SoftBank Expected To Report Record Loss As Bets On WeWork, Ride Sharing Backfire

Tyler Durden

Sun, 05/17/2020 – 15:10

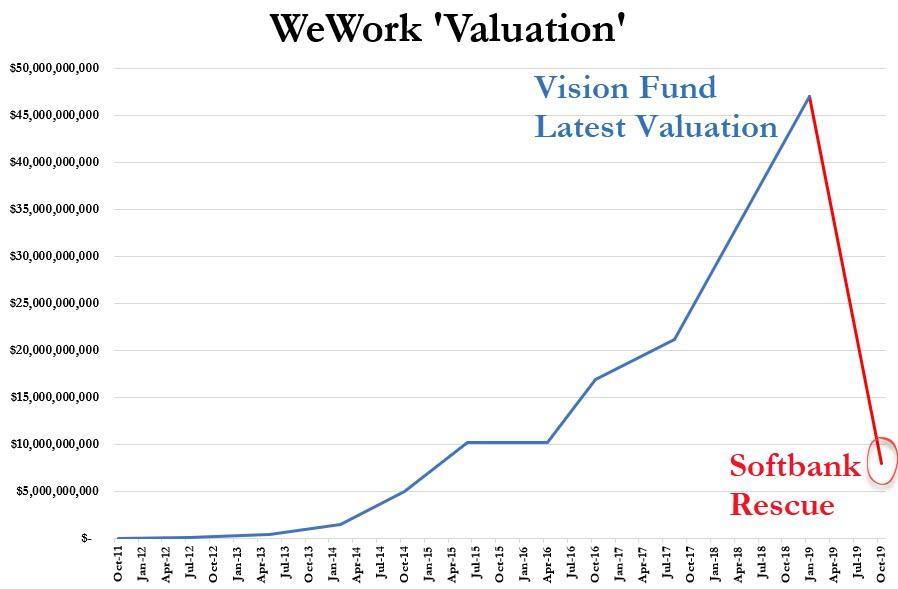

After SoftBank quadrupled-down on its investment in WeWork late last year while taking massive writedowns on its Vision Fund, we suspected the bank/telecom/venture investor/whatever was drifting ever-closer to its inevitable destiny: A contender for ‘short of the century’, and a poster-child of the Silicon Valley ‘unicorn’ bubble era.

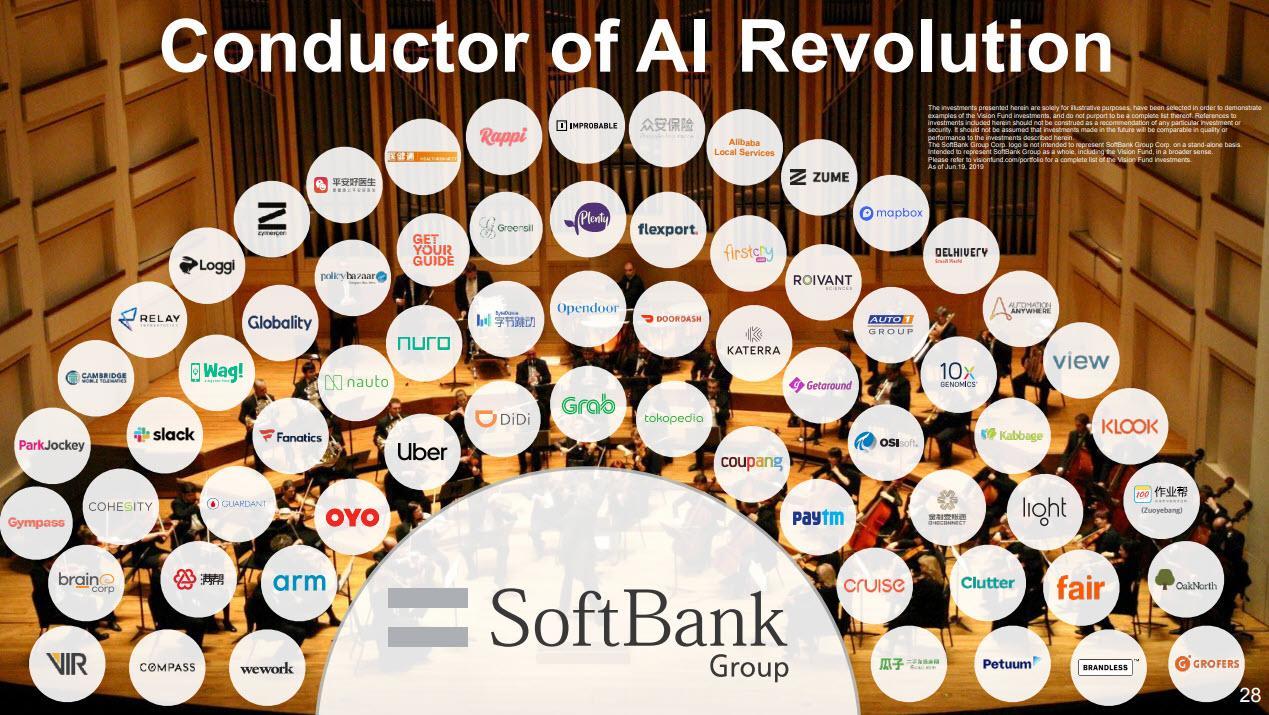

Beyond WeWork, the massive Japanese conglomerate also invested in Theranos (via its stake in US-based PE/hedge fund Fortress) and dozens of lesser-known startups, many of which focused on moonshot AI technology as SoftBank sought to portray itself as the “conductor of the AI revolution,” BBG reports.

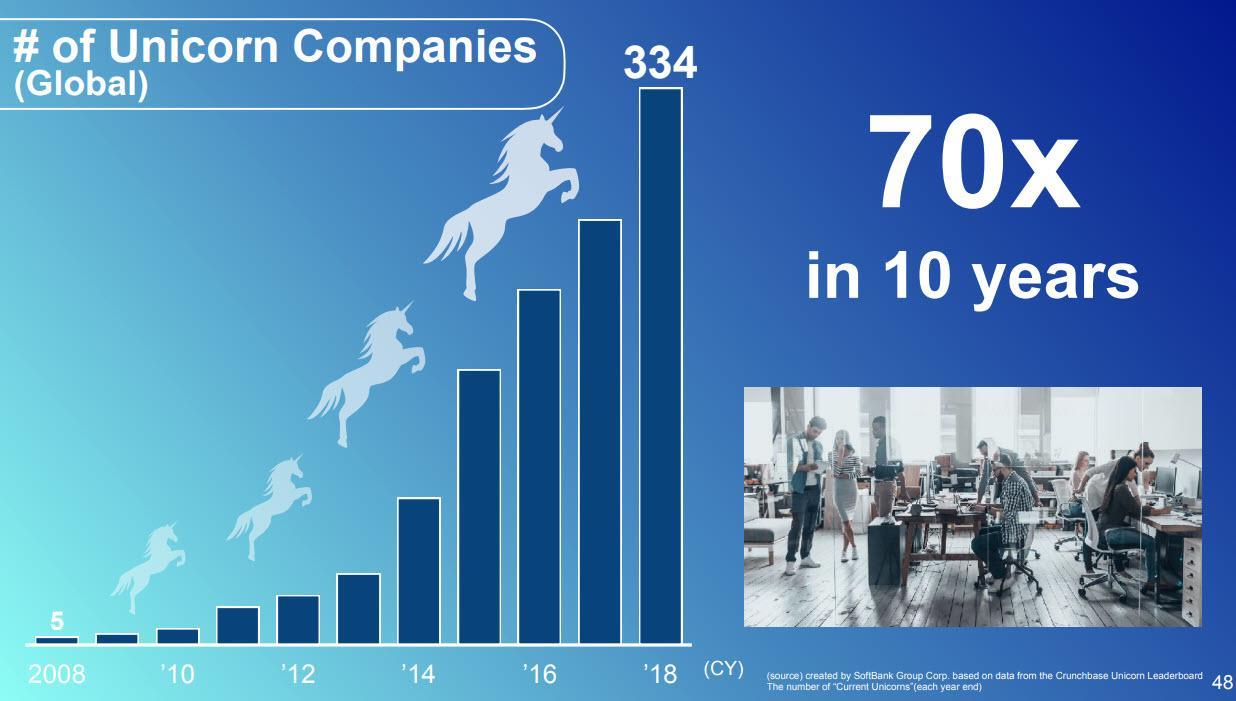

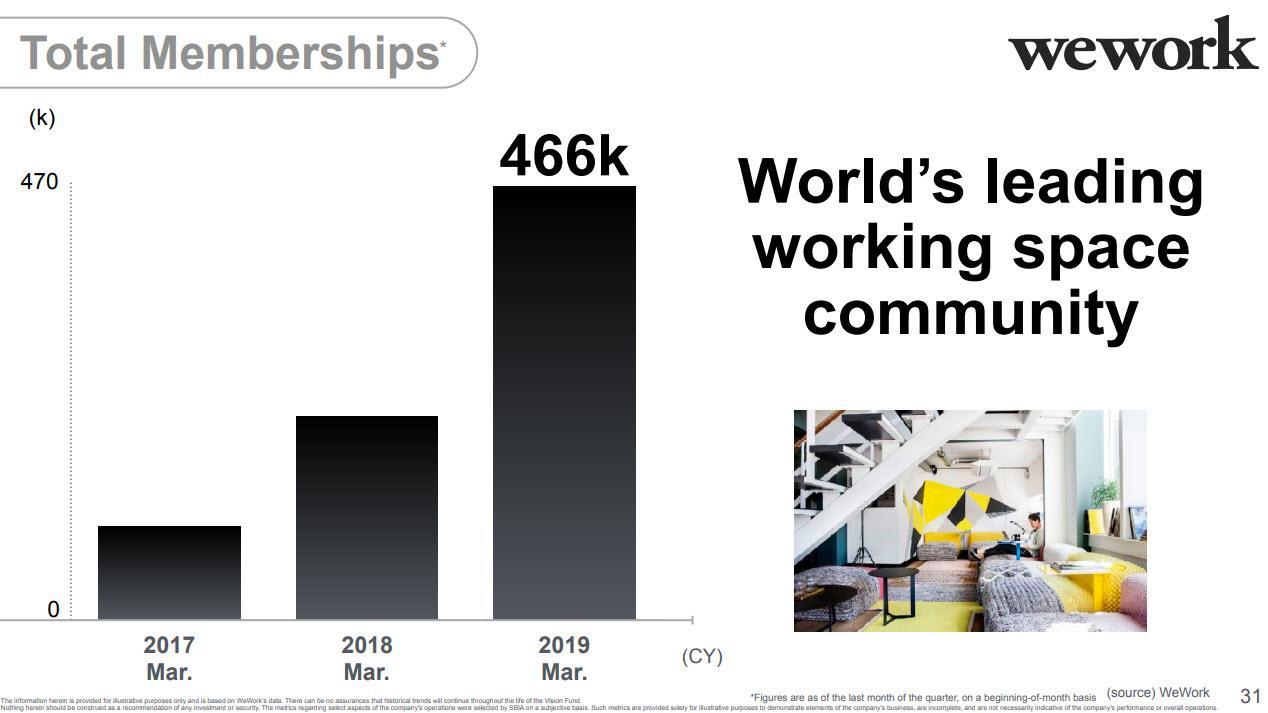

As we’ve noted, a version of the following slides was inevitably included during practically every SoftBank earnings presentation of the past few years…

…and last but not least.

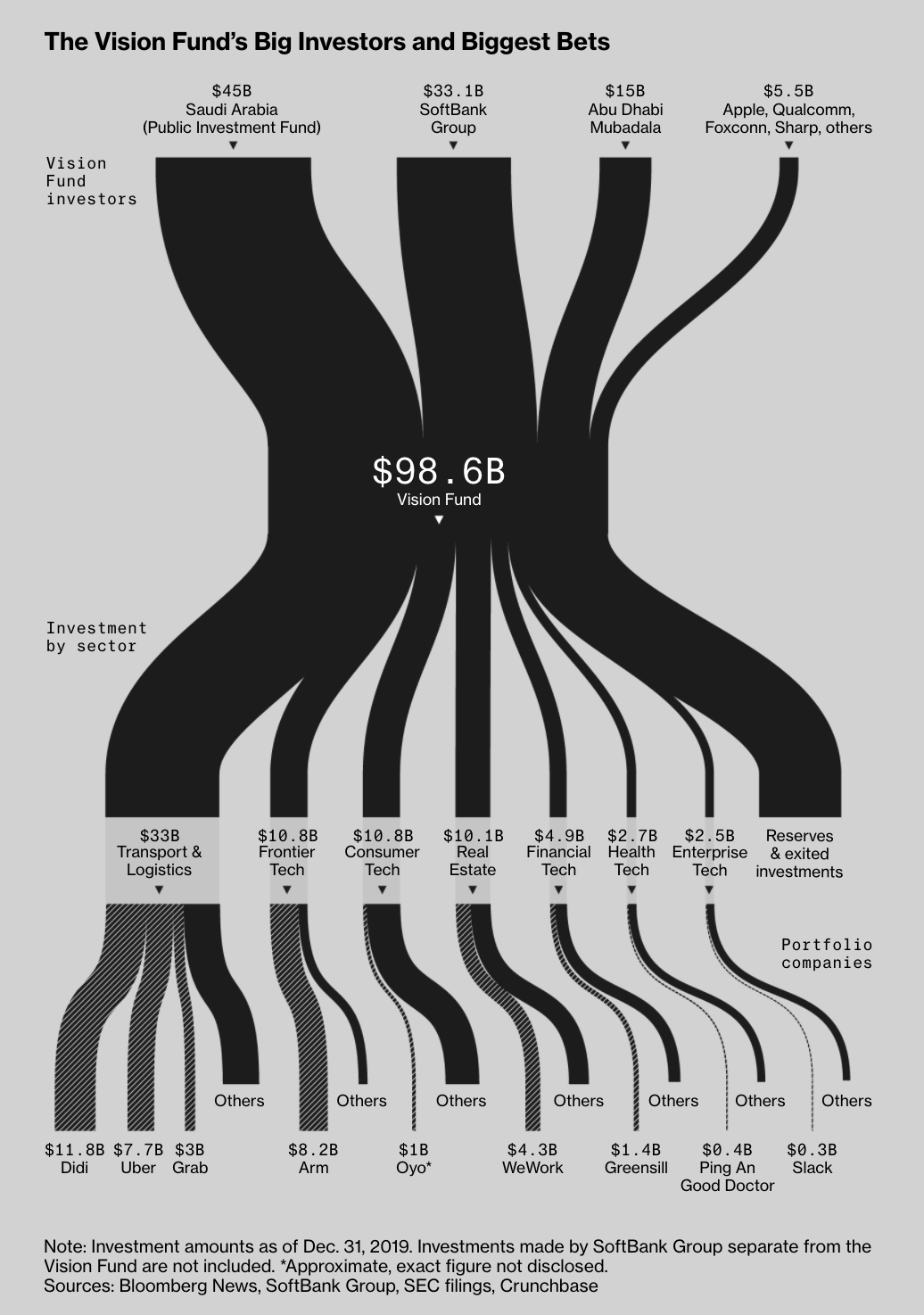

When it reports earnings tomorrow, SoftBank will confront a vastly different financial reality from a year ago: following a string of portfolio company explosions, SB Chairman Masayoshi Son’s reputation as one of the world’s greatest momentum investors has been sullied. Son’s plans to launch a new massive investment vehicle every few years have been spoiled by the WeWork fiasco, which prompted Saudi Arabia’s Public Investment Fund and Abu Dhabi’s Mubadala Investment Co, which contributed the majority of the capital to the original VF, to walk away.

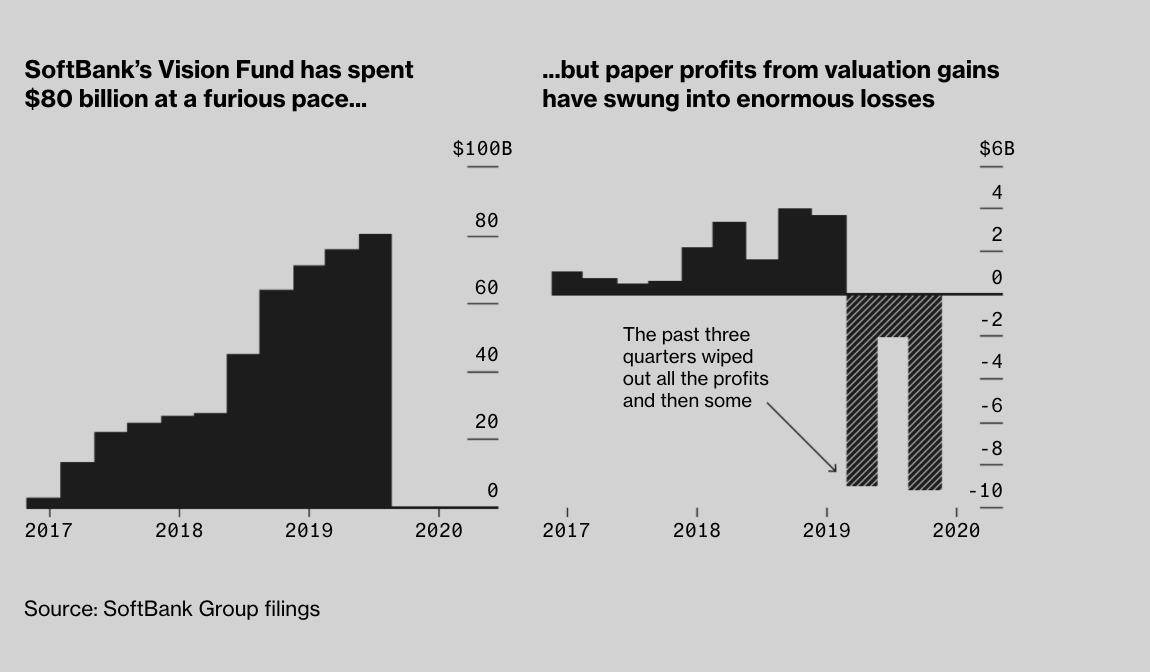

And in February, Son conceded that SoftBank will have to use its own capital for the time being.After claiming during a May earnings call last year that “our time has finally come”, 2019 went much differently than Masa probably expected. As the company acknowledged in a filing from last month, SoftBank expects to report a $12 billion+ operating loss for the fiscal year ended March 31. The company also expects to report a nearly $10 billion – ¥1 trillion – loss from investments. Of that, roughly $7 billion is linked to WeWork (SoftBank has said it invested roughly $18 billion in WeWork in total) while most of the rest is linked to satellite operator OneWeb.

In total, SoftBank spent more than $80 billion during its epic startup spending spree, according to BBG.

SoftBank expects to book a record 1.35 trillion yen ($12.5 billion) operating loss for the fiscal year ended March 31 when it reports results on Monday. The company’s Vision Fund business, technology investments that contributed more than half of the conglomerates profit a year ago, has swung to a record 1.8 trillion yen loss. The conglomerate’s overall net loss will reach 900 billion yen, SoftBank said last month in a preliminary earnings statement.

Son admitted in February that plans to raise money for a new Vision Fund had fallen apart, and that SoftBank would need to use its own capital (he also pledged more of his own personal fortune to secure more of the company’s debt).

During SoftBank’s most recent earnings report in February, Masa Son said Uber’s rising share price would help the company turn its fortunes around.

But as if 2019 wasn’t bad enough, the advent of the coronavirus has effectively sealed WeWork’s fate while also hammering ride-share services like Uber.

Instead, as the pandemic grounded potential riders, Uber was forced to cut costs to stem losses. The company instituted a hiring freeze in March, withdrew its financial forecast and wrote down some $2 billion worth of investments in April. Those investments include Uber’s stakes in Didi Chuxing and Grab—two other ride-hailing companies in which SoftBank has invested. Earlier this month, Uber announced plans to eliminate 3,700 jobs, permanently close 180 driver service centers and shutter food delivery operations in seven countries. Its shares are trading about 27% below its IPO price.

Son once compared ride sharing apps to a transportation “revolution” which he compared to the invention of the horse drawn buggy (of course, these delusions of ‘revolutionary disruptive grandeur’ are very on-brand for Silicon Valley). That view led SoftBank to write massive checks to ride-sharing companies around the world in recent years, including Grab and China’s Didi, a ride-share company with a once lofty valuation that outcompeted Uber in China (hardly surprising) with a little help from its friends in the Communist Party.

Another major SoftBank play: Oyo, and Indian hotel-booking site that has also obviously been hammered by the outbreak.

At stake is $18 billion of investments in all of the industry’s major players, including China’s Didi, Southeast Asia’s Grab and India’s Ola.

SoftBank has poured more than $10 billion into Didi, but after two horrendous years, China’s dominant ride-hailing provider is losing the confidence of at least some investors that it can live up to its once-lofty ambitions. In January, even before the virus hit, Didi’s shares were trading privately at as much as a 40% discount to its peak valuation, according to people familiar with matter. Ridership tumbled during the outbreak in China and Didi cut driver subsidies.

Grab’s Chief Executive Officer Anthony Tan late last month warned that the coronavirus is creating significant challenges for the Southeast Asian ride-hailing startup that will require “tough decisions” about cutting costs and managing capital. Grab has been trying to offset some of the shortfall in ridership with food delivery. SoftBank invested $3 billion into the company.

India’s Oyo, a hotel-booking service, is another prime example of how the virus is affecting Son’s portfolio companies. Less than a year ago, the billionaire publicly declared its founder Ritesh Agarwal one of the star entrepreneurs backed by SoftBank. Son poured about $1.5 billion into the company and encouraged the young founder to try to become the world’s largest hotel operator by room count.

The Indian company has been expanding rapidly by guaranteeing a certain amount of revenue to hotels if they sign on as franchisees. Today, Oyo is freezing operations around the world and furloughing thousands of employees as it struggles to survive the coronavirus pandemic. Travel has slammed to a halt, leaving hotel rooms empty and losses rising.

Compounding the company’s problems are the immense amounts of leverage it used to ramp up its investments, which magnify losses as well as profits. Additionally, about $40 billion of the shares in the Vision Fund are preferred stock that earn a 7% dividend payment every year whether the fund earns money or not. That added up to a nearly $900 million additional loss last year.

In the middle of all of this chaos, SoftBank has been spending money buying back shares at a rapid clip as activist investors bear down on the Japanese titan. Bloomberg reported that the company has spent $2.3 billion on buybacks since March, citing a Friday statement.

If it keeps going at this rate, the BoJ bailout that we have long joked about might just become a reality.