Fed Warns Stocks Face “Significant Declines” If Pandemic Worsens

Tyler Durden

Fri, 05/15/2020 – 16:32

Just moments after equities closed near the highs on Friday after yet another retail-driven rush into the stock market, the Federal Reserve poured cold water over all the bulls when the central bank unexpectedly issued a stark warning that stock and other asset prices could suffer “significant declines” should the coronavirus pandemic deepen – which we hope is not a shock to anyone – while highlighting that commercial real estate, which as we showed just yesterday just won’t stop collapsing, will be the hardest-hit industries.

Nested toward the top of the overview of its semiannual Financial Stability, just so nobody misses it, the Fed said that “asset prices have been volatile across many markets. Since their lows in late March and early April, risky asset prices have risen and spreads have narrowed in key markets. Asset prices remain vulnerable to significant price declines should the pandemic take an unexpected course, the economic fallout prove more adverse, or financial system strains reemerge.”

Why is the Fed making this warning, and tying the next market crash specifically to the coming second wave of coronavirus infections which the liberal media will do everything in its power to be unleashed one way or another just as long as it crippled Trump’s November re-election chances? Because as we said yesterday, the Fed has to monetize over a trillion in debt in the next 6 weeks, and it rapidly needs to boost its current paltry $6 billion in daily POMO to be able to digest the coming issuance. In other words, brace for impact, as the pandemic “takes on an unexpected course”, allowing the Fed to respond even more forecefully to prevent said “significant price declines.”

And just to set the scene for the coming crash, the Fed also was surprisingly explicit on the other three core risks facing capital markets, including:

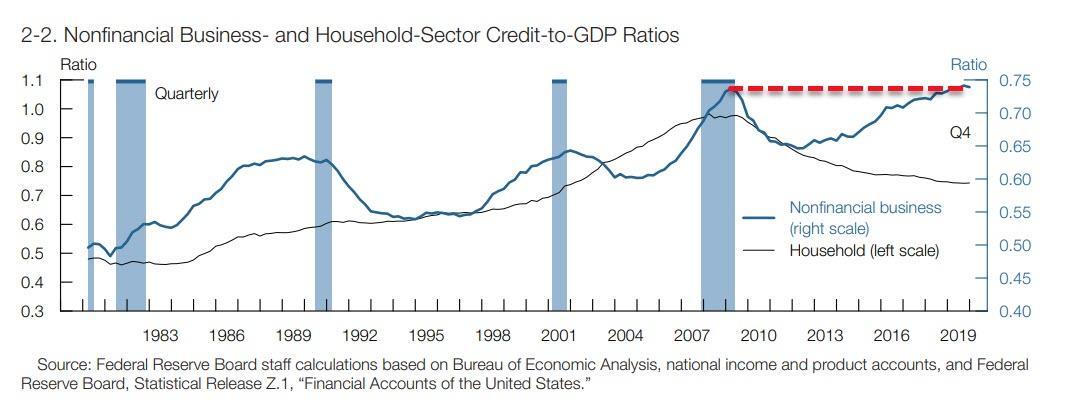

- Borrowing by businesses and households. Debt owed by businesses had been historically high relative to gross domestic product (GDP) through the beginning of 2020, with the most rapid increases concentrated among the riskiest firms amid weak credit standards. The general decline in revenues associated with the severe reduction in economic activity has weakened the ability of businesses to repay these (and other) obligations. There has been a widespread repricing of credit risk, and the issuance of high-yield corporate bonds and the origination of leveraged loans appear to have slowed appreciably. While household debt was at a moderate level relative to income before the shock, a deterioration in the ability of some households to repay obligations may result in material losses to lenders.

- Leverage in the financial sector. Before the pandemic, the largest U.S. banks were strongly capitalized, and leverage at broker-dealers was low; by contrast, measures of leverage at life insurance companies and hedge funds were at the higher ends of their ranges over the past decade. To date, banks have been able to meet surging demand for draws on credit lines while also building loan loss reserves to absorb higher expected defaults. Brokerdealers struggled to provide intermediation services during the acute period of financial stress. At least some hedge funds appear to have been severely affected by the large asset price declines and increased volatility in February and March, reportedly contributing to market dislocations. All told, the prospect for losses at financial institutions to create pressures over the medium term appears elevated.

- Funding risk. In the face of the COVID-19 outbreak and associated financial market turmoil, funding markets proved less fragile than during the 2007–09 financial crisis. Nonetheless, significant strains emerged, and emergency Federal Reserve actions were required to stabilize short-term funding markets.

And just in case someone still is confused about systemic leverage, here it is again.

The Fed went so far as to highlight which sector the next crash may start in, noting that “price declines could be especially pronounced in areas where valuations have remained high and where asset values are sensitive to the pace of economic activity.” It then adds that “CRE markets are an example, as prices were high relative to fundamentals before the pandemic, and disruptions in the hospitality and retail sectors have been severe.”

The review also found that “prices of commercial properties and farmland were highly elevated relative to their income streams on the eve of the pandemic, suggesting that their prices could fall notably.”

While markets settled down as the Fed flooded the financial system with liquidity, this week Chairman Powell said in a Peterson Institute video conference that the economy still faces unprecedented risks if fiscal and monetary policy makers don’t continue to act.

“Additional fiscal support could be costly, but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery,” Powell said on Wednesday.

Of course, in an attempt to stabilize the economy from against the ravages of the coronavirus crisis, the Fed has effectively nationalized the bond markets, cutting short-term interest rates effectively to zero, buying $2.7 trillion worth of Treasury and mortgage-backed securities, and announced plans for nine emergency lending programs, five of which are up and running, including a program to purchase corporate bonds. It’s also funneled hundreds of billions of dollars to foreign central banks via swap lines and temporary Treasury securities purchases.

The Fed has also eased some rules to encourage banks to increase lending to households and businesses crippled by the pandemic.

“Forceful early interventions have been effective in resolving liquidity stresses, but we will be monitoring closely for solvency stresses among highly leveraged business borrowers, which could increase the longer the Covid pandemic persists,” Fed Governor Lael Brainard said Friday.

Surely Lael knows: after all she is a member of the Fed and they know everything… well, maybe one small exception: after all, who can forget that just three years ago, Janet Yellen said there would be no more financial crises in her lifetime.

To that what can we say but… rigorous analysis.

* * *

But going back to the report, we’ll just conclude by saying that it was the clearest warning yet to Trump that as he rushes to reopen the economy, and the second wave takes hold, not even the Fed will be able to stabilize the market as it crash… just a few months before the Nov 3 presidential election.

The full report can be found here.