Government Is On The Hook To Forgive Hundreds Of Billions In PPP Loans, Has No Idea How They’ll Do It

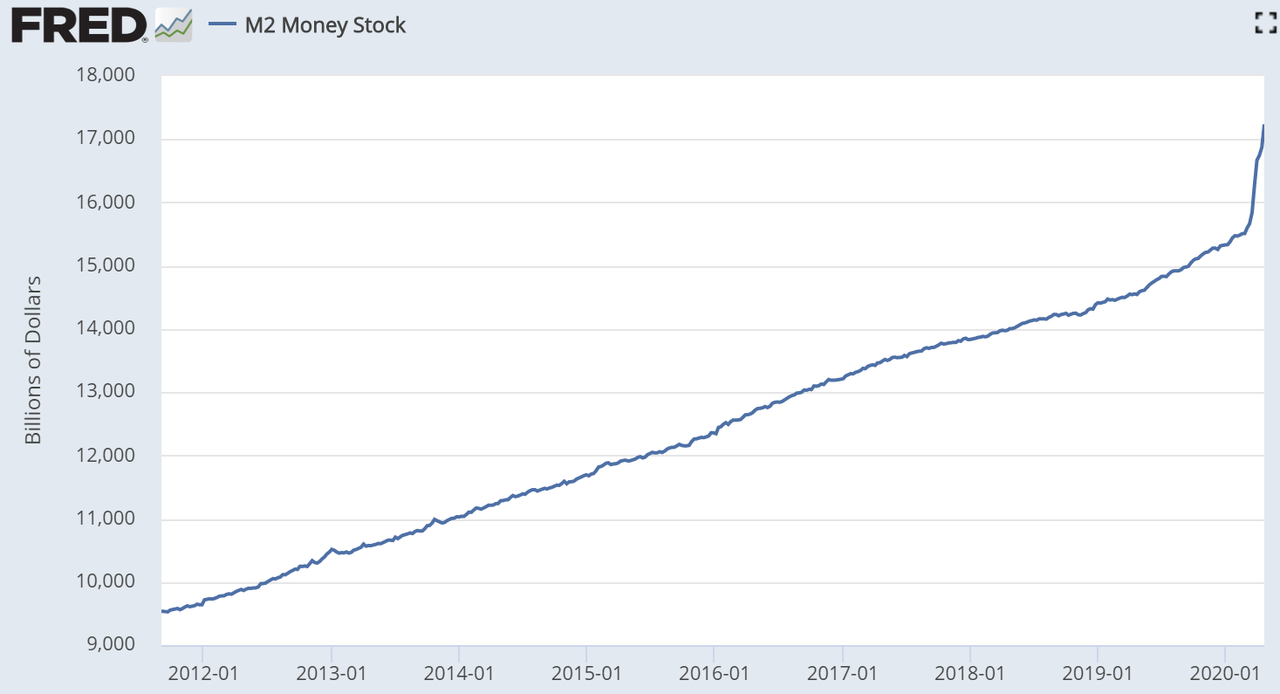

As with any piss-broke society that functions purely by taking on massive amounts of debt via money printing to try and keep itself afloat, the next obvious step after Central Banks make “loans” by printing money, is inevitable defaults.

It looks like that’s exactly what the U.S. government is now gearing up for with regards to loans they made just weeks ago and are continuing to make.

The administration’s Small Business Administration’s Paycheck Protection Program launched its second round on Monday, which allowed lenders to issue forgivable government guaranteed loans to small businesses affected by the coronavirus outbreak. Or, maybe just to anyone that fills out an application. We don’t really know – the oversight has been a bit shaky to say the least, thus far.

Regardless, the key element to the loan program (it’s hilarious to even call them “loans”) is the idea that the loans can be forgiven. After all, if given the choice to pay back your loan or have the government forgive it, which would you choose?

Exactly. And that’s why “smoothing the forgiveness process is critical for the program to succeed,” according to Reuters. But the program is that the government hasn’t issued any guidelines and exactly how to go about getting the loans forgiven.

Plus, we think this will likely mean the obvious: we’ll have fraud from both people who received the loans and from those who will eventually turn back to the government to have them “forgiven”.

Paul Merski, an executive at the Independent Community Bankers of America said: “Probably every PPP borrower expects their loan to be forgiven, but it is not that simple. There are rules and regulation to consider. So the borrower best have their information and paperwork in order.”

Ah, yes. The rock-solid compliance step of good old fashioned paperwork.

The terms of forgiveness for the loans are relatively simple:

“…borrowers must spend 75% of the loan on payroll costs, such as salaries, tips, leave, severance pay and health insurance, within the first two months. The remaining 25% can be spent on other running costs, such as rent and utilities. Money spent on non-qualifying expenses must be repaid at an annual rate of 1% within two years.”

But trying to come up with partial forgiveness sums will be difficult, banker say. There are plenty of grey areas, including what happens when employees have to be rehired and how (inevitable) misuse of funds will be tracked and punished.

Recall, yesterday, we reported that preliminary inquiry into loans granted under the Paycheck Protection Program (PPP) has revealed early signs of fraud among businesses seeking funds.

Chris Giamo, head of the commercial bank at TD Bank in New York said: “I do think it could become a little bit complex, because with every answer there’s another question.”

The Treasury Department hasn’t even gone as far as making one standard forgiveness form, which banks are now pushing for. And banks don’t really seem to want to even be a part of the equation.

David Pommerehn, general counsel of the Consumer Bankers Association said: “From a banking perspective, we are really acting as a middleman here. We don’t want to carry these loans on our books. We see this as potentially a bigger mess than the funding process.”

Business owners are confused, too. Josh Mason, founder of Maryland catering company Vittles Catering, said his bank warned him about eligibility for forgiveness, saying the process was “not yet clear”.

“I have read all the guidelines, but I wouldn’t be able to say exactly how much will be forgiven and not forgiven. I think that ambiguity is going to create a little bit of a mess when all of this comes to a close,” Mason concluded.

Meanwhile…

Tyler Durden

Fri, 05/01/2020 – 12:28