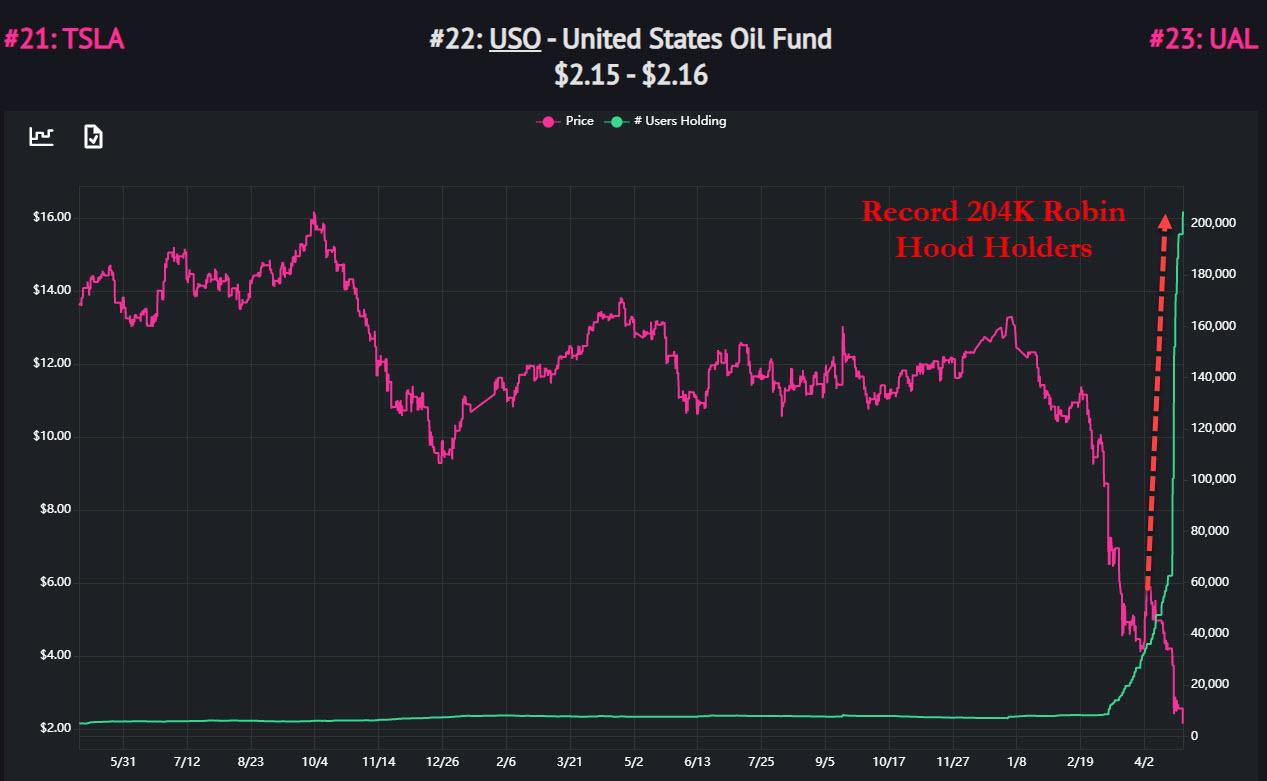

200,000 Retail Investors Hoping To Buy The F**king Dip In USO End Up Just Getting F**ked

For the second week in a row, the largest US oil ETF, the USO roiled oil markets after it unexpectedly starting selling its holdings of the most active West Texas Intermediate futures contract, triggering a massive swing in the price relationship between the June and July contracts, which – as we reported earlier – sent both the June WTI contract tumbling…

… which pushed WTI spreads even deeper into contango, as the discount between June WTI and the contract for December deepened sharply after the filing, reaching as low as $15.17 a barrel…

… while the price of USO crashed to all time lows.

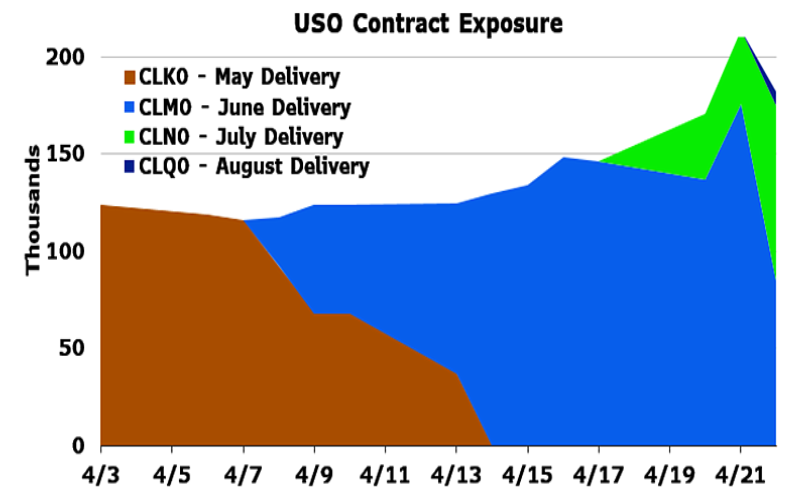

The changes, which were detailed in a Monday morning regulatory filing, represented the latest in a series that Bloomberg said “have wreaked havoc on crude prices.” The fund said it’s moving its money to contracts spread between July 2020 and June 2021 due to new limits imposed upon it by regulators and its broker. Specifically, USCF which manages the USO ETF, said it would now target the following allocation:

- 30% of its portfolio in the July contract,

- 15% of its portfolio in the August contract,

- 15% of its portfolio in the September contract,

- 15% of its portfolio in the October contract,

- 15% of its portfolio in the December contract,

- 10% of its portfolio in the June 2021 contract.

… and revealed that it would roll into the positions described above over a three-day period with approximately 33.3% of the investment changes taking place each day on each of April 27, 2020, April 28, 2020, and April 29, 2020, which explains why the June WTI contract is tumbling this morning as speculators frontran the USO selling.

The ETF has changed its investment policy five times in the last two weeks, as shown in the following chart which depicted the ETF’s holdings as of Friday’s close:

It also warned investors its valuation may deviate significantly from the underlying oil price, in effect acknowledging that it’s momentarily less focused on the price of WTI crude.

“While it is USO’s expectation that at some point in the future it will be able to return to primarily investing in the Benchmark Futures Contract or other similar futures contracts of the same tenor based on light, sweet crude oil, there can be no guarantee of when, if ever, that will occur,” it said in the filing, adding that USO investors “should expect that there will be continued deviations between the performance of USO’s investments and the Benchmark Oil Futures Contract, and that USO may not be able to track the Benchmark Oil Futures Contract or meet its investment objective.”

The fund listed factors including “a change in regulator accountability levels and position limits” as part of its reasons for the shift. As a result it will now struggle to meet its own investment objectives, it warned.

As Bloomberg notes, the long-only oil fund has in recent weeks become a magnet for retail investors looking to Buy The Fucking Dip and time the bottom to the historic price rout that’s pushed oil futures in New York into negative territory for the first time in history. The knock-on effects have impacted retail investors everywhere. While USO was not holding the May contract when it plunged below zero, traders pointed to retail money as having caused large gyrations in the market.

And while the USO has quickly become a rich target for speculators that are able to take advantage of the moves by trading ahead of it, thanks to its detailed regulatory disclosures, such as today’s crash, retail investors continue getting slaughtered and according to the latest Robin Hood data, there was now a record number of holders above 204,000…

… even though the USO is by definition a product designed to fleece retail, offering a detailed calendar and the exact contracts that’s selling and buying, allowing more sophisticated investors to place financial bets ahead.

Our advice: only when retail has “dumped it“, and hedge funds have to look elsewhere for sheep to fleece, will it be safe to expect a modest oil rebound.

Tyler Durden

Mon, 04/27/2020 – 12:41