Stocks Scream To “Most Expensive Ever” In Greatest Month Since ’87

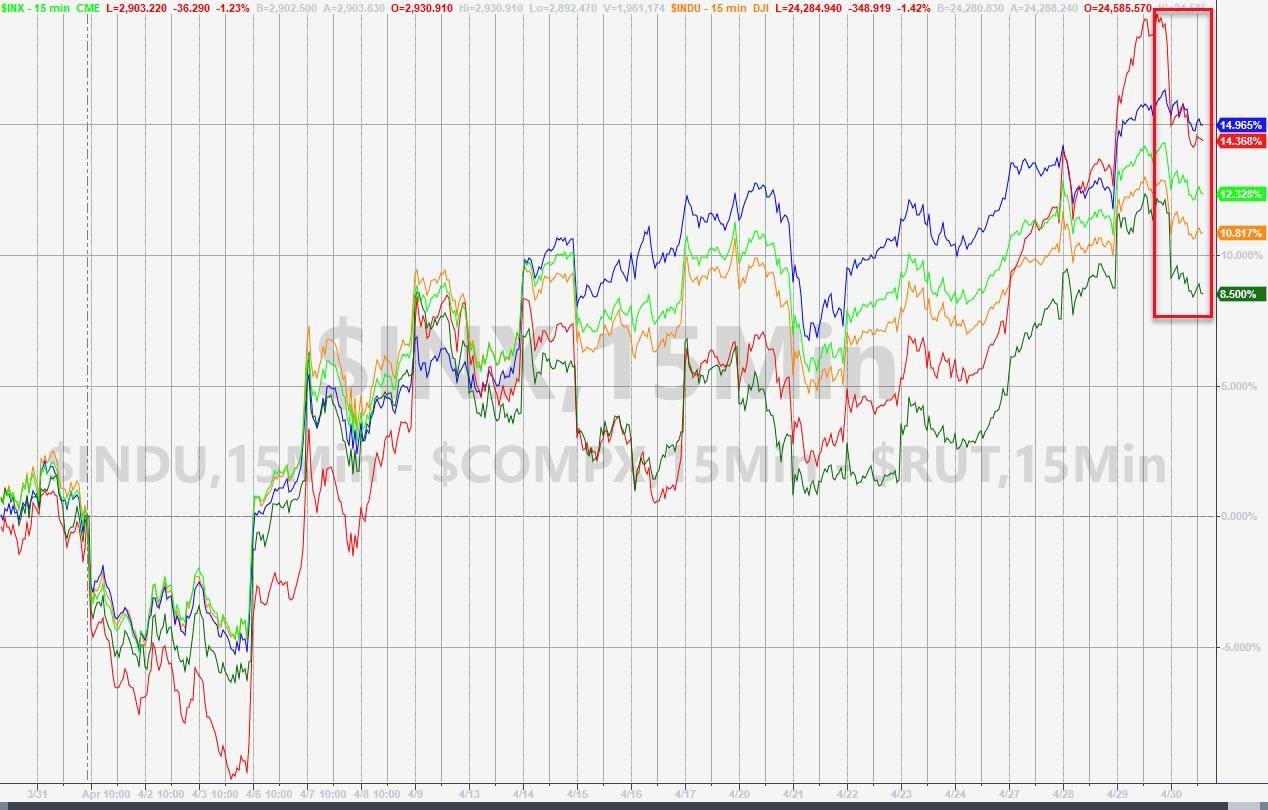

US stocks have exploded higher in April… (ended weak on what many suspect is simple rebalance flows)

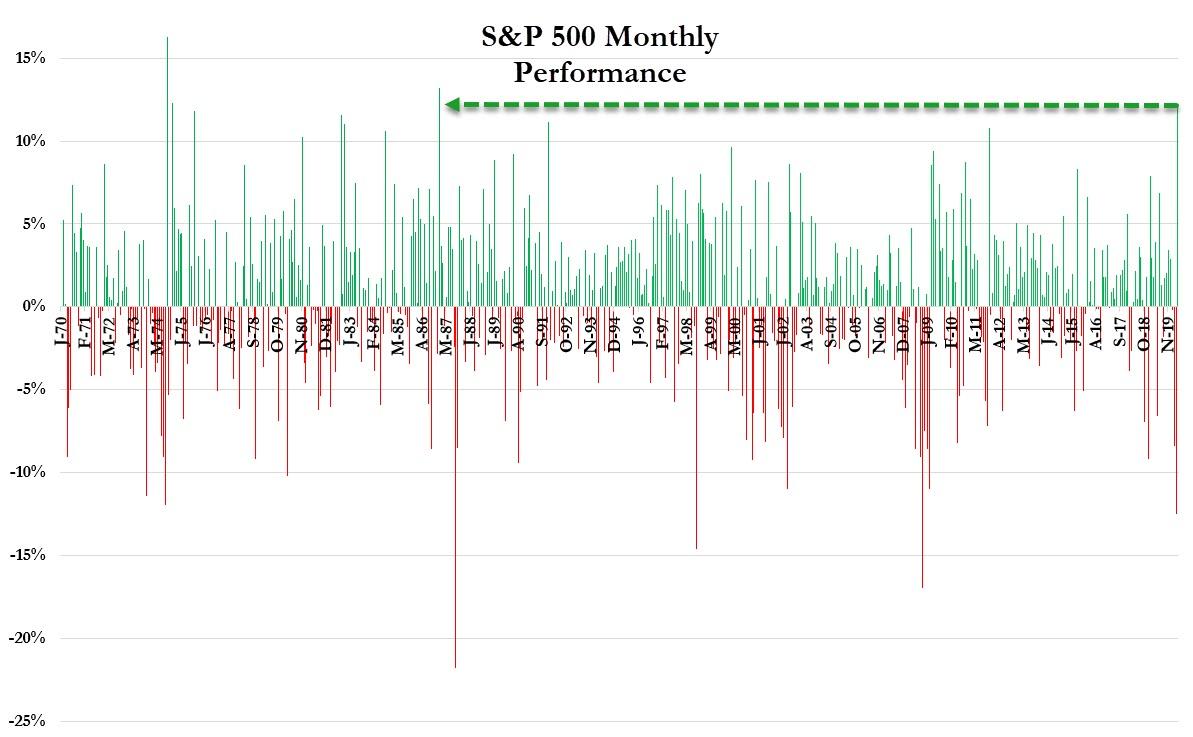

This is the best month for the S&P 500 since January 1987 (and was the best since 1974’s 13.17% gain until today’s drop)

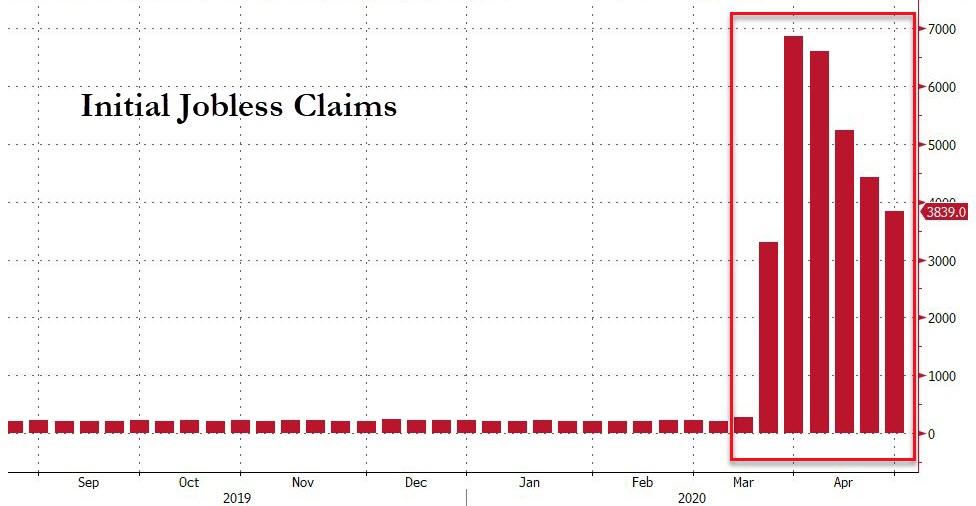

Despite the loss of over 30mm jobs…

Despite the collapse in economic data (far worse than expected)…

Source:Bloomberg

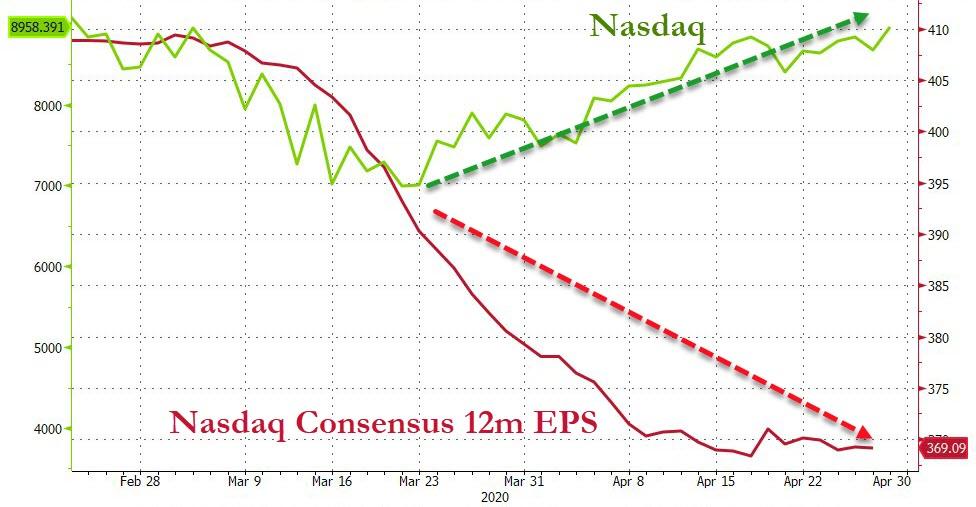

Despite a plunge in earnings expectations…

Source:Bloomberg

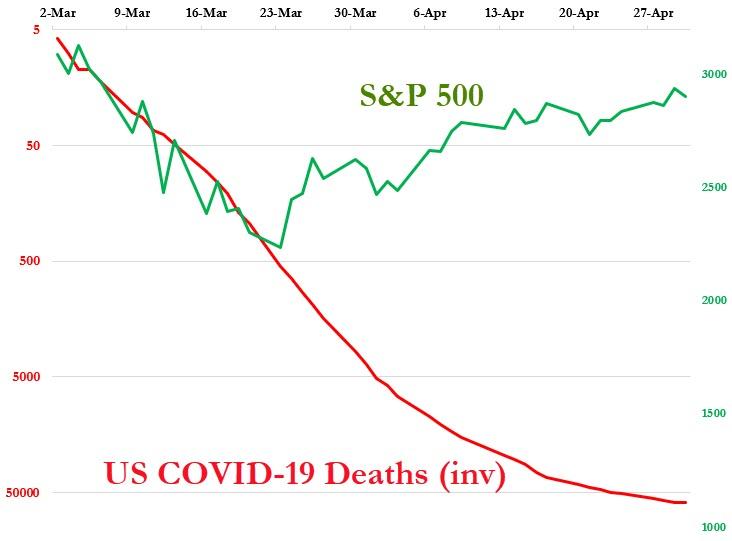

Oh and Despite an ongoing surge in COVID Deaths…

Source:Bloomberg

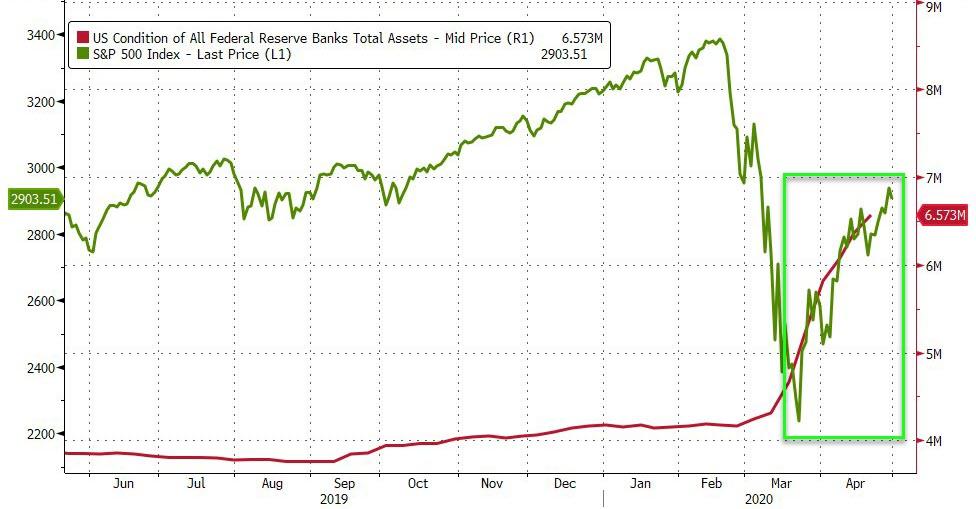

As Avenue Capital’s Marc Lasry shockingly told CNBC:

“none of this [equity rally] is based on fundamentals, this is all about what The Fed is doing… and sooner or later reality will reassert itself.”

Source:Bloomberg

So, everything is awesome?

Well, Jim Bianco warns that any recovery from here will be “slow and long” and adds that:

“I understand the market has been up a lot since the March low. But what I see in the market is a retracement rally that looks very similar to the first type of rallies that you get in protracted bear markets.”

Bianco added, ominously that:

“we’ll revisit the 2,200 S&P low, if not make a lower low – probably by late summer,” he said.

“That’s going to come because we’re going to find out now is a critical time for the market.”

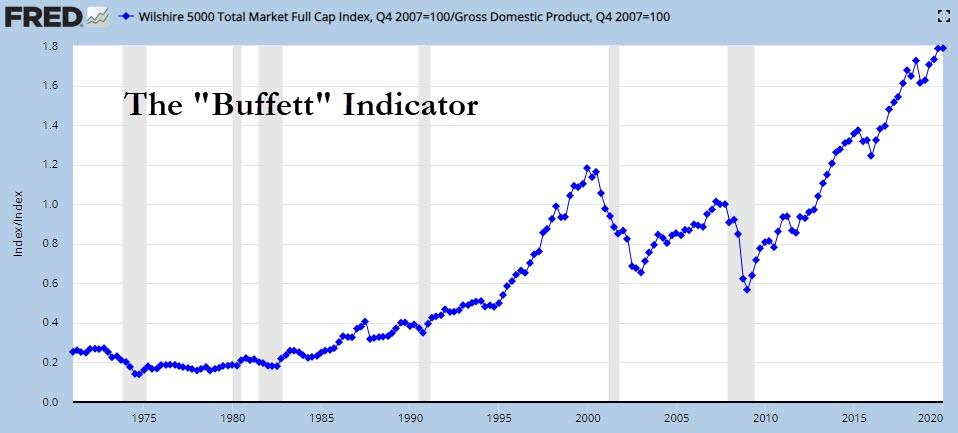

Oh and in case you were thinking of buying the dip, Warren Buffett’s favorite stock market indicator is signaling “sell, mortimer, sell” as it pushes to its most expensive ever…

The Dollar is unch in April, bonds are barely higher (in price), Gold showed some gains (as oil crashed), but stocks were panic-bid…

Source:Bloomberg

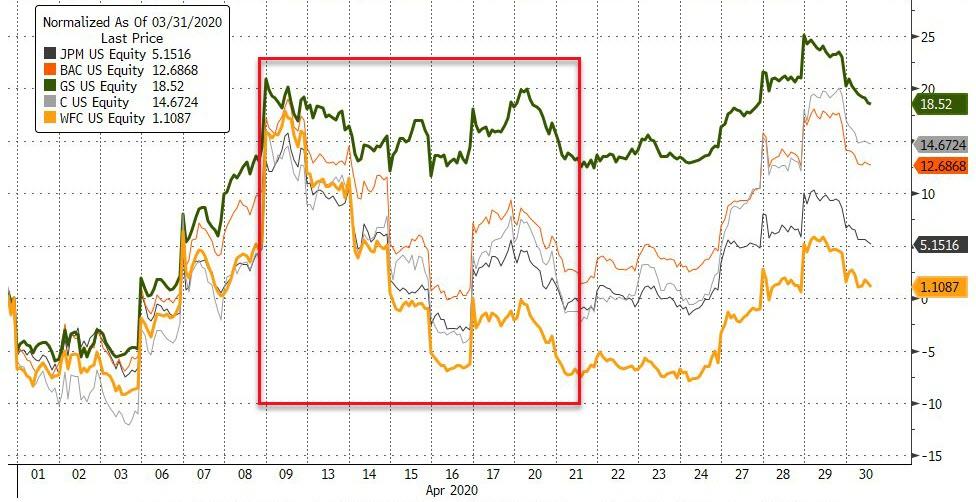

After a mid-month meltdown after earnings, bank stocks all managed gains in April…

Source:Bloomberg

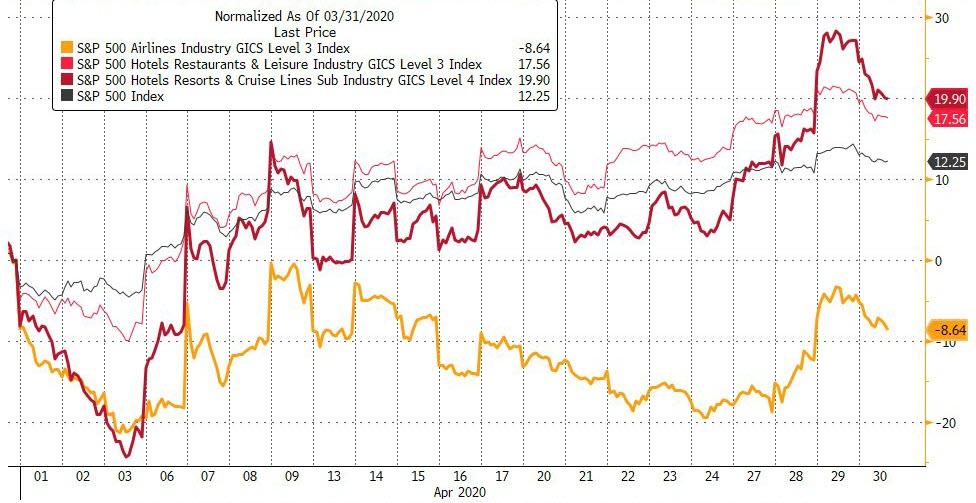

Virus-impacted sectors were mixed with airlines ugly but cruise lines positive…

Source:Bloomberg

Overall, the “virus-fear” trade eased off in April…

Source:Bloomberg

Despite stock market gains, bonds ended the month lower in yield, led by the long-end (all despite massive Fed-sponsored corporate issuance)…

Source:Bloomberg

However, today’s late-day spike in rates, once again recoupled them with stocks briefly…

Source:Bloomberg

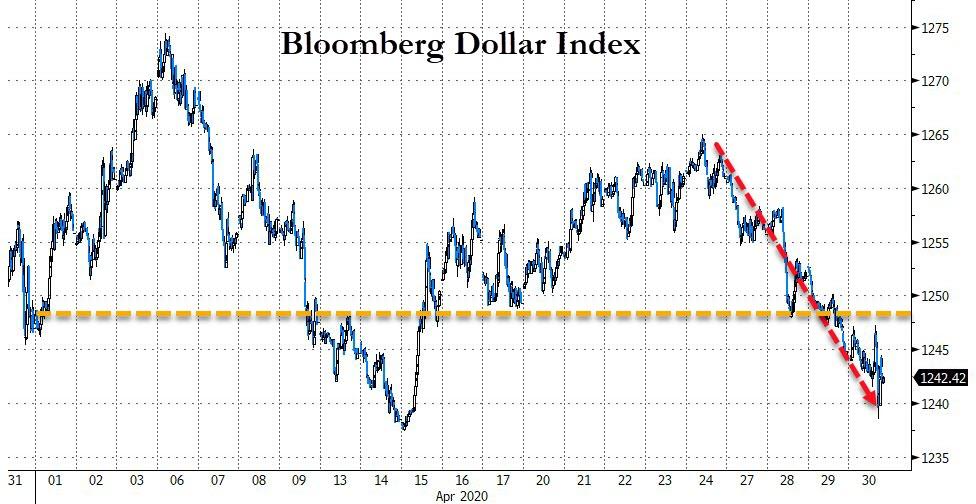

The Dollar ended the month lower, thanks to 5 straight down days…

Source:Bloomberg

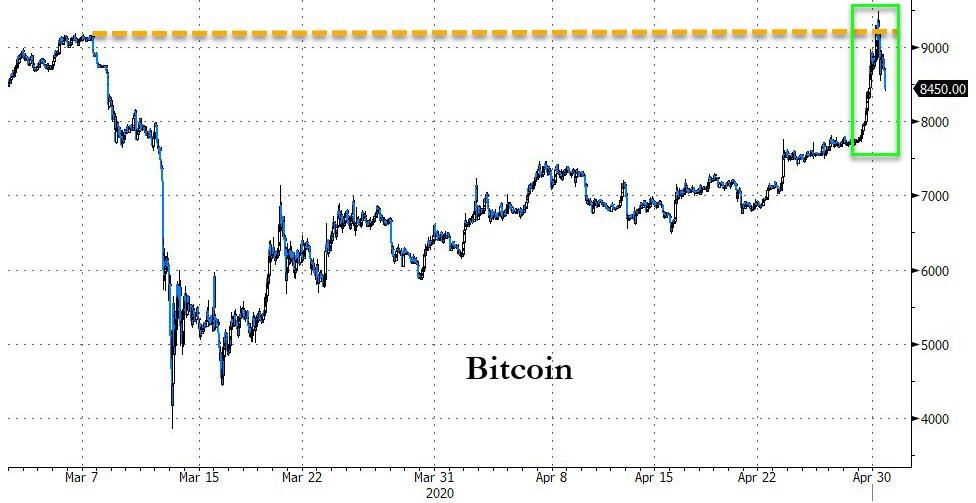

And as the dollar dipped, Bitcoin soared to test $9,500 intraday today…

Source:Bloomberg

It was a big month for all of crypto with Ethereum best…

Source:Bloomberg

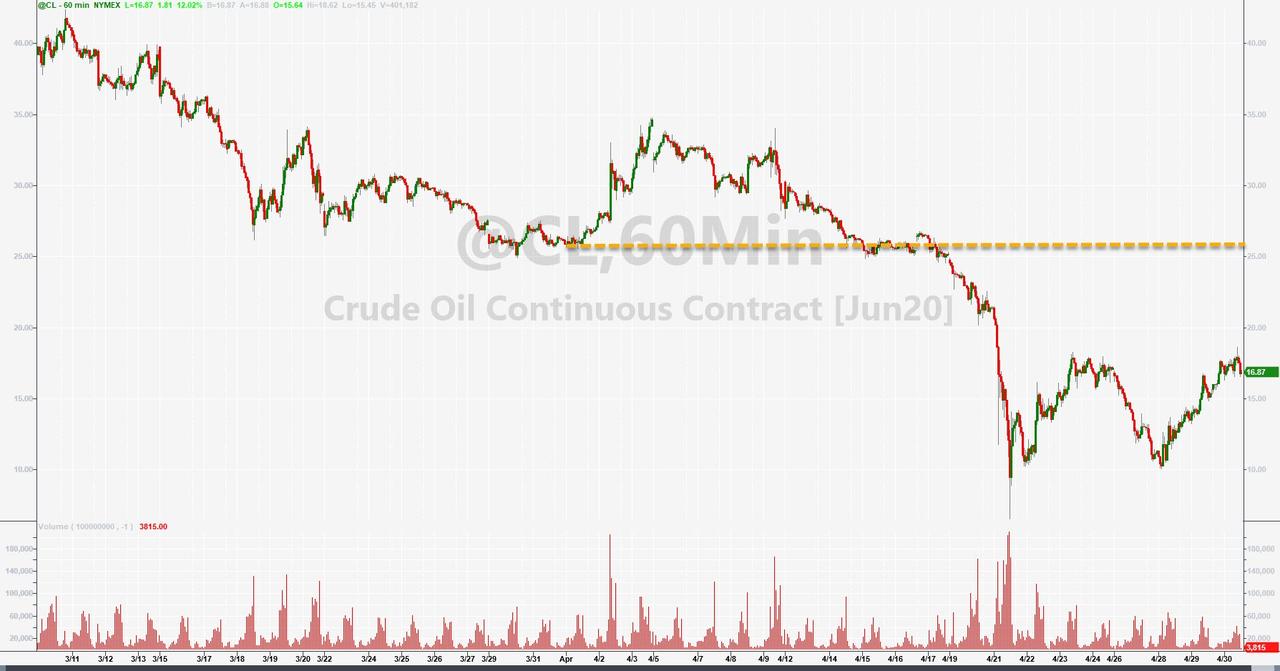

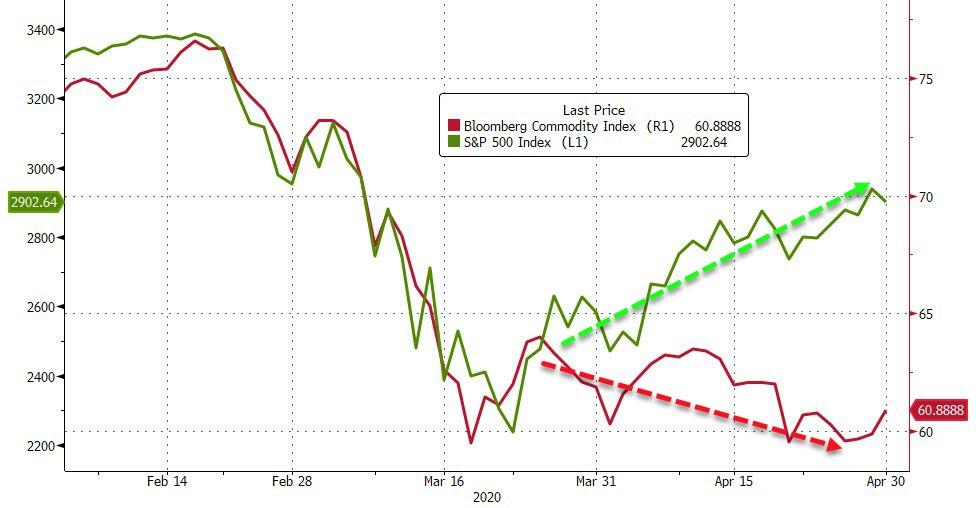

Commodities were mixed with crude collapsing (chart shows the June contract – the May contract was down 300% at its worst) as gold, silver, and copper rallied in April…

Source:Bloomberg

Gold futures were clubbed back below $1700 as the end of month gold-dump played out once again…

Silver was also hit today to end the month on the downswing…

WTI was a bloodbath…

It would appear the new normal post-COVID is an economy that does not require commodities…

Source:Bloomberg

Finally, as Bloomberg notes, the Nasdaq Stock Market’s biggest companies may have reached a “major top” relative to the smaller ones that make up the Russell 2000 Index, according to David Halloran, director of portfolio strategies at Greenwood Capital Associates LLC.

Source:Bloomberg

Halloran cited the ratio between the Invesco QQQ exchange-traded fund, tracking the Nasdaq-100 Index, and the iShares Russell 2000 ETF in an email Wednesday. The ratio fell 11% between April 16 and Wednesday after surging 42% earlier in the year, according to data compiled by Bloomberg. At its high, the ratio came within 4% of a record set in September 2000.

As The Fed continues to taper its bond-buying (quietly), we enter the month of May with nothing but hope holding stocks up. We give Jim Bianco the last words…

“What the market seems to be thinking is we’re going to restart, and we’re all going to pretend that it’s 2019,” said Bianco.

“And, we’re all going to stand on the subway platform with 500 other people waiting for the next train.”

“We are moving to a lower growth environment, and I think the market is a little ahead of itself right now in what that means,” Bianco said.

“There’s going to be more changes and more evolution that the economy is going to have to go through before we’re ready to start a full on bull market.”

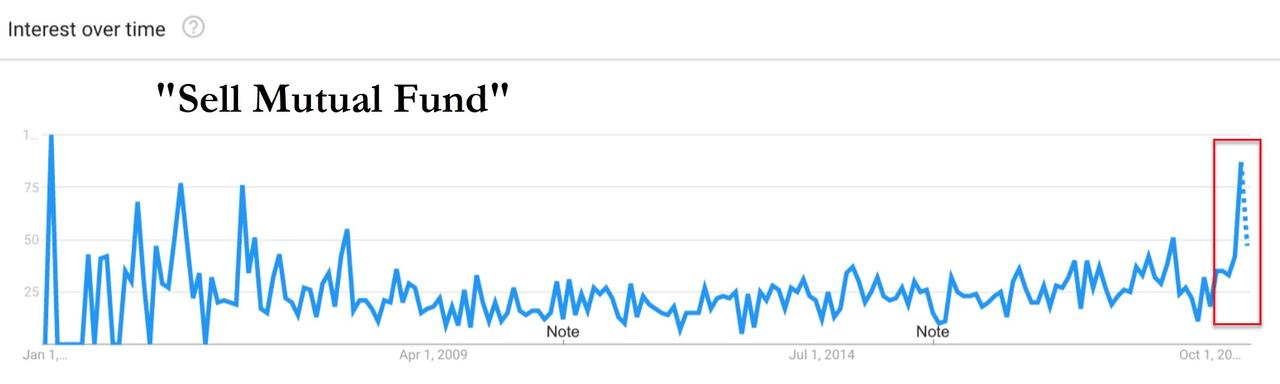

It seems for now that the Boomers are panicking…

Oh and one more thing – AAPL tonight… and it’s all about fundamentals, NOT!

Source:Bloomberg

Tyler Durden

Thu, 04/30/2020 – 16:00