Gold Spikes As Fauci & The Fed Distract Stocks From Crushing Collapse In Economy

Seconds before the US GDP print, a well-timed report (and aggressively disseminated by mainstream media) on marginal success in a COVID therapy (mortality rates improved from 11.6% to 8.0%), which was then promoted by Fauci (who played down another study from The Lancet that showed no effect from the COVID therapy), distracted the stock market algos just enough from the economy’s worst collapse since 2008 (and devastation in consumption)…

Look over there…

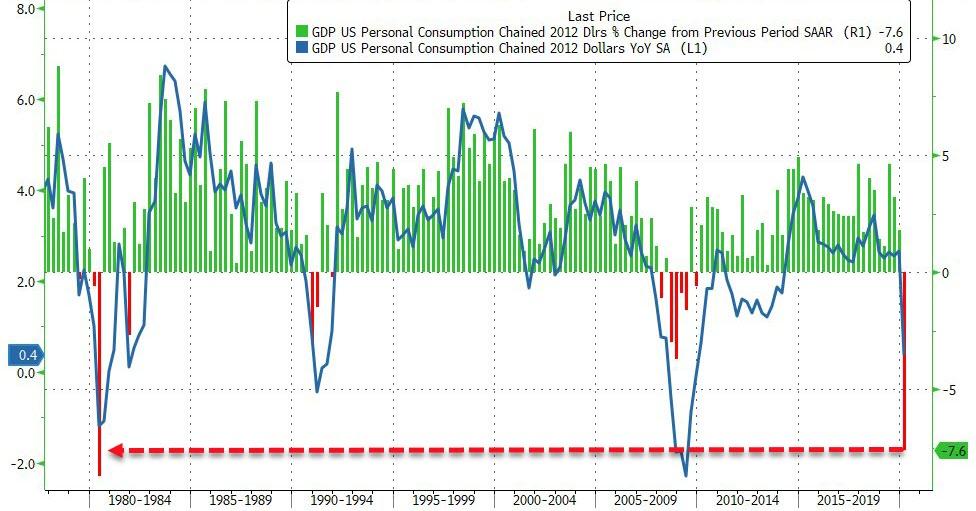

Ignore this…

Source: Bloomberg

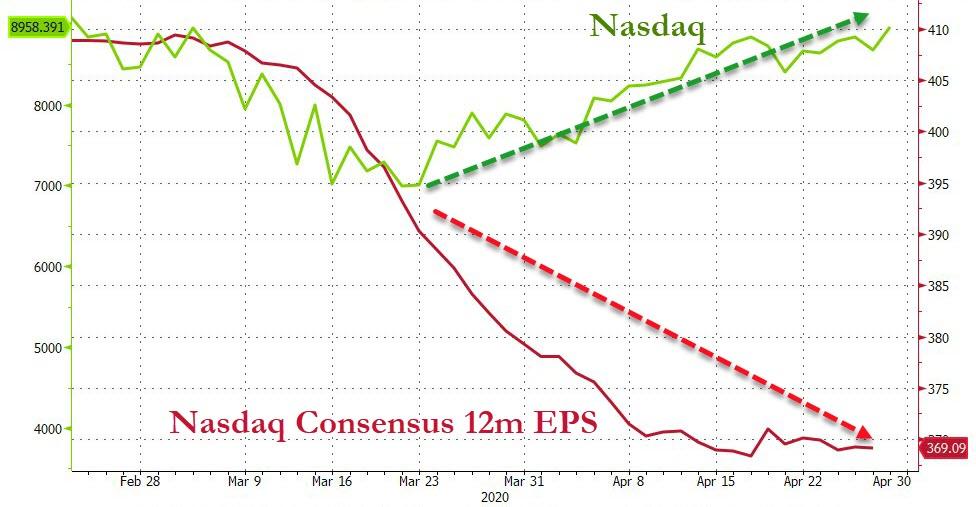

Oh and ignore this too…

Source: Bloomberg

Oh and even better news – expectations are for another 4-million-plus initial jobless claims tomorrow – that should be good for more stock market gains, because remember fake drug trials + helicopter money = good!

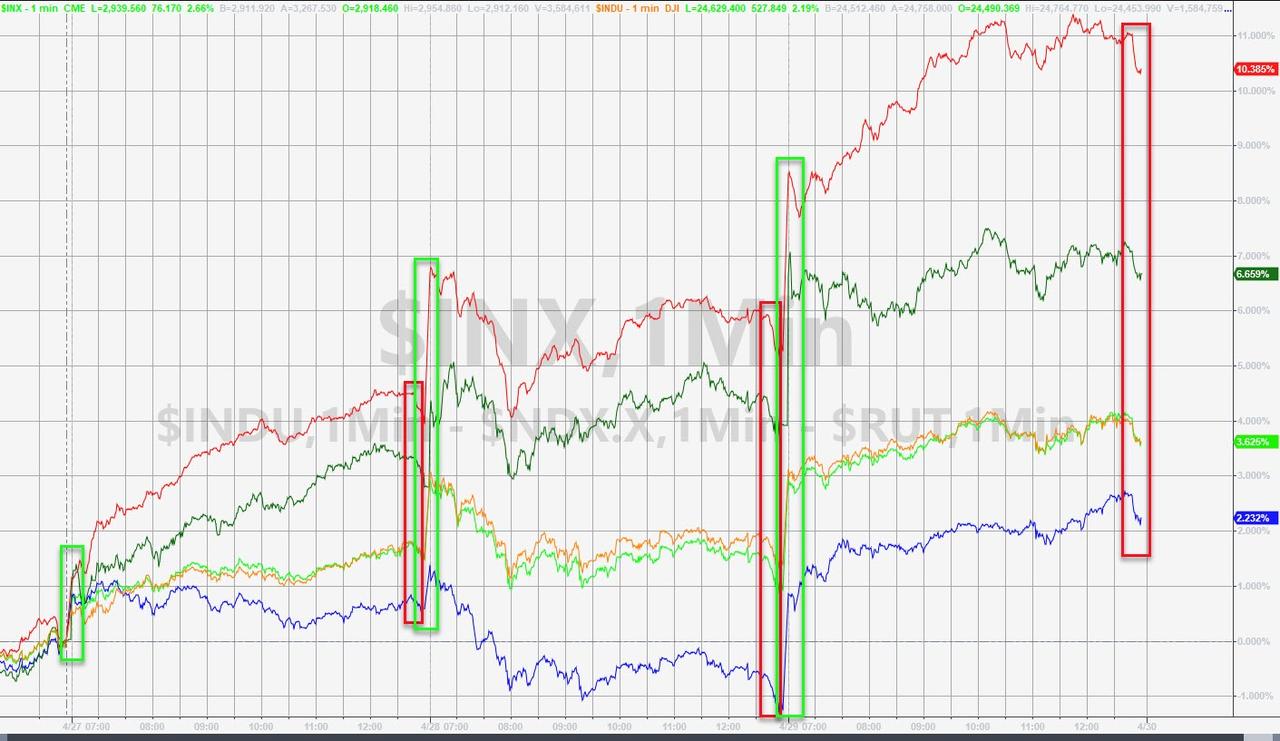

With Small Caps now up over 10% on the week – NOTE that for the 3rd day in a row, the close was weak…

Small Caps are up 41% off the lows…

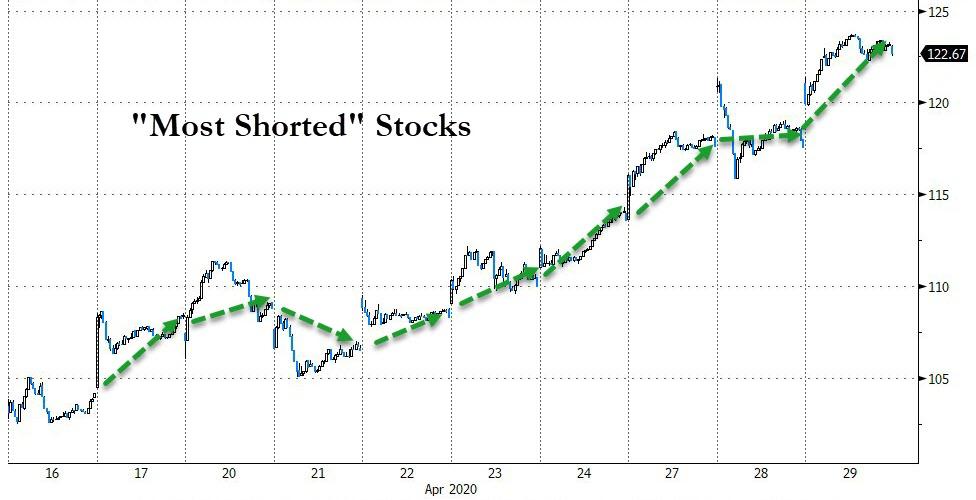

“Most Shorted” stocks are up for the 6th day in a row (and 9th of the last 10 days)…

Source: Bloomberg

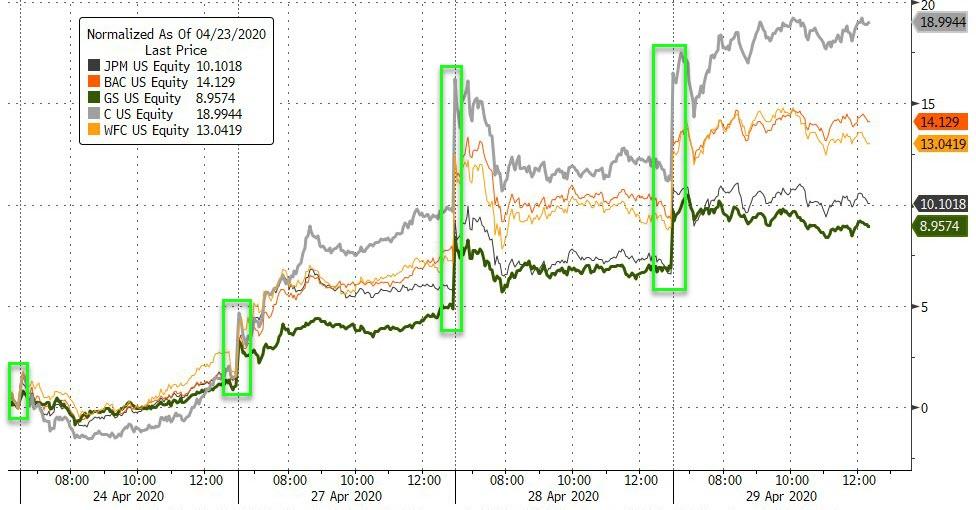

Banks ripped higher again today – 4th day in a row of opening squeeze gap higher…

Source: Bloomberg

Bond yields caught up to stocks today… then fell back

Source: Bloomberg

Mixed picture in bond-land with the short-end bid and long-end offered (2Y -1bps, 30Y +3.5bps)

Source: Bloomberg

30Y spiked on The Fed, only a few bps, but back into its two week range…

Source: Bloomberg

The dollar extended its decline to two-week lows…

Source: Bloomberg

And as the dollar dived, gold spiked on The Fed’s confirmation that it will do “whatever it takes”…

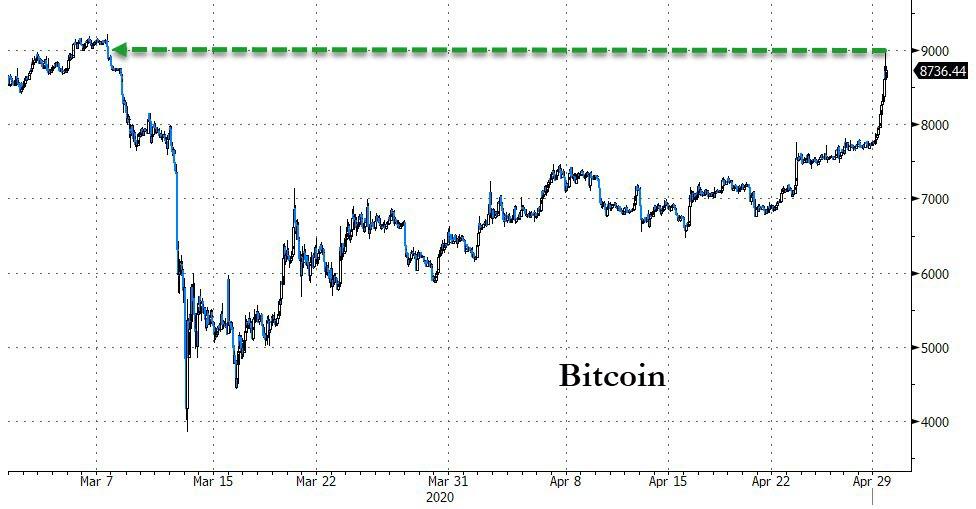

Cryptos all ramped today as the halving grows closer for Bitcoin…

Source: Bloomberg

Bitcoin soared up near $9,000 – its highest since the March puke…

Source: Bloomberg

Oil managed magnificent gains in the front-month once again after a smaller than expected crude inventory build BUT faded late on…

Quite a round trip on the week…

Source: Bloomberg

Finally, don’t forget… near record high valuations of the S&P as economic confidence is near record lows?

Source: Bloomberg

And this…

Tyler Durden

Wed, 04/29/2020 – 16:02