That Was Fast: CTAs Hammered After Turning “+100% Long” As Gamma Craters

When yesterday we discussed the recent bizarro ramp in stocks that sent the S&P just shy of 3000 on the day the latest GDP print confirmed the US had entered a recession if not a depression, we explained that – in a world now totally disconnected from fundamental and economic reality – the move higher was entirely due to machines chasing momentum as CTA had flipped form net short to max 100% long…

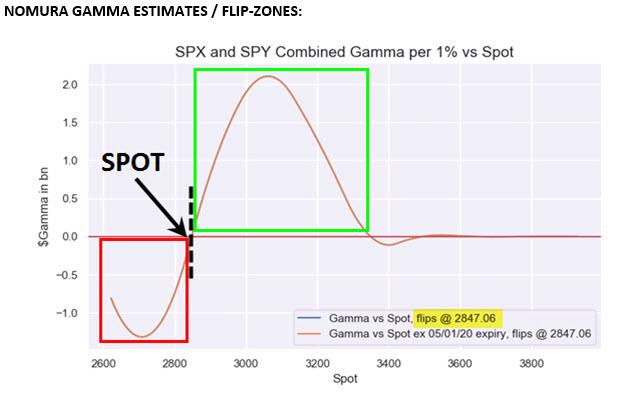

… coupled with the sticky dealer “gamma” gravity at SPX 3,000 which served as a “strange attractor” for the market, pushing it just shy of this particular bogey.

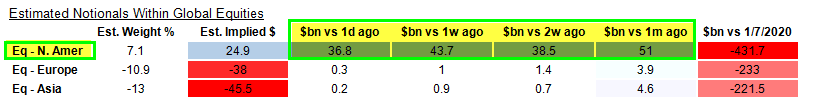

Well, a lot can change in 24 hours, because as we closed out the best month for stocks since 1974, the rabid buying reversed violently after Trump warned he would seek retribution against China on their COVID19 response, which as Nomura’s Charlie McElligott writes created the dreaded “macro shock-down” catalyst to trigger an “accelerant (sell) flows” in the other direction.

What this means is that just as the technicals – i.e., dealer gamma and CTA momentum 0 conspired to send stocks soaring on the day the US entered a depression recession, so we are now facing the mirror image and as McElligott writes:

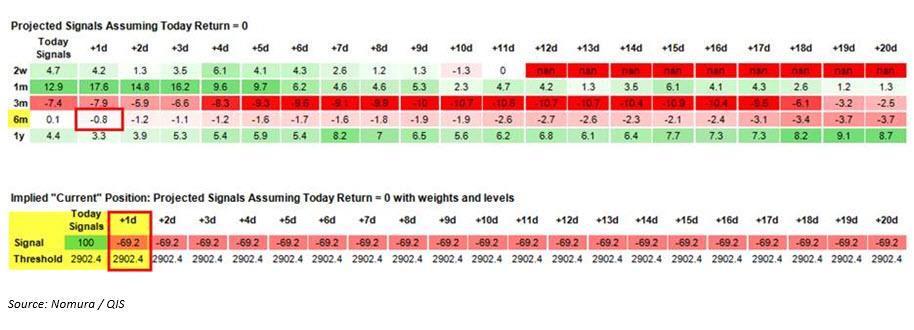

- The gap-down tripped the just-established CTA “+100% Long” signal back into “-69% Short” territory (ref 2845 last in spot, well-below the 2926 trigger on-close required for the “flip short” and actually now proximate to the 2805 “-100% Short” signal trigger level)

- The gap also shocked the also just-established Dealer “Long Gamma” position (when ref was ~2940 yday morning) now all the way back down to the exact “Neutral Gamma” level (2847, basically right where spot is now)—while any push lower from here then risking a move deeper into outright “Short Gamma” territory which would elicit heavier-handed Dealer hedging flows that likely dicate “selling-into lows”

In other words, the trapdoor opened just a day after CTAs flipped from legacy “short” back into a “+100% Long” stance in its S&P futures position with the S&P bounced safely around the significant Gamma levels between 2900 and 2950 strikes, when the avalanche of anti-China stories sent the ES trading off 135 handles from yesterday’s overnight highs to this morning’s lows.

As Nomura concludes, the extent/velocity of the selloff in Spooz matters because:

- it has sent the S&P back below the trigger level where CTAs would again pivot back -“short” as the 84.6% loading in the 6m window would “flip” (a close below 2926 has signal to -69% short, while below 2805 goes back -100% short—albeit all on smaller gross $ exposure)’

- this current spot ref ~2840 level is actually back (lower) to the “Gamma Neutral” level from yesterday’s typically insulating “Long Gamma” position for Dealers…but certainly now capable of slipping into outright “Short Gamma” on another surge lower

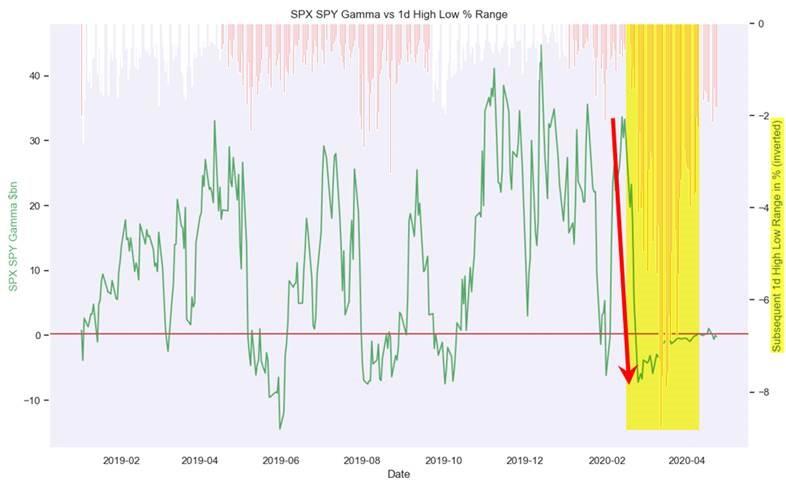

To the second point above, McElligott adds that impulse shifts lower in the Dealer “long gamma” position – think of its a third derivative of prices – tend to corroborate with larger trading ranges, especially as we get deeper into “short gamma” territory and Dealer hedging behavior is altered, having to “sell into the hole.”

In other words – thanks to this broken market – the more we drop, the lower the liquidity, the greater the bid/ask range, the higher the resulting vol, the greater the likelihood to drop more, and so on, which makes perfect sense in a bizarro market that hasn’t responded to any actual fundamentals in years, but is merely one giant reflexive feedback loop where past price action dictates future price action.

So, as McElligott concludes, the levels to watch today:

a bleed deeper into “Short Gamma” territory now that we are slightly below the “Gamma Neutral” level at 2847 (with $1.1B $Gamma at the 2850 strike)…things get especially frisky into an approach of 2805 (CTA’s going deeper short from “-69% Short”- to “-100% Short”- signal) and the “Short Gamma” more aggressive options Dealer hedging flows (selling into lows), all of which could conspire and accelerate this market reversal–particularly in light of weaker holiday volumes.

Tyler Durden

Fri, 05/01/2020 – 10:56