Fitch Warns Of Record Loan Defaults In April As Economy Implodes

Over the past two weeks, we have observed several very ominous tactical shifts from the largest US commercial bank: after it first announced it would halt all non-government insured loan issuance for the foreseeable future, traditionally the bank’s “bread and butter” business, JPMorgan then said it would raise its mortgage standards, stating that customers applying for a new mortgage will need a credit score of at least 700, and will be required to make a down payment equal to 20% of the home’s value, a dramatic tightening since the typical minimum requirement for a conventional mortgage is a 620 FICO score and as little as 5% down. Then late last week, JPMorgan also said it was had stopped accepting new home equity line of credit, or HELOC, applications.

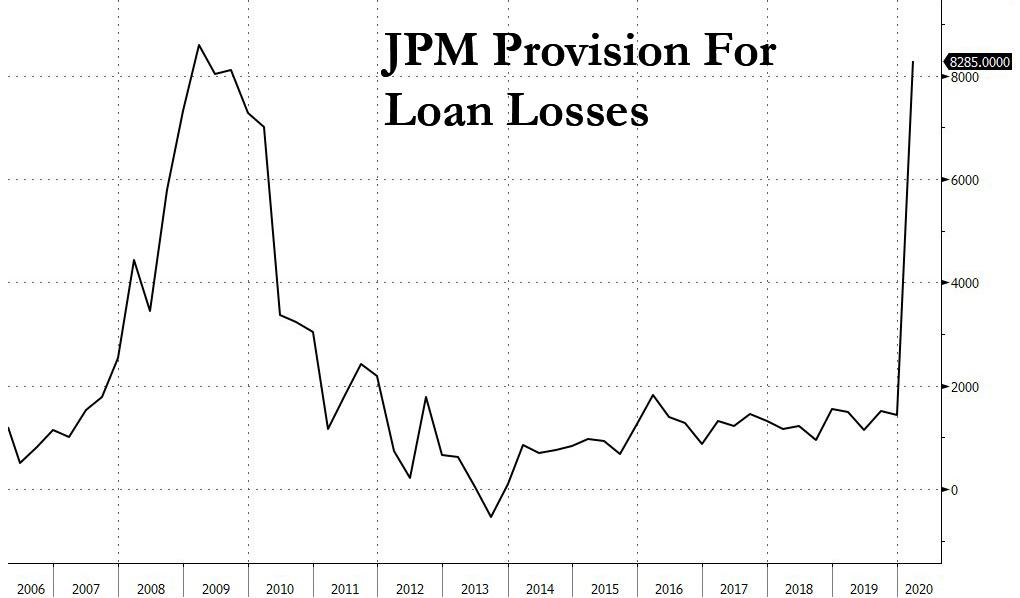

All this, of course, was happening around the time JPMorgan unveiled a 5x increase to its loan loss provisions, confirming that the bank was expecting a surge in loan defaults.

Overnight, Fitch validated all of Jamie Dimon’s worst fears – and his decision to effectively shut down JPM’s loan issuance machinery – when it warned that it expects the number of institutional term loan defaults in April to top the record of 15 set in 2009.

“Fitch anticipates the default rate will exceed 3% in May, which would be the highest since March 2015,” said Eric Rosenthal, Senior Director of Leveraged Finance. “The $7 billion of April default volume propelled the TTM default rate to 2.6% from 2.2% at March end.”

The 14 defaults registered this month impacted 10 separate sectors, led by three in healthcare/pharmaceutical which is perhaps a little odd with everyone focusing on the tsunami about to sweep through the energy sector. At least another $3 billion is projected to occur this month, with Neiman Marcus Group Inc. and Akorn Inc. expected to default imminently.

As reported previously, several other large companies have missed corresponding bond interest payments earlier this month and are likely to file bankruptcy including Intelsat Investments, JC Penney, and Ultra Resources.

According to Fitch, Neiman’s and JC Penney’s defaults would together lift the retail rate to 13% from the current 7% level. The default rate for retail is then forecast to jump to 19% by year end, led by anticipated defaults for Serta Simmons Bedding, J Crew, Ascena Retail Group, and Jo-Ann Stores.

Meanwhile, the energy default rate stands at 5.5%, but sizable expected defaults from Seadrill Partners, California Resources and Chesapeake Energy would push the rate to 18.0% by year end.

The telecommunications default rate reached 4.0% following Frontier Communications’ bankruptcy and would rise above 7.5% once Intelsat – which also missed a coupon payment – also files.

Fitch’s Top and Tier 2 Loans of Concern’s combined lists total $258.5 billion, exceeding 18% of the loan index. This is up from $233.6 billion last month and two and a half times above the $102.1 billion of February’s pre-pandemic total. The Top Loans of Concern total jumped to $69.4 billion from $54.8 billion in March. Retail, energy, healthcare/pharmaceutical and telecommunications together account for 60% of the Top Loans of Concern’s outstandings.

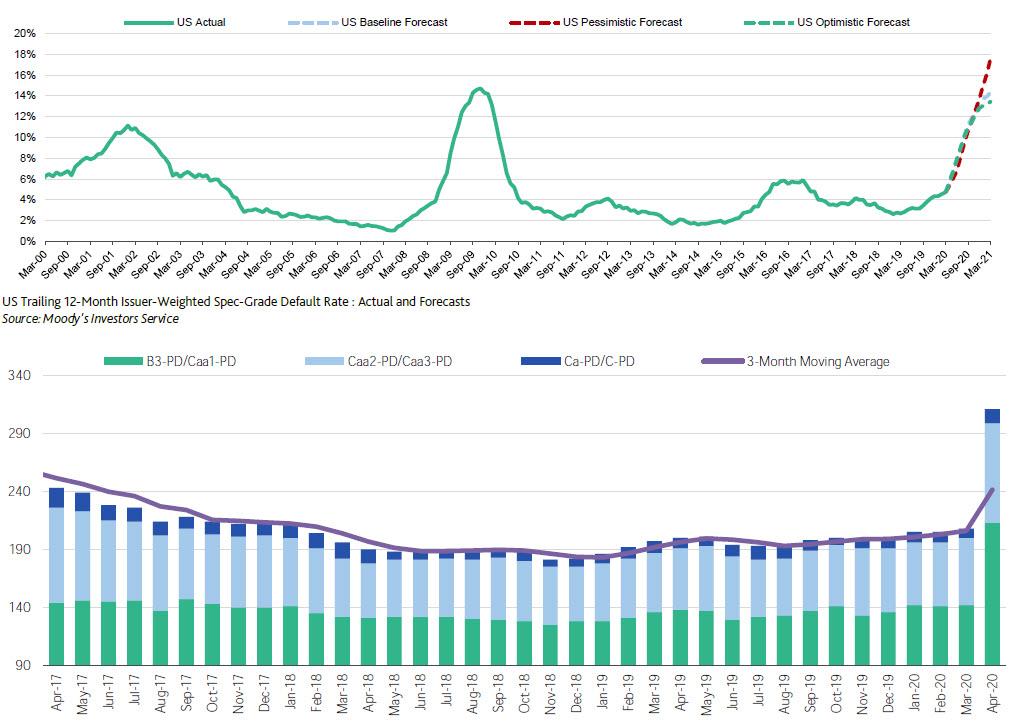

Last month, Fitch raised its 2020 default forecast to 5%-6% from 3%, equating to roughly $80 billion of volume which would top the record $78 billion from 2009. In addition, Fitch projects an 8%-9% default rate for 2021. If the expected recession becomes prolonged, a double-digit default rate is conceivable for 2021.

In a similar report last week, Moody’s warned that an “unprecedented jump” in its “B3 Negative and Lower” tally underscores the “sharp deterioration in credit conditions.”

Our B3 Negative and Lower Corporate Ratings List (B3N list) soared to its highest tally ever of 311 companies (see Exhibit 1), topping its old peak of 291 companies hit during credit crisis of 2009 and commodity-related downturn in April 2016. This spike is the result of the confluence of a coronavirus outbreak, tanking oil prices, and mounting recessionary conditions, which combined created severe and extensive credit shocks across many sectors, regions and markets, the effects of which are unprecedented.

Ironically, even as cash flows collapse, and a wave of bankruptcies hits corporations, which will add millions in unemployed workers to the tens of millions already laid off due to the coronavirus, stocks remains within spitting distance of all time highs. We only note that in case anyone still harbors any delusion that markets reflect anything but the trillions in liquidity that the Fed is injecting at any given moment.

Tyler Durden

Fri, 04/24/2020 – 08:03