“They Saw This Day Coming” – Huawei Forges Alliances With Rival Chipmakers As Washington’s Crackdown Intensifies

Tyler Durden

Fri, 05/22/2020 – 18:05

The US Commerce Department’s latest move to block companies from selling products to Huawei that were created with American technology, equipment or software has undoubtedly hurt the Chinese telecoms giant. But it won’t be nearly enough to take it down.

Since Washington launched its campaign against Huawei two years ago (when the trade tensions between the US and China started to heat up, as President Trump started slapping more tariffs on foreign goods) the company has been strengthening ties with contract chipmakers in Taiwan and elsewhere, while ramping up its own microchip-technology arm, known as HiSilicon Technologies.

On Friday, Nikkei reported that Huawei had initiated conversations with other mobile chipmakers to try and figure out where it might source certain essential components for its handsets (remember, Huawei is the second-largest cellphone maker by sales volume) and other products.

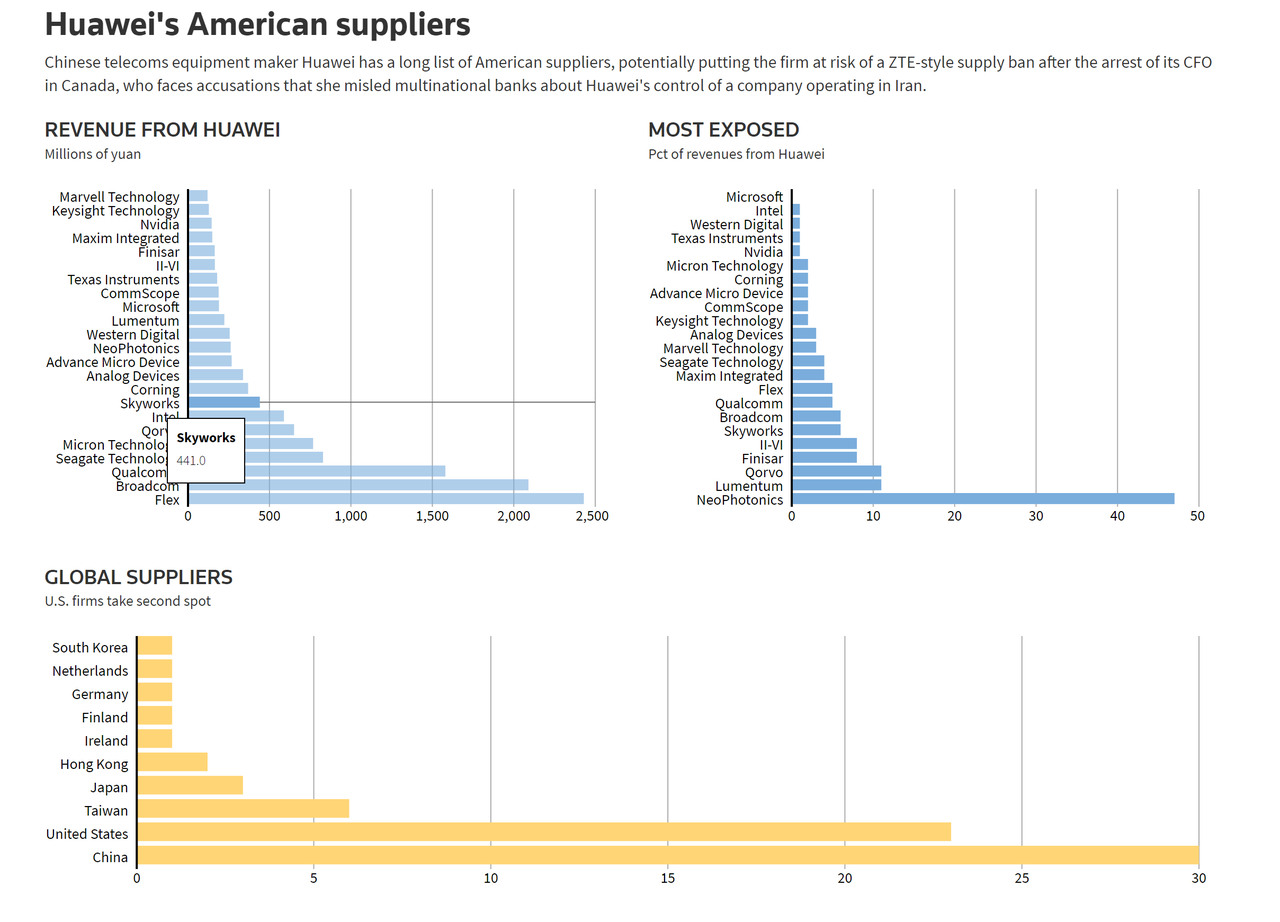

Of course, the crackdown cuts both ways, as several American companies relied heavily on Huawei’s business (they can still apply for licenses to continue selling to Huawei…so long as Commerce approves).

As we reported earlier this week, it’s not just American chipmakers that are distancing themselves from Huawei: some Taiwan-based chipmakers are also dropping the telecoms giant for fear of being targeted by Treasury sanctions, including TSMC, the world’s largest contract chipmaker.

Now, Huawei is reportedly in talks with MediaTek, the world’s second-largest contract chip producer.

Huawei Technologies is seeking help from rival mobile-chip makers to withstand a U.S. clampdown aimed at crippling the Chinese company, sources familiar with the matter told the Nikkei Asian Review.

Huawei is in talks with MediaTek, the world’s second-largest mobile chip developer after Qualcomm of the U.S., and UNISOC, China’s second-largest mobile chip designer after Huawei’s HiSilicon Technologies unit, to buy more chips as alternatives to keep its consumer electronics business afloat, the sources said.

To work with a contract chipmaker, Huawei would still need to design its own chips. Over the past two years, Huawei has expanded its team of engineers working on chip design to more than 10,000, Nikkei said.

To be sure, MediaTek already makes low- and medium-end chips for Huawei, evidence that the company, which was founded by a veteran of China’s PLA, and purportedly maintains strong links to the Chinese military, has been bracing for the other shoe to drop. MediaTek, meanwhile, is still trying to figure out if it can meet Huawei’s latest bid.

“Huawei has foreseen this day coming. It started to allocate more mid- to low-end mobile chip projects to MediaTek last year amid its de-Americanization efforts,” one of the sources said. “Huawei has also become one of the key clients for the Taiwanese mobile chip developer’s mid-end 5G mobile chip for this year.”

MediaTek is evaluating whether it has sufficient human resources to fully support Huawei’s aggressive bid, as the Chinese company is asking for volume 300% above its usual procurement in the past few years, another source familiar with the talks said.

The situation has also created an opportunity for small Chinese chipmakers (working, we imagine, mostly with technology stolen from American and Taiwanese companies) to expand.

Huawei also seeks to deepen its collaboration with UNISOC, a Beijing-backed mobile chip developer that relies mostly on smaller device makers as customers and mainly supports entry-level products and devices for emerging markets. Previously, Huawei used only very few UNISOC chips for its low-end smartphone and tablet offerings, sources said.

“The new procurement deals would be a great boost to help UNISOC further upgrade its chip design capability,” said a chip industry executive. “In the past, UNISOC was struggling quite a bit, because it could not really secure big contracts with global leading smartphone makers as these top smartphone makers could find better offerings elsewhere. This time could be an opportunity that it could really seek to match the international standard.”

UNISOC last year accelerated its 5G chip development to catch up with Qualcomm and MediaTek, Nikkei has reported. More recently, the company received 4.5 billion yuan ($630 million) from China’s national integrated circuit fund, the so-called Big Fund.

UNISOC is preparing to list on the Shanghai STAR tech board, the Chinese version of Nasdaq, later this year. Qualcomm has needed a license from the U.S. Department of Commerce to supply Huawei since mid-May of 2019.

Huawei has already expanded production of in-house mobile processors for its smartphone business to 75%, up from 69% in 2018 and 45% in 2016, according to to data from GF Securities cited by Nikkei. Huawei shipped 240 million smartphones in 2019. And with China now throwing caution to the wind and cracking down on Hong Kong, we wouldn’t be surprised to see more Huawei drama in the headlines next week, with serious market repercussions for the US semiconductor industry.