The S&P500 Committee Is Facing A Stark Choice: How To Reshape The World’s Most Important Index After The COVID Shock

Tyler Durden

Sun, 05/17/2020 – 18:50

Submitted by Nicholas Colas of DataTrek Research

How will the S&P 500 change as a result of the economic impacts of COVID-19? Scores of companies in the index now merit removal because of diminished market caps. But… S&P also requires a company to post a 4-quarter profit to be included. Consider Tesla, which has a market cap sufficient to make it the 500’s 64th largest stock but now won’t be profitable enough for several quarters. Disruption matters to S&P 500 returns: without AAPL, MSFT and GOOG returns over the last decade would have been 23% lower.

Even as Elon Musk’s market cap-based compensation plan stands to net him as much as $700 million this year, the most important number for capital markets is less than half that: $145 million. That’s how much Tesla would have had to earn in Q1 to post its first ever 4-quarter profit. Elon’s pay is partially set by TSLA’s market cap, which stands at $151 billion today, so it’s not like Q1’s $129 million shortfall matters much to him.

But showing black ink at the bottom of an annualized income statement still has one point of relevance: a company can’t get into the S&P 500 without it. Getting TSLA into the 500 would dramatically remake the automotive slice of the index from one that centers on the sale of pickup trucks (all of GM and Ford’s profits) to electric vehicles. Tesla’s weight in the index would be about 0.66%, versus 0.12% for GM and 0.08% for Ford. It would slot in between Salesforce.com ($141 billion market cap) and Comcast ($165 billion), and rank as the 64th largest stock in the 500.

But… Given presumed lower demand for luxury electric vehicles over the next year or two, Tesla isn’t likely to shoulder its way into the 500 for a while and this got us thinking about the nature of index investing in a post-COVID Crisis world.

Three thoughts on this:

#1: The S&P 500 needs large, scalable and disruptive businesses to both reflect American economic reality and provide reasonable returns to index investors. A few examples:

- Apple’s market cap has grown by $1 trillion from the end of 2010 to now. That is 7.5% of the entire gain in the S&P 500 over the last decade.

- Google’s market cap is up by $800 billion over the same timeframe, 6.0% of the S&P’s gain.

- Microsoft’s market cap has increased by $1.2 trillion since 2010, 9% of the S&P’s gain.

The upshot here: all these companies had similar/slightly larger market caps in 2010 as TSLA has just now, and collectively they make up 23% of all the gains in the S&P 500 over the last decade. Their performance is what made the S&P 500 compound over the last decade at 13.4% instead of 10.4%. We’re not saying Tesla is as good as any of these companies; it could be better, worse, or just different. But not including TSLA in the 500 means the index will be missing a company that could make an outsized difference to long run returns.

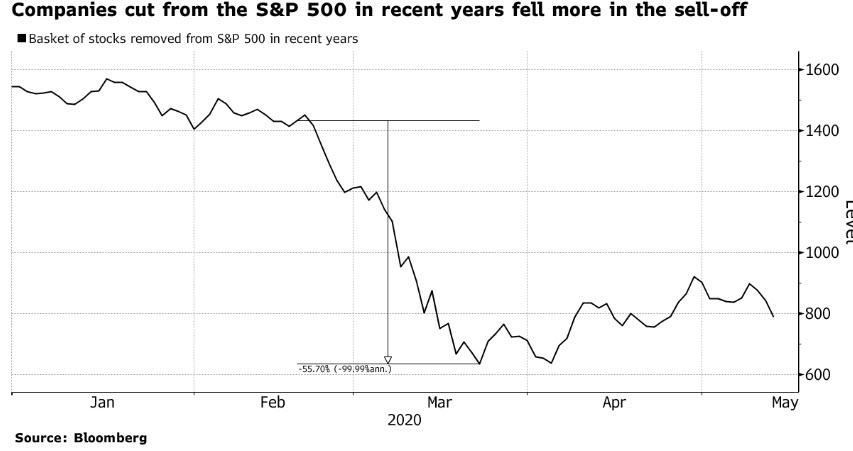

#2: The list of companies in the S&P 500 changes happen frequently, and given recent market volatility the index committee could have to replace +30 companies this year alone.

- Last year 20 companies were deleted from the S&P 500 due primarily to acquisitions or too-low market caps, replaced by 20 companies chosen by the index committee. In 2018 there were 22 changes, and in 2017 there were 24.

- There are now many companies that fall well below S&P’s current $8.2 billion market cap requirement for initial inclusion in the 500. Alaska Air, which was just added in 2016, is valued at $3.5 billion, for example. Apparel maker PVH has a market cap of $3.1 billion, as does iconic brand Harley-Davidson.

The bottom line on this point: the S&P committee is going to have to decide how long they want to wait before ditching COVID-damaged companies from the 500, and there are certainly enough to allow them to dramatically remake the index if they so choose.

#3: The sorts of companies that can post a 4-quarter profit in a post-COVID world are very different from those which might have had a chance before the outbreak. Since this is the cost of entry into the S&P 500, it will alter the profile of companies the S&P committee can consider for index inclusion this year:

- Those based on travel, leisure, or the sharing economy don’t have much of a chance. Uber, Lyft, and similar business models will remain unprofitable for years to come.

- Worth noting: S&P protocols require a company to be profitable in the quarter immediately prior to its inclusion in the index. With Q2 2020 expected to be even worse than Q1 in terms of corporate earnings, that’s an additional notable constraint to many companies’ potential inclusion.

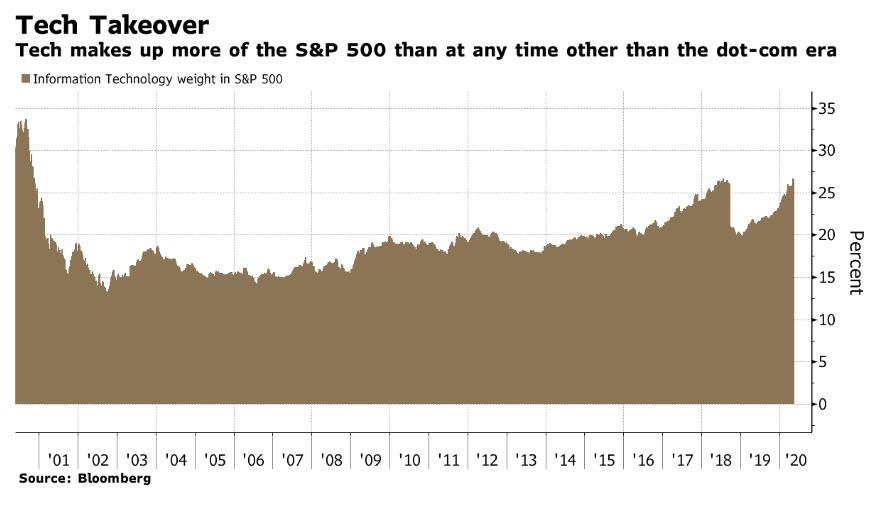

- With technology already 26% of the S&P 500 and 36% once you include Amazon, Google and Facebook, the S&P committee may be reluctant to layer on even more disruptive tech into an already concentrated index.

The bottom line: as S&P considers what to add to the 500 this year, it may well use the opportunity to add non-Tech names and nibble away at that sector’s preeminence. Finding profitable firms, however, will be more challenging than any time since 2008/2009.

Pulling this all together: the S&P 500 may be the world’s most-followed passive index but COVID-19 and its aftermath is going to force its constructors into some very active choices. Based on existing financial requirements (profitability) and an already top-heavy (with Tech) portfolio, there is a good chance important disruptive companies will not make it in. How that changes the S&P’s long run return potential remains to be seen, but history is clear on the fact that returns come from disruptive companies first and everything else a very distant second.