“It’s Junk!” – Illinois’ Borrowing Costs 5 Times Higher Than AAA-Rated States

Tyler Durden

Wed, 05/20/2020 – 16:25

Authored by Ted Dabrowski and John Klingner via Wirepoints.org,

A new borrowing by Illinois shows lenders are already treating the state like it’s junk-rated.

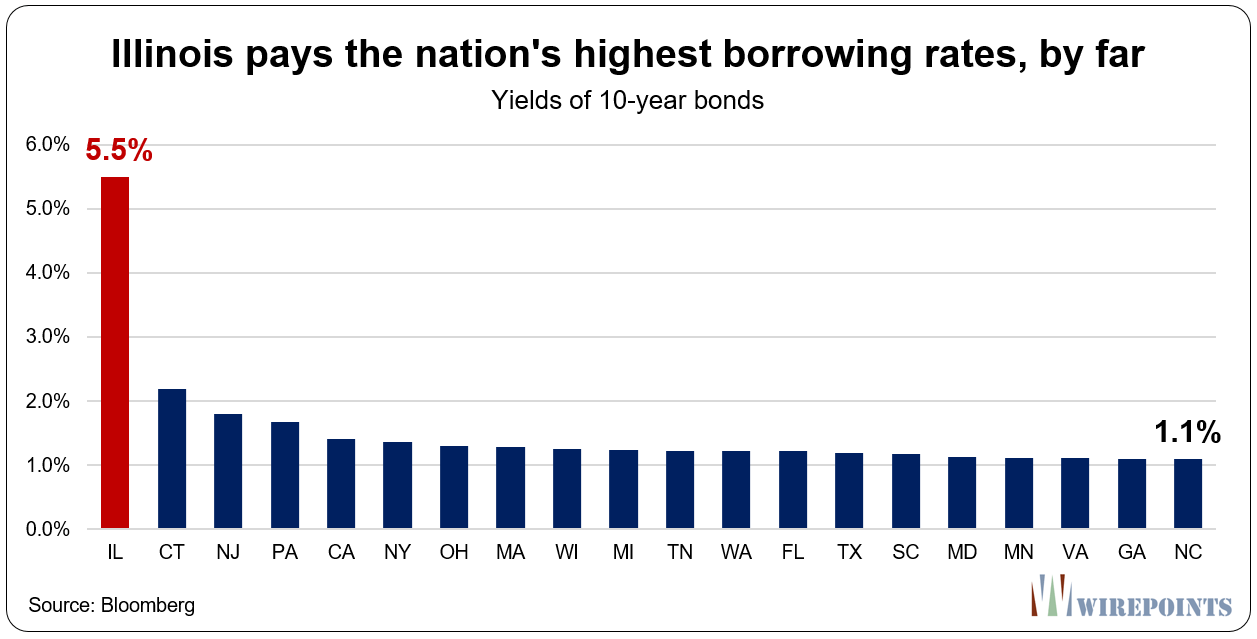

Last week, Illinois raised $800 million from the bond market with repayment dates through 2045. The borrowed money, meant for summer construction projects and a pension buyout program, costs Illinois as much as 5.85 percent yearly. No other state in the country pays such high interest rates.

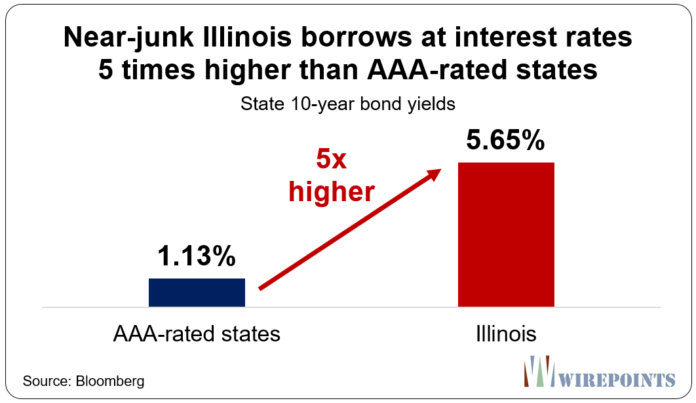

To see how punitive borrowing has become for Illinois, look at the interest rates the state is paying on its 10-year bonds. At 5.65 percent, Illinois’ rate is now five times higher than the 1.13 percent rate it costs AAA-rated states to borrow.

In other words, Illinois is paying 4.52 percentage points more compared to AAA-rated states like Indiana, Iowa and Missouri.

Greg Saulnier, MMD’s managing analyst says:

“(Illinois is) pretty much trading like it’s in junk category…I think anybody who’s going to buy this stuff is demanding the bigger coupon payments just for some sort of peace of mind.”

Over the life of the $800 million bond issue, Illinois will end up paying $450 million more in interest costs than if it were a AAA-rated state.

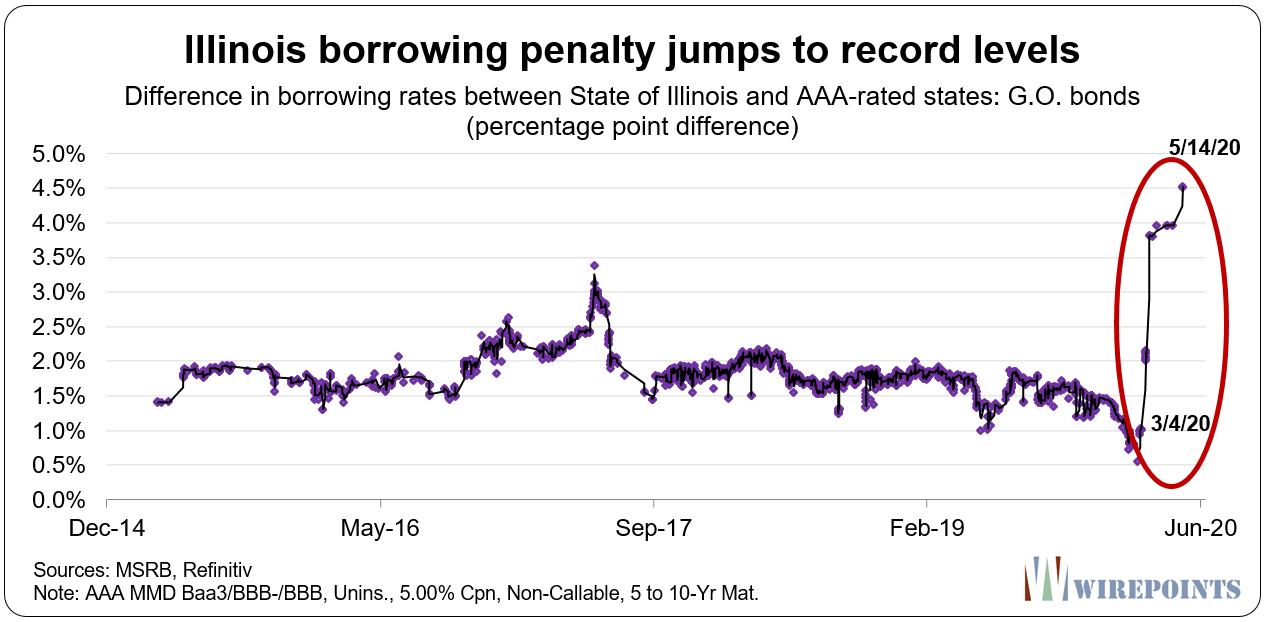

The massive difference in costs is a reflection of Illinois’ collapsing finances. No one will lend to Illinois at favorable rates because of the state’s fiscal situation.

The state was rated one notch above junk even before the coronavirus crisis hit. And Illinois’ pension debts, its high taxes and its loss of residents already made it the extreme outlier among states.

Illinois’ precarious position was made all the more obvious when State Senate President Don Harmon and the Democratic caucus asked the federal government for a direct bailout in April. The caucus used the negative impact of the coronavirus to ask for $42 billion in funds, including $20 billion for pensions. That in turn prompted U.S. Senate President Mitch McConnell to suggest bankruptcy as an alternate solution for states like Illinois.

Illinois is paying the price for its fiscal irresponsibility. Data from Bloomberg on states’ 10-year bond yields shows Illinois pays interest rates that are multiple times higher than other states.

The fact that Illinois is willing to pay such a high cost for cash shows the state has no apparent alternatives to raise money more cheaply.

The situation for Illinois recently proved difficult when it was forced to postpone a $1.2 billion bond issue two weeks ago. Concerns about pricing and demand led the state to put the bond issuance on day-to-day status. Reports now say the state may try to tap the Federal Reserve’s new Municipal Liquidity Facility (MLF) if it can’t access the funds from the market directly. If the state does use the Federal Reserve, it will send even more bad messages to the market.

With bad finances, a bailout request, bankruptcy comments and the impact of the coronavirus hanging over it all, it’s no wonder Illinois is paying payday rates to borrow.

Finally, we give the final word to Mike Shedlock who sums up the situation harshly and perfectly: “Illinois does not deserve a bailout. Its pension woes are of it own making and have nothing to do with the coronavirus. Illinois debt trades like junk, because it is junk.”