COVID-19 Is Changing The Way America Lives, Works, & Votes

The data below reflects the findings of a national survey of 3,500 American adults conducted by Azurite Consulting, a tech-enabled consulting firm that uses unique methodologies, on behalf of Peak Prosperity to reveal the specific changes in behavior and sentiment triggered by the coronavirus in US households and businesses. This online survey of the PeakProsperity.com audience was conducted April 17-24, 2020, and is subject to a +/- 1.7 percentage point margin of error at the 95 percent confidence level.

‘All-American Impact Survey’ Three Key Findings

Beyond the high cost in human life already suffered, much of American society — perhaps even the future of the Presidency itself — has fallen victim to the the microscopic covid-19 virus.

So much damage has been done to job security, social norms, and voter trust that it will be years before life returns to the way it was before, if ever. Many of the changes forced on us by the pandemic are looking to be permanent.

#1: Covid-19 Is An Existential Threat To Businesses & Jobs

Despite quick and widespread layoffs and furloughs to cut costs, many companies fear they may not survive much longer. And those that do, don’t plan to hire back the same number of workers they’ve let go:

-

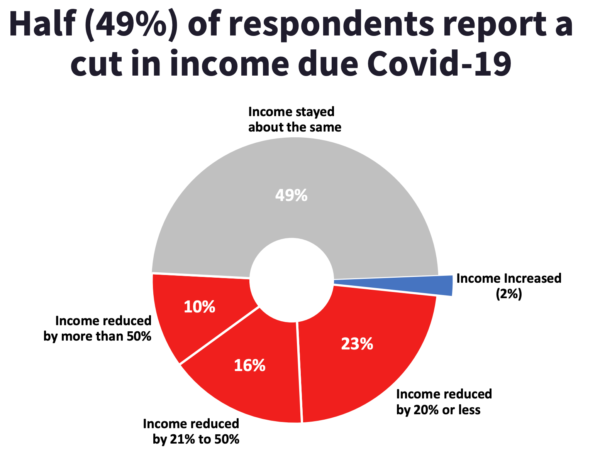

Half (49%) of all Americans report a loss income, partial or total, attributed to covid-19

-

If social distancing lasts until October, more than a third (36%) of US SMBs don’t believe they will survive

-

After the US emerges from covid-19, 70% of American c-suite executives and SMB owners plan to hire fewer employees back to perform the same work. Only 4% currently plan to hire more people than before.

#2: Covid-19 Is Pinching Budgets, Reducing Savings & Spoiling Retirement

The loss of income and reduced job security caused by the coronavirus, combined with the related recent stock market volatility, are making US households more financially insecure:

-

19% of Americans are having to dip into their savings accounts to cover normal monthly expenses due to the impact of covid-19

-

18% of retirees are considering having to return to the workforce to bolster their retirement savings

-

In order to make ends meet, households are cutting back on expenses. 62% of Americans have increased their home cooking and 36% are buying less “indulgent” foods. 39% have postponed larger household purchases (TVs, cars, designer clothing, home improvement, etc)

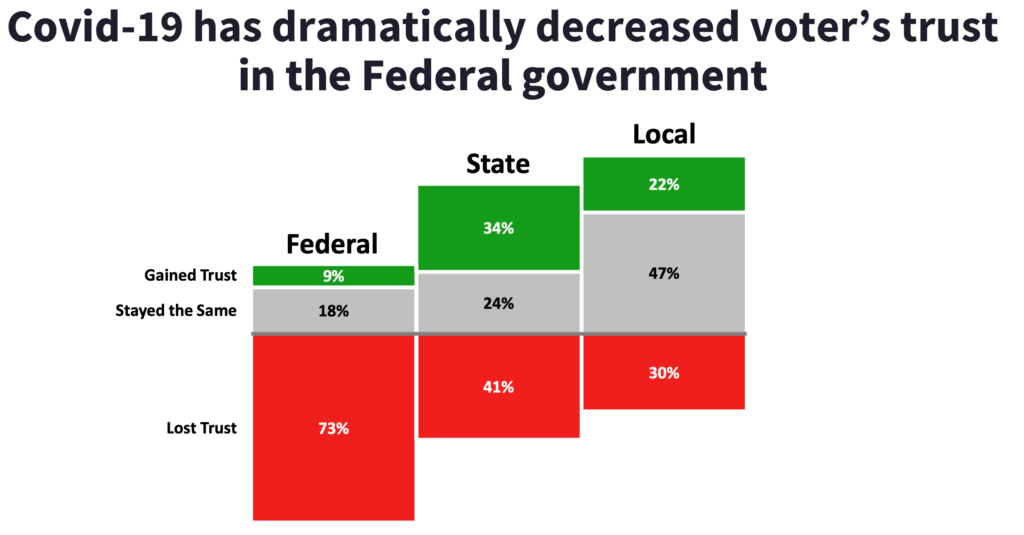

#3: Covid-19 Has Resulted In So Much Loss Of Voter Trust That It May Cost President Trump The 2020 Election

The majority of the voting public is dissatisfied with the federal government’s response to the pandemic, much more so compared to state and local levels. President Trump’s performance specifically receives the worst ratings of all, and that’s influencing a material percentage of voters in the 2020 swing states to decline to vote for him:

-

73% say they now trust the Federal government less since the covid-19 outbreak. This loss of trust is much more severe than that reported for state (41%) and local (30%) governments.

-

58% of all voters report themselves as dissatisfied with President Trump’s performance. 44% report themselves as “extremely dissatisfied” (0 or 1 on a 10 point scale)

-

Only 73% of 2016 Trump voters in the 2020 swing states are willing to say they’ll vote for him again. More than half of the remaining 27% plan to vote for another candidate or not at all.

“Four months ago, the world was unaware of covid-19,” notes Adam Taggart, president and co-founder of Peak Prosperity.

“Now the pandemic is directing nearly every decision we make while clouding our personal, professional and national prospects with an ongoing uncertainty. That’s why accurate insights of the kind Azurite has helped us obtain through this survey are so important to households and businesses right now. Without good data, how will we collectively navigate well through this challenging time in history?”

“To date, there has been a pronounced lack of statistically sound data on how Covid-19 continues to swiftly alter the world around us.” says Eli Diament, founder of Azurite Consulting. “Azurite is excited to partner with Peak Prosperity to produce one of the first studies of this scale and rigor, to help households, business leaders, the media and policymakers utilize reliable data to underpin their decision making

Further insights from the All-American Impact survey are presented below.

For media inquiries, contact Annie Scranton (annie@pacepublicrelations.com) of Pace Public Relations.

To download the full survey results, press ready graphics and obtain details on the methodology used, click the button below:

* * *

‘All-American Impact Survey’ Additional Findings

In addition to the insights above, the survey reveals that Americans are being forced by covid-19 to adopt more cautious behavior that will handicap economic recovery and likely strain social unity.

That said, life under lockdown isn’t all bad news.

Personal Life In The Age Of Covid-19: Caution Is King

It will take a long time for American life to return to “normal”, as people plan to refrain from many common activities for months (at least) after the lockdown is lifted, and in a number of cases, even after a vaccine is widely available:

-

Dining out: 53% won’t be comfortable going to a sit-down restaurant for at least 3 months after social distancing ends. 38% will wait at least 5 months. 24% won’t dine out until there’s a vaccine. 15% will wait 3 or months after a vaccine.

-

Gyms: 57% of gym-goers will wait 3+ months before returning after social distancing ends

-

Sporting event: 44% won’t attend a live game until a vaccine is issued, 63% of these people will wait at least another 3 months after the vaccine is out to attend

-

Travel: Air: 36% who took at least 1 international flight in 2019 will not fly internationally again until a vaccine is available

-

Travel: Cruise Ship: 22% of avid cruise goers say they’ll never take a cruise again. 65% will wait at least until there’s a vaccine. 55% of those waiting will delay their next cruise until at least 1 year after the vaccine is out.

-

Casinos: 45% don’t plan to go until a vaccine is available. 35% of these people will wait at least 6 months after vaccine release before going back.

And even once a covid-19 vaccine becomes available, Americans will not rush to get it:

-

52% say they will wait at least 6 months after the vaccine’s release to take it

-

29% (included in the above 52%) plan on never taking it

Fear of becoming infected is pushing us towards becoming a divided nation. About half of Americans believes themselves to be at higher risk (due to age and/or pre-existing condition). As a result, they take the covid-19 threat substantially more seriously, and may increasingly clash with what they see as “reckless” behavior by others as lockdowns are lifted and social activity resumes:

-

Those who consider themselves “At Risk” (AR) are substantially more critical than those who consider themselves “Not At Risk” (NAR) of the speed (73% AR vs 56% NAR) and forcefulness (64% AR vs 48% NAR) of the governments covid-19 response.

-

At Risk respondents are half as likely to eat out (19% AR vs 44% NAR) or shop in stores (11% AR vs 28% NAR) three times less likely to fly (6% AR vs 21% NAR) after social distancing ends

-

At Risk respondent will wait TWICE as long to do ANYTHING (go to a movie theatre, house of worship, sporting event, etc) after a vaccine becomes available than NARs

On the home front, frazzled parents have had to determine on-the-fly how best to bend, break or completely re-draw home rules during this age of forced lockdown:

-

49% of American parents have relaxed TV watching rules

-

~40% have purchased games & activities to occupy their kid’s attention

-

39% are encouraging additional online education

-

27% are alternating working hours with their spouse in order to engage with their children. 18% are simply working fewer hours in order to be able to do so.

Given the sharp market drop and subsequent damage to the economy covid-19 has caused, Americans are now more likely to invest less in “paper” assets (stocks, bonds, Treasuries) and more in hard assets

-

American investors plan reduce their exposure to the stock market by 15%

-

47% plan to increase their portfolio’s exposure to gold

Stressed out households are seeking comfort in cannabis, Consumption is increasing among marijuana smokers in lower-income households

- Marijuana smokers earning <$100k are 50% more likely to have increased cannabis consumption. They are also 2x more likely to have been laid off or furloughed from the impacts of covid-19.

It’s not all fear, anxiety and struggle, though. On the more positive side, despite the uncertainty we’re all living under, the common adversary we face in the coronavirus is creating social solidarity:

-

29% of Americans have, for the first time, purchased or shared groceries and other essential supplies with/for their neighbors

-

36% of Americans report acting more friendly now to strangers

Business: Covid-19 Is Accelerating The Transition To A Remote Workforce

The digital collaboration tools (video conferencing, team communication/collaboration software, etc) being adopted during this forced ‘work from home’ period is accelerating permanent changes in the way American companies operate

-

Nearly half (48%) report that 50% or more of their company’s employees are currently working from home

-

80% expect these newly-adopted tools to be used permanently by their business going forward

-

83% agree or strongly agree that these tools will result in greater flexibility to work from home after covid-19

Working from home has resulted in gains in personal satisfaction and career introspection among managers & employees:

-

Nearly half (48%) of American managers report a better work/life balance now

-

36% of American employees report better work/life balance

-

57% of American corporate managers say they are going to prioritize job meaning (vs money) more highly for their next professional role

* * *

PeakProsperity.com publishes analysis on the macro trends most likely to impact our future and helps individuals prepare prudently for them. Its website receives over one million visits per month and over 350,000 subscribers follow its daily video reports on YouTube.

Azurite Consulting is the leading provider of unique primary research to private equity firms, hedge funds, and large enterprises. Azurite’s unique methodologies provide our clients with original primary research they can trust, allowing them to make their most critical decisions with the highest degree of conviction.

Tyler Durden

Sun, 05/03/2020 – 09:45