Druckenmiller Turns Apocalyptic: “Risk-Reward For Equities Is As Bad As I’ve Seen It In My Career”

Investing legend Stan Druckenmiller unleashed a firehose of cold water on market bulls today during an interview with the Economic Club of NY (the same venue that will interview Jerome Powell tomorrow on the topic of negative interest rates), when he said the “The risk-reward for equity is maybe as bad as I’ve seen it in my career,” (although “the wild card here is the Fed can always step up their purchases”), that the government stimulus programs won’t be enough to overcome the economic problems, that it makes no sense for the market to jump so much when optimism emerges around certain drugs like remdesivir (“I don’t see why anybody would change their behavior because there’s a viral drug out there”) and, most concerning, that “there’s a good chance that we just cracked the credit bubble that’s the result of free money.”

Looking for a V-shaped economic recovery? Not so fast, Druckenmiller warns. pic.twitter.com/DyFbjxmbvZ

— The Economic Club NY (@EconClubNY) May 12, 2020

“The consensus out there seems to be: ‘Don’t worry, the Fed has your back’,” Druckenmiller said during Tuesday’s webcast before adding “there’s only one problem with that: our analysis says it’s not true.”

With markets, “the consensus seems to be don’t worry, the Fed has your back,” Druckenmiller said. “There’s one problem with that, our analysis says it’s not true.” #ECNYDruckenmiller pic.twitter.com/VWH6m3fALs

— The Economic Club NY (@EconClubNY) May 12, 2020

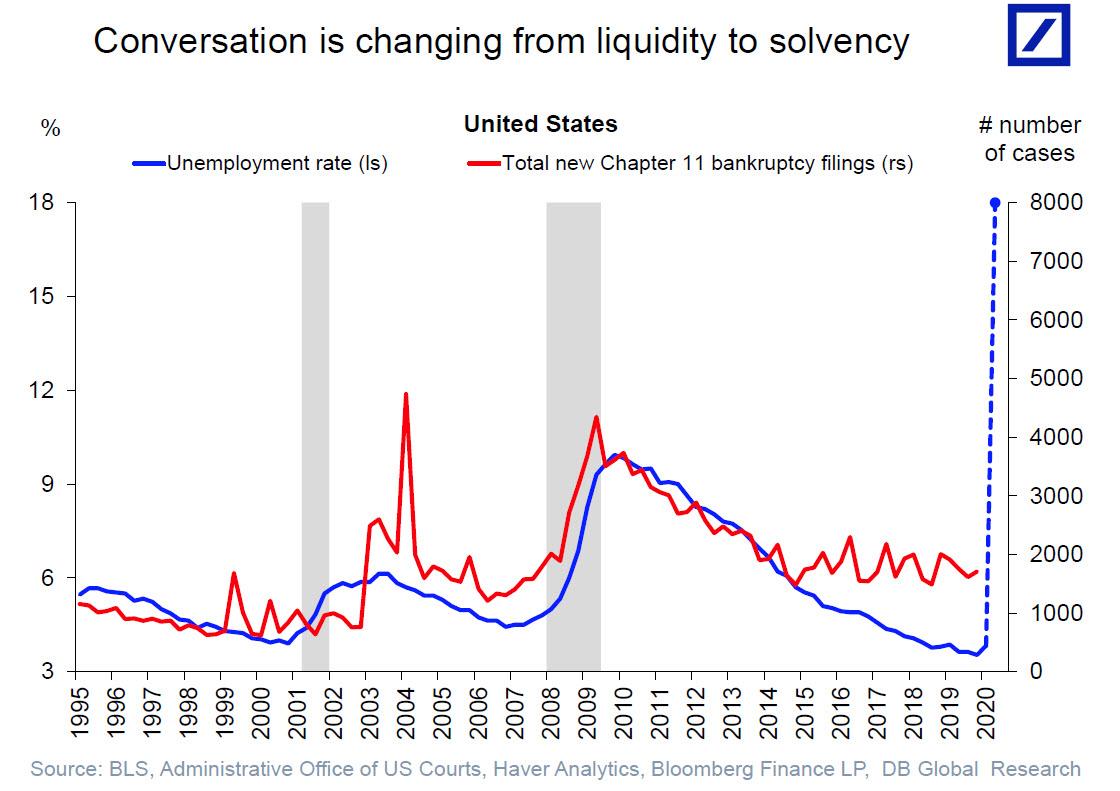

Furthermore, while traders think there is “massive” liquidity and that the stimulus programs are big enough to solve the problems facing the U.S., resulting in stratospheric P/E multiples, the economic effects of the coronavirus are likely to be long lasting and will lead to a “slew” of bankruptcies, Druck said, agreeing with our observations from last week that the underlying problems are shifting from illiquidity to insolvency, as a “biblical” wave of defaults is coming:

“I pray I’m wrong on this, but I just think that the V-out is a fantasy,” the trading legend said, crushing hopes for a V-shaped recovery, assuming anyone still harbored those, and added that the recent increase in unemployment in the U.S. stunning. The official U.S. unemployment rate is at 14.7%, the highest level since the Great Depression.

As Bloomberg summarizes, “Druckenmiller’s remarks are among the strongest comments yet by a Wall Street heavyweight on the bleak outlook facing the U.S.” Druck’s apocalyptic outlooks also sharply contrasts to the optimism that has pushed the S&P 500 Index to rally 30% since its March low even as the pandemic has brought the economy to a standstill, seized up credit markets and ended the longest bull market in history, all thanks to the now ubiquitous Fed backstop and moral hazard.

And speaking of the Fed, Druckenmiller said that the Fed’s $2.3 trillion move to shore up markets in March, was “somewhat puzzling and aggressive” adding that the Fed “may not have had to take such extreme measures to shore up the U.S. economy in March had they acted earlier to normalize interest rates”, which it of course can’t as the stock market has been in one giant post-financial crisis bubble, and why the Fed’s modest attempt to normalize rates ended in catastrophe in 2018.

Worse, Drucknemiller said that the Fed’s $3 trillion in stimulus programs aren’t likely to spur future economic growth: “It was basically a combination of transfer payments to individuals, basically paying them more not to work than to work. And in addition to that, it was a bunch of payments to zombie companies to keep them alive.”

“I’m not a scientist. I’m a common sense guy,” Druckenmiller tells us. “I just don’t think you can take massive amounts of money … allocate capital to zombie companies. It just doesn’t make any sense to me.” #ECNYDruckenmiller pic.twitter.com/8LT3rsCguz

— The Economic Club NY (@EconClubNY) May 12, 2020

And with the US set to introduce negative rates over the next 6-12 months much to Donald Trump’s delight, discussing negative rates Drucknemiller said that “I don’t understand even what the argument is.”

Touching on another source of stimulus – which it now appears is indispenable for the US economy not to collapse in cardiac shock – Druck then discussed the “record low” unemployment headed into the Covid-19 crisis, Druckenmiller said that unemployment may have been at a record low going into Covid-19, but to me it was a result of reckless fiscal spending and huge leveraging on the government side.”

Which also explains why the Fed and Treasury effectively merged to unleash helicopter money, as the economic and market performance before the covid-crisis were already the result of one giant monetary and fiscal bubble, so the only possible resolution would have been an even more gigantic monetary and fiscal bubble. And that’s precisely what we got.

That said, Druckenmiller did agree with David Zervos that “liquidity is going to move markets more than earnings during this period”, which means that for better or worse, fundamentals are indeed dead. The silver lining is that the former Soros chief strategist said he thinks that the current liquidity will soon shrink as US Treasury borrowing crowds out the private economy and even overwhelms Fed purchases. Indicatively, Deutsche Bank believes the US will issue over $5 trillion in debt this year.

Commenting on the coronavrisis response, Druckenmiller said that neither Taiwan or Hong Kong had to lockdown their economies to fight Covid-19, while in the US “this is one of the most bizarre decision making processes I’ve ever seen” elaborating that the economically cripplling shutdown is a bad idea, and adding that “I can guarantee you poverty kills.”

“I can guarantee you poverty kills,” Stanley Druckenmiller said on today’s member call. #ECNYDruckenmiller pic.twitter.com/nnULWvAccX

— The Economic Club NY (@EconClubNY) May 12, 2020

The investing legend spared no words for his criticism of the Trump administration’s response to the coronavirus outbreak, saying he would not be surprised if it becomes the “poster child for the worst public policy decisions ever made from a cost-benefit analysis.”

Probably so, but when the money helicopters are now in the air paradropping cash who cares? Incidentally, that may explain why Druck was quick to point out that gold is now 28% higher than it was a year ago. Separately, Drucknemiller, said that on a relative basis, he’s as bullish on long-short strategies as he’s been in 10 years. “That’s partly because I’m worried about everything else.”

Finally, Druckenmiller is also bullish on Amazon.com, saying people should be thankful that the company exists right now given the number of jobs created and that it has “made all of lives better. I think it’s an amazing company. I get a little emotional when politicians attack it.”

Tyler Durden

Tue, 05/12/2020 – 21:24