6 Reasons Why Goldman Sees The S&P Sliding Back To 2,400 By August

Amid the mass market confusion, where traders are torn between polar extremes such as i) economic reopening vs second infection wave, ii) fears of hyperinflation due to unprecedented central bank liquidity injections (now also the base case of iconic traders such as Paul Tudor Jones) vs deflationary collapse from demand destruction, iii) continued stock surge on the back of momentum-chasing algos vs skepticism among human investors who have not participated in the recent 30% rally, iv) catastrophic corporate earnings vs hope of a V-shaped economic and profit recovery in 2021, Goldman’s chief equity strategist David Kostin writes that in the last week, he held “a wide-ranging set of phone conversations and Zoom video meetings with clients across the investor spectrum (mutual funds, pension funds, insurance companies, sovereign wealth funds, family offices, and hedge funds) from around the world (Europe, Middle East, Asia, Latin America, and the US)”, and in his attempt to separate signals from all the noise, learned the following:

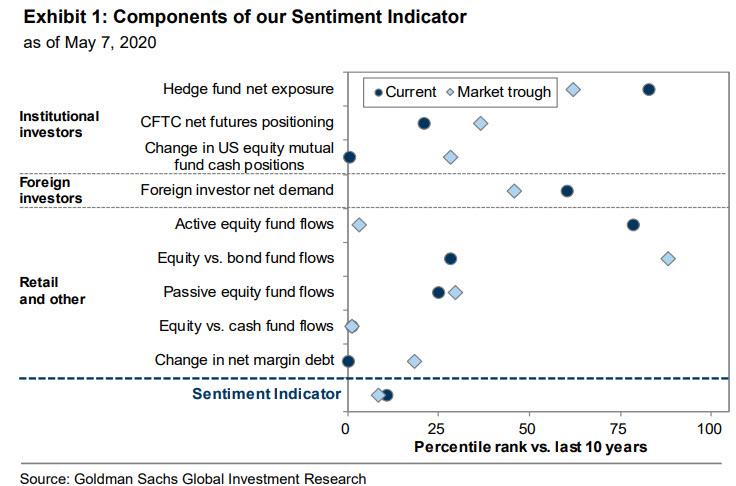

- The rally remains unloved. While long-only fund managers are pleased the index has rebounded by 31% from its bear market low on March 23rd, 60% of mutual funds lagged their benchmark during the rally. Long/short and macro hedge funds returned only 8% and 1%, respectively, since late March. CIOs expressed varying degrees of concern about how swiftly the market rebounded from its low, the current level of valuation, and the forward return potential. Goldman’s Sentiment Indicator now reads -1.3 and reflects the lack of re-risking that has occurred across many investor categories since the market low in late March. The ‘fear of missing out’ best describes the thought process of many investors. A few fund managers also expressed the view that upside tail risk exists if further medical progress is made on the antiviral and vaccine front.

- Investors uniformly cite the same three drivers of the rally: The slowdown in the rate of new virus infections, the series of dramatic Fed policy actions, and the CARES Act. Investors expect a fourth round of fiscal stimulus (“Cares 2.0”) will be enacted.

- Skepticism abounds regarding the likelihood the rally will continue. The distrust in the persistence of momentum stems from the narrow breadth of the rebound. As we explored in two recent reports (here and here), market concentration is the highest in recent history with the five largest stocks accounting for 21% of the S&P 500 equity capitalization. While the S&P 500 index trades 13% below its February 19th all-time high, the median stocks trades at a more substantial 23% below its high. FB (+3%), AAPL (+6%), AMZN (+29%), MSFT (+17%), and GOOGL (+3%) have each posted positive YTD returns while the index has returned -9%.

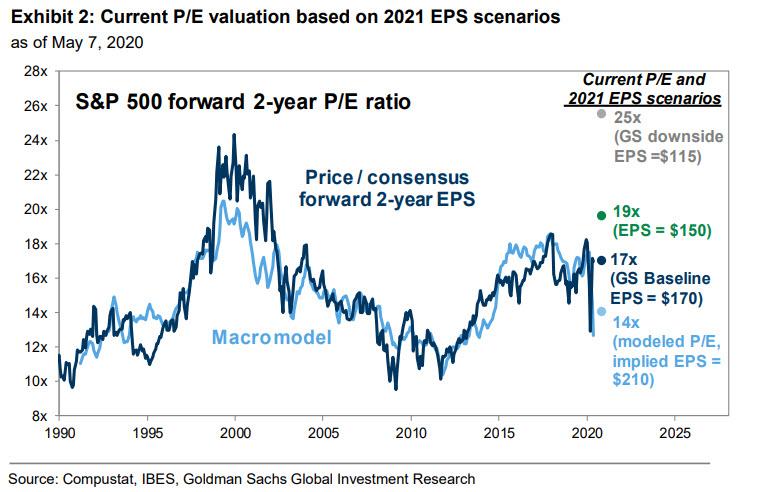

- The level of 2021 EPS is a pivotal issue globally. Goldman’s baseline forecast of $170 optimistically assumes the US economy gradually recovers during 2H 2020 and next year posts earnings 3% above 2019. A downside case of $115 assumes a slower path of resumption. Most portfolio managers assume 2021 EPS will be around $150. Valuation is stretched based on forecast 2021 EPS. At 2930, the S&P 500 trades at 19.5x the BUY-side estimate of EPS, the highest level since 2002. In other words, the S&P 500 trades at 17x Goldman’s baseline EPS forecast, 25x its downside scenario, and 36% above its macro model-implied valuation level.

- Fund managers are encouraged by the initial signs of success in reopening economies. China and Germany were the examples most frequently cited. Analysis of high frequency indicators by Goldman’s Asia economics and equity research colleagues shows that overall China activity through the week of April 24th had recovered to roughly 95% of the 2019 level, up from 90% in March (week ending March 20) and 70% in February. It remains unclear just why Goldman – or anyone else – would believe any Chinese data, however.

Looking ahead, Kostin reiterates that while the bank is optimistic over the medium-term (i.e., one year), and keeps his year end S&P 500 forecast of 3,000 (only 2% upside), he remains bearish over the short-term, expecting “18% downside to our three-month target of 2400”, and add that while a “single catalyst may not spark a pullback, but a number of concerns and risks exist that we believe, and our client discussions confirm, investors are downplaying.” And so, to validate his near-term skepticism, the Goldman strategist has listed not one but six catalysts that justify a 500+ point drop by the end of July:

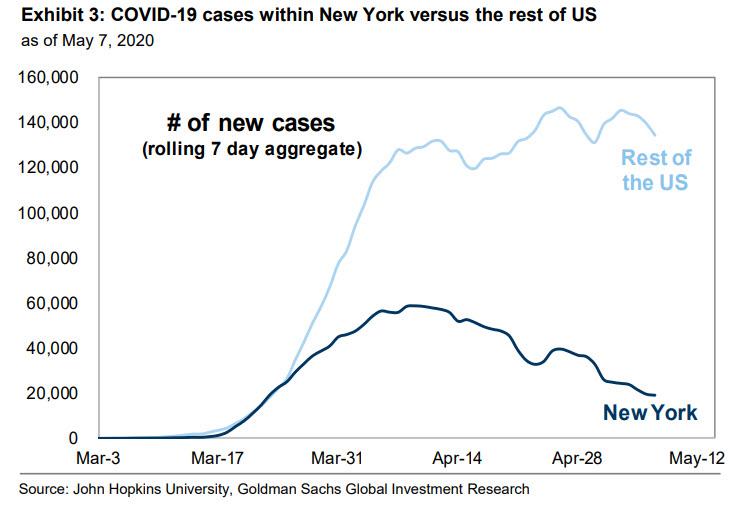

- First, COVID-19 infection rates outside of New York continue to grow. While New York has thankfully been able to flatten the curve and the rate of growth of new cases had decelerated, new infections in the rest of the US are increasing. Cases of infection may accelerate as states begin to relax shelter-in-place rules.

- Second, the re-start process will take time. As IDEX Corp. noted on its call: “And just to be clear, our expectation here is that this is going to be fits and starts. I am not someone who has bought into a super aggressive, everything gets fine in the fall sort of thing. I think that’s crazy talk. And I think we have to face the reality that’s in front of us. And you know what, if we get lucky, and for some reason, this goes away with weather or something else or a vaccine is found more quickly than we think or you have very, very effective treatments, great news. I don’t think anybody should bank on that, and I certainly wouldn’t manage the company expecting that.“

- Third, bank loan loss reserves in 1Q totaled $46 billion vs. $49 billion for full-year 2019. All of the banks “marked to market” their provision estimates assuming a 9.5-10% unemployment rate. The jobless rate spiked to 14.7%, with Goldman analysts forecasting $115 billion in provisions in the next four quarters. Banks and other firms have cancelled repurchase plans, and recently Goldman forecast that buybacks will fall by 50% in 2020. And while this step delights credit investors, Kostin warns that “equity investors should be concerned because buybacks have been the only source of net demand for shares in the past decade.”

- Fourth, dividends are also at risk. In an effort to preserve liquidity, more than 40 stocks have suspended or reduced their dividends YTD. Goldman expects dividends to fall by 23% this year. Growth plans are frozen and capex spending will drop by 27%.

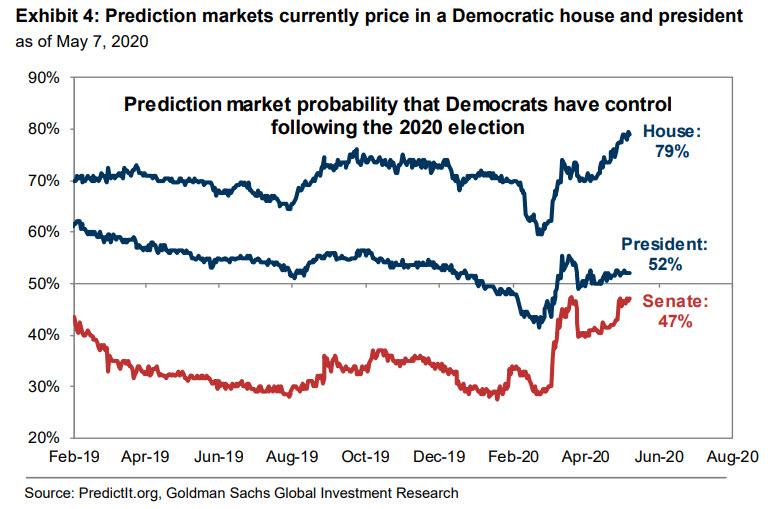

- Fifth, domestic politics. The presidential election is six months away. If the economy is on a path to normalization by early 3Q, investor focus will shift to the election. The 2017 tax reform act lowered the effective corporate tax rate to 18% from 26%. However, the tax law could be reversed depending on the election result, i.e., if Biden wins. If so, 2021 EPS would fall by $19 and imply a P/E multiple 15% higher than the already stretched valuation (assuming anyone still cares about fundamentals).

- Sixth, global politics. Investors may need to contend with another twist in US-China trade/strategic development, which was at the forefront of investor concerns for much of 2019. The nature of the tension seems multi-faceted going beyond conflicts in merchandising and service trades, with the US administration’s rhetoric and actions towards China turning more hawkish in the past month across various issues and strategic domains.

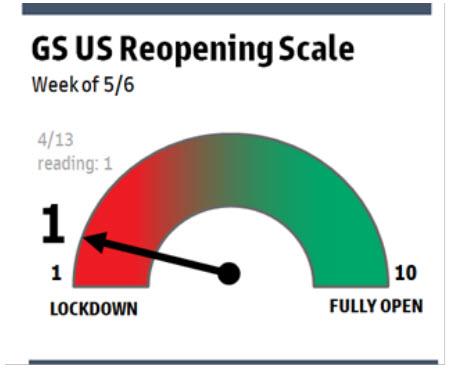

And while we applaud Goldman’s ability to cover both bullish and bearish bases at the same time (although even Goldman’s bullish case leaves only 2% upside in the S&P for the full year), as we noted yesterday the only thing that will matter out of Goldman for the foreseeable future is its reopening index (currently at 1 out of 10)…

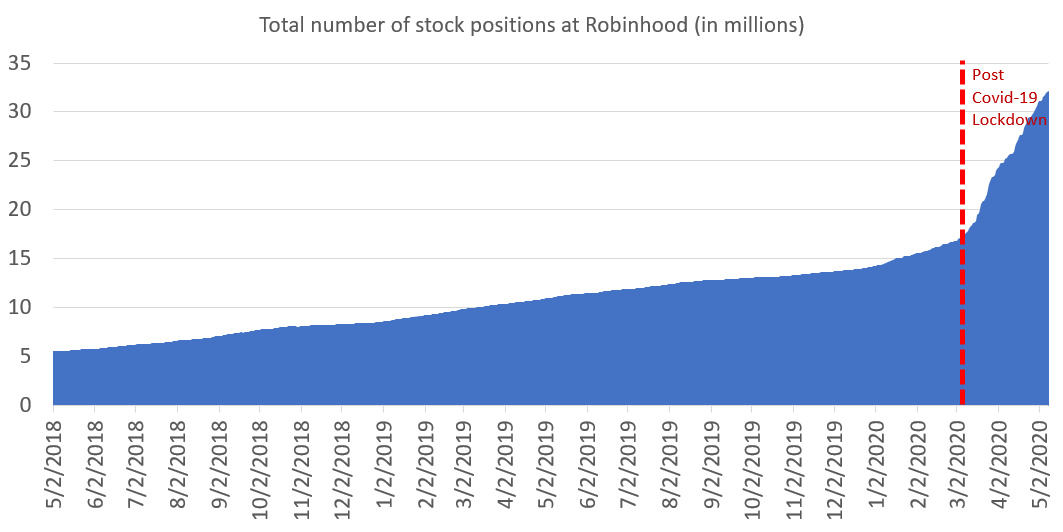

… which will tick up progressively over the next few weeks, at least until a new corona “event” emerges, propping upward momentum amid optimism that the reopening is going well, and making sure that “distribution” continues apace as institutions – which includes Goldman’s prop desk – dump whatever stocks they have left to the general public at least until the next crash. And speaking of retail investors flooding into stocks since the start of the pandemic, take just one look at what is going on in Robinhood, where retail investors are – for lack of a better word – going nuts now that the Fed has effectively taken risk off the table.

Tyler Durden

Sun, 05/10/2020 – 16:45