“Creative Destruction Is Dead”: Powell Has Spawned An Army Of Zombies

Tyler Durden

Tue, 05/19/2020 – 18:05

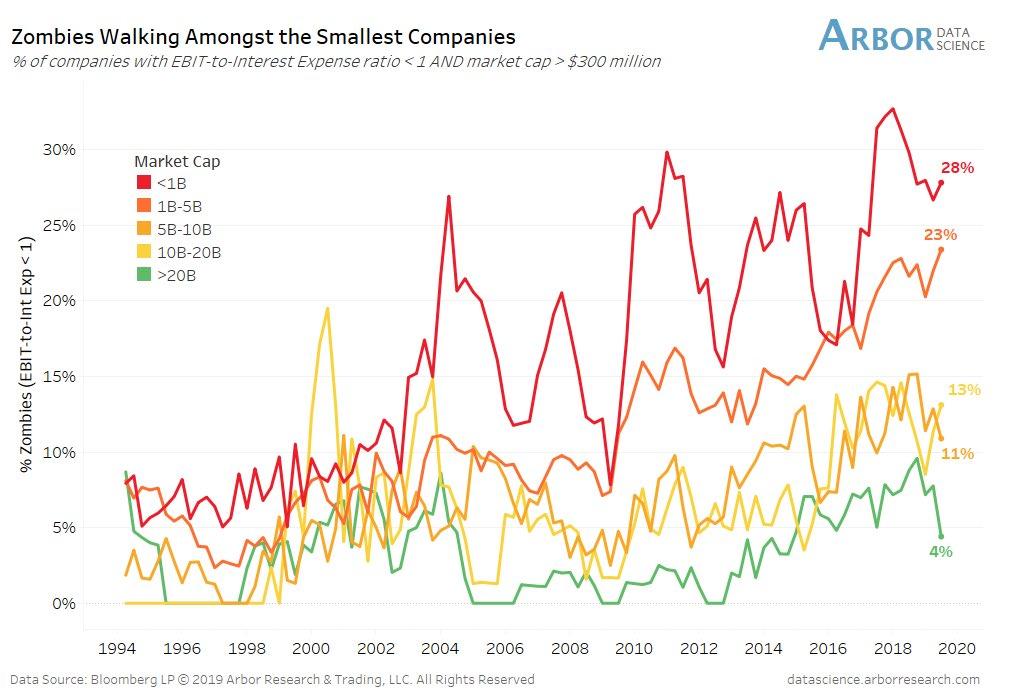

Heading into 2020, the number of zombie companies – corporations whose cash flow is not sufficient to even cover their interest expense yet which survive thanks to record low interest rates and central bank generosity – was already at an all time high.

However, following the March bailout of the bond markets and countless already insolvent companies, the number of zombies in corporate America has absolutely exploded, and as Bloomberg writes this morning, from Carnival, Marriott International and Delta Air Lines to Gap and Avis, many of the companies hardest hit by the coronavirus outbreak have priced billions of dollars of bonds and loans in recent weeks, allowing companies that were already insolvent to continue their dismal existence for a few more years.

And while these companies will never again be profitable, and that their business operations aren’t viable if left to their own devices, what is shocking is that as long as they’re propped up by the Fed, investors are willing to lend.

However, as expectations of a V-shaped economic recovery vanish rapidly – with Goldman joining the bandwagon most recently cutting its profit forecasts for Q3 and Q4 – more industry veterans are starting to express concern about these debt dynamics. Some – such as this website – have warned that the Fed is putting credit markets on course for a future wave of defaults that makes the current stretch of corporate bankruptcies look timid by comparison.

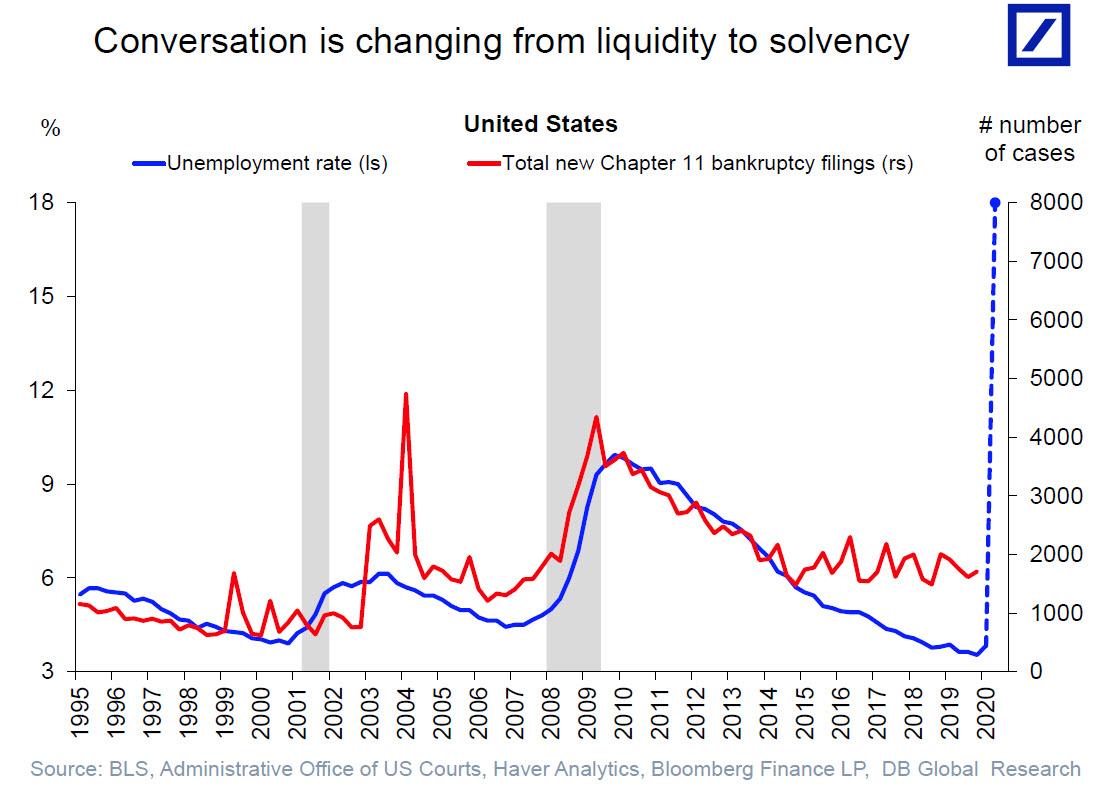

Others see an even more dire outcome. As Bloomberg points out, in this scenario, they say, zombie companies in industries scarred by the pandemic will just keep borrowing. As a result, market watchers such as Deutsche Bank chief economist Torsten Slok, who designed the above chart, fear that a new breed of so-called zombie companies “could have profound and painful consequences for everyone from workers to investors for years to come.”

“The Fed and the government are interfering in the process of creative destruction,” Slok said in an interview. “The consequence is that we are at risk the longer this persists – companies being kept alive that would otherwise have gone out of business – that it will begin to weigh on the overall potential for growth of the economy and on productivity.”

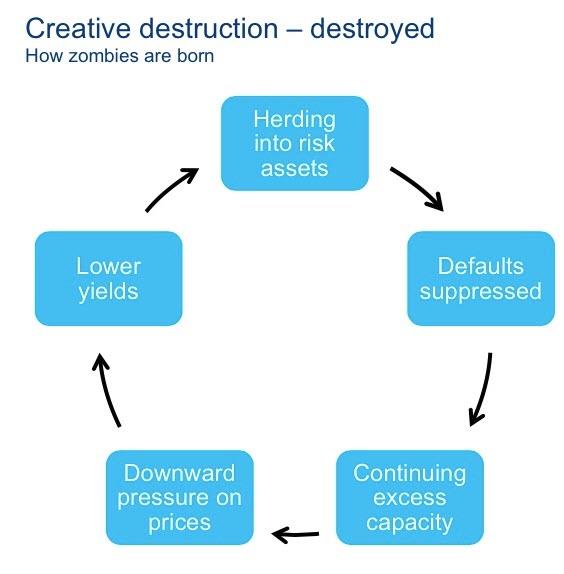

Torsten’s observation is hardly new: it was more than five years ago, in April 2015, that we showed how the Fed creates zombies in one flow chart.

This is what we said: “By lowering the cost of borrowing, QE has lowered the risk of default. This has led to overcapacity (see highly leveraged shale companies). Overcapacity leads to deflation. With QE, are central banks manufacturing what they are trying to defeat?“

By that, we meant that QE is in fact deflationary, and that the more the Fed injects debt to stabilize the corporate system, the more deflationary the ultimate outcome because in a world without a cost of capital (see VC backed idiocies such as doordash and Uber) all companies can do outcompete and capture market share by cutting prices more and more, in hopes of putting their competition out of business. The problem is that since the competition has the exact same source of capital – the Fed – nobody is going out of business, and instead deflation surges (alternatively, supply-driven inflation also makes frequent appearances, but that’s beyond the scope of this post).

That said, with the Fed having long ago gone all in on bailing out the system, it no longer has a choice, and as Bloomberg adds, given the scope of the economic collapse and the unprecedented spike in unemployment that has accompanied it, most analysts say policy makers had to throw everything they could at the problem: “It’s just that such dramatic intervention comes with great risks that will have to be addressed down the road.”

“The Fed had no other choice than to do what it did,” Slok said, repeating the oldest fallacy in the book. Of course the Fed has a choice – it could have prevented a tidal wave of bailouts and the institutionalization of moral hazard and corporate socialism, and instead restarted the creative destruction process. Alas, the political cost of tens of millions unemployed permanently would have been too high for either the Trump administration or whoever is president after him.

And so, the Fed has no choice but to kick the can and make the biggest bubble ever even bigger.

In doing so, the Fed is also emboldening money managers to take greater chances and seek fatter returns, and to spawn a new army of undead zombie companies.

“You can’t say ‘we’ll do whatever it takes’ and not do it,” said Jack McIntyre, who runs about $60 billion Brandywine Global Investment Management. “Otherwise, the Fed will lose credibility.”

Putting his money where his mouth is, McIntyre said he’s buying select investment-grade corporate bonds in lieu of Treasuries “because the Fed has backstopped the market – if spreads widen, the Fed will step in.”

It’s also why the corporate bond market has now been taken over, and why fundamentals are terminally disconnected from prices. That’s just the sort of sentiment that can ultimately lead to the proliferation of zombies, economists say, repeating what we said back in 2015.

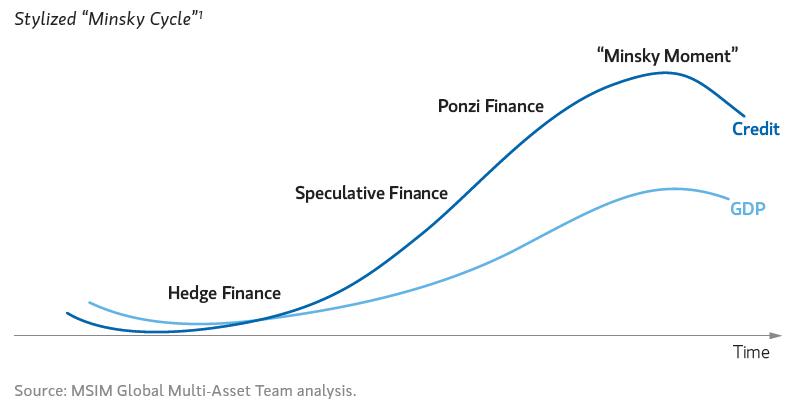

To be sure, a quick look at the market reveals no shortage of zombie companies should the economic rebound take time to gain momentum. Consider that earnings for companies, excluding financials, in the S&P 500 are forecast to drop a staggering 42% in the second quarter from the previous year as the full effect of global lockdowns are felt, according to estimates compiled by Bloomberg. At the same time, corporate debt issuance has ballooned, and could approach as much as $1 trillion this year, according to Bloomberg Intelligence. That means billions in new interest expense, which will have to be funded not from cash flows, but from even more debt, which of course is the “ponzi stage” in the Minsky Cycle diagram. What comes next – and last – is bad.

And while investors are deluding themselves into believing that these insolvent companies whose junk bonds they just bought could turn things around, if only the recovery is fast enough, the question on the minds of investors and economists alike is: how long will the Fed be willing to support firms via its pledge to buy corporate debt if the recovery is slower to develop than expected?

“The government has done more than I could have imagined to allow businesses to access capital, and if the markets shut down again the government will do even more,” said Bill Zox, chief investment officer of fixed income at Diamond Hill Capital Management.

That’s when the Fed will start buying stocks.

Until then, corporations will have to make do with bonds; in recent weeks, cruise lines have borrowed more than $8 billion via the bond market, selling notes secured by everything from ships to islands. Airlines, for their part, have gotten more than $14 billion in new financing from banks and investors, even as the vast majority of flights remain grounded.

“We have entire industries that are going to be protracted long-term if not permanently disrupted because of this,” said Vicki Bryan, a veteran credit analyst who runs Bond Angle LLC. “The cruise industry is ripe for elimination of companies. It should logically renounce the weaker players but that’s not happening because we have dirt-cheap money that we’re willing to throw back into the market from the Fed.”

And in an absolutely idiotic twist, beyond just lending insolvent zombies, creditors are also committing figurative suicide by waiving or loosening financial markers on existing debt, allowing companies that have seen revenue dry up stave off potential tumult and in the process waiving any financial leverage they may have had.

Vail Resorts Inc. — owner of the eponymous winter vacation destination — was granted a two-year reprieve on key debt covenants last month, paving the way for the company to raise $600 million with a new bond offering. Marriott, one of the world’s largest hotel chains, struck a similar agreement with lenders.

A representative for Vail said that the company’s bank covenant waiver provided additional flexibility given the short-term dislocation from Covid-19, and that it remains confident in the long-term outlook for both profit and cash flow.

Which is not to say that creditors are completely toothless: to agree to waivers, lenders are extracting higher interest rates, which incidentally only makes future defaults even more likely because if most companies can’t afford a 5% cash coupon, how will they deal with 10% or 15%?

Just ask Norwegian Cruise Lines, AMC Entertainment Holdings and Avis, which all paid double-digit yields to borrow in recent weeks. That could depress their capacity to make capital expenditures and adapt to shifting consumer tastes as the coronavirus changes how people spend money.

“Taken together with margin contraction and leverage that was already near record highs, you may end up with a corporate sector that has less capacity to invest in growth,” said Noel Hebert, director of credit research at Bloomberg Intelligence.

Which also means that the corporate sector will have to engage in even more price cutting, resulting in even more deflation, forcing the Fed to do even more QE, resulting in even more deflation and so on until we hit the monetary singularity at which point the Fed will finally start literally paradropping money to everyone.

There is a silver lining: the current artificial state will only exist as long as the central bank is explicitly active in the market. Some say as successful as the Fed has been boosting credit-market liquidity, the support is only temporary, and will result in a wave of defaults and distress when it steps back.

“There will be plenty” of debt defaults and bankruptcies when corporate borrowers start running out of cash in the months ahead, Howard Marks said in a Bloomberg TV interview, repeating what we said two weeks ago in a “Biblical” Wave Of Bankruptcies Is About To Flood The US. “There are large, highly levered companies and investment vehicles that the government and Fed rescue program is not likely to reach and take care of.”

Others see central-bank intervention keeping companies alive for much longer, crowding out investment and employment at healthy firms, similar to what occurred in Japan during the nation’s ‘lost decade’ of the 1990s, where the ‘zombie company’ term was first applied.

“You are misallocating capital to businesses that are not productive and in some sense taking resources away from companies that have high growth,” Deutsche Bank’s Slok said.

The repercussions may only become apparent years from now, according to Marc Zenner, a former co-head of corporate finance advisory at JPMorgan. “It’s hard for me to think that something like that doesn’t have a cost,” Zenner said. “What you’ll see is some of these costs will probably only emerge years later. Are we going to have reduced capacity to act? Is it that other economies will be less burdened and will attract more capital? Is there another crisis that will come because of this misallocation of capital?”

The answer is yes – the final crisis, that of faith in the reserve currency itself, and which may be precipitated by the Fed itself (as it begins buying gold) in hopes of sparking a final reflationary conflagration because to money printers, inflation is always better than deflation. Until then, we can enjoy this “Japanified” economy and market, where the zombies refuse to die, just shrink and become smaller with every passing day until one day they finally disappear, because as Matt King said back in 2015, “sometimes the side effects outweigh the benefits.”