“A Crucial Session For Stocks” – Nasdaq 15-DMA Breach Signals Imminent Breakdown

Tyler Durden

Thu, 05/14/2020 – 11:20

According to Saxo Bank’s head of equity strategy Peter Garnry, equities are facing a “crucial session” due the last two sessions seeing a significant change in sentiment. It started on Tuesday with CDC Director Fauci’s testimony to the US Senate that a too early reopening of the economy could cause more deaths and economic fallout. Then yesterday Fed president Powell said that negative interest rates were off the table which was a clear divergence against market expectations that are pricing negative a Fed Funds Rate.

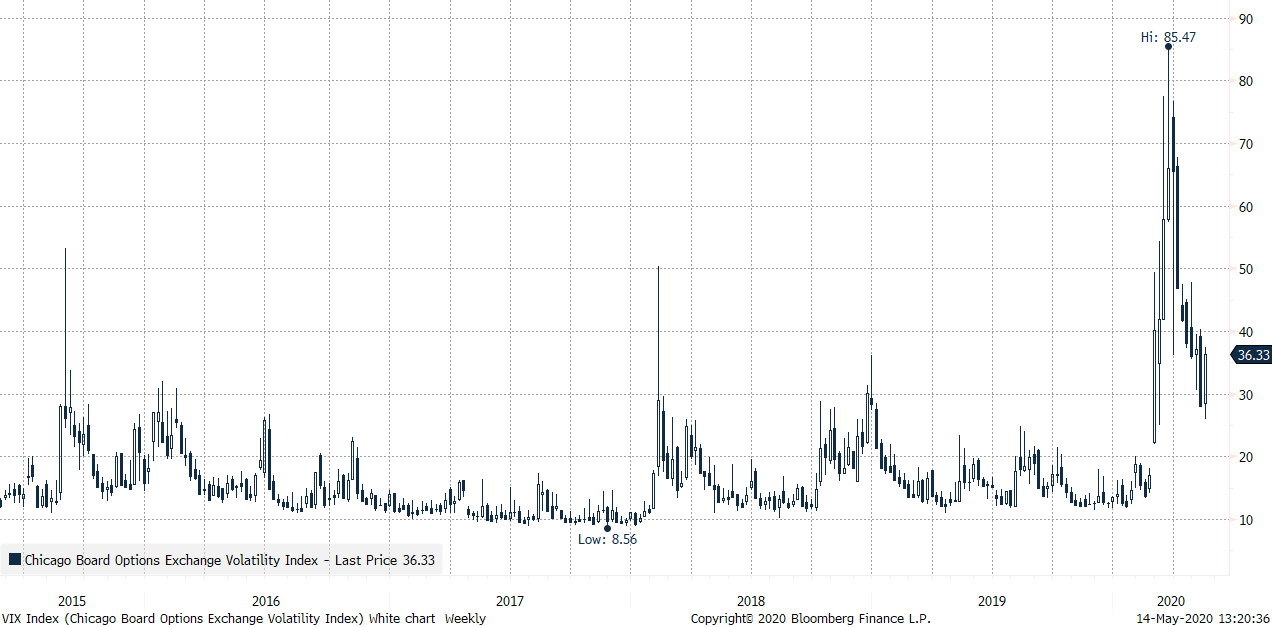

The change in risk sentiment has come with the biggest 3-day move in the VIX Index since 17 March and the volatility index is trading around 36 today far above the historical equilibrium point of 22 separating bull from bear markets.

In other words, we remain in a bear market and the recent rally has not nullified that classification. Today is a key session for equities and if the leading technology index NASDAQ 100 closes below its 15-day moving average then we have potentially a significant breakdown of the uptrend that started in mid-March.

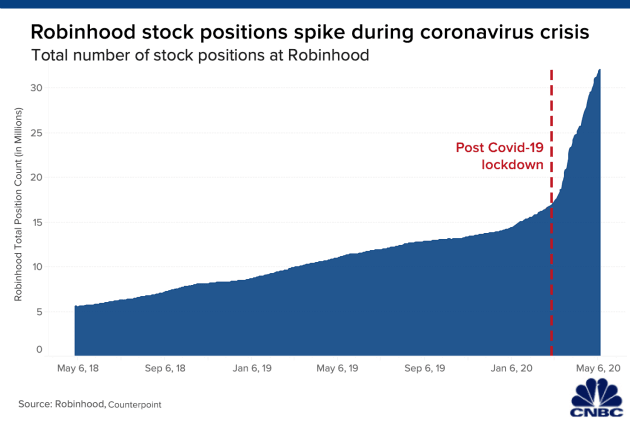

As the Saxo strategist also cautions, a bubble might be developing fast in US technology stocks fueled by significant new trading account opening driven by zero commission.

While dividend futures on S&P 500 suggest that profitability will take a massive hit over the coming years US technology stocks have been immune. Even a stock such as Tesla, where the co-founder and CEO Elon Musk has said that the stock is overvalued, has continued to rally higher.

Next, Garnry warns that “with risk sentiment changing we want Saxo clients and investors in general to acknowledge the potential dangers in these so-called ‘bubble stocks’. If you have exposure to these stocks we recommend investors to apply strict risk management on these stocks as they are at risk of a major correction.” The catalyst is a technical change in risk sentiment and then catapulted by one-way buying behavior, concentration risk by hedge funds in these stocks and the large degree of new retail money that has flowed into this segment.

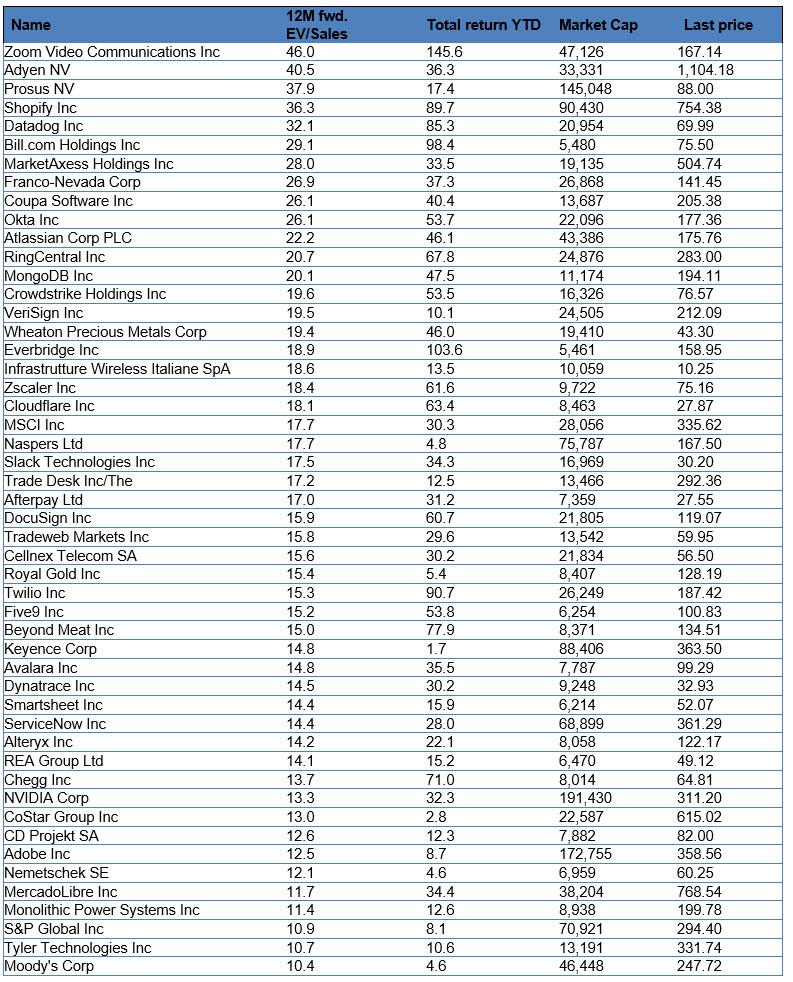

The table below shows 50 ‘bubble stocks’ traded on US exchanges, which meet Saxo’s criteria for a bubble: minimum $5bn in market value, positive return this year and then sorted on 12-month forward EV/Sales from highest to lowest. What is striking is that absence of the FANG+ stocks but the big bubble is in the large technology landscape just below the mega-caps although some of the names have high market values such as NVIDIA, Adobe, Shopify, Keyence, ServiceNow and Zoom Video Communications.

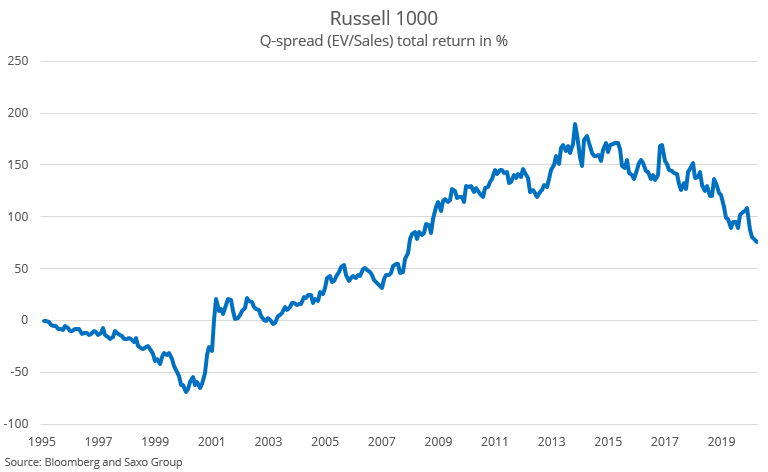

If you take the Russell 1000 Index and divide the index members into deciles on EV/Sales and measure the performance of the most expensive against the cheapest stocks on this metric then cheaper has been over time. But we observe two periods of growth stocks outperforming and that’s the period Feb 1995 to Feb 2000 and then again from Nov 2013 to Apr 2020. Significant outperformance of highly valued growth stocks tends to run out of speculative fuel when realized performance by the growth companies cannot meet the lofty expectations. The dot-com collapse caused the highest decile on EV/Sales to experience a 91% drawdown. It’s this dramatic turn of events we would like to warn investors about.

Another important theme OVER the past two months is the underperformance of financials against the market. With the fault lines in European politics increasing, negative rates potentially coming to USD assets and collapsing demand picture banks are fragile and especially European banks have our attention. Several large European banks reached yesterday the lows from 21 April and are also under pressure today. At one point this weakness will cause a binary spillover into broader risk-off sentiment as Europe can hardly deal with another banking crisis.

And then we get this:

- *STOXX EURO ZONE BANKS INDEX FALLS 4.4% TO RECORD LOW

But even in the US banks are under pressure and potential negative rates will cause a market value destruction as we have seen in Europe as it penalizes banks. Maybe that’s the reason why Berkshire Hathaway has been selling out of US Bancorp on Monday and Tuesday? Is Warren Buffett preparing for a period of more government intervention in the banking industry crowding out banks through their lending and guarantee programmes? It would certainly be a sensible move to protect capital and the lesion from Sweden in the early 1990s is that governments have a tendency to nationalize banking in a deep crisis and then slowly letting the private sector back into the lending business.