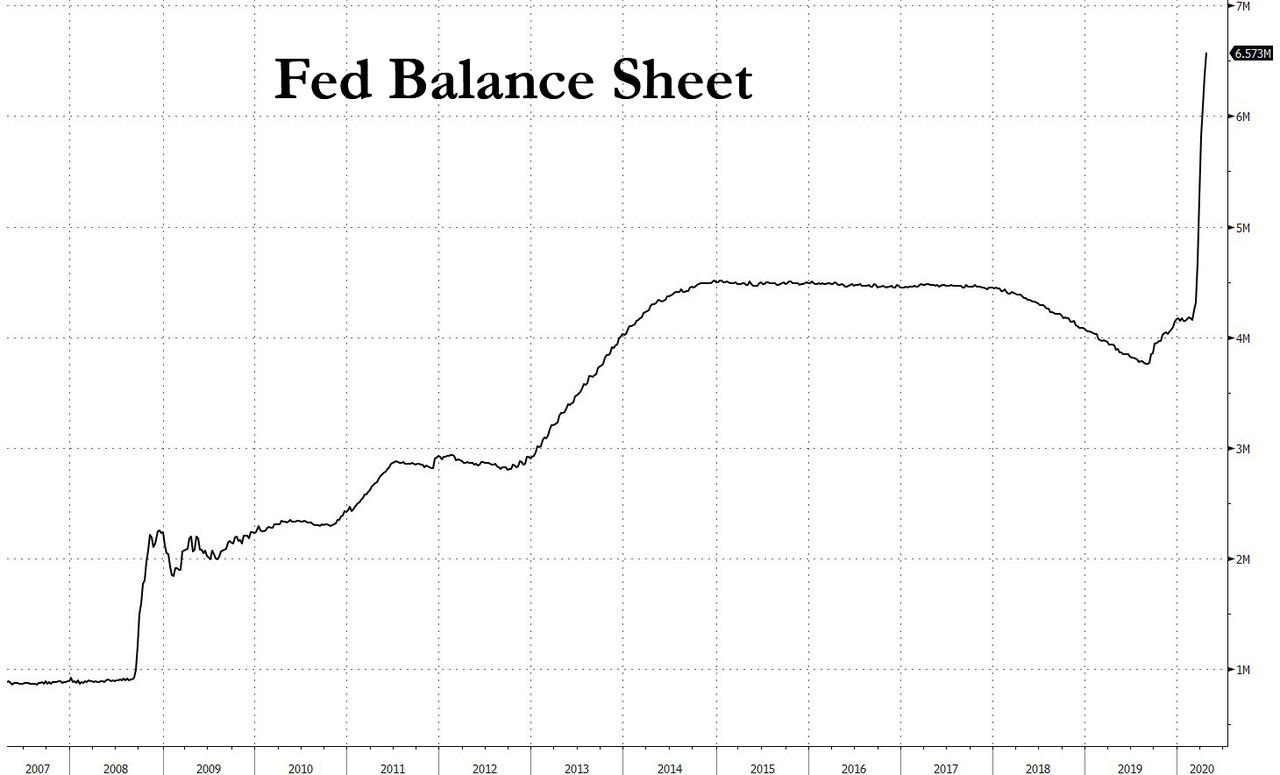

Meanwhile, as we showed last night, as of April 22, the Fed’s balance sheet was a record $6.57 trillion, up $205 billion on the week and up $2.644 trillion from a year ago. Just staggering numbers and unprecedented dollar debasement.

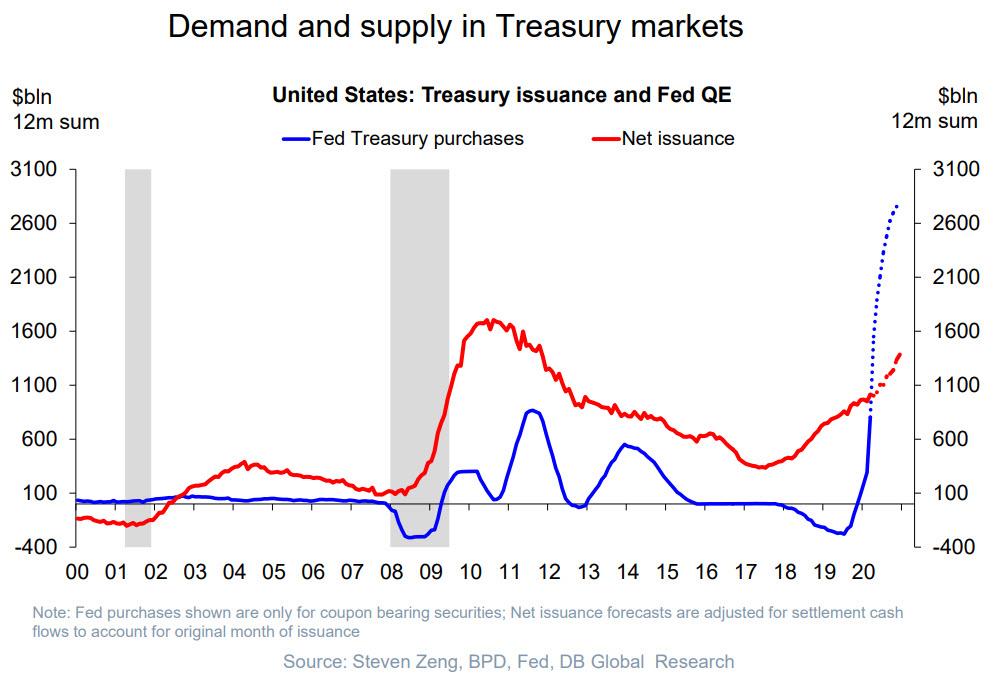

For those curious what the “helicopter money” big picture looks like, now that the Fed and Treasury are effectively merged with the Fed stuck monetizing Treasury issuance indefinitely, here it is: as we reported last night when the Fed did QE in the years following the 2008 financial crisis monthly Treasury purchases never exceeded US Treasury net issuance, but the Fed is now on track to buy double the amount of net issuance.

Tyler Durden

Fri, 04/24/2020 – 14:48