One Bank Sees Fed Balance Sheet Hitting $130 Trillion If Powell Buys Everything

Tyler Durden

Mon, 05/18/2020 – 13:15

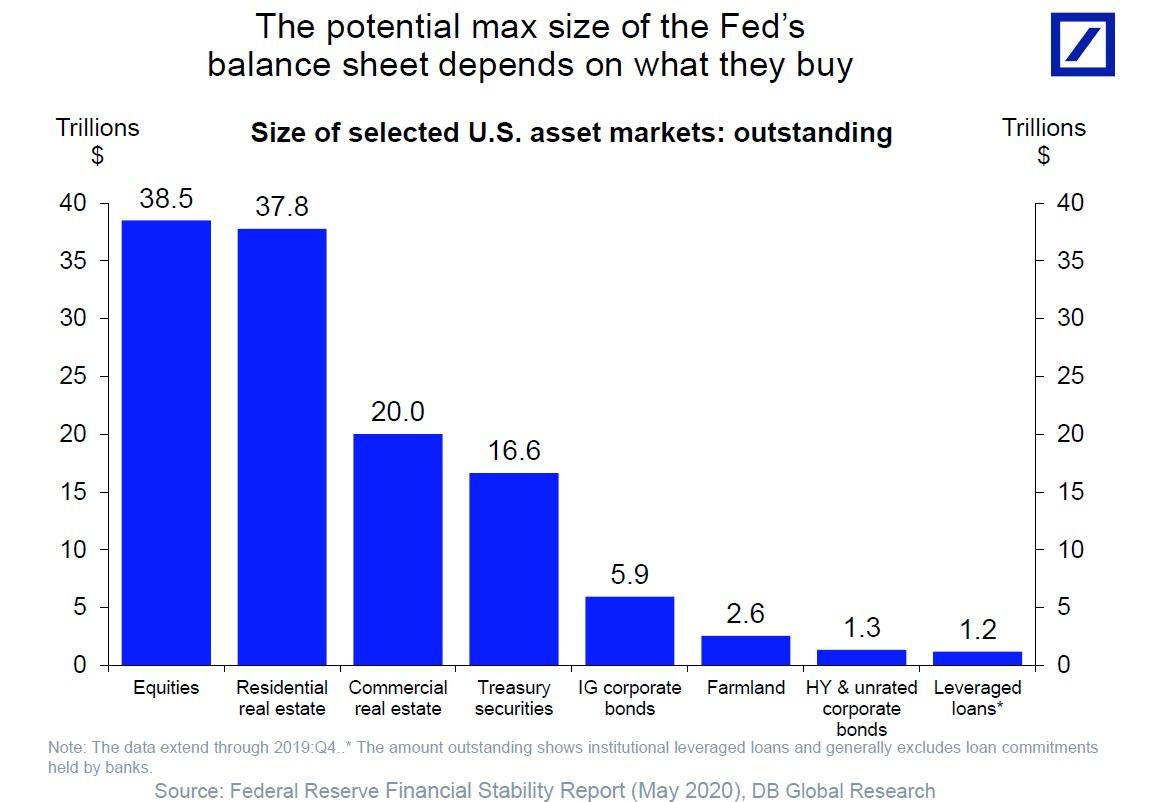

Just a few weeks ago, the following chart from Deutsche Bank would have been a joke in serious financial circles. Not any more.

With the Fed’s balance sheet surging to $7 trillion amid heated discussions just how much bigger it will get in the next year as the Fed is tasked with monetizing the US bailout program, DB’s Torsten Slok has come up with a rather “ingenious” and disturbingly non-comedic estimate of what the potential maximum size of central bank’s balance sheet could be. To calculate it, Slok assumes that the Fed may, at some point, monetize all US assets, including but not limited to equities, residential real estate, commercial real estate, all treasury and corporate bonds, farmland and so on.

It all adds up to about $130 trillion…

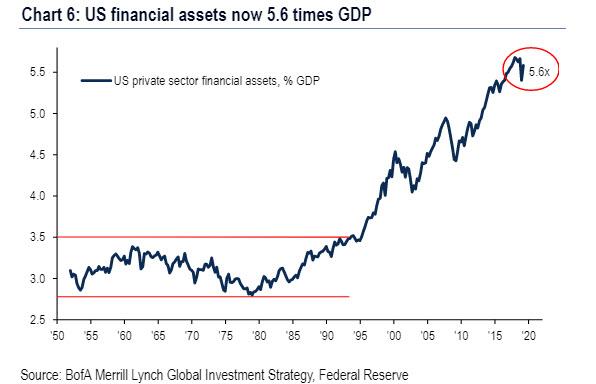

… roughly 6 times the size of total US GDP and a number we have seen before: it’s also BofA’s 2019 calculation of all US financial assets.

$130 trillion is also a number which even MMTers would admit is the endgame as there will be nothing left to nationalize, or privatize depending on one’s view of who ultimately owns the Federal Reserve.