Retail Investors Face Another Rout As Daytrader Darling Favorite Hertz Prepares To File

Tyler Durden

Fri, 05/22/2020 – 18:25

Here’s some bad news for all the Robinhood day traders indiscriminately buying Hertz Global Holdings as it crashed during coronavirus lockdowns — a CNBC report indicates the distressed rental car company is preparing to file for bankruptcy as soon as Friday night.

Minutes after the news hit the wires, Hertz’s stock extended its recent bloodbath…

The upcoming bankruptcy filing reportedly comes after the company failed to reach a deal with its top lenders. The company missed a lease payment last month, and the bankruptcy could be one of the most high-profile defaults during coronavirus lockdowns. Hertz has approximately $19 billion debt (about $4.3 billion of corporate bonds and loans, $14.4 of vehicle-backed debt).

In recent days, realizing the ends was inevitable, the company resorted to dumping a fleet of sports cars on the used-car market to build liquidity and avert bankruptcy, but according to this evening’s report, it seems after years of trying to restructure its business — the rental car company has likely met its fate thanks to a Chinese virus crushing the global travel and tourism industry.

It would not shock us if Hertz was forced to dump more of its fleet on the used car market during bankruptcy proceedings – thus crashing used car prices even further.

As for the Robinhood day traders using their stimulus checks to lever up in trades — well, a whole bunch of them piled into the stock ahead of the upcoming bankruptcy.

And another one bites the dust. As for those day traders trying to buy every dip — well, many of them are about to have a crappy Memorial Day weekend… (a 50% collapse after-hours)

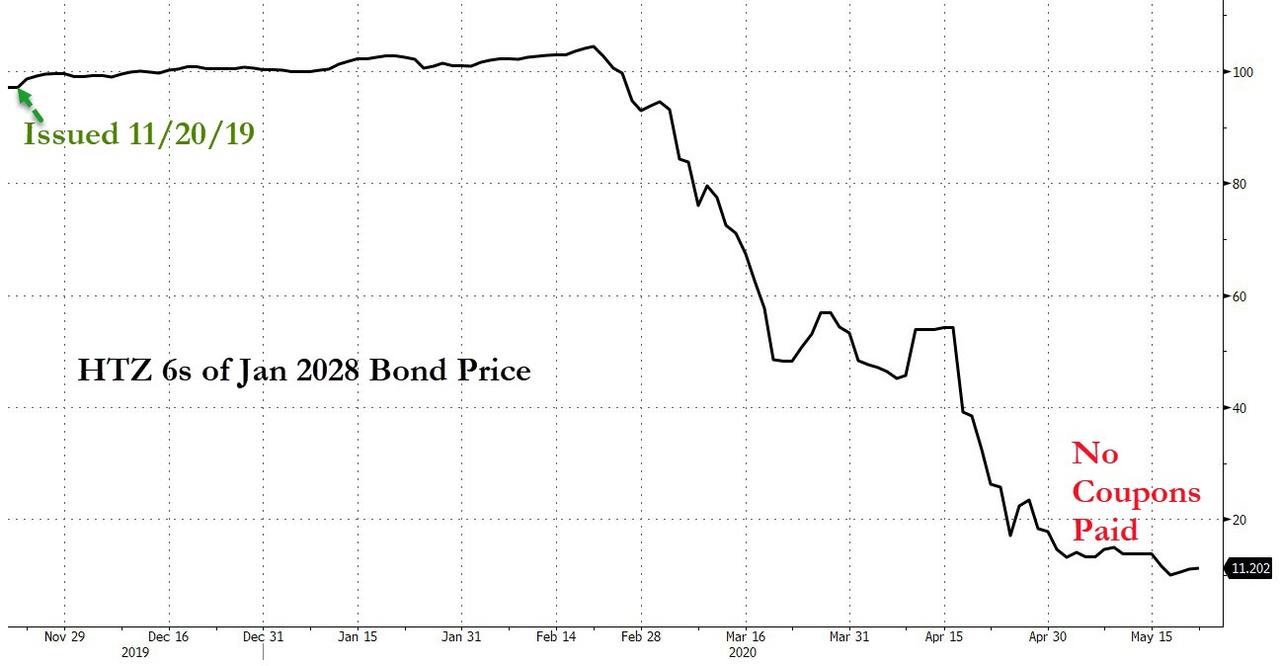

…and so are the bond-holders who bought $900 million of 6% notes issued last November…

…which are about to join Movie Gallery, MF Global, Just for Feet and Ameriserve in defaulting before paying investors a single coupon payment.