Stocks, Silver, Black Gold & Bond Yields Jump This Week As Dollar & Yuan Dump

Tyler Durden

Fri, 05/22/2020 – 16:02

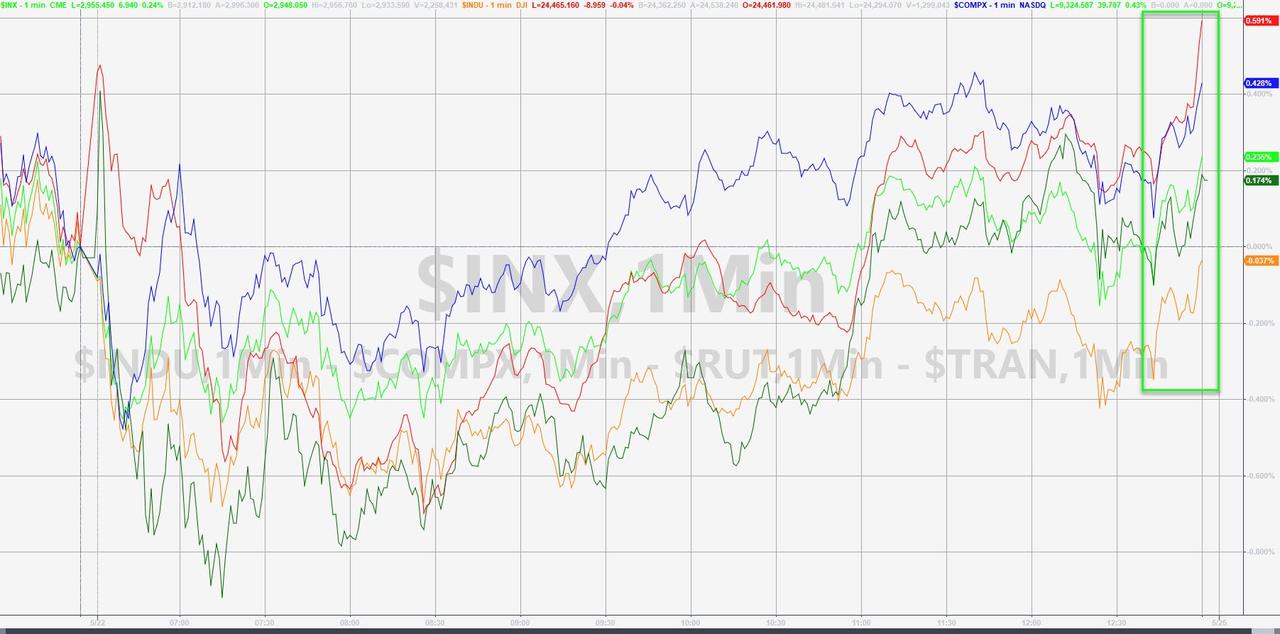

Millions more job losses, thousands more deaths, hundreds more earnings outlooks cut or dismissed, dozens of rancorous threats and promises exchanged between US and China… and still a handful of key US stocks sent the major indices soaring on the week led by Trannies and Small Caps…

A panic bid at the close to get the indices green for the day…

Almost as if it never happened…

Source: Bloomberg

Or put another way…

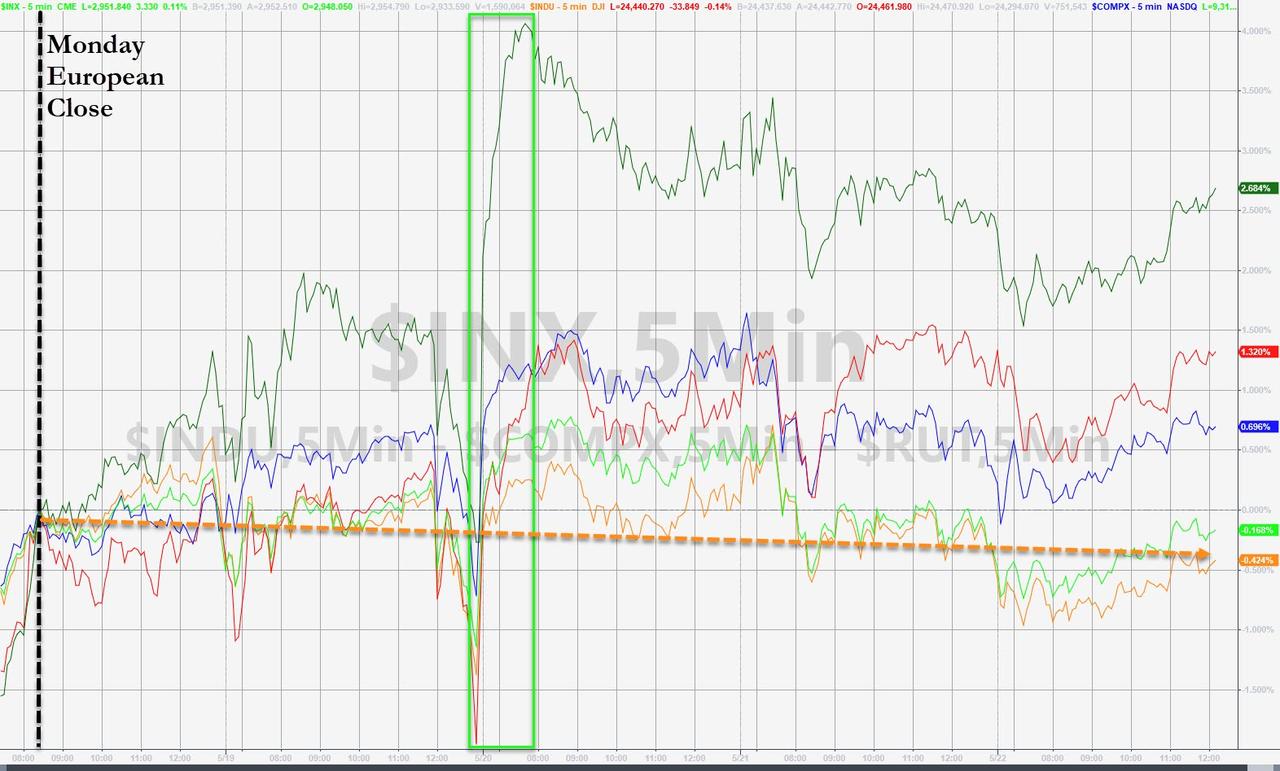

Notably, after the European close on Monday, The Dow and S&P went nowhere!

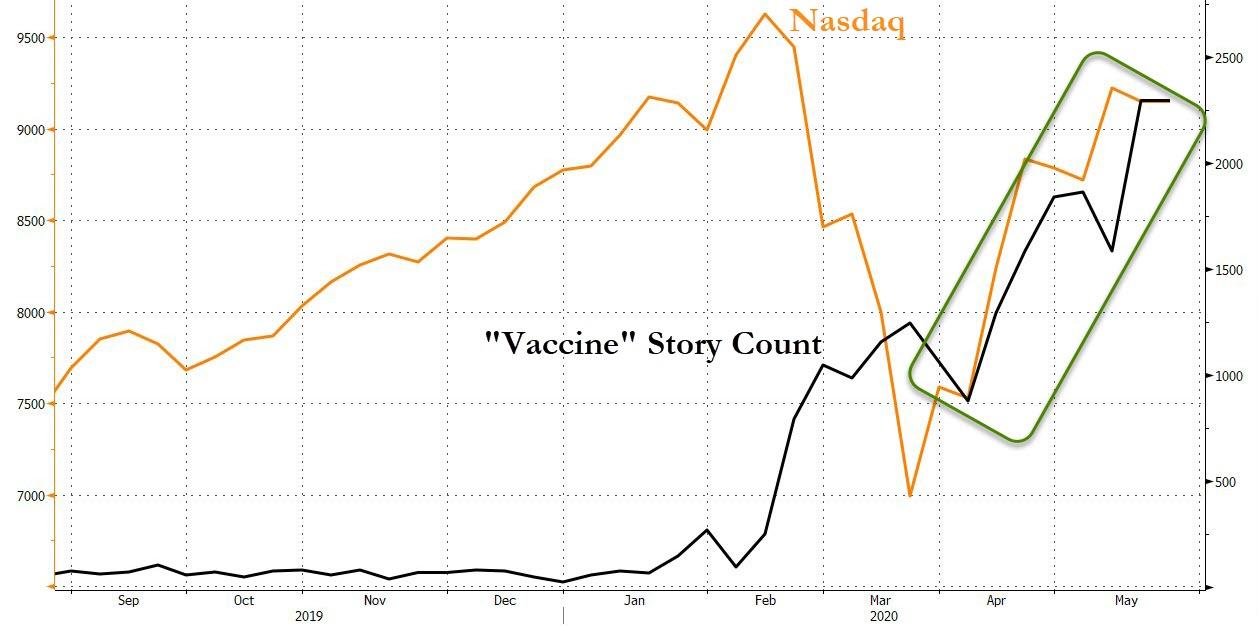

But hey “vaccines” and shit means it’s a good week!!

Source: Bloomberg

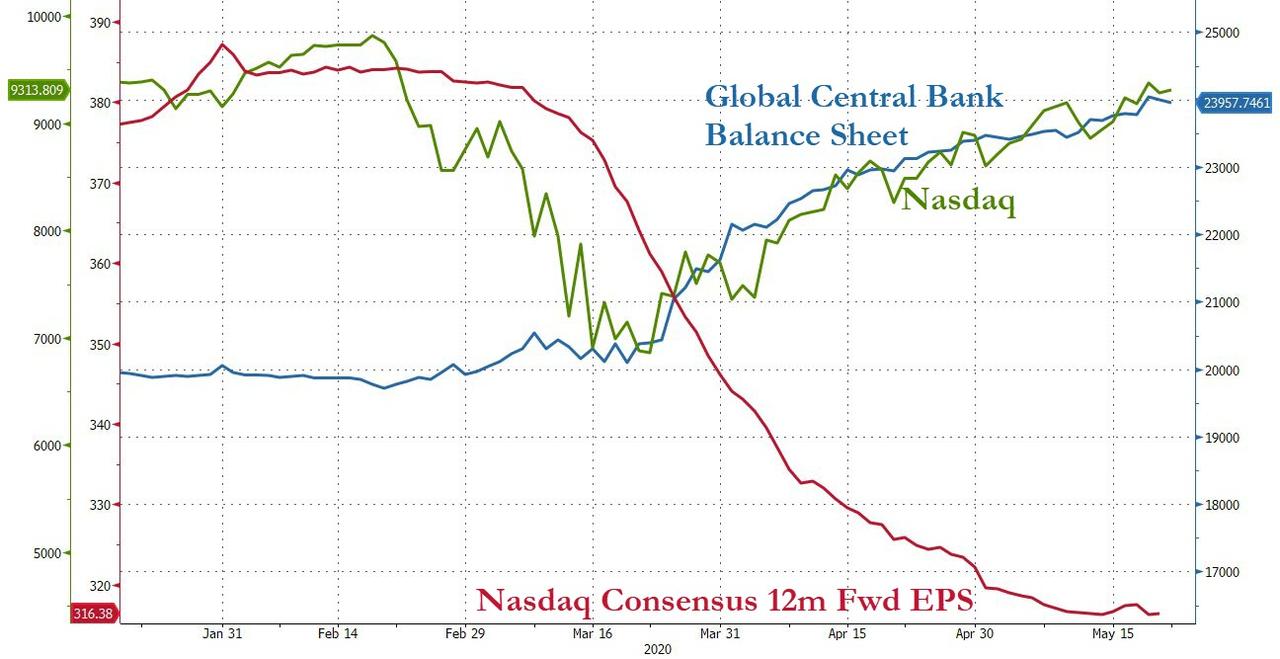

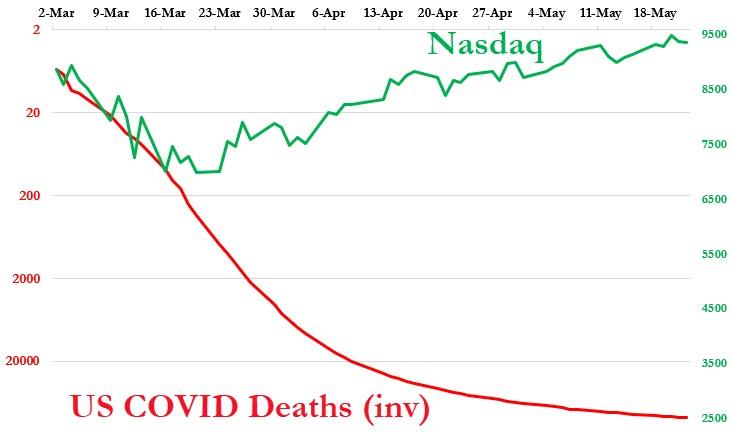

Or it could be something else?

Source: Bloomberg

Seriously though, it’s Mission Accomplished…

Source: Bloomberg

The big banks are higher on the week but notice that from the opening spike on Monday, they are all lower…

Source: Bloomberg

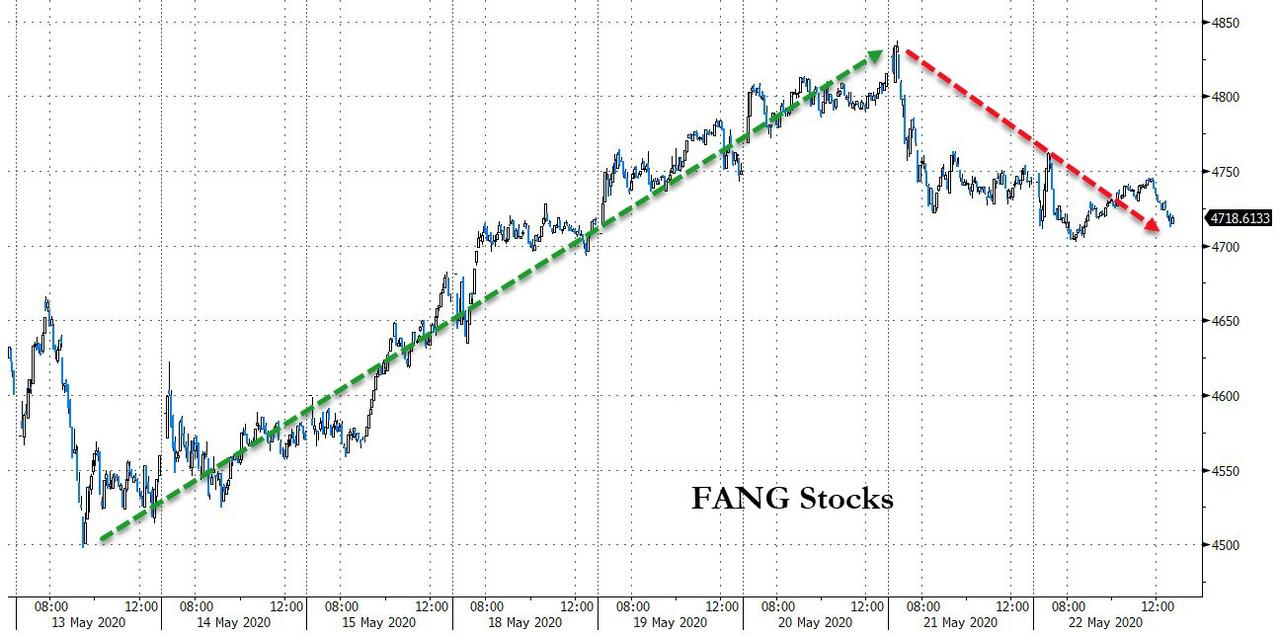

FANG Stocks were up on the week but sold off after The Fed…

Source: Bloomberg

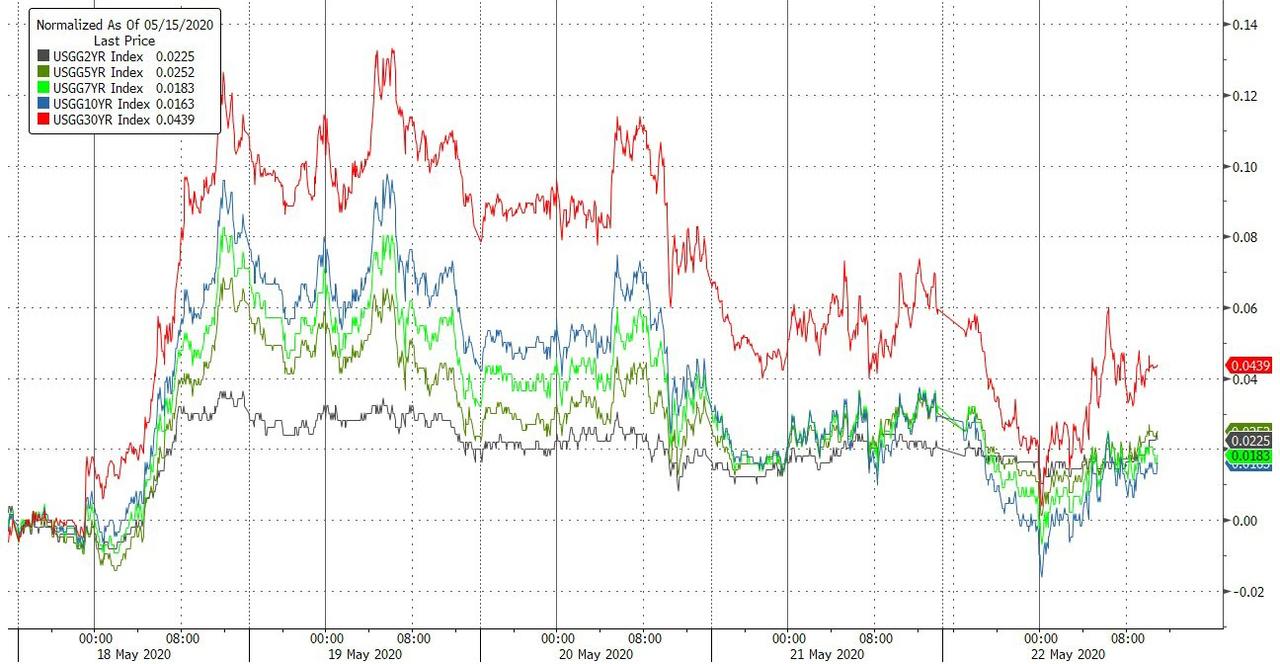

Treasury yields ended the week higher across the curve, but only modestly with the long-end up 4bps…

Source: Bloomberg

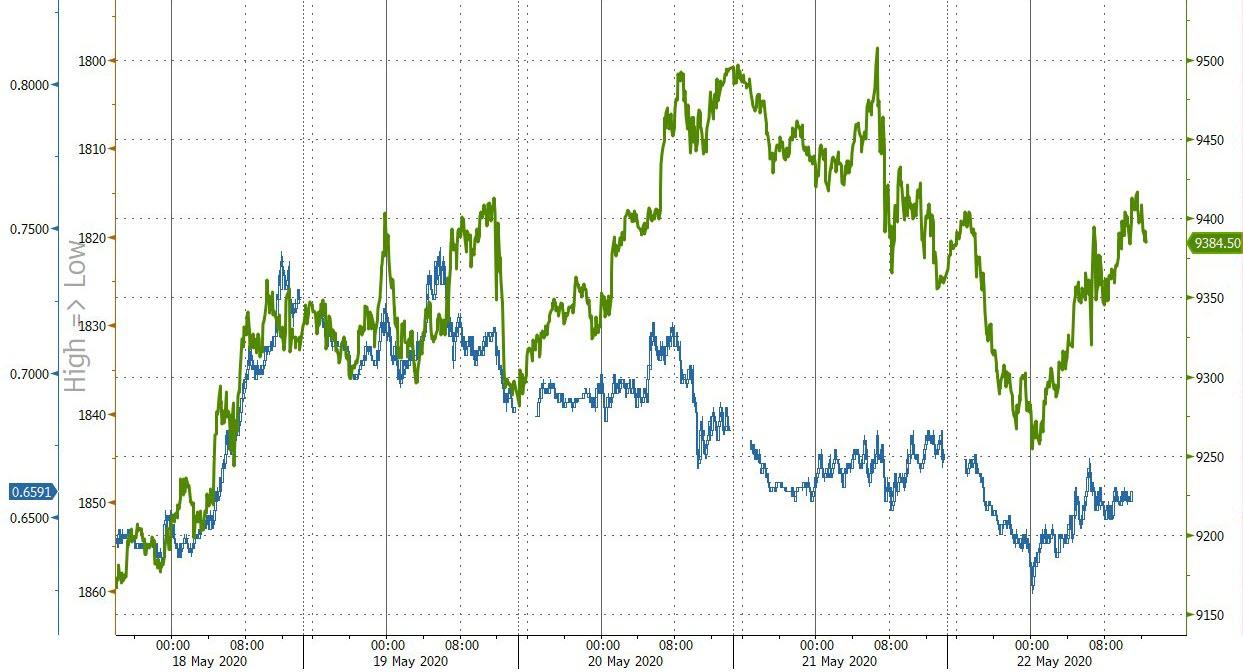

Bonds and stocks decoupled…

Source: Bloomberg

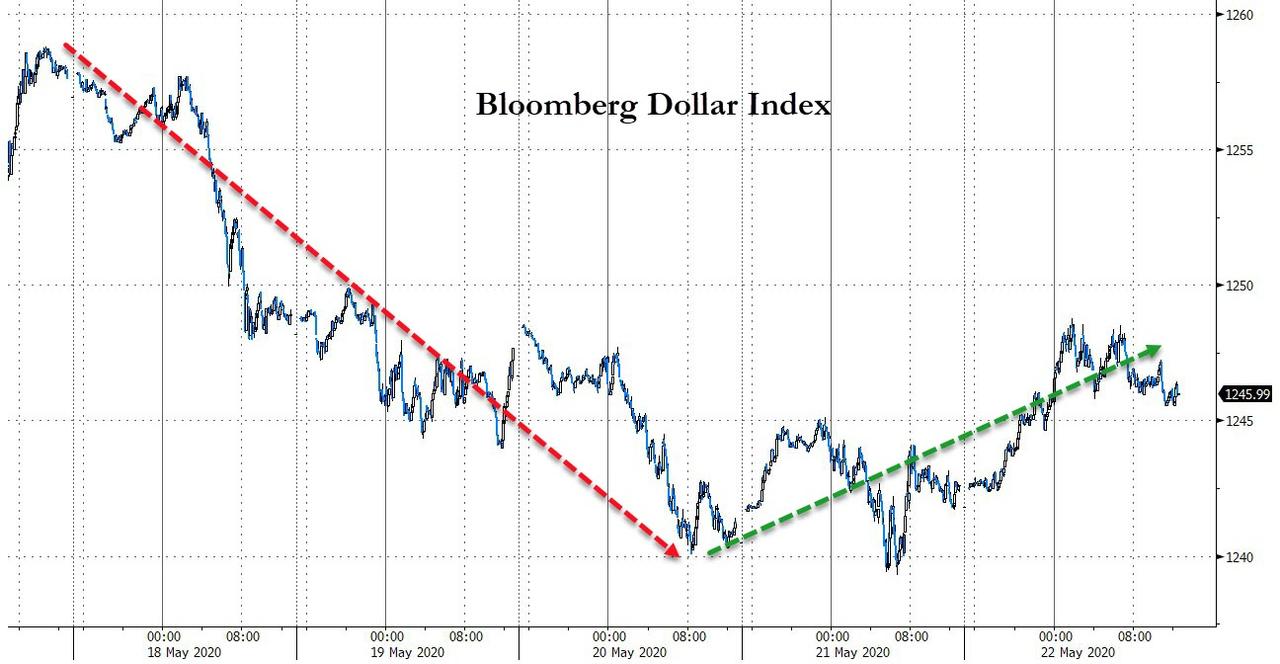

The Dollar slipped again this week (selling ahead of The Fed and rallying after)…

Source: Bloomberg

But on a longer-term context, the dollar is coiling…

Source: Bloomberg

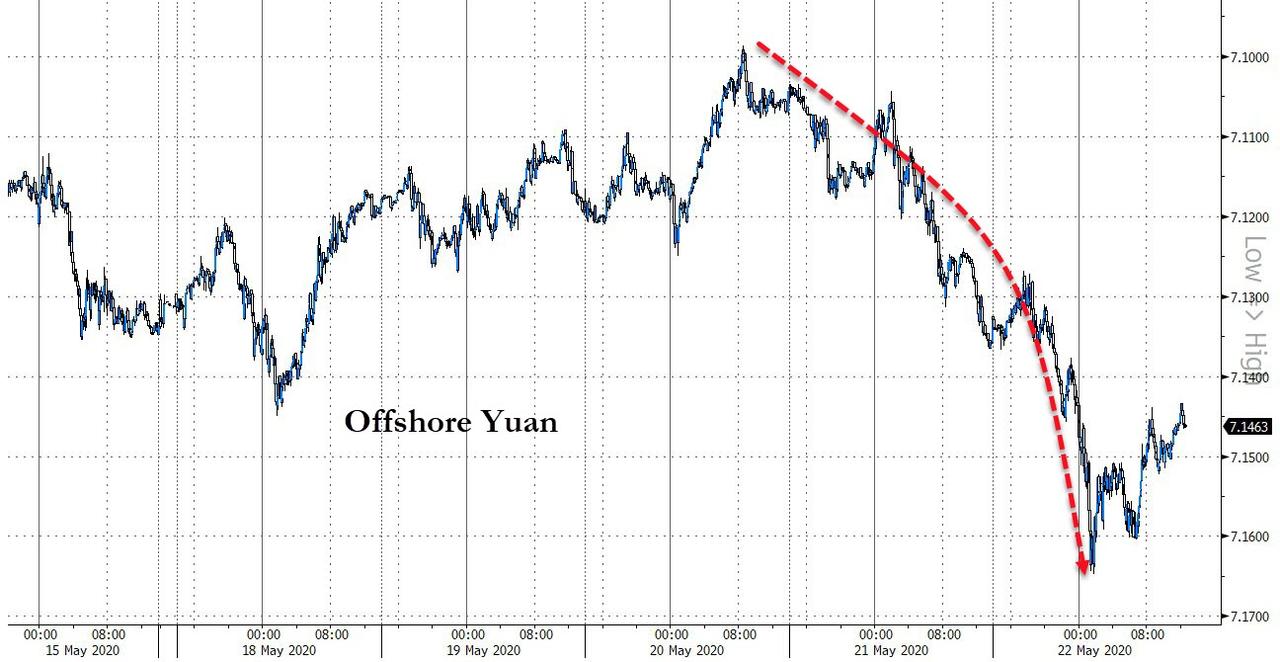

Offshore Yuan dumped this week as US-China tensions rose…

Source: Bloomberg

And Hong Kong Dollar Fwds puked amid Beijing’s new “security” law…

Source: Bloomberg

Bitcoin was flat on the week, erasing most of the post-halving gains, but Ethereum had a strong week…

Source: Bloomberg

The dollar continues rangebound against its fiat friends but is weaker and weaker against sound money…

Source: Bloomberg

Oil was the week’s big winner (again) but silver surged as gold slipped…

Source: Bloomberg

Gold/Silver just got too juicy after The Fed went all-in…

Source: Bloomberg

July WTI is back at around the $34 level and stalling again…

Finally, we appear to still be following the 1930s analog for now… which means we lift to around 26k on The Dow… Bear market rallies in 1929, 1938, 1974 saw an average 61% rebound from lows (after an average 49% drop)…which would take SPX to 3180…

Source: Bloomberg

As Johnny Depp said, COVID deaths tell no tales of economic collapse…