By Tyler Durden

By Tyler Durden

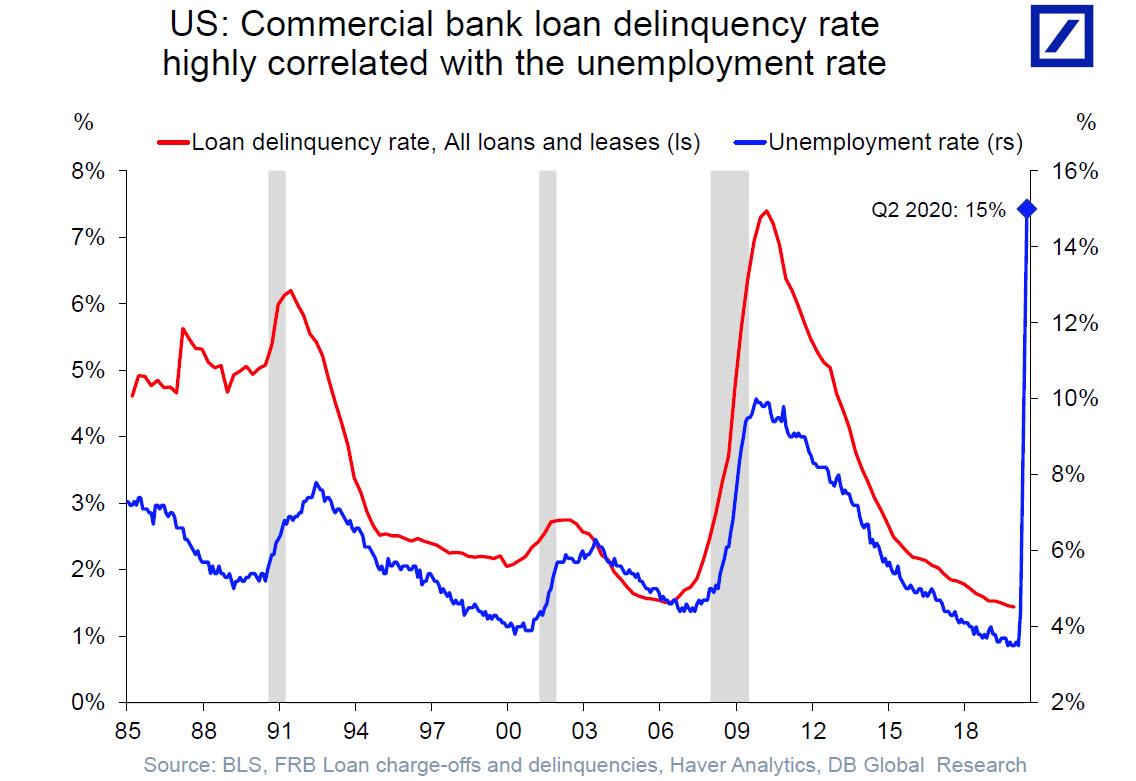

Two weeks ago, when looking at the recent flurry of chapter 11 filings and a striking correlation between the unemployment rate and loan delinquencies, we said that a “biblical” wave of bankruptcies is about to flood the US economy.

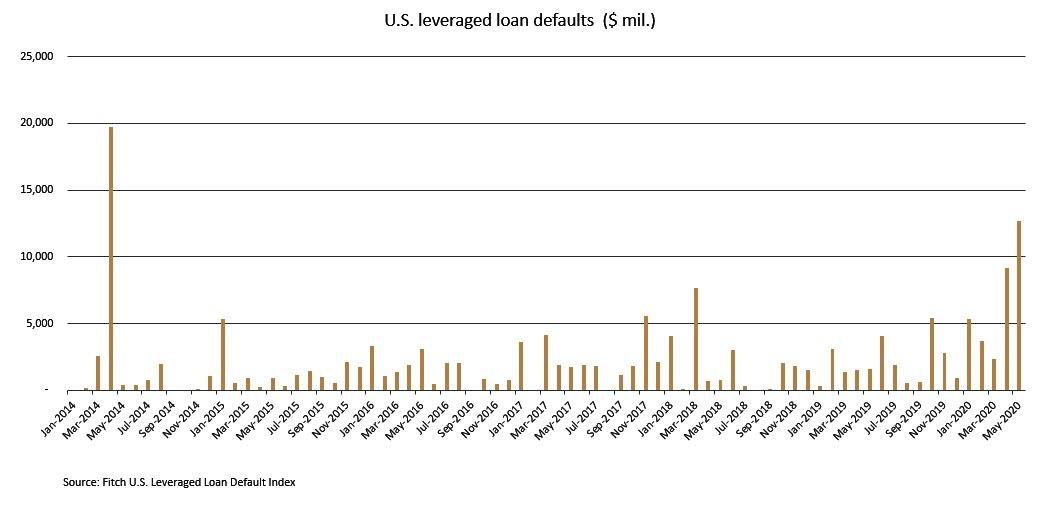

It now appears that the wave is starting to coming because according to Fitch, the monthly tally of defaults in the U.S. leveraged loan market has hit a six-year high, as companies are either missing payments or filing for bankruptcy because of the fallout from the coronavirus pandemic.

According to the latest Fitch Leveraged Loan Default Index data, the total amount of defaults in this high-risk, high-yielding area of the debt markets at $12.6 billion in May so far, the highest since April 2014, bringing the leveraged loan default total for the year to date is $33.3 billion.

See: 177 Different Ways to Generate Extra Income

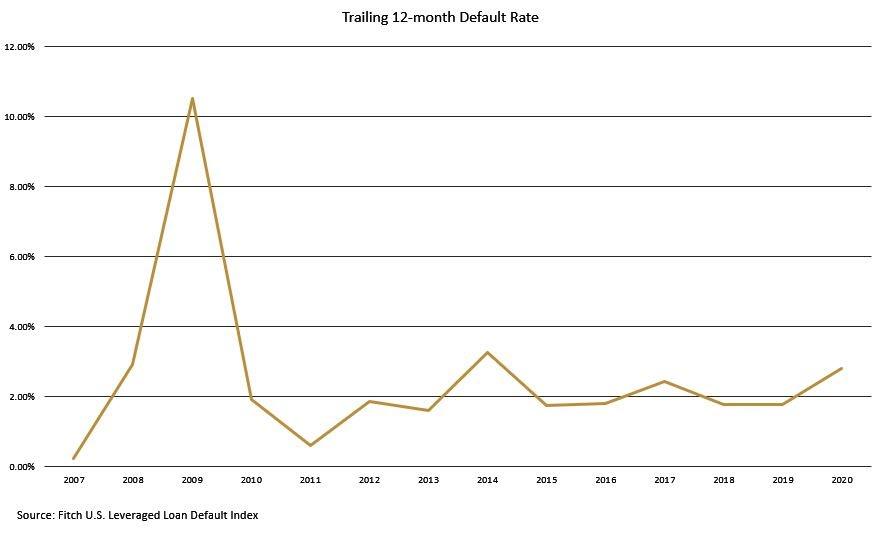

At the end of April, the trailing 12-month default rate jumped to 2.8%, compared to just 1.8% at the end of last year. Fitch forecast that U.S. leveraged loan defaults would reach $80 billion in 2020, surpassing the previous high of $78 billion in 2009.

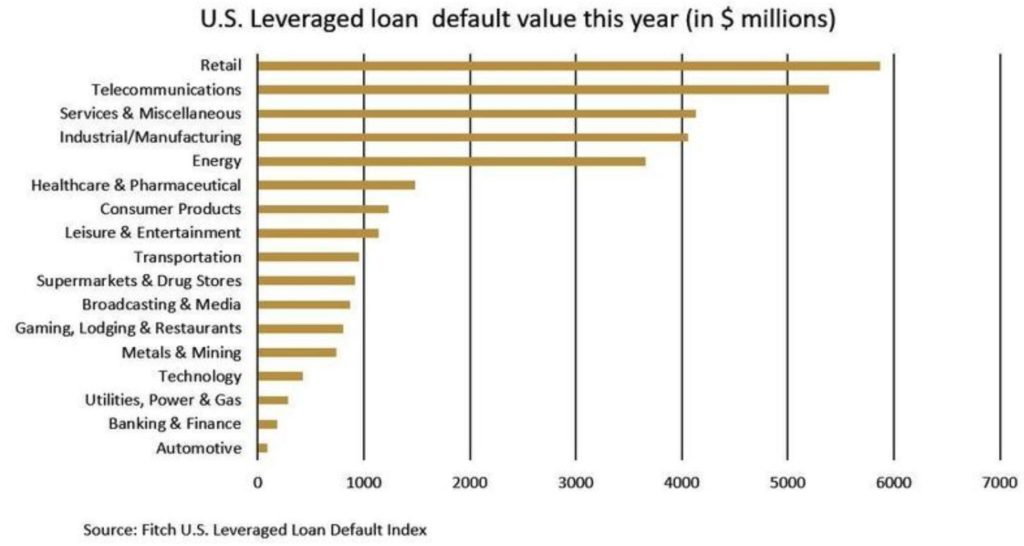

While many expect the US shale sector to lead in the coming default spike, US retailers have accounted for the bulk of defaults over the past two months, as they were forced to temporarily close stores in response to the COVID-19 pandemic. For now, energy remains in 5th spot after the telecom, services, and manufacturing sectors.

Retailers Neiman Marcus Group, J.Crew and J.C. Penney all filed for Chapter 11 bankruptcy protection this month in the United States, while Chesapeake Energy said this month it was unable to access financing and was considering a bankruptcy court restructuring of its over $9 billion debt if oil prices did not recover from the sharp fall caused by the COVID-19 pandemic.

What’s coming will be far worse, with none other than the CEO of the world’s biggest asset manager confirming as much: speaking on a call with clients, Larry Fink who runs the $7.5 trillion Blackrock, said that bankers told him they “expect a cascade of bankruptcies to hit the American economy.”

Source: ZeroHedge

Subscribe to Activist Post for truth, peace, and freedom news. Become an Activist Post Patron for as little as $1 per month at Patreon. Follow us on SoMee, HIVE, Flote, Minds, and Twitter.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.