Biggest European Banks Brace For Default Tsunami As Loan Losses Soar

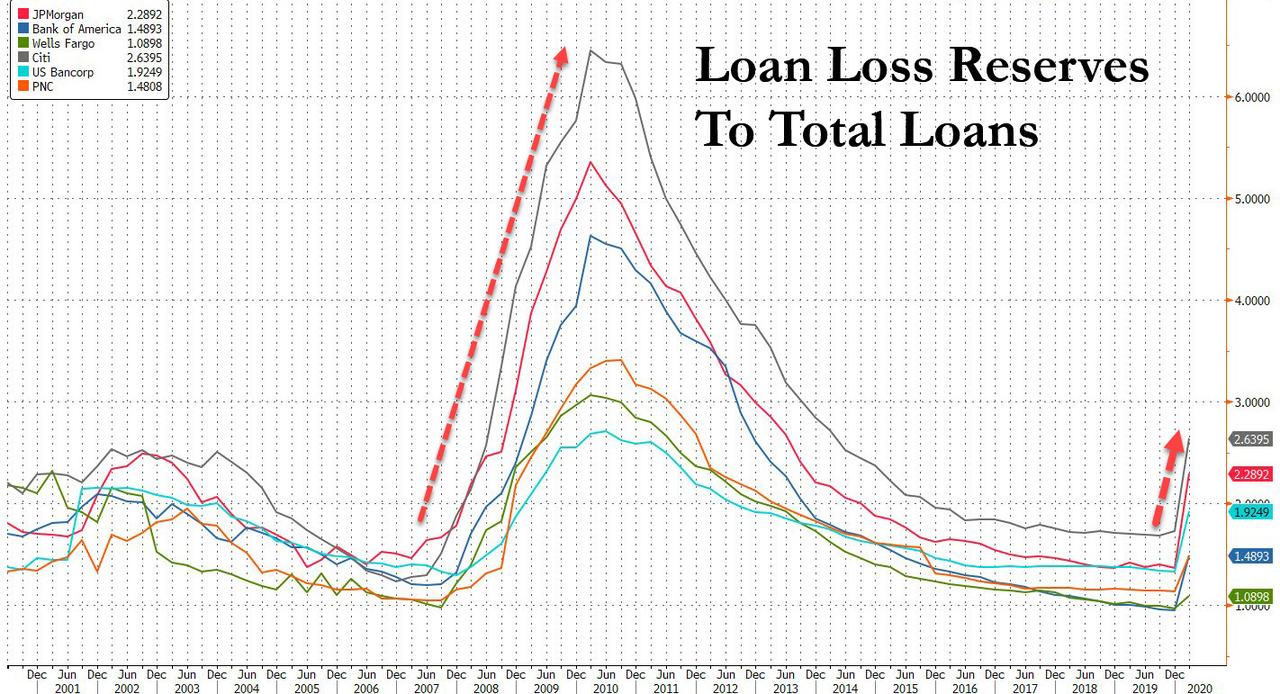

After a dismal first quarter for US banks which saw a surge in loan loss reserves, if not nearly enough to offset the default wave that is coming…

… it was the turn of Europe’s mega banks to “open the kimono” so to speak, and what they revealed was not pretty.

On Tuesday morning, European banking giants HSBC Holdings and Banco Santander, took the biggest hits so far among European banks struggling to contain the impact of the coronavirus on their loan books, with the U.K.-based lender expecting as much as $11 billion of damage this year because of the outbreak.

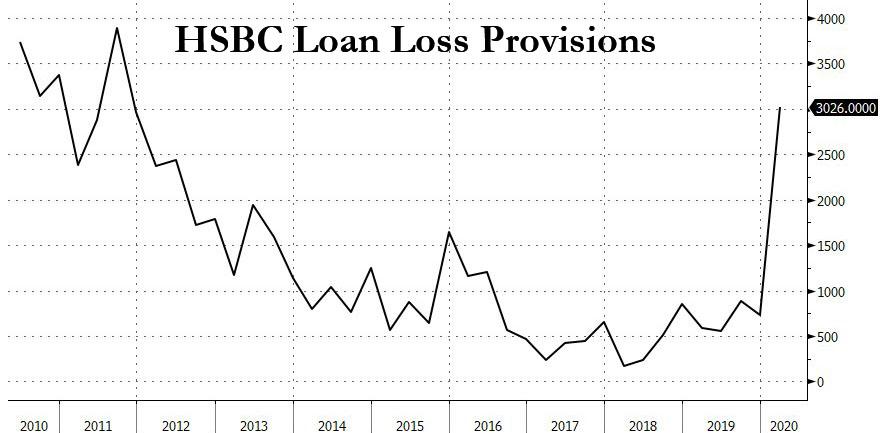

HSBC slashed its first-quarter profit in half on Tuesday after reserves for bad loans surged fivefold – similar to the increase in provisions recorded at JPMorgan – prompting Europe’s largest bank to deliver a stark warning on the deep and lasting impact of coronavirus on the financial sector.

Loan provisions jumped 420% to $3BN, on track to hit the highest annual level since the financial crisis, as the bank prepared for a flood of bankruptcies and defaults caused by global lockdown measures to control the pandemic.

A large chunk of the loan losses were blamed on a single “corporate exposure in Singapore”, which the bank said was “the primary driver” of a $700MM increase in expected loan losses in the region. As the FT previously reported, HSBC has the biggest known exposure to the previously discussed Singapore oil trading giant Hin Leong at $600MM, which has filed for bankruptcy and is currently under police investigation for fraud.

Unlike US banks – who were notoriously shy about disclosing future loan loss reserve plans and rather conservative in their loss provisions as the six largest US lenders increased first-quarter loan provisions by a combined $25.4bn — a year-on-year rise of 350% – HSBC execs had not problem cautioning that this was just the beginning, with provisions set to hit $7BN to $11BN by the end of the year, causing “materially lower profitability” in 2020. To preserve liquidity, HSBC has already suspended its dividend, reducing expenses and slashing the bonus pool by a third.

Still, HSBC’s huge increase in provisions was more severe than its American rivals, with the six largest US lenders increasing first-quarter loan provisions by a combined $25.4bn — a year-on-year rise of 350 per cent.

“Loan losses are larger-than-expected but HSBC usually errs on the side of conservatism,” said Ronit Ghose, an analyst at Citigroup. “Business performance and a strong capital level is reassuring” he added, referring to the bank’s core CET1 ratio of 14.6 per cent, among the strongest of any of the world’s largest lenders.

The dismal outlook underlines the challenge facing new HSBC CEO Noel Quinn: as the FT notes, the crisis has already forced him to delay what he has described as one of the “deepest restructurings” in HSBC’s 155-year history. This saw it strengthen its focus on the lender’s pivot to Asia — where it makes the majority of its earnings — and shrink less profitable operations in Europe and the US.

“We are anticipating deep, severe recession events in western Europe and the US in the second quarter,” chief financial officer Ewen Stevenson told the Financial Times on Tuesday. The scale of loan losses depends on the “path of the economic impact and the shape of the recovery”, both of which are still unknown.

There was a silver lining, with the bank “seeing some encouraging signs of recovery in Asia . . . but as the rest of the world enters its crisis, China will not be immune from the impact of falling global demand” as “The outlook for world economies in 2020 has substantially worsened in the past two months.”

Last week, Credit Suisse saws its loan loss provisions surge by 600% albeit from a smaller base, while Italy’s UniCredit set aside an additional €900m for the first quarter. On Tuesday UBS increased provisions by a factor of 268 (1,240%), also from a lower base, while Santander posted an additional €1.6bn of Covid-19 related reserves. Santander CEO Jose Antonio Alvarez said in an earnings call that the situation is “workable” if there’s a relatively rapid recovery in the global economy as the lockdowns ebb.

“We are well prepared to face the headwinds we’re going to suffer in the coming quarters,” Alvarez said on a conference call Tuesday after the bank reported net income for the first three months plunged 82% because of its provisions.

“There are difficult times ahead,” said Nicholas Hyett, equity analyst at Hargreaves Lansdown. “If conditions get worse from here provisions for bad loans will increase, and together with credit downgrades that will eat into capital reserves.”

Tyler Durden

Tue, 04/28/2020 – 12:00