“Sell In May” Might Be A Good Risk Strategy This Year

Authored by Lance Roberts via RealInvestmentAdvice.com,

Biggest Rally Since 1974

Could “Sell In May” be a good risk strategy this year? Maybe, considering we asked a simple question last week: “Is the bear market rally over?”

“That’s the question we have been discussing over the last few weeks. So far, most of it has played out much as expected by turning previous ‘selling panic’ into a ‘buying rush,’ and convincing a vast majority of investors the ‘bull market is back.’”

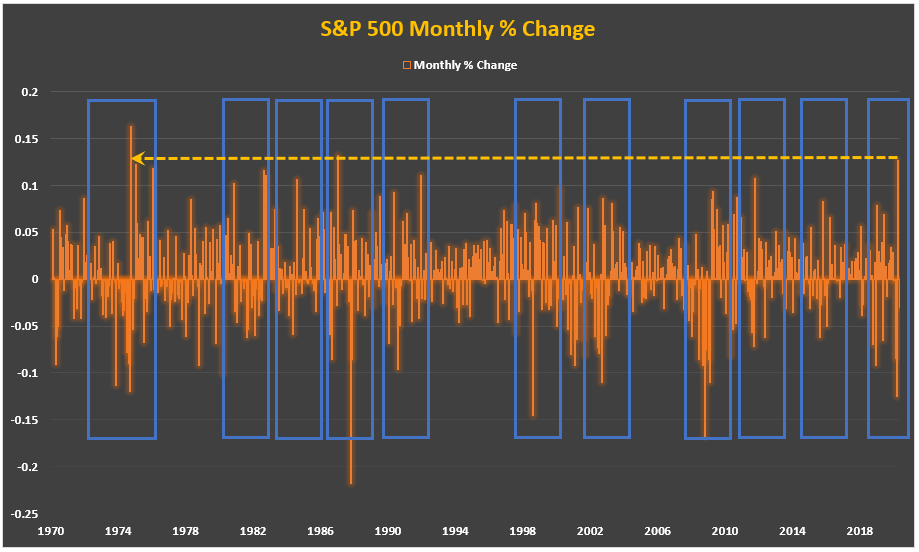

Just as we have seen in previous “bear market” bounces, the gains for April were quite stunning with stocks putting in the best one-month advance since 1974.

These exceedingly large bounces usually occur during bear markets. Unfortunately, in many cases, the majority of those big one-month advances are followed by negative returns.

Timing, as they say, is everything.

Sell In May

My colleague, Jeffrey Hirsch from Stocktraders Almanac, recently penned:

“Despite the sell-off on the last day of April, the Best Six Months has ended on a positive note, registering the best month in decades and the best April since the Great Depression.”

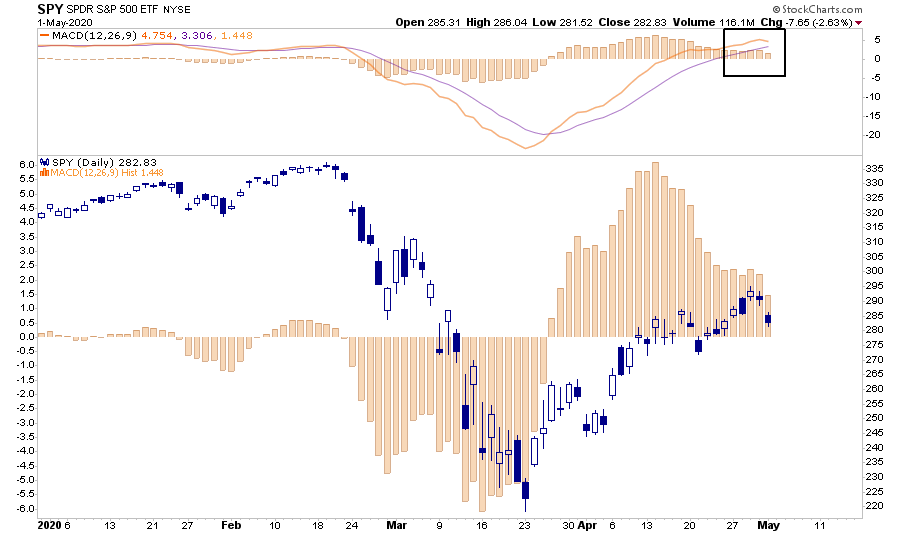

Currently, the primary signal has not crossed into negative territory yet but seems to be heading in that direction. It won’t take but a couple of more days of falling, or stagnating markets, to trigger that signal.

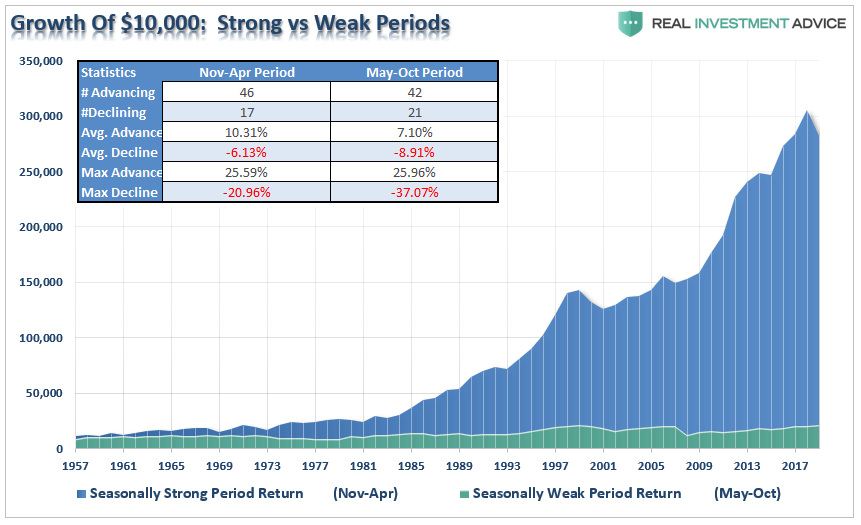

While not every “summer period” is negative, the long-term history of investing during the summer months is not stellar.

However, the adage “Sell in May” may be more appropriate this year given the state of the actual economy, earnings risk, and a potential revaluation of markets, the odds of a weak summer period has risen markedly. (This is particularly the case as we head into the Presidential election and trade tensions with China are heating up.)

Managing The Risk

Jeff continues:

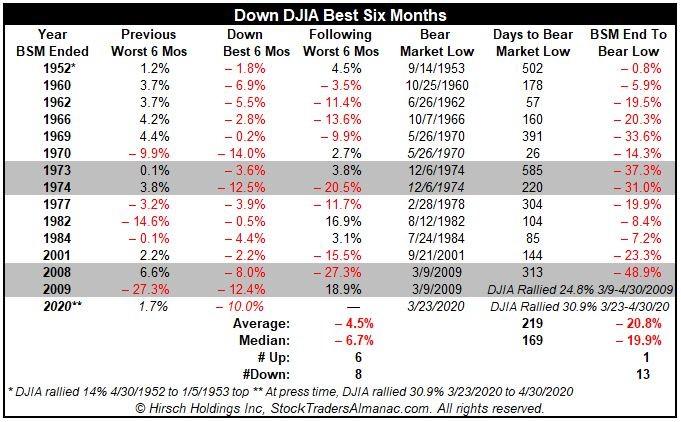

“The massive rally has surely been impressive and a welcome change from the carnage we experienced in February and March. April 2020 has been the best month since January 1987 for DJIA and S&P 500, and the best April since 1938.

But April’s huge move was not enough to put the Best Six Months (November-April) in the black, and that concerns us. The DJIA was down 10.0% for this Best Six Months period, which ended today, and the S&P 500 lost 4.1%.

When the market is down during the “Best Six Months,” it’s an indication that there are more powerful forces than seasonality at work, and when the bullish season is over, those forces may really have their say.”

“Following the first back-to-back down Best Six Months since 1973-1974, the market hit a secular bear market low in March 2009. The market made a similar secular bear market bottom in August 1982, which began in 1966. Of course, that bottom came after the infamous 1980s double-dip recession.

Our concern here is that this time around, we’ve only just begun.”

The Risk Starts In May

We can’t disagree with that statement. While there are many hoping that the worst of the economic data is now behind us, I highly suspect it isn’t. As noted in this week’s #MacroView:

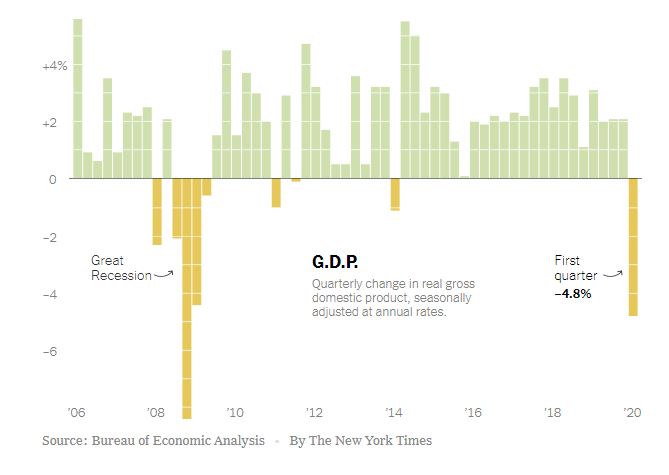

“The negative 4.8% decline in GDP in the first quarter was stunning. Importantly, that reading only encapsulated the impact of the economic “shutdown” in that last two weeks of the quarter. Such suggests, considering the entire month of April (1/3rd of the quarter) was a wash, the numbers will worse next quarter.”

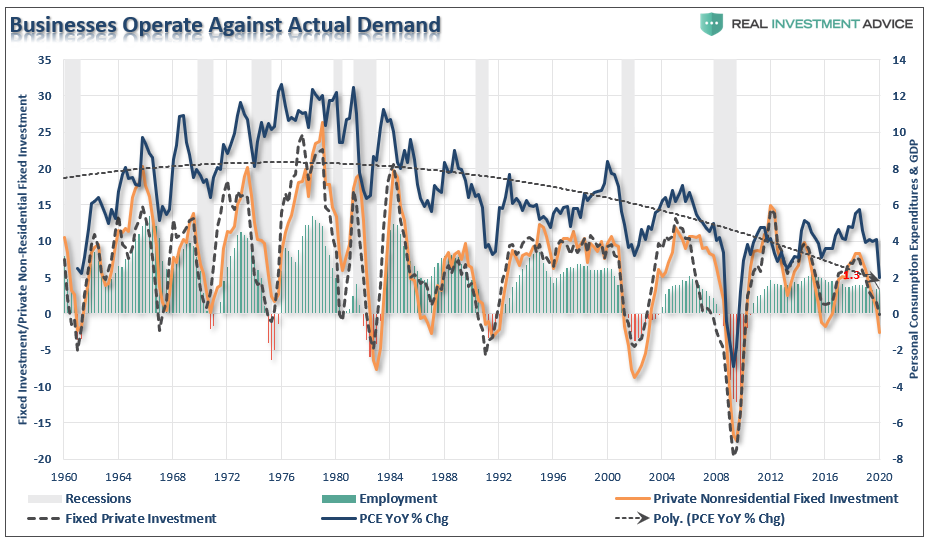

“There is a negative feedback loop between employment and consumption. As unemployment rises, consumption falls due to a lack of income. Since businesses operate based on demand for goods and services, the correlation between PCE, fixed investment, and employment is high.”

“Despite the reopening of the economy, businesses will not immediately return to full operational activity, until consumption returns to more normal levels. Such a recovery is likely going to frustrate policy-makers and the Fed.”

It isn’t just the economic data that is going to be horrid over the next few months, but earnings will likely be just as bad.

Earnings can not live in isolation from the economy.

So goes earnings, so goes the market.

“Sell In May” Starts With Overbought Risk

In the short-term, the markets remain incredibly overbought and extended after the run from the lows.

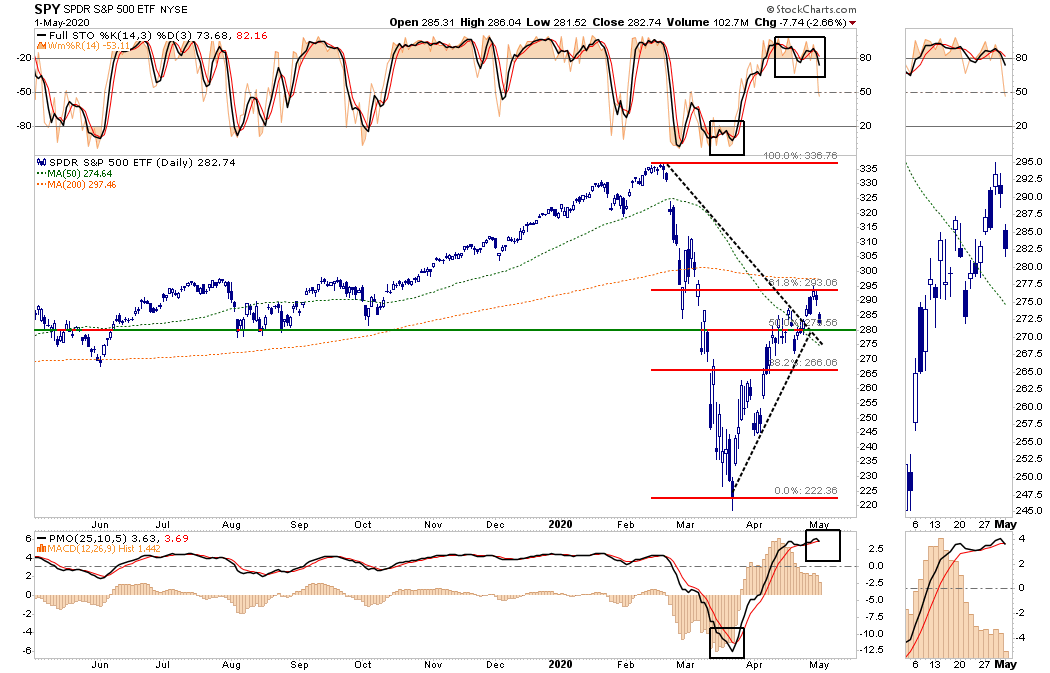

Previously, I discussed that markets had gone from extremely oversold, to extremely overbought during April. This sharp advance pushed the S&P 500 back to its 61.8% retracement level, where it failed on Friday.

While the sell-off on Friday did trigger an initial sell-signal, a further decline on Monday will trigger the primary sell-signal in the lower panel. Such would coincide with a break below 2800, and signal the start of a deeper corrective process.

There is currently a lot of “bullishness” built up in the markets, so investors will likely buy dips for now. However, it won’t take long for investors to remember March and head for the exits much sooner this time. So, be careful.

Reversions happen fast.

A Risky Game Of Hope

As we discussed with our RIAPro Subscribers (30-day Risk-Free Trial) last week, our colleague Jeffrey Marcus made some salient comments about investor’s “risky game of hope.”

“The table shows EPS growth for U.S. companies that have so far reported the 1st quarter. 20% of U.S. companies have reported so far.”

“There is only one-month of Covid-19 effect in the 1st quarter. Earnings growth from all 993 companies is -12%, but the price reaction to bad EPS has been stellar. The one-day price reaction to EPS on the day of release is in the lower right quadrant of the table.

As TPA has discussed in previous World Snapshots, the positive price action to negative news is a good sign. The problem is that EPS growth is down 12% with only one-month of the Covid-19 effect. Importantly, this is only 20% of stocks having weighed in; one has to wonder why?

The answer has to be that investors have an awful lot of hope in the power of the FED to keep the tire with a large hole inflated and as the man who taught me how to trade told me, ‘Hope is a bad investment strategy.’”

“Sell In May” Risk Outweighs Reward

What this all suggests is that “risk” still outweighs the potential “reward” of being aggressively invested in the markets.

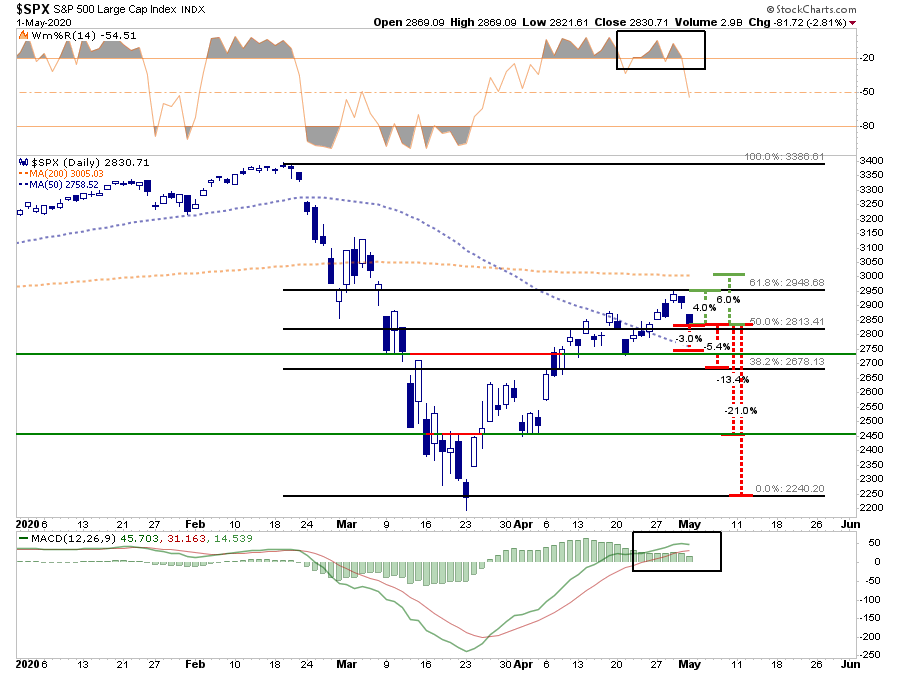

With Friday’s sell-off, the risk/reward ranges remain unfavorable for the “Sell In May” period.

-

-3.0% to 50-dma vs. 4% to the 61.8% retracement. Risk/reward equally balanced.

-

-5.4% to the 38.2% retracement vs. 6% to the 200-dma. Risk/reward equally balanced.

-

-13.4% to the April 1st lows vs. 4-6% higher. Risk/reward out of favor.

-

-21.0% to the March 23rd low: Risk/reward extremely out of favor.

The risk of a downside retracement as we head into summer months outweighs the upside currently. Importantly, this does NOT mean the markets can’t rally to all-time highs. It is possible, just not probable, and as investors, we must weigh our outcomes.

While we are discussing “Selling in May,” such doesn’t mean we are sitting in cash. We continue to remain long our reduced equity exposure and have been buying undervalued opportunities over the last few weeks. However, we are also balancing that equity exposure with offsetting hedges and a larger than average level of cash. We also continue to increase our duration in our bond portfolios as we expect interest rates will head toward ZERO this summer.

As my friend Victor Adair reminded me this week:

“Investors tend to buy the most at the top and the least at the bottom.” – Bob Farrell.

While it’s no guarantee, “Sell In May” just might be a good “risk strategy” to employ this year in particular.

Tyler Durden

Sat, 05/02/2020 – 13:50