FOMC Preview: A Confidence Game Where The Difficult Questions Will Be Avoided

Two days ago, the WSJ’s Fed watchers Jon Hilsenrath and Nick Timiraos started off their expose on how the “Fed Is Changing What It Means to Be a Central Bank” in which the only thing that really mattered was the first paragraph:

The Federal Reserve is redefining central banking. By lending widely to businesses, states and cities in its effort to insulate the U.S. economy from the coronavirus pandemic, it is breaking century-old taboos about who gets money from the central bank in a crisis, on what terms, and what risks it will take about getting that money back.

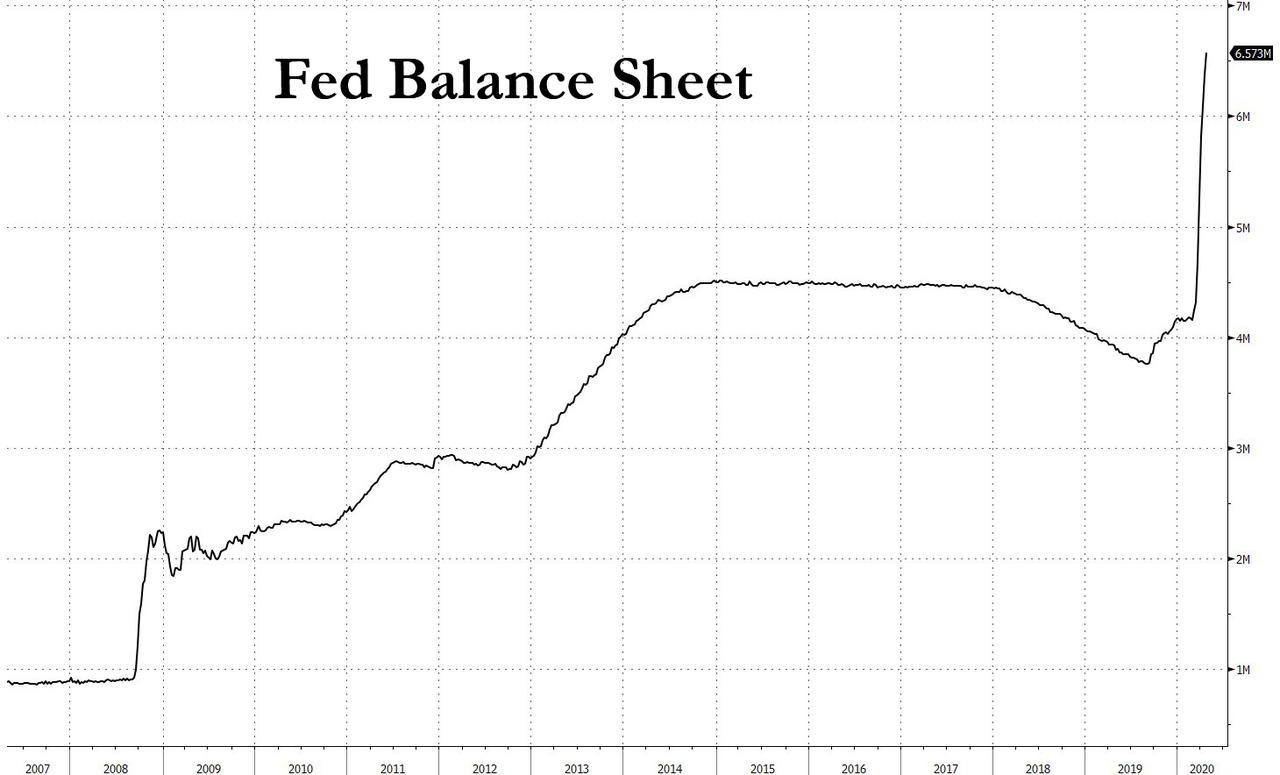

This is a good description of what the Fed has done in the past month: the breach of virtually every central bank taboo imaginable, crossing lines not even Ben Bernanke dared to cross by openly buying corporate bonds and backstopping virtually all credit instruments, all in the pursuit of stabilizing markets the US economy and avoiding a full-blown depression, even if it meant institutionalizing moral hazard as the only imperative and ending free and capital markets as we know them, resulting in “markets by decree.” It also propelled the Fed’s balance sheet to a record $6.6 trillion, well on its way to hitting $12 trillion, or half of US GDP.

Commenting on the Fed’s recent unprecedented step, Standard Chartered’s Steven Englander writes that the Fed’s absolute priority is preventing financial market stress from escalating, and will do anything it needs to achieve this goal, even as major policy moves as made inbetween meetings.

Which brings us to today’s FOMC meeting, where with markets decidedly calmer, and the S&P about 10% below its all time highs even as the US economy remains effectively frozen, Englander does not expect big policy decisions at Wednesday’s FOMC. After all, with rates at zero and QE already “unlimited” what can the Fed do absent announcing negative rates and starting to buy stocks (it will likely pursue both, but it first needs another market crash.)

In terms of what the Fed will do today:

- The FOMC will likely raise the IOER by at least 5bps, according to Englander, to push effective fed funds a bit further from the zero bound. Looking further down the road, Englander expects some form of YCC but not on Wednesday. The big medium-term questions are how to deal with ballooning deficits and how much credit risk to take on. Powell will likely adopt a market friendly tone, but couch policy in conventional terms.

- Saxobank agrees and expects Powell to “explain the why, the what and the how of the latest Fed’s monetary policy tweak”, while also not anticipating any monetary policy change. And since a rate cut is out of the box, with rates already at the lower bound –Powell could also rule out negative rates once again, which could be met with strong market disappointment.

- It is unlikely that Powell will provide strong guidance on the path of interest rates or discuss extensively the future of QE or the Fed’s credit support programs, especially the Main Street lending program. It is certainly too early to have details. At best, Powell could give the market a hint on how the central bank sees the recovery and could allude to a target of unemployment rate as a pre-condition for monetary policy normalization.

- Regarding recent market developments, especially oil prices turning negative, the Fed should downplay risk of outright deflation in the United States and indicate the recent volatility observed in the oil markets is seen as transitory by the committee.

- To sum up, today’s press conference is essentially a confidence game during which the Fed will continue to repeat almost every minute its readiness to act as appropriate to offset the current crisis and avoid a market crash, which implies a dovish statement on the Fed ballooning balance sheet.

* * *

The bottom line is that, besides some technical adjustments, what the Fed does from now on will have very limited impact, and in fact having gone “nuclear”, the risk is that an economic recovery will force the Fed to unwind some if not all of the emergency measures implemented in recent weeks, leading to the next destabilization event in the market.

With that said, here is a preview of today’s FOMC meeting, where as Steven Englander predicts, the “Difficult questions are likely to be avoided.“

A pause to see what is working and what is not

Federal Reserve policy makers have been sleeping above the shop in recent weeks, conducting monetary and financial policy almost in real time. As such, no big policy decisions are likely to be made at the 28-29 April meeting, given the policies already implemented; but some adjustments will likely be made to existing policies. The FOMC will probably want to use the six weeks between this meeting and the 9-10 June meeting to assess the effectiveness of already announced policies and the likely recovery path of the economy.

The FOMC will be circumspect in discussing larger structural issues both at the meeting and the press conference. Ensuring that the Federal government’s path remains sustainable as it uses fiscal policy to stabilize activity will likely become a key Fed priority. The Fed may also need to absorb more credit risk, as vulnerable segments of financial markets are identified. Problems could emerge among mortgage servicers, commercial real estate firms, state and local governments, non-profits, and weak EM borrowers.

Fed Chair Powell will likely stress the Fed’s ability and willingness to support activity and asset markets without providing specifics. On balance, he is likely to provide an asset-market-friendly message, because there is no benefit in doing otherwise. With little visibility on an economic rebound, the FOMC’s incentives are to talk up its ability and willingness act, even if no short-term moves are likely.

What might the FOMC do?

- Push the IOER higher?

This is the most likely move and the FOMC will likely be at pains to characterize this as a technical move. Effective fed funds have been trading below 5bps in recent days; pushing the interest on effective reserves (IOER) higher by 5bps could enable fed funds to trade closer to the mid-point of the 0-25bps range. A 5bps move is unlikely to alarm asset markets, but highlights the abundant liquidity in parts of money markets and elevated spreads elsewhere. Nudging up the IOER reduces the risk of negative fed funds rates and averts accusations that the Fed is introducing negative rates through the back door. The FOMC may keep the IOER steady, if fed funds trade closer to 10bps in coming days, but the base case is a move higher.

- Adjustments to the CPFF and PPPLF

Take-up of the Paycheck Protection Program Liquidity Facility (PPPLF) has been c. USD 8bn so far. The Commercial Paper Funding Facility (CPFF) has lent out c. USD 2.7bn, the Money Market Mutual Fund Liquidity Facility (MMFLF) is below USD 50bn. These levels are very likely lower than the Fed expected.

The latest data are for the week ended 22 April, so if volumes have not ramped up significantly, the Fed may adjust terms to make them more attractive to lenders and borrowers. On balance, the FOMC will announce an alteration of terms if the Fed is convinced that the programs will not gain traction in their current form, but from its perspective, waiting a few days or weeks is not costly.

What won’t the FOMC do?

- Monetary policy framework issues put aside

The two issues we see as major framework issues are credit risk and monetization. For now the Fed will keep policies within a normal monetary policy framework, even if the FOMC recognizes the heavy monetization component implied by its policies. There is a point at which fiscal sustainability becomes a direct objective of monetary policy, but the FOMC probably does not see the economy there yet.

Monetisation can be regarded as ‘helicopter money’ to the fiscal authority. Taking on private-sector credit risk can be seen as a form of helicopter money for private- sector borrowers. It may be more effective to act directly on private-sector yields, including taking on credit risk to below-prime borrowers, if spreads between private-sector borrowing rates and US Treasuries are too wide. We doubt that the Fed wants to address this issue head-on right now. It may do so if conditions deteriorate in the weaker parts of credit markets, but so far, we do not think it sees the need.

- Expanded program for non-profits and state and local governments

The same credit risk issues apply to non-profits and state and local borrowers. Many were in soft fiscal positions before the crisis, and face extended revenue losses. There may have to be a separate congressional allocation to backstop Fed lending to such borrowers in difficult credit positions. We do not expect any concrete announcements at the upcoming FOMC meeting.

The Fed has already indicated that it will broaden eligibility for municipal borrowers, and introduce a facility for non-profits. There may be some indication at this meeting of the eligibility changes for municipalities and terms for non-profits, but we expect any such announcement to have limited impact. Questions on other weak credit segments of credit markets will probably be acknowledged, but not addressed.

Tyler Durden

Wed, 04/29/2020 – 12:25