Yields Hit Session High After Fed Cuts Treasury QE To Just $7 Billion Per Day

From an initial $75 billion per day when the Fed announced the launch of Unlimited QE in mid-March, the US central bank first reduced its daily buying to $60 billion per day, then announced another ‘taper’ in its bond-buying program to $50 billion per day, which was followed by a reduction to 30 billion per day, which three weeks ago was again cut in half to $15 billion per day. Then, two weeks ago the Fed again slashed its daily POMO by another 33%, to $10BN per day, before cutting it to $8 billion last week. Fast forward to today when, in its latest just published schedule, the Fed unveiled that in the coming week it would purchase “only” $7BN per day.

Contrary to some expectations that the Fed would only announce a month POMO total, the Fed is continuing the practice of incremental tapering, and providing a weekly preview of its purchasing operations, which in the coming week will amount to just $35BN in TSYs, down $5BN from the current week.

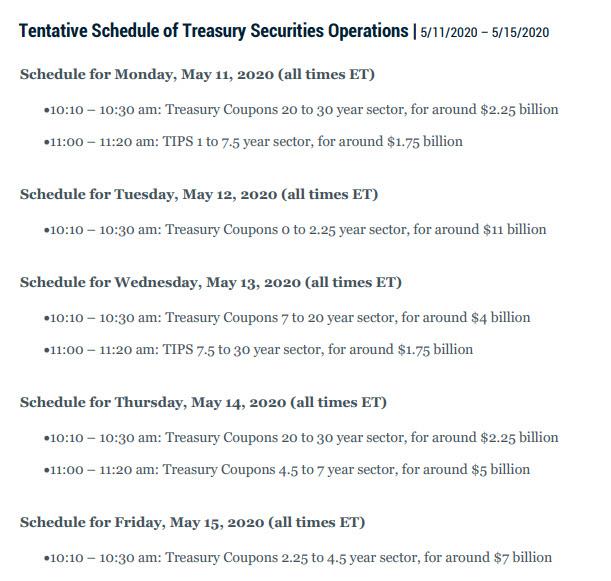

Here is the full schedule of Treasury purchases for the week ahead. Note the increasing divergence between some days of the week, such as the $4.5BN in POMO on Monday vs the $13BN on Tuesday.

Additionally, the Fed will also taper its MBS buying from $6 billion to $5 billion on average in MBS per day next week:

- Mon: $5,083BN from $6.16Bn last Monday

- Tue: $4.875BN from $5.76BN last Tuesday

- Wed: $5.083BN from $6.16BN last Wednesday

- Thur: $4.875BN from $5.76BN last Thursday

- Fri: $5.0833BN from $6.16 last Friday

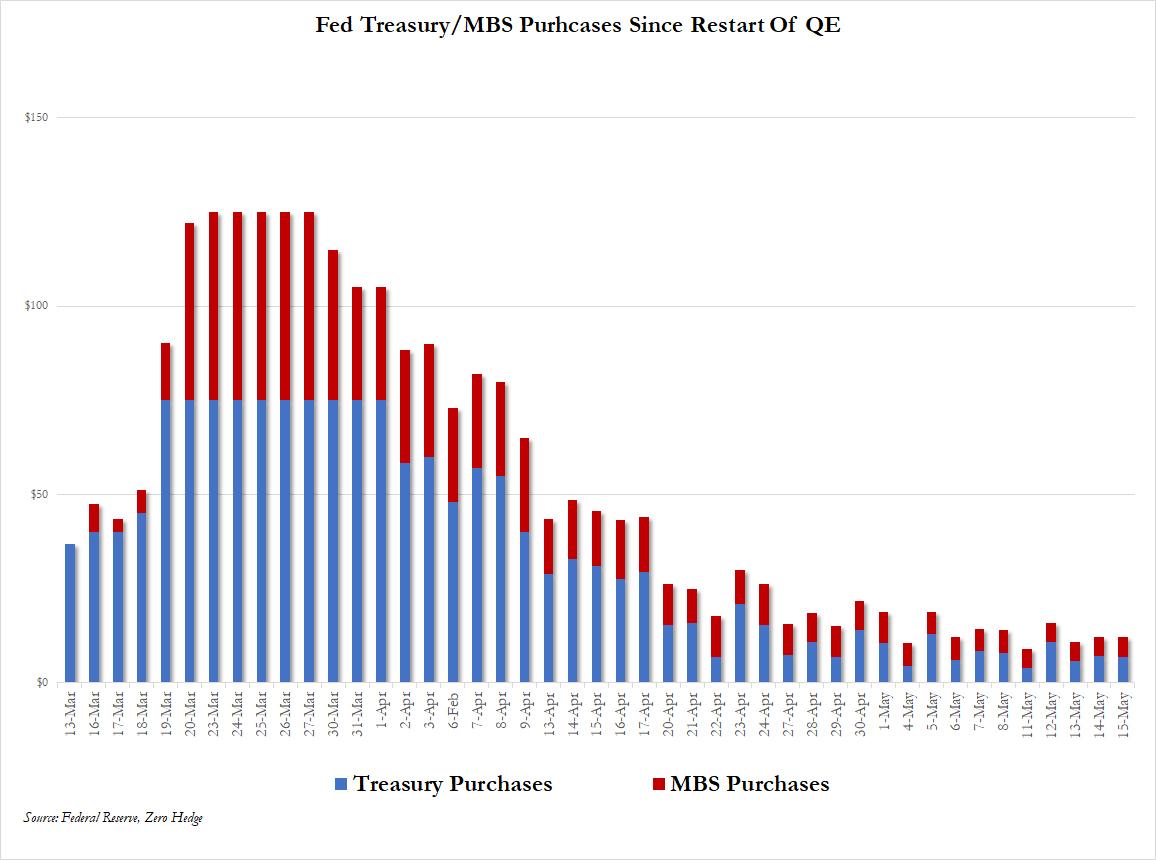

The chart below summarizes all the Fed Treasury and MBS buying completed and scheduled since the relaunch of QE on March 13:

So, in aggregate, the Fed will buy a total of $60 billion of MBS/TSYs next week, down from $70 billion but still more on a weekly basis than the largest QE programs monthly totals before this crisis, if well below the $625 billion in purchases conducted in the week starting March 23, when the financial system was once again on the verge of collapse due to a decade of ruinous Fed policies… and only the Fed could bail it out.

The news of the latest POMO cut, while expected, did not please the the market, and 10Y yields pushed higher by 2bps, rising from 0.66% to 0.68%…

… although still well below the 4.5% yield on the 10Y that bond guru and creator of the bond VIX index, Harley Bassman, said could be the trigger that causes the Fed to lose control.

In any case, bonds are clearly starting to get anxious about the pace of Fed tapering, and should Powell cut $1-2 billion more, we may finally see a bond market tantrum as traders realize they have no choice but to force the Fed to keep buying bonds at the current pace, especially with some $3 trillion set to be sold this quarter.

Tyler Durden

Fri, 05/08/2020 – 15:09