US Futures Drop On Renewed US-China Tensions

Tyler Durden

Thu, 05/21/2020 – 08:13

S&P futures drifted lower alongside European and Asian stocks on Thursday as Trump ramped up his criticsm of China and Xi Jinping, amid rapidly deteriorating Sino-US relations, souring the mood on the the recent rally in risk assets. Safe havens such as Treasuries edged up with the dollar. As reported here last night, in a rare outburst that went so far as to accuse the “very top” of China’s government of a “massive disinformation campaign”, Trump slammed China again just days before the biggest Chinese political gathering of the year, with traders betting that it was now just a matter of time before China retaliated in deed instead of just in word.

….It all comes from the top. They could have easily stopped the plague, but they didn’t!

— Donald J. Trump (@realDonaldTrump) May 21, 2020

As a result, contracts on the three main equity index futures dropped after the S&P closed at the highest level in two months, a day after the Senate overwhelmingly passed a bill that could bar some Chinese companies from listing on U.S. exchanges, with the Emini flirting on either side of the critical 2,950 level.

“Markets may be pricing in far too much complacency as the U.S.-China ‘phase one’ trade deal could be at risk,” said market strategist Stephen Innes. “The pandemic and resulting acute economic downturn have made China’s trade commitment to the U.S. much more challenging to fulfill.”

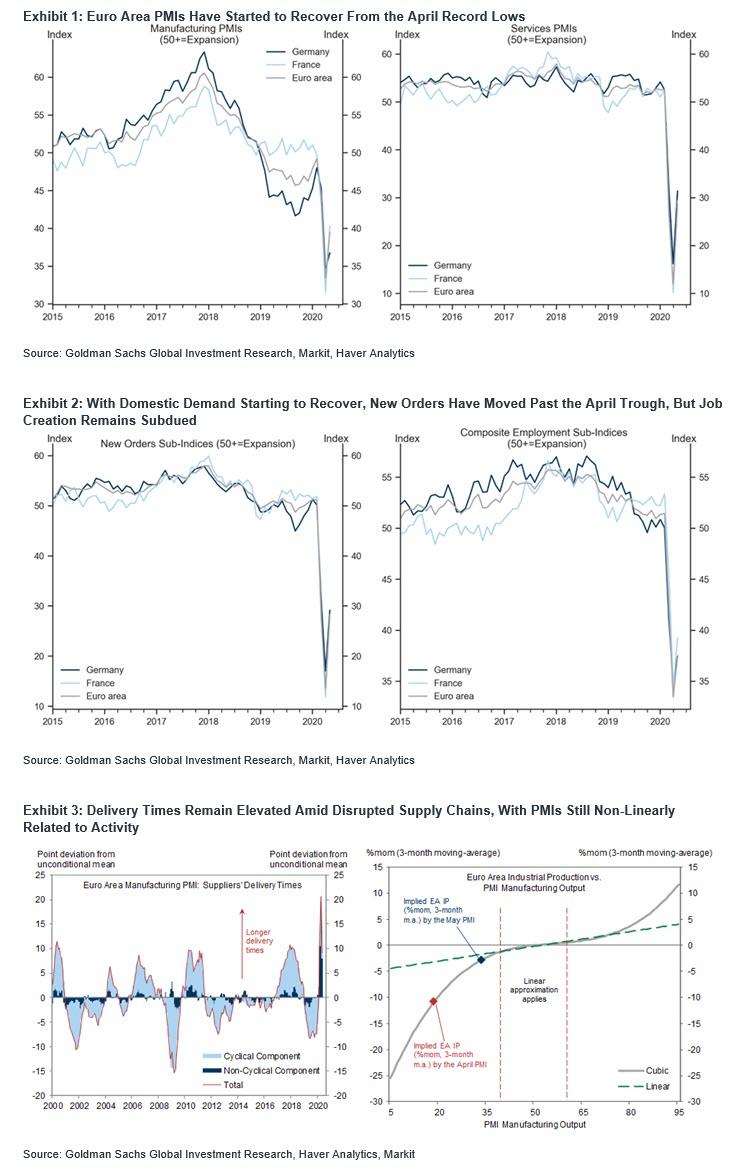

Europe’s Stoxx 600 Index fell, with nearly all 19 sector groups in the red. Deutsche Lufthansa AG shares bucked the trend after the carrier said it was close to a multibillion-euro bailout deal from the German government. There was some good news out of Europe, where May flash PMIs (even though there is still ten days in the month) rebounded solidly from April’s lows. As Goldman notes, after reaching a historical low in April at the height of the coronacrisis, the Euro area flash composite PMI rebounded by 16.9pt in May (to 30.5), and above consensus. The increase was broad-based across sectors—with manufacturing output rising by slightly more than services activity—consistent with the gradual lifting of containment measures from early May.

Yet there was some continued weakness with German manufacturing PMI printing at 36.8, below the 39.2 expected.

Earlier in the session, Asian stocks also fell, led by utilities and communications, after rising in the last session. Markets in the region were mixed, with Shanghai Composite and Hong Kong’s Hang Seng Index falling, and India’s S&P BSE Sensex Index and Taiwan’s Taiex Index rising. The Topix declined 0.2%, with Funai Soken and Marudai Food falling the most. The Shanghai Composite Index retreated 0.5%, with Xinjiang Korla Pear and Nanjing Chervon Auto Precision posting the biggest slides.

Concerns over the growing stress between the US and China and global coronavirus cases reaching 5 million are vying for investor attention with optimism over reopening economies and progress on thwarting the pandemic. AstraZeneca received more than $1 billion in American funding to develop a Covid-19 vaccine. Meanwhile, the U.S. legislation could lead to Chinese mega-companies such as Alibaba Group Holding and Baidu being barred from exchanges. Both slipped in early trading, with Baidu going so far as declaring it may delist first before it is kicked out:

- EXCLUSIVE-CHINA’S BAIDU CONSIDERS DELISTING FROM NASDAQ TO BOOST VALUATION – RTRS

Investors are also awaiting the latest weekly jobless claims data, which is due at 8:30 a.m. ET and is expected to show millions more Americans filing for unemployment benefits due to layoffs and mass furloughs as a result of the lockdown. Still, claims have gradually declined since hitting a record 6.867 million in the week ended March 28 and Thursday’s report could offer early clues on how quickly businesses re-hire as they reopen.

In rates, Treasuries were flat into early U.S. trading after paring Asia-session gains that were paced by demand for longer-dated tenors after Wednesday’s well-received 20-year auction, the first in decades. Yields remain lower by about 1bp across the curve, 10-year around 0.67%, with 5s30s, 2s10s flatter by around 0.5bp each. Gilts outperformed, richer by 2bp vs. Treasuries; BOE conducted buybacks via three operations Thursday, totaling GBP4.5b. Treasuries also drew support during Asia session from rising U.S.-China tensions. The new 20-year, priced at 1.22% Wednesday, improved to about 1.16%.

Market Snapshot

- S&P 500 futures down 0.8% to 2,945.50

- STOXX Europe 600 down 0.9% to 339.81

- MXAP down 0.3% to 148.47

- MXAPJ down 0.2% to 479.40

- Nikkei down 0.2% to 20,552.31

- Topix down 0.2% to 1,491.21

- Hang Seng Index down 0.5% to 24,280.03

- Shanghai Composite down 0.6% to 2,867.92

- Sensex up 0.8% to 31,058.54

- Australia S&P/ASX 200 down 0.4% to 5,550.43

- Kospi up 0.4% to 1,998.31

- German 10Y yield fell 1.1 bps to -0.479%

- Euro down 0.1% to $1.0967

- Italian 10Y yield fell 0.2 bps to 1.46%

- Spanish 10Y yield rose 2.2 bps to 0.662%

- Brent futures up 2% to $36.47/bbl

- Gold spot down 0.8% to $1,734.25

- U.S. Dollar Index up 0.2% to 99.31

Top Overnight News

- U.S. and European futures retreated and the dollar advanced with Treasuries as deteriorating Sino-American ties cast a cloud over the recent rally in risk assets

- The euro-area economy started to claw its way out of its deepest downturn ever as the relaxing of coronavirus lockdowns allows thousands of businesses to reopen. Markit’s headline gauge of private-sector activity rose in May, though it continued to signal contraction in both manufacturing and services

- The U.K.’s economic slump eased this month as some companies resumed trading amid a lockdown that has brought most activity to a halt. IHS Markit’s Purchasing Managers Index for the whole economy rose to 28.9 from 13.8 in April in a preliminary estimate

- The U.S. threw its weight behind one of the fastest-moving experimental solutions to the coronavirus pandemic, pledging as much as $1.2 billion to AstraZeneca Plc to help make the University of Oxford’s Covid vaccine

- British banks are confronting the European import of sub-zero interest rates that could damage profits already weakened by the coronavirus pandemic, and the Brexit divorce rumbling towards its rocky end

Asian equity markets struggled to sustain the impetus from the rebound on Wall St where stocks were underpinned by hopes of a pick-up in economic activity after all US states were said to have at least partially reopened and as the continued recovery in oil prices also supported the risk tone, with sentiment in Asia eventually clouded by ongoing US-China tensions. ASX 200 (-0.4%) was initially led higher by strength in energy names although the index later reversed the moves after its top weighted financials sector dipped into the red and amid the souring ties with China. Nikkei 225 (-0.2%) also failed to hold on to opening gains despite reports Japan is set to lift the emergency declarations in Osaka, Kyoto and Hyogo, but with Tokyo not included in the status lifting, while participants digested mixed trade data that showed Exports at a narrower than expected contraction, which was still the worst decline since 2009. Hang Seng (-0.5%) and Shanghai Comp. (-0.5%) were subdued as the war of words between US and China persisted with US President Trump alleging the incompetence of China was behind the mass worldwide killing and that China’s disinformation and propaganda attack on the US and Europe is a disgrace. Furthermore, the White House released a report blasting China for its actions ranging from predatory economic policies to human rights abuses, and the US Senate recently passed the bill aimed at increasing oversight of Chinese companies that could see them delisted from US exchanges. Finally, 10yr JGBs were higher as they tracked the upside seen in T-notes following the hostile US-China rhetoric and decent results at the new US 20-year auction which disproved the naysayers that had anticipated a lacklustre auction, while the BoJ presence in the market and mild deterioration in risk tone also added to the upside for JGBs.

Top Asian News

- China Simplifies Iron Ore Import Rules Amid Australia Spat

- Chinese Port Operator Xinghua’s Owner Said to Explore Sale

- Fiscal Nightmare Ties Up Kuwait’s Stimulus With 40% Deficit

- Airlines Caught Off Guard as India Suddenly Allows Flights

European stocks see losses across most major bourses [Euro Stoxx 50 -1.4%], as the negative APAC sentiment reverberated into the region. Bourses see broad-based losses amid the escalating rhetoric between US and China as sentiment between the nations hit a low – with Spain faring slightly better after earlier underperformance on account of its extended State of Emergency, while Switzerland and Scandi markets are closed amid holidays. Broader sectors are all in the red with defensives faring better than cyclicals – suggesting risk aversion across the market, whilst the breakdown pains a similar picture with banks and Travel & Leisure among the laggards. In terms of individual movers, easyJet (+6.3%) holds onto gains after announcing the resumption of flights from 15th June. Co. believes there is sufficient customer demand to support profitable flying. Initial schedule will comprise mainly of domestic flights in UK and France, Further routes will be announced in the coming weeks as customer demand increases. Sticking with the airline sector, Lufthansa (+4.8%) confirmed it is in advanced talks with the German Govt’s Economic Stabilisation Fund (WSF) on a stabilisation package comprising of measures amounting up to EUR 9bln, with the package subject to approval by the European Commission. On the flip side, Altice (-12%) shares tumble post earnings.

Top European News

- EasyJet Among First Carriers in Europe to Plan Restart

- Swissport Seeks Support to Raise up to $417 Million of Loans

- British Lenders Brace for Sub-Zero Rates Floated by Central Bank

- U.K. Grid Struggles as Renewables Overtake Fossil Fuels

In FX, mixed to weaker than forecast French and German PMIs were rather misleading, as the preliminary survey for the bloc as a whole beat on all counts to keep the Euro elevated and more resistant than other majors against a broad Dollar revival. Indeed, Eur/Usd remains underpinned above 1.0950 even though the DXY has pared some losses from Wednesday’s 99.001 low to sit a bit more comfortably within a 99.183-434 range ahead of US PMIs and the latest weekly jobless claims data. Similarly, albeit to a lesser extent, the Pound has regained composure in wake of UK services, manufacturing and composite readings all surpassing consensus, with Cable back above the 1.2200 handle and Eur/Gbp just holding below 0.9000. However, the former still looks bearish from a technical standpoint after breaching one side of an inverse head and shoulders chart formation at 1.2225, while a softer than forecast CBI trends metric did little to spur any action.

- AUD/NZD – Renewed risk aversion and further assurances from RBA Governor Lowe about turning up the QE dial again if needed have prompted a pull-back in the Aussie and Kiwi from midweek peaks vs their US counterpart, as Aud/Usd reverses from 0.6600+ and Nzd/Usd is back under 0.6150. Note much in the way of additional impetus gleaned from CBA PMIs overnight, but NZ retail sales could be more pivotal later.

- CAD/CHF/JPY – Firm crude prices continue to cushion the Loonie from downturns in broader risk sentiment, but Usd/Cad has further from sub-1.3900 lows into a band up to 1.3946, while the Franc is pivoting 0.9650 and Yen is consolidating between 107.49-84 parameters following a much wider than expected Japanese trade deficit due to exports plunging around 3 times more than imports.

- SCANDI/EM – The Scandi Crowns have both lost momentum amidst the aforementioned risk-off mood, with Eur/Sek and Eur/Nok rebounding after forays to fresh multi-month lows towards 10.5000 and 10.8500 respectively, but the overall trend remains bearish in cross terms. Meanwhile, EMs have also handed back some of their recent gains as the clock ticks down to CBRT and SARB rate verdicts that are predicted to reveal matching 50 bp benchmark reductions, but could conceivably culminate in more aggressive easing moves. Usd/Try is straddling 6.7900 at present and Usd/Zar has reversed through 18.0000 after crossing the psychological mark on Wednesday.

- RBA Governor Lowe said the future remains unusually uncertain in which one uncertainty is the pace of which restrictions are eased and another source is the level of confidence people have about their future, while he added the RBA remain prepared to scale up bond purchases again if necessary but noted there is a limit to what can be achieved with monetary policy. Furthermore, RBA Governor Lowe added there is no change to thinking on negative rates which are still extraordinarily unlikely and that the costs of negative rates exceed the benefits. (Newswires)

In commodities, WTI and Brent front month futures eke mild gains in what is another new-flow light European session. Rising US-Sino frictions weigh on the stock markets but caps gains in the energy market, as the complex still prices in demand from reopening economy alongside lower supply from producers. Regarding OPEC, Russian oil and condensate between May 1-19 was reported to have averaged 9.42mln BPD – although condensate is not part of the OPEC+ deal – its output was reportedly between 700-800mln BPD, meaning Russian oil output was modestly above the agreed cap of 8.5mln BPD, according to ING. WTI July resides just south of USD 34/bbl whilst its Brent counterpart trades on either side of USD 36/bbl – with both benchmarks within a USD 1/bbl or so intraday band. In terms of bank commentary, Citi sees Brent prices averaging USD 39/bbl in Q2 and USD 48/bbl in Q4, expects oil market to move into a deficit from June through Q3 2020 onward. Meanwhile, spot gold remains weighed on by a firmer USD as President Trump ramped up rhetoric against China – with the yellow metal around USD 1735/oz having printed a high of USD 1749.50 thus far. Copper prices have receded in tandem with stocks and the overall protectionism-hit sentiment, but downside action remains limited as the demand prospect from opening economies underpin demand for the red metal.

US Event Calendar

- 8:30am: Philadelphia Fed Business Outlook, est. -40, prior -56.6

- 8:30am: Continuing Claims, est. 24.3m, prior 22.8m; Initial Jobless Claims, est. 2.4m, prior 2.98m

- 9:45am: Bloomberg Economic Expectations, prior 29; Bloomberg Consumer Comfort, prior 35.8

- 9:45am: Markit US Manufacturing PMI, est. 39.5, prior 36.1

- 9:45am: Markit US Services PMI, est. 32.3, prior 26.7

- 9:45am: Markit US Composite PMI, prior 27

- 10am: Existing Home Sales, est. 4.22m, prior 5.27m; Existing Home Sales MoM, est. -19.92%, prior -8.5%

DB’s Jim Reid concludes the overnight wrap

One interesting stat that we’ve included in our penultimate CCD today is that in the US state of Pennsylvania (12.8m pop.) more people have died of covid-19 aged over 100 years old than below the age of 45. In total it is 41 deaths under the age of 45 vs. 72 over the age of 100. In fact more people have died in the 105-109 year old age bucket (six people) than in any 5 year buckets up to the age of 30. Eight people under 30 have died in total in the state out of 4493. We show the graph in the CCD today. It is perhaps the most granular age data we’ve seen so far and goes up to those 110 years old.

Onto markets now and it was yet another strong day for risk assets yesterday, with the S&P 500 climbing a further +1.67% to reach its highest closing level since the crisis was in full-swing. Indeed, the index now stands at an astonishing +32.82% higher since its closing low less than 2 months ago, as abundant liquidity, the continually slowing rates of infection and possible signs of hope on a vaccine have seen equities make one of their fastest moves upwards in many years. The question is whether this can sustain itself given that the very live risk of a second wave remains, as well as the fact that a vaccine is far from certain.

In terms of the details, 23 of 24 industry groups in the S&P moved higher, with energy leading the way on the back of higher oil prices. Europe also made gains as the STOXX 600 rose +0.98%, led partially by oil and gas stocks. The DAX was also up +1.34% and at a 2-month high. As mentioned, oil’s rally helped the covid laggards lead the day’s rally with both WTI (+3.05%) and Brent crude (+3.71%) making significant advances as both reached their own 2-month highs. It was not all positive for the commodity as data out of the US showed that there was an increase in gasoline storage thus showing the ongoing demand weakness. Markets continue to look beyond this at the moment with hopes that reopening of large parts of the US will see demand return.

The positive moves yesterday actually came in spite of a further escalation in rhetoric between the US and China. Secretary of State Pompeo said that China was ruled by a brutal, authoritarian regime, and that Beijing was hostile to free nations, which follows warnings from China after Pompeo congratulated the new Taiwanese President on her inauguration, since China claims Taiwan as part of its “one China” principle. Lastly, the US Senate passed by unanimous consent, legislation yesterday which require companies certify that they are not under the control of a foreign government for them to be listed on US exchanges. This was pointed at China with the Senator introducing the bill, John Kennedy (Republican from Louisiana), saying that “I do not want to get into a new Cold War,” but he wants “China to play by the rules.”

In terms of markets this morning, momentum has faded somewhat as that trade rhetoric weighs on sentiment. The Nikkei (-0.16%) is down, Hang Seng and Shanghai Comp both flat and Kospi (+0.33%) has posted a modest gain. Futures on the S&P 500 are also down -0.62%. Elsewhere, the US dollar index is trading up +0.24% while yields on 10y USTs are down -2.1bps.

We’ve also had the preliminary May PMIs for Japan and Australia overnight. Japan’s manufacturing PMI printed at 38.4 (vs. 41.9 last month), the lowest reading since March 2009 while the services print came in at 25.3 (vs. 21.5 last month) thereby putting the composite at 27.4 (vs. 25.8 last month). For Australia, the manufacturing PMI came in at 42.8 (vs. 44.1 last month) and services reading improved to 25.5 (vs. 19.5 last month) which put the composite at 26.4 (vs. 21.7 last month). In addition to that, Japan’s April trade data revealed that exports fell by -21.9% yoy (vs. -22.2% yoy expected), the largest decline since 2009 while the decline in imports was -7.2% yoy (vs. -13.2% yoy expected). In other overnight news, President Trump said that he may hold the June G-7 meeting at Maryland’s Camp David after previously planning a video conference.

Here in the UK, Bloomberg reported overnight that the government is considering an option of asking businesses to take over paying national insurance and employer pension contributions for furloughed staff as it weighs up winding down its spending on the program. Separately, the Financial Times has reported that Chancellor Sunak is drawing up plans to extend the holiday on mortgage payments that banks have to give 1.7 million homeowners suffering financial stress due to the virus. The holiday is currently set to finish at the end of June.

There were two noteworthy items out of central banks yesterday. Later in the day the Fed’s minutes from the 28-29 April meeting were released. The highlight was the level of concern the committee felt the virus posed to the US economy and the need to stem the fallout. “Members agreed that the Federal Reserve was committed to using its full range of tools to support the U.S. economy in this challenging time.” There was ample discussion into how forward guidance should be determined in the upcoming months, two suggestions were an outcome-based approach specifying macroeconomic indicators that needed to be reached or a date-based approach with the target range for the benchmark rate only rising after a specific amount of time had passed. The topic of negative rates were only brought up once, as “respondents to Desk surveys attached almost no probability to the FOMC implementing negative policy rates.” One of the issues with determining the best approach to forward guidance is the uncertainty around the path of the virus itself. Many Fed officials judged that there was a “substantial likelihood of additional waves of outbreak in the near or medium term. In such scenarios, it was believed likely that there would be further economic disruptions.” See our US economists recap for further details. Link here.

The cautionary tone of the FOMC minutes did not help the dollar as it fell against other major currencies on the day. The Bloomberg dollar index was down -0.25% to levels last seen on 1 May. The Euro rose 0.52%, trading higher for the fourth straight day, the longest such streak since the last week of March.

Back here in the UK, we got a few headlines from the Bank of England, as Governor Bailey said that “we’re keeping the tools under active review in the current situation”. He continued to not rule out negative rates, in line with the recent rhetoric we’ve been hearing, but he also acknowledged that there’ve been pretty mixed reviews on their use elsewhere, so it doesn’t obviously look as though these are going to be on the table anytime soon. The comments came as the UK’s debt management office actually sold bonds at a negative yield for the first time yesterday, raising £3.75bn at a yield of -0.003%. Our economists’ view is that the next policy move will be £125bn of extra QE next month, rather than negative rates.

Meanwhile, we got reports from MNI that the ECB would soon announce details on the reinvestment of principal payments on the bonds it’s bought under their Pandemic Emergency Purchase Programme launched in March. It was also said to be likely to add junk debt to its purchases. Credit had a good day yesterday with IG cash spreads 5bps tighter in USD and 3bps tighter in EUR, and HY cash spreads 19bps tighter in USD and 11bps tighter in EUR.

Looking at sovereign bonds yesterday, they were mostly treading water on both sides of the Atlantic, with no big moves in either direction. This was even as the US government sold 20-year bonds for the first time since 1986, and at a yield (1.220%) only marginally above the pre-auction levels. 10yr US Treasury yields ended the session mostly unchanged, down -0.8bps at 0.68%, while those on bunds fell by -0.4bps. One of the bigger moves was seen in Greece, where the country’s spread over 10yr bunds came down by -4.7bps to their lowest level in over a month.

There wasn’t a lot of data to mention, though we did get a number of CPI inflation prints. In the UK, CPI fell to +0.8% in April and the final Euro Area CPI reading was revised down a tenth from the flash to +0.3%, which in both cases is the lowest inflation has been since August 2016. In Canada, we actually saw deflation, as CPI was at -0.2% in April, moving into negative territory for the first time since September 2009.

Attention today will be back on the data once again, with the both the flash PMIs for May as well as the weekly initial jobless claims from the US offering markets the latest clues on how economies are faring as they ease off their most stringent lockdown measures. Starting with the PMIs, last month we saw the composite PMIs fall to record lows on both sides of the Atlantic as the surveys fully encompassed the lockdowns. There will likely be a decent bounce but bear in mind that PMIs are diffusion indices, where respondents simply say whether things are better or worse than last month, meaning that in extreme events such as these they don’t necessarily give the best picture on the scale of the declines or rebounds when they happen.

On those weekly jobless claims, our US economists are forecasting a 2.5m reading for the week through May 16. We’re also likely to see downward revisions to the previous week since we’ve been informed that last week’s number for Connecticut was around 10 times what it should have been. A 2.5m reading would be the 7th consecutive decline since the peak back in late March, but given that such a number would still be at least triple the previous record before the coronavirus took hold, the big question is how long it’ll take before we start to see more “normal” numbers again.

To the day ahead now, where the data highlights are likely to be the aforementioned flash PMI readings from around the world and the weekly initial jobless claims from the US. Other than that, there’ll also be the CBI’s industrial trends survey for May in the UK, while from the US we’ll get the Philadelphia Fed’s business outlook for May, as well as the leading index and existing home sales for April. From central banks, there are monetary policy decisions from Turkey and South Africa today, in addition to remarks from the Fed’s Powell, Clarida and Williams, along with the ECB’s Panetta. Finally, earnings releases include Nvidia, Medtronic, Intuit, TJX and Hewlett Packard Enterprise.