Wall Street Caught Short Again As “Money Printer Go BRRRRRR To 11”

Tyler Durden

Mon, 05/18/2020 – 10:32

With US stocks soaring to start the week on the combination of Powell’s 60 Minutes affirmation that the Fed’s money printer go BRRRRR to 11 (as Nomura’s Charlie McElligott poetically puts it) coupled with favorable news of a coronavirus vaccine trial by Moderna (which saw favorable results in a group of 8 “young and healthy” volunteers), the bulk of Wall Street institutions is once again positioned on the wrong side of today’s rally.

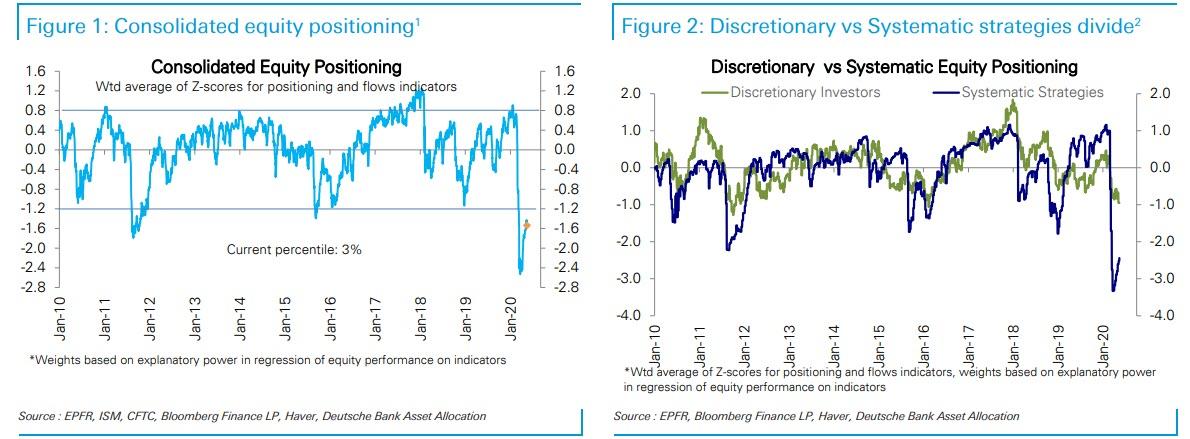

As we showed on Friday using the latest Deutsche Bank flow data…

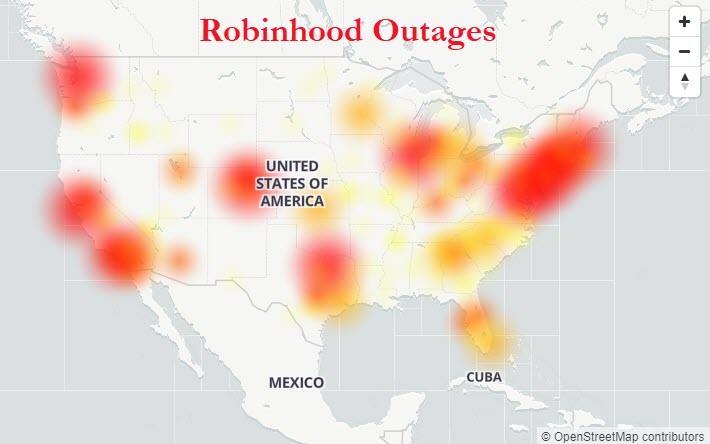

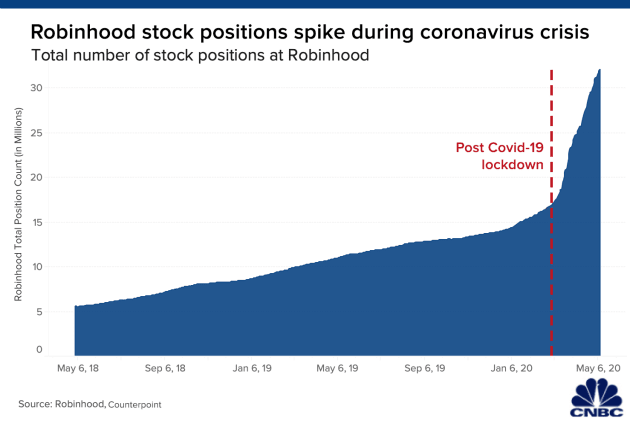

… both consolidated and systematic positioning was just off decade lows, while discretionary positioning – namely hedge funds and various other levered investors – have continued to take down exposure, selling to retail investors all the way on the way up, assuming of course that Robin Hood is up on any given day.

Yet while institutions may yet have the final laugh, for now it is retail investors that are smiling all the way to the bank as they continue to buy everything that the pros are selling.

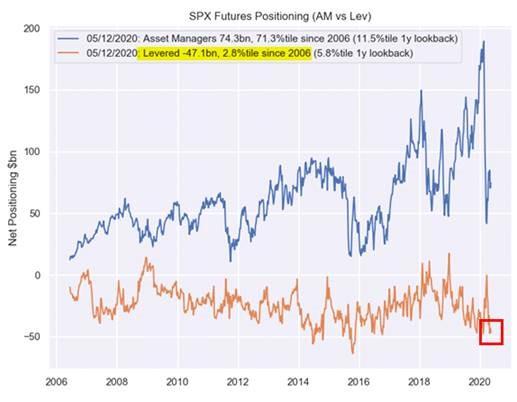

And, as Nomura’s Charlie McElligott writes this morning, futures are “un-clenching higher”, as the abovementioned institutions scramble to chase the market with “both Asset Managers- (cumulative -$10.5B of US Equities futs sold across the May-to-date numbers so far) and the Leveraged Funds- (sold -$3.4B of US Eq futs in May so far) have continued to sell or be short / very hedged into the Equities move MTD.”

Here’s are the details why Wall Street is once again chasing stocks (and retail) on the way higher, via McElligott:

- TFF Leveraged Fund data shows that the “net” position in SPX is -$47.1B (short), only a 2.8%ile outcome since 2006, while also net Nasdaq position is short -$3.5B, similarly prolific at just 6.1%ile since 2006.

CFTC Non-Comm investor-type data shows the net position in SPX futures at just 2.2%ile since 1999 (only occurred 6x’s previously), while the cumulative 3m “sale” by Non-Comms is just 1.5%ile (only been this “net short” 5x’s since ’99)

Not surprisingly then, Long-Short Fund “performance beta to S&P” at just 3.1%ile since ’04

Meanwhile, Asset Manager data shows “the 3 month cumulative selling was massive, a monstrously negative outcome at -$119B, just 3.3%ile since 2006 (only happened 5x’s).”

As McElligott concludes, “this off-side positioning serves as a source of the “Squeeze Pivot” observed over the past 1 week reporting period, when Asset Managers bought +$6.4B of US Equities futures (+$4.0B SPX, +$1.6B NDX, +$800mm RTY), which is a 96th %ile 1w outcome since 2006.”

Taken collectively then and thematically within U.S. Equities today, we should see a very “pro-cyclical” risk-rally, with the “Value / High Beta over Growth / Defensives” ANTI-MOMENTUM trade—especially as this re-risk comes in conjunction with the aforementioned bear-steepening in US Rates

This would of course be a profound reversal of the YTD and MTD trend within US Equities, as my tactically-favored “1Y Price Momentum” factor +13.9% MTD and now +14.5% YTD, which of course is consistent with the very popular “long Secular Growth / Min Vol” vs “short Cyclicals” positioning—meaning that today’s trade will likely drive significant underperformance for many

Bottom line: Wall Street pros continue to fight the Fed – and are getting steamrolled- even as retail is more than happy to go with the money flow (which is now in the trillions), oblivious to the dire fundamental picture and putting all of its faith in the Fed.