Stocks, Yuan Tick Lower As Senate Passes Bill That Could Force De-Listing Of Chinese Companies

Tyler Durden

Wed, 05/20/2020 – 12:17

Update (1240ET): As the Senate vote gets a broader airing on newswires, Chinese tech stocks – including Alibaba, Baidu & JD.com – are taking a beating.

* * *

The CCP’s leaders including President Xi are probably dedicating massive intelligence resources to try and discern how much of the White House’s belligerent rhetoric toward China is just that – talk – and how much represents serious plans for action.

Well, after President Trump raised the prospect of de-listing Chinese companies from US exchanges last week (around the time that Carson Block unveiled his latest bet against a “fraudulent” Chinese Co. trading in the US) – which prompted Beijing to threaten to move its IPOs to London, the Senate on Wednesday voted on a new bill that would intensify scrutiny of the

- SENATE PASSES BILL AIMED AT BOOSTING OVERSIGHT OF CHINESE COS.

- SENATE PASSES BILL AIMED AT BOOSTING OVERSIGHT OF CHINESE COS, BILL COULD REQUIRE CHINESE COS. TO DELIST FROM U.S. EXCHANGES, AND ALSO BILL WOULD REQUIRE COS. TO CERTIFY NO FOREIGN GOVT. CONTROL

- BILL WOULD REQUIRE COS. TO CERTIFY NO FOREIGN GOVT. CONTROL

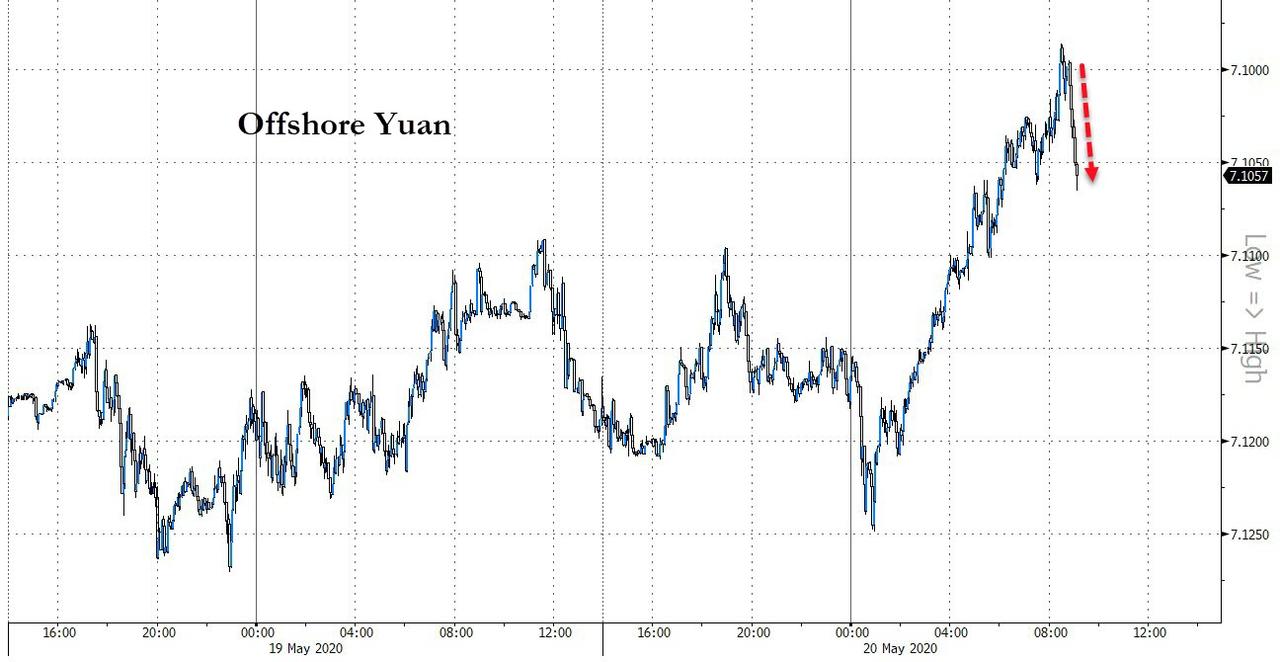

The bill comes as Washington moves to cut off Chinese telecoms giant Huawei from using US-made parts and technology. Stocks and the yuan both declined slightly on the news…

…as it adds even more credence to the “economic decoupling” narrative.

Sen. John Kennedy, a GOP Senator from Louisiana, has pushed the Holding Foreign Companies Accountable Act, legislation that has been co-sponsored by Democratic Sen. Chris Van Hollen of Maryland and Republican Sen. Kevin Cramer of North Dakota – making it a genuinely bipartisan effort. Earlier,

The law would require Chinese companies to establish they are not owned or controlled by a foreign government, and require them to submit to an audit that can be reviewed by the Public Company Accounting Oversight Board (PCAOB), the nonprofit body that oversees audits of all US companies that tap the public markets in the US.

“The central core of the US stock markets is that publicly listed companies are subject to financial oversight,” said Harris Bricken lawyer Steve Dickinson in a piece published on the China Law Blog nearly a year ago.

While American companies have submitted to the PCAOB, China has refused to allow its companies to follow the US securities law because – get this – Chinese law bars auditors’ work from being transferred out of the country, according to Dickinson. That this is merely a smokescreen that effectively has allowed Chinese companies to unaccountably siphon money from US investors.

“Stated more directly, unlike companies from the US and Europe and everywhere else in the world, Chinese companies that list on the US stock exchanges are exempt from meaningful financial oversight,” the lawyer said.

And while that’s been great for Carson Block, many American savers have suffered the consequences.

To try and rectify this, Nasdaq imposed new requirements on Chinese firms trying to list on the exchange just two days ago. A week ago, the Senate passed another bill intended to pressure China over its treatment of Muslim minorities in the northwest of the country.

We imagine we’ll be hearing from Beijing shortly.