Mexico’s Economy Is Disintegrating

While few have lofty expectations for economic performance with the global economy still largely shutdown, what is happening in Mexico is simply unprecedented. Here are some striking observations detailing the unprecedented economic collapse of the southern US neighbor, courtesy of Goldman.

Business confidence declined sharply in April (the seventh consecutive monthly decline) with the index now sitting deep within pessimist territory. The Manufacturing and Services PMIs also fell sharply in April, and are now at the lowest levels on record.

Business sentiment and conditions were on a gradual weakening trend well before the coronavirus pandemic as producers were apprehensive with regard to policy direction and overall macro and sector-level policies under the AMLO administration, and have in March-April deteriorated sharply in anticipation of a severe global and domestic recession triggered by the Covid-19 pandemic and the underwhelming policy response, particularly on the fiscal front.

Business confidence in the manufacturing sector recorded a -6.2pt decline in April to 37.4, adding to the six consecutive monthly declines since October 2019. The headline index has now declined a cumulative 13pt in the past seven months and is sitting significantly below the 50 optimism/pessimism threshold.

The decline of business confidence in April was broad based: for the fourth consecutive month all five sub-indices declined, with the index assessing whether this is the right moment to invest down by 11.7pt in the month and down 29.1pt from a year ago, to a low 18.9. The indices reflecting present and future economic conditions also recorded sharp declines of 8.0pt and 2.9pt, respectively, to 31.8 and 43.7, respectively. Finally, the indices measuring current and future conditions of the individual business/firms declined by 8.4pt and 2.3pt, respectively, to 40.9 and 51.3.

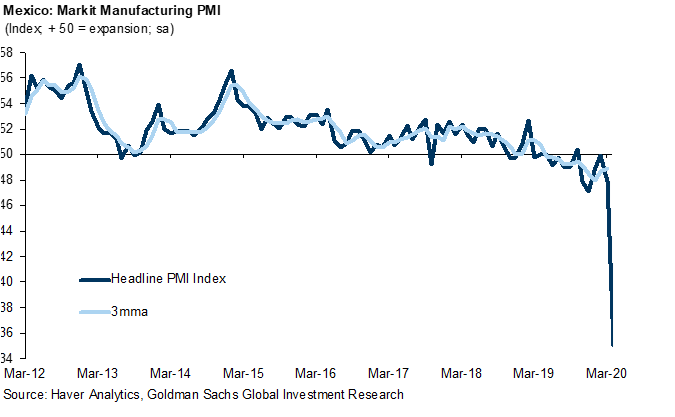

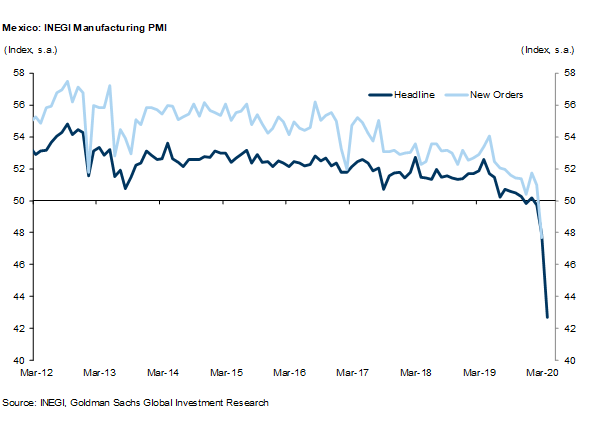

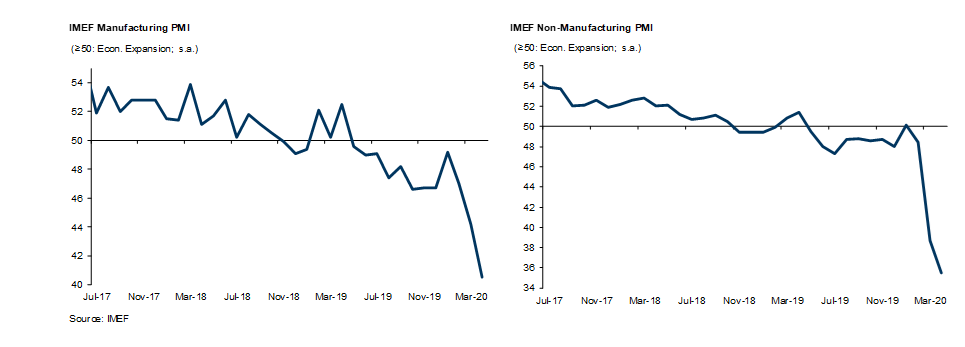

All three Manufacturing PMI indices weakened significantly in April, suggesting overall business conditions in the sector have deteriorated sharply at the beginning of 2Q2020:

- Inegi Manufacturing PMI declined 5.2pt (to 42.7). The new orders index declined 11.3pt to 36.4 and the expected production index declined by 7.5pt, to 38.9. The employment index declined by 2.9pt to 46.0. This is the lowest headline and expected production reading on record;

- Markit Manufacturing PMI fell by a large 12.9pt, to 35.0. The Output (-17.3pt to 29.7), New Export Orders (-18.2pt to 30.8), New Orders (-17.8pt to 27.7) sub-indices declined sharply in the month. The Employment (-15.0pt to 34.2) sub-index also declined significantly. The input and output prices indices declined by 6.2pt and 6.1pt, pointing to an overall deflationary environment;

- IMEF Manufacturing PMI declined by 3.7pt, to 40.5 (third consecutive monthly decline). The New Orders (-3.8pt to 29.0) and Production (-6.8pt to 28.7) sub-indices declined in April but by less than the March decline. The Employment sub-index declined by 3.307, to 42.3. Finally, the IMEF Non-Manufacturing (Services) PMI declined by 9.7pt in March and another 3.2pt in April to an all-time low 35.5 in March, and moved deeper within negative territory. The New Orders (-6.9pt, to 22.5), Production (-6.1pt, to 23.6), and Employment (-2.5pt, to 41.7) recorded significant declines in April (but the monthly drop was lower than that observed in March).

Tyler Durden

Mon, 05/04/2020 – 16:43