Luxury Real Estate Suffers Price Declines, Suffocated By Social Distancing And Lockdowns

Deutsche Bank published a new note this week, suggesting its global forecast “has turned decidedly gloomier…[M]uch of the world has struggled mightily with the virus, and the economic fallout…we now see global GDP falling 10% in Q2 and remaining well below pre-virus levels through most of next year.” If correct, the bank’s latest forecast implies that a recovery in the global economy could take several years. With that being said, luxury real estate across the world will likely get marked down through this unprecedented economic collapse. A new report via Knight Frank LLP indicates that a decline in luxury real estate could already be underway.

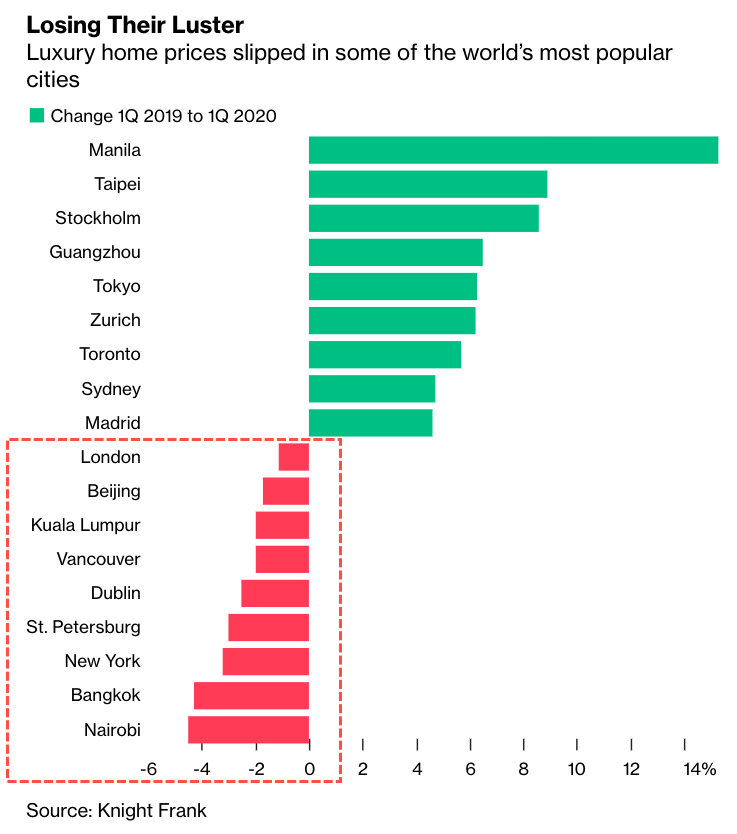

Bloomberg, citing Knight Frank’s latest global real estate report, says luxury homes in New York, London, Hong Kong, Vancouver, and Singapore recorded price declines in the first quarter on a YoY basis as the pandemic began to destroy complex supply chains and entire economies around the world.

Knight Frank said the virus pandemic “was in its nascent stages in the U.K. and the U.S., meaning it is likely to be the second quarter before we can accurately gauge the full impact.” Knight Frank has a point because when it comes to actual impacts of aggregate demand getting completely crushed across the world because of lockdowns, and entire supply chains crumbling to the ground, full effects won’t be realized until the second half of the year.

But in the meantime, Knight Frank provides a full list of luxury home markets where noticeable price declined have been seen in Nairobi, Bangkok, New York, St. Petersburg, Dublin, Vancouver, Kuala Lumpur, Beijing, and London. On the flip side, home prices in some cities, including Manila, Taipei, Stockholm, and Tokyo, saw advances during the quarter.

Knight Frank said luxury real estate markets would stagnate as social distancing measures and travel limitations will likely be in effect for many parts of the world for the foreseeable future.

“With travel restrictions firmly in place and with many solicitors and land registries largely closed, we expect the second quarter to see a marked drop in sales volumes,” it said. Prices, on the other hand, may display more resilience.

As the pandemic unfolds, rich people aren’t hanging out in their million dollars flats, they’re weather the virus storm in doomsday bunkers. Did coronavirus top tick the global luxury real estate market?

Tyler Durden

Mon, 05/11/2020 – 20:25