The “Lost April” And The Failure Of Economic Cheerleading

Tyler Durden

Fri, 05/15/2020 – 13:42

Authored by Mike Shedlock via MishTalk,

The Cass Freight Index report discusses the Lost April. But what’s next?

Is May the Shipping Bottom?

The Cass Freight Report suggests April is the bottom while blaming what has happened as a self-inflicted wound.

The Cass Freight Index showed the expected big dip in activity last month, after all the March consumer panic buying subsided, leaving us with just the negative impact of shut-in orders and rising unemployment levels. For April, the overall index for both shipments and expenditures fell sharply y/y to recessionary levels. This is concerning but would be more concerning if it weren’t a self-inflicted wound. Businesses and mobility were severely limited by unprecedented governmental restrictions in April, and those are loosening here in May and should further loosen on their way back to “normal” in June.

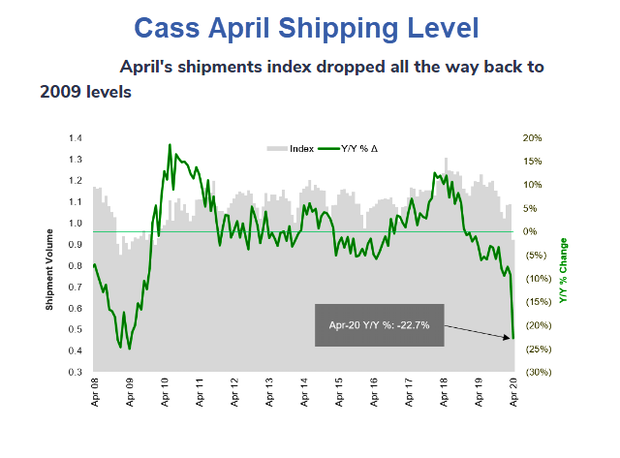

Cass April Shipping Level

Cass Freight Index

There are many addition charts and the report is well worth a look, but here is another snip that caught my eye.

Shipment volumes dropped 22.7% vs April 2019 levels, and we believe this will mark the bottom. May should be better, as the U.S. economy slowly begins to re-open and some manufacturing plants turn back on (many automotive OEMs are targeting plant re-openings in the next week or two).

Self-Imposed

Covid was not self-imposed.

US Covid-19 Deaths

March, April, May

-

March 13, 2020: 40

-

April 13, 2020: 22,108

-

May 13, 2020: 82,387

The above data points are from Our World.

In precisely two months, the number of US Covid-19 deaths went from 40 to 22,108 to 82,387.

And those deaths are way underestimated by any rational measure although numerous poorly-written articles and theories claim otherwise.

Cass Freight Index Showed Economic Weakness Way Before the Pandemic

I commented on that aspect last month in Cass Freight Index Showed Economic Weakness Way Before the Pandemic

Ever since Cass outsourced production of this report to Stifel, the Cass report been one of rampant overoptimism.

The original writers (named Cass) were sounding recession signals whereas Stifel writer David G. Ross, spoke of signs of a freight bottom for the last few months.

We can never prove which view is correct, but seeing signs of a bottom in a recovery that was already the longest in history seems more than a bit questionable.

Not Self-Inflicted

This was not self-inflicted although we do not know and never will how many deaths would have occurred had the US done nothing.

Key Rebuttal Points

-

Even had the US done nothing, with the rest of the world shut down and supply chains totally wrecked, precisely how was US manufacturing supposed to stay intact?

-

With deaths soaring to 82,387 from 40, it is irrational to presume bar and restaurant traffic would have done anything other than collapse.

Bottom In?

Perhaps Ross is correct. But that is not the issue.

The speed and shape of the recovery are the issues.

Fed’s Three-Point Assessment

Fed Chair Jerome Powell gave this assessment today:

-

“The path ahead is both highly uncertain and subject to significant downside risks.”

-

“The loss of thousands of small- and medium-sized businesses across the country would destroy the life’s work and family legacy of many business and community leaders and limit the strength of the recovery when it comes.”

-

“The result could be an extended period of low productivity growth and stagnant incomes.”

Negative Rates Not an Option

For discussion of those points and also the Fed’s assessment of negative interest rates, please see Negative Rates Are Not an Option

Realistically, we should now toss ideas of a bottom in April (as the Cass report suggested last month) or even May, as the latter is essentially irrelevant.

Unfortunately, the Covid-19 Recession Will Be Deeper Than the Great Financial Crisis.

Don’t expect a V-shaped recovery.

That thought applies to restaurants, manufacturing and shipping as a direct consequence.