“The Comments Are Highly Important”: China’s Xi Reportedly Indicated Desire To Avoid Strong Stimulus

Tyler Durden

Sun, 05/24/2020 – 20:15

One of the more remarkable aspects of the global policy response to the coronavirus crisis has come out not out o the G10, where virtually every nation has unleashed an unprecedented stimulus, both fiscal and monetary, but rather out of China – the country which following the global financial crisis launched an unprecedented debt-fueled reflation and stimulus, yet which this time has done very little if anything at all, as the following chart comparing the fiscal response across countries demonstrates.

This should hardly come as a shock: after all, according to the IIF, China’s total debt/GDP as of March 31, 2020 is now a record 317%, the highest in history, and up 17% in just the past quarter and nearly double what it was in 2008, suggesting the country is basically out of room to layer on even more debt leaving far less space for a major new fiscal stimulus push.

Overnight, Goldman confirmed as much, writing that President Xi participated at group discussions at the Two Sessions on Friday, with some of his comments reported on Saturday. Notably he said if it were not because of the pandemic, the growth target would be set at around 6%. He added that a global recession is guaranteed, and given this, if a numerical target (implicitly at a relatively high level) was set, it would require a strong stimulus and the focus of the government would be on the growth rate. He said the focus should instead be on the “six stabilities” and “six guarantees” in six areas — the pursuit of these goals will indirectly contribute to GDP growth but the latter should not be the focus of the government, according to the report.

“The comments are highly important”, according to Goldman because they both explain some past policy decisions and will have significant future policy implications. While this is the first report publicly quoting President Xi on the issue of the GDP growth target, it is probably not the first time he has made this kind of comment, Goldman’s Yu Song goes on to note. If he indeed made similar comments non-publicly, possibly to small groups of senior officials, it would have affected the behavior of government officials and could explain the relative lack of aggressive stimulus measures relative to China’s past stimulus and relative to that of many other economies (as shown in the top chart). One example might be the relatively small MLF and LPR adjustments compared to market expectations. Such decisions had been subject to extensive discussions and debates and had to be signed off by President Xi because they were presented to the National People’s Congress.

President Xi’s comments will likely have implications for the behavior of officials. The doves at both central and local levels who have been advocating a growth target for fear of disappointing market expectations may well find it harder to argue their cases. While it is true that the “six stabilities” and “six guarantees” goals will contribute to GDP growth, they are much less specific. Some methods of achieving those goals may not contribute much to overall economic growth as measured by GDP. For example, to ensure employment stability, companies may find themselves under more pressures not to lay off workers. This often leads to cuts in pay for a broader group of employees. While having the burden more widely shared is arguably socially more desirable, its contribution to economic growth is likely to be limited and also often not sustainable.

Non-governmental economic agents such as companies and individuals may become more cautious with their plans as well.

Lastly there probably will be less pressure on data reporting (read fudging economic numbers for which China is notorious). While on the surface this is a good thing, as it tends to reduce distortions, it also boosts the likelihood of a lower level of reported GDP growth.

Earlier on Friday NDRC Director He Lifeng stated the performance of high frequency indicators since the beginning of May has been encouraging. If GDP growth in 2020 is 3%, then the level of income will be 1.95 times that in 2010. (The longer-term policy goal of doubling income over the decade is not precisely defined, but implicitly Goldman thinks a 1.95 level should be good enough to be rounded up to 2.)

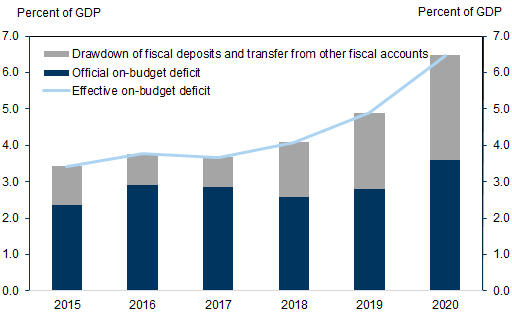

Separately, Minister of Finance Liu Kun revealed the government will transfer around 1 trillion RMB from the SOE fund to central government fiscal spending. If so, this means the actual fiscal loosening is meaningfully larger than the apparent fiscal deficit target of 3.6%. In fact, according to Goldman calculations, the effective deficit which is a more relevant indicator to measure the on-budget fiscal stance by taking financing through drawdown of fiscal deposits and transfers from other fiscal accounts into account, will increase even more, by 1.6pp to around 6.5% this year, according to the budget report released on the MOF website over the weekend.

That said, as Goldman also notes, the 1tr RMB of central government special bond quota (primarily 10-year tenor) is significantly lower than the bank’s pre-NPC expectation of Rmb 2tr. And here an interesting observation from the bank: “Recently there have been debates on whether PBOC should monetize the issuance (i.e., PBOC buys directly), and as suggested by the budget report, the issuance of these bonds would be market based. This will put pressure on interbank market liquidity, so PBOC needs to provide liquidity support (e.g., through RRR cut; 50bp of RRR cut could release liquidity of around Rmb 800bn).” In short: even with a rather limited fiscal stimulus, is the PBOC setting the stage for its own QE?

In any case, going back to Goldman, the bank estimates that the augmented fiscal deficit would increase by around 5.5% this year, slightly higher than the bank’s previous forecast of 5.3%, pointing to a slightly stronger fiscal stimulus, but still notably smaller than that in GFC.

In other words, whereas it was China that managed to pull the world out of the depression triggered by the global financial crisis with an unprecedented surge in debt creation (something we discussed back in 2013), this time around – whether due to political reasons, or purely based on balance sheet limitations – it will be up to every developed and emerging nation to restore its historical growth rate. While that explains the speed, and lack of discussions, with which helicopter money was adopted by the entire world, it begs the question: can the global economy rebound without China’s help this time?