As The Gold Market Broke In March, HSBC Was Hit With A Record 12 VaR Breaches

Every quarter, banks proudly announce their VaR limits to demonstrate to the world just how overcapitalized they are for a worst case scenario. The only problem is that VaR calculations look at the past, not future, and when we get a forced global economic shutdown as a result of a viral pandemic which sends the VIX above 80, VaR models tend to… fail.

That’s what happened with the two largest European banks HSBC and BNP, whose risk limits were brutally and repeatedly violated in March as unprecedented market volatility made a mockery out of the banks’ estimates on how much they could lose or gain on their trading desks.

According to Bloomberg calcualtions, Europe’s two biggest banks exceeded their value-at-risk, or VaR limits, a measure of risk used to calculate how much capital they need to hold against potential losses, more times in March than over several years during calmer times.

In March alone, London-based HSBC’s trading models breached the daily expected profit-and-loss threshold 12 times, while French megabank BNP Paribas, which suffered hundreds of millions in losses on its various equity derivative products as discussed previously, reported nine such violations during the same quarter, close to a third of all such instances reported since 2007.

HSBC had 15 “back-testing exceptions” in January and March, when the firm was caught out by moves in the prices of precious metals. Europe’s biggest bank said it made two outsized profits and one loss in January that were driven largely by palladium volatility; subsequent problems were caused in part by “delivery disruptions in the gold market” which means that we now know which bank was on the other side of the gold spot-future trade.

While HSBC said it would normally only expect to record two to three breaches in an entire year, the pandemic “caused price disruptions that have not been observed in the past two years,” according to a filing, and in a statement to Bloomberg, the bank added that VAR “modelling forms just one part of our market risk management toolkit.” Hopefully the other “models” are more credible and don’t boil down to “beg central bank for bailout.”

At the same time, Germany’s Deutsche Bank reported several such “backtesting outliers” as well, while the largest Swiss bank, UBS, reported three “negative backtesting exceptions” in the quarter because of “unprecedented price moves in various asset classes,” filings show.

As Bloomberg notes, regulators have closely scrutinized banks that have problems gauging the risks their traders are taking ever since the huge losses racked up during the last financial crisis. While significant breaches usually lead to automatic penalties, regulators have naturally eased off when the breaches do occur, given how quickly trading models can become obsolete during such a virus pandemic, which begs the question: just what use are capital markets models, or stress tests for that matter? (Don’t answer, Nassim Taleb has written several books on the subject).

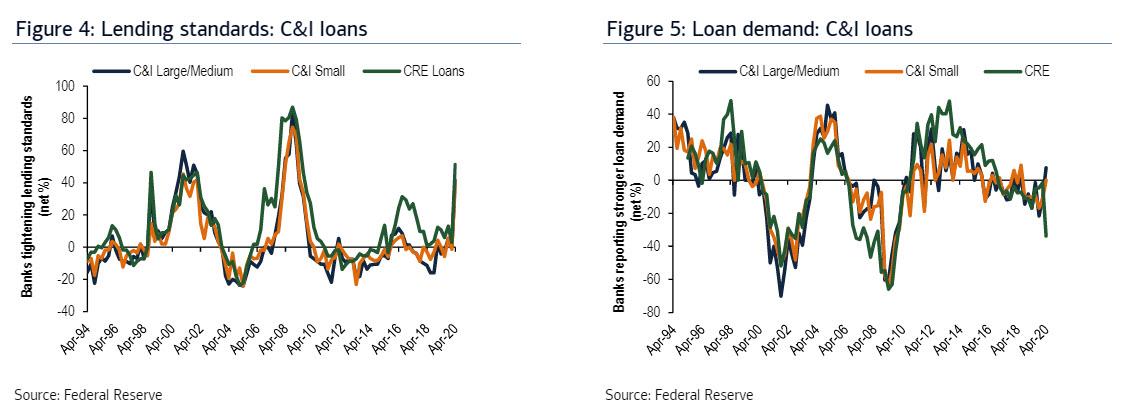

In March, the Bank of England said that it would temporarily allow banks to offset increases in value-at-risk calculations “through a commensurate reduction” in other risks they take. Which, considering the surge in loan standards, apparently means no longer offering loans or credit cards to ordinary peasants.

At BNP Paribas, the average daily value at risk soared to €35 million because of “the shock of volatility on equity markets,” mostly from mid-March onwards, according to a presentation Tuesday. That was the highest level in four years, and 49% above its quarterly average last year.

The surge in the VaR which caught the French bank unprepared, was reflected in BNP Paribas’ results. Its stock-trading business swung to a loss in the quarter, even as FICC climbed 35% as investors lifted their trading in interest rates, foreign exchange and corporate debt. Deutsche Bank has said the impact of the modeling breaches was mitigated because the European Central Bank relaxed its rules, and there was no overall impact on its capital requirements as a result.

Tyler Durden

Wed, 05/06/2020 – 13:20