Strategist: I Have Received More Emails From People Who Are Bullish Because “Everyone” Is Bearish, Than From Actual Bears

Tyler Durden

Thu, 05/14/2020 – 16:25

The time to buy is when there is blood (or a viral pandemic) in the streets and everyone is bearish, right? “Of course” the bulls will yell, and even without knowing the fact, will quickly conclude that now is just the right time, because… well, “everyone is bearish.” But what if everyone is in fact bullish because they think that everyone is bearish?

That’s the amusing brainteaser revealed in a note to clients from Evercore ISI chartist Rich Ross, who writes – not without a trace of irony – “The number of email’s I get suggesting that they are bullish because “everyone” is too bearish, now exceeds the number of emails I receive from people that are actually bearish, which partially offsets the former.”

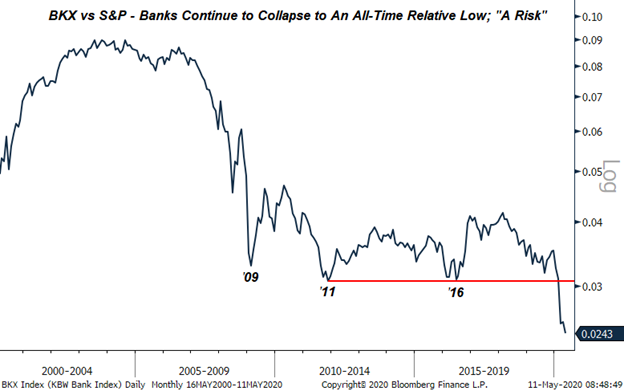

Amusing syllogisms aside, in the same note Ross has a chart that is very troubling: it shows the relative plunge of bank stocks to all time lows against the broader S&P (by which we of course mean the five or so FAAMG names that have now become the de facto market).

As Ross says, the “ongoing relative collapse to new all-time lows remains a headwind for risk assets. While relative bank undereprformance is nothing new, and in isolation (pun intended) is not a deal breaker for the S&P, the glaring weakness in Banks and strength in Tech is not sustainable, hence the ‘tactical caution’.”

It gets better, because while US banks are at all time lows on a relative basis (vs the rest of the market), European banks just dropped to record lows in absolute terms:

- STOXX EURO ZONE BANKS INDEX FALLS 4.4% TO RECORD LOW

Then again, who needs a working financial system when you have activist central banks now acting as lenders of last (and first) resort, as underwriters of risk-free loans to small and medium businesses, and as hedge funds that can and will buy risk assets any time there is even a whiff of a correction?