Powell Needs To Immediately Address Negative Rates Or He Will Lose Control

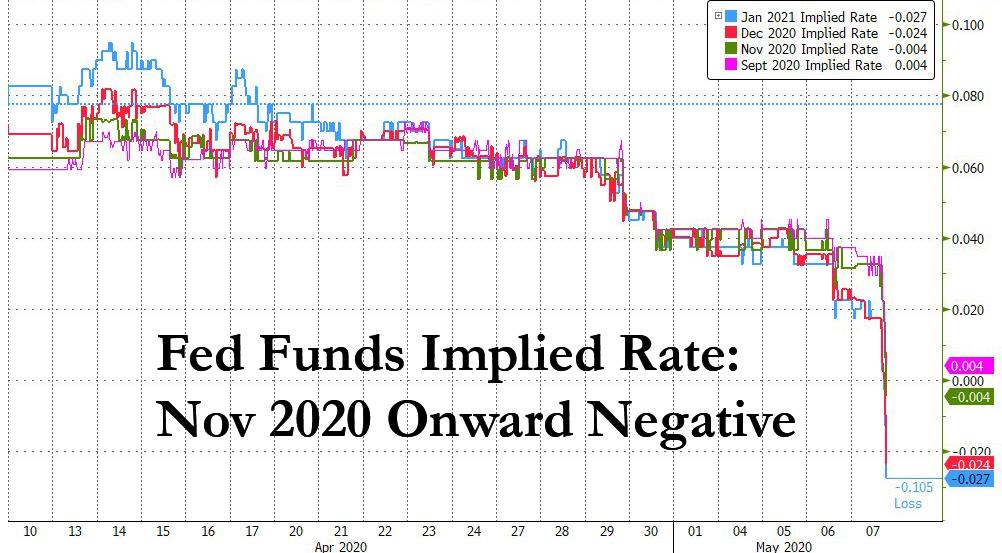

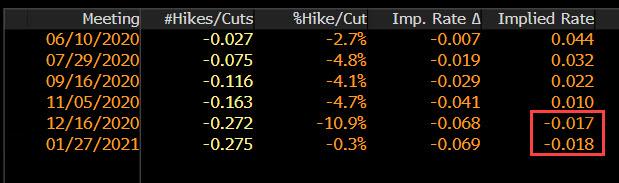

Today was a historic day, not for the latest algo-driven meltup in stocks, but because for the first time ever, fed fund futures priced in negative rates, first in January 2021 and shortly after, as recently as November 2020.

In response to the dramatic move which reverberated across asset classes, sending stocks and gold sharply higher, and 2Y yields plunging to record lows as markets suddenly realized that NIRP may be coming in just a few months, Richmond Fed president Thomas Barkin said that it’s not worth trying negative rates in the US:

“I think negative interest rates have been tried in other places, and I haven’t seen anything personally that makes me think they’re worth a try here.” He then added that “if you looked at data as of today, you’d see it about as low as it’s going to go. We’ll be bringing people back to work, and eventually hopefully people back to stores and the like, in the coming weeks and months, and I would expect the data to go up from here.”

But one look at fed funds after Barkin’s comments showed that markets barely noticed, with December implied rates still in negative territory.

Which means that only Powell addressing this issue – immediately – can reverse the market’s test of the Fed’s resolve to go from ZIRP to NIRP, because the longer Powell does nothing, the more negative rates will become widely accepted, and any “unexpectedly” denials by Powell in the coming months would be seen as hawkish reversal and lead to another market crash, which the Fed will argue nobody could have possibly seen and be forced to cut to negative anyway.

This is the gist of the point made by BMO analyst Jon Hill today who wrote that with “certain fed funds futures contracts now trading with a negative implied yield… Powell needs to decide whether he wants to nip that possibility in the bud – if the FOMC drags their feet too much, they run the risk of creating either a self-fulfilling dynamic and/or having to effectively implement ‘hawkish’ Fedspeak later down the road.”

Hill’s own assessment remains that “a cut into negative territory remains unlikely. On three separate occasions during the last press conference, Powell referred to the current target range as the ‘effective lower bound’; implicitly acknowledging that any further reduction in the target range would be self-defeating.”

But clearly the market disagrees, and investors are already starting to push the ‘negative rates’ trade as soon as November.

Should Powell fail to respond, increasingly more proximal fed funds futures will breach the NIRP line, until the market eventually is convinced that NIRP is not only allowed but priced in. At that point it will be too late for Powell to do anything, because as recent events have shown, once there another negative reaction in stocks the Fed chair will fold like, well, a cheap lawn chair. And unless Powell is ready to inject another $2-3 trillion via QE, which would be the equivalent of catching down to the -1% r* (as calculated by Deutsche Bank), Powell only other option will be to throw his hands up and concede that the US has joined Japan and Europe in the monetary twilight zone.

Will that happen? We don’t know, but keep a close eye on gold: if the yellow metal hits $1800, then $1900, and then explodes above $2000, we’ll know what comes next.

Tyler Durden

Thu, 05/07/2020 – 18:00