$180 Billion Asset Manager Explains What May Spark The Collapse Of The Dollar

Tyler Durden

Fri, 05/22/2020 – 17:46

The optimists see our current time as one of intermission – a pause, followed by a renewal of the show from wherever exactly it left off.

Is this realistic? Tens of millions have been laid off or furloughed – will the businesses and industries they worked for be there when the intermission is over?

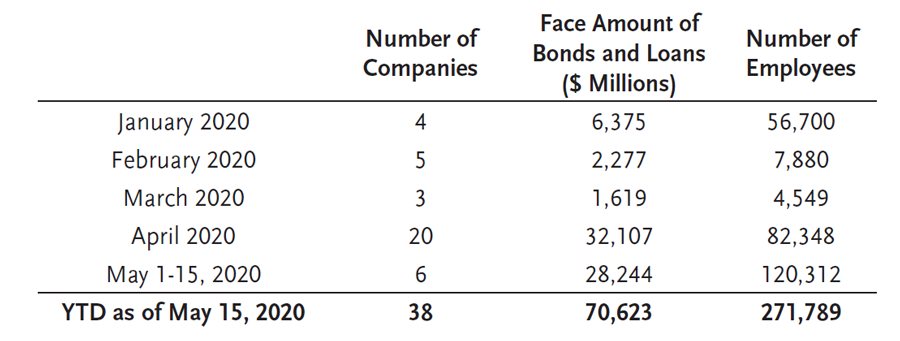

In just a few short months, the tally of business casualties is stunning:

YTD Corporate Defaults and Restructurings

Source: JP Morgan, Bank of America, Bloomberg, TCW

In fairness, some of these enterprises were only one recession away from business failure. Even so, the sheer number of enterprises that have failed to survive even the first few months of “intermission” raises serious doubts as to whether a straight path back to where we were is remotely feasible.

Yet, meanwhile, the “true” condition of the “intermission” economy is utterly obscured. The macro data tells us where we are without giving us a clue as to where we are going. Meanwhile, the majority of corporate managements have come face-to-face with the opacity of our times and have more or less systemically pulled their forward earnings guidance. The vast helicopter drops of new money represent—again—an attempt by the Fed to replace lost incomes and savings with new credit. Whether the new money is the bridge to the next economy, or whether it is mostly just delaying the adjustment with a price that has yet to be tallied is unknowable.

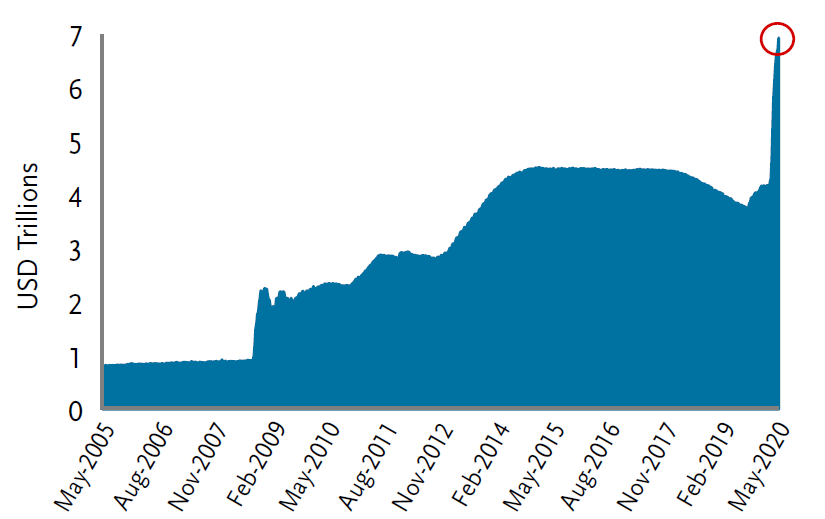

For, what the Fed and the fiscal authorities have undertaken is without precedent:

Fed Balance Sheet

Source: Federal Reserve

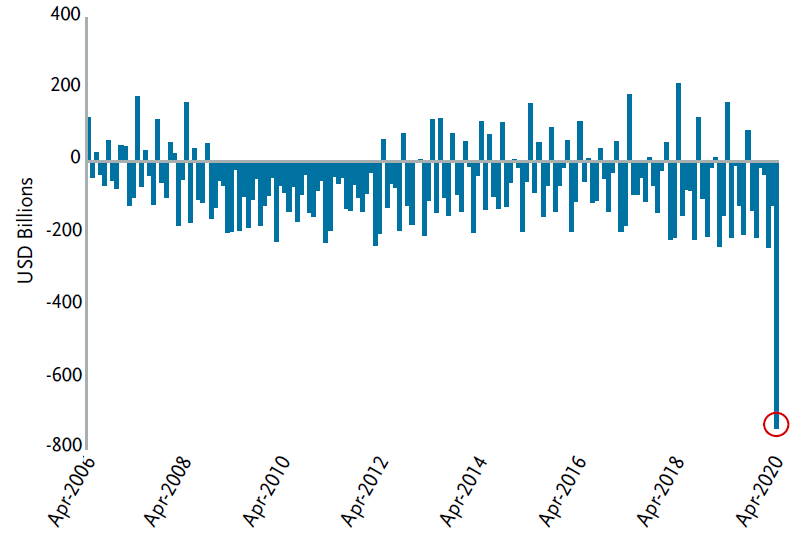

U.S. Budget Deficit

Source: Bloomberg, TCW

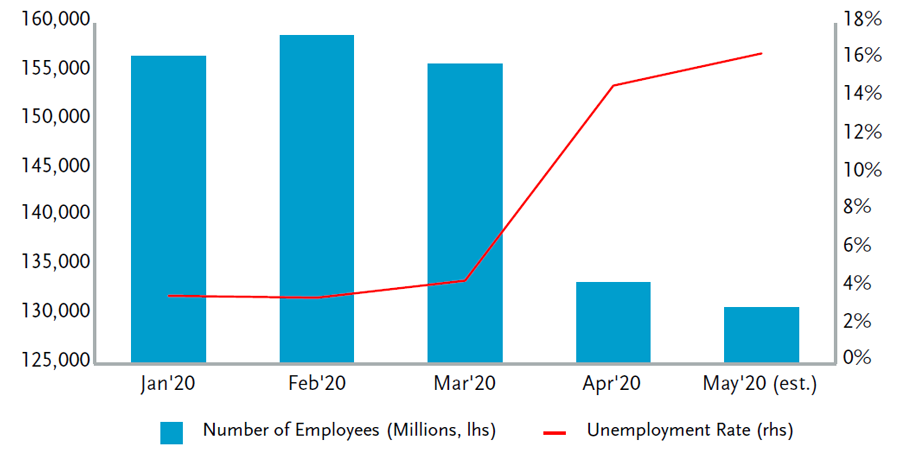

New money created by the trillions has been dropped on an economy whose productive potential has plummeted at rate that is not just beyond what anyone would have supposed—it is beyond what anyone could have supposed:

The Pandemic Sweeps Through U.S. Labor Market

Source: TCW

Meanwhile, the Fed is maintaining a stiff upper lip. Not only will the recovery come, they reassure us, but in the event that it does not, the Fed will simply dig deeper into its bag of tricks. Its toolkit is, after all, “unlimited.” Or is it? Can the Fed print money without limit? Could we drop Federal tax rates to zero and send the economy into orbit? Has the Fed somehow been convinced that Modern Monetary Theory (MMT) is really the answer to the question of how do we get ourselves out of our pandemic hole?

MMT holds that Fed IOUs (dollars) are really no different than Treasury IOUs (T-bills and T-notes). In fact, since a dollar never “matures”, it is also a kind of perpetuity: indeed in that respect it is even “better” than asking the Treasury to issue 100-year bonds! And, not only does it never mature, the dollar IOU carries no interest charge. In short, as the Fed expands its balance sheet, it is issuing non-interest paying perpetuities to its counterparties. In ordinary times, one might reasonably suppose that the bid for such perpetual zeroes to be limited by the desire of said counterparties to use those dollars either in trade or to repay dollar liabilities. The notion that the global private sector has an unlimited appetite for dollars does not stand scrutiny. Yet, the fact that the Fed has managed to issue trillions of these perpetual zeroes at a time of decline in trade and economic activity, would appear to be prima facie evidence that dollars are eagerly sought after, presumptively in large measure as a safe haven store of wealth.

While the point may be a bit speculative, the Fed has “discovered” that MMT “works” when your counterparties would rather store their incremental wealth in dollar denominated perpetual zeroes rather than in say commercial real estate or in EM currencies.

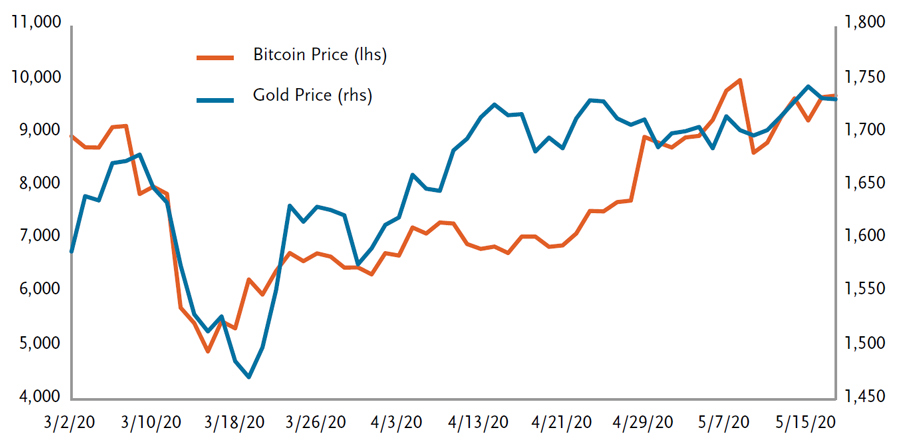

The relentless rise in gold (and bitcoin) since its mid-March low might also suggest that storing wealth in even a modestly “negative yielding” perpetuity has also looked increasingly attractive to many.

In short, when the collective outlook fears generalized asset price deflation, a “zero” may look like a pretty good place to hold your wealth, at least for “now.” But what about “later?”

Daily Price of Gold and Bitcoin Since March 1

Source: TCW

While we do not question the near-term efficacy of the helicopter drops in stabilizing the economy and feeding the concomitant ravenous demand for dollars, we do not believe that new money alone can restore the pre-COVID economy. We cannot imagine how the show will just pick up from where it left off. The shutdowns and accompanying shifts in consumption preferences will radically alter — for some time — the nature of certain key industries: restaurants, retail, energy, travel, lodging, hospitals, aircraft manufacturing, health clubs, and much of commercial real-estate, to name some of the more obvious.

Indeed, how can a service economy go back to “normal” when the nature and quantity of so many of the services offered for sale have likely undergone intermediate if not permanent transformation?

While the economy will of course recover, the more the post-COVID economy differs from that of the pre-COVID, the longer we should expect that recovery to take.

Further, while the Fed’s initial experience with MMT has been favorable — or at least consistent with its hopes — future helicopter drops are dependent on the willingness of the global private sector to further accept the new dollars the Fed wishes to offer. That the Fed can electronically print zillions of new dollars goes without saying. But all transactions are a dance. The power to add new money to the system is restricted by the willingness of human actors to further shift their portfolio wealth into dollars. That appetite is surely not unlimited and will likely prove dynamic: if “others” become more reluctant to take dollars, so may “you.”

The Fed has complete governance over the supply side of the dollar market — but not so the demand side. Adding dollars beyond the point at which the marginal human actor is willing to accept them would force the dollar lower in value, further altering its perception as a safe store of value. So, yes, the obvious constraint for printing still more nominal dollars so as to replace losses in real income is exactly what you’d think it would be: the risk of currency depreciation. Almost by definition, when I no longer see the dollar as a safe store of value, I will be reluctant to accept dollars either now or in the future on the same terms as when I saw it as a safe preserve of value. This mere shift in perception might be enough to spark an inflation. At the very least, prudent investors perhaps need to anticipate a heightened risk of inflationary outcomes, a notion that we grant today seems so remote from today’s deflationary realities.

But, keep throwing dollars at the demand side of the economy while production remains impaired by supply bottlenecks, protectionism, a general dysfunction in trade and travel, and sooner or later, we may all see that while the Fed built us a bridge over this Depressionary trough, the landscape on the “other side” might look a good deal less than January 2020 and a lot more like the stagflationary 1970s. While the benefits of MMT-like policies are as apparent as they are real-time, the costs will not be known for some time. Either way, we believe a more realistic timeline for recovery ought to be measured in years rather than months, affording patient investors with many opportunities to allocate capital in support of building a newer and hopefully better normal.