Fed’s Beige Book Is Blue With Alarm At Economic Devastation Across The US

Tyler Durden

Wed, 05/27/2020 – 14:34

While one didn’t need the Fed’s Beige Book to know that the US economy is currently in a horrific state as a result of the coronavirus lockdowns, the just published summary of anecdotes from across various Fed regions confirmed the obvious.

After years of “modest” and “moderate” growth across the US, in the latest Fed Beige Book released this afternoon, the assessment of the economy downgraded sharply with the Fed reporting that “economic activity declined in all Districts – falling sharply in most – reflecting disruptions associated with the COVID-19 pandemic.” with the hardest-hit industries—because of social distancing measures and mandated closures— were retail, travel, and hospitality.

The report which had a May 2018 cutoff date, found that:

- Consumer spending fell further as mandated closures of retail establishments remained largely in place during most of the survey period. Declines were especially severe in the leisure and hospitality sector, with very little activity at travel and tourism businesses.

- Auto sales were substantially lower than a year ago, although several Districts noted recent improvement.

- A majority of Districts reported sharp drops in manufacturing activity, and production was notably weak in auto, aerospace, and energy-related plants.

- Residential home sales plunged due in part to fewer new listings and to restrictions on home showings in many areas.

- Construction activity also fell as new projects failed to materialize in many Districts. Commercial real estate contacts mentioned that a large number of retail tenants had deferred or missed rent payments.

- Bankers reported strong demand for PPP loans.

- Agricultural conditions worsened, with several Districts reporting reduced production capacity at meat-processing plants due to closures and social distancing measures.

- Energy activity plummeted as firms announced oil well closures, which led to historically low levels of active drilling rigs.

- A contact in the Pacific Northwest also warned of reduced local government revenue collection and its implication for potential cuts in fiscal spending and public services. In the entertainment sector, demand for broadcasting and voice-over services increased.

And although many contacts expressed hope that overall activity would pick-up as businesses reopened, the outlook remained highly uncertain and most contacts were pessimistic about the potential pace of recovery.

With nearly 40 million unemployed, the Beige Book also noted that “employment continued to decrease in all Districts, including steep losses in most Districts, as social distancing and business closures affected employment at many firms. Securing PPP loans helped many businesses to limit or avoid layoffs, although employment continued to fall sharply in retail and in leisure and hospitality sectors.”

- Contacts cited challenges in bringing employees back to work, including workers’ health concerns, limited access to childcare, and generous unemployment insurance benefits.

- Overall wage pressures were mixed as some firms cut wages while others implemented temporary wage increases for essential staff or to compete with unemployment insurance.

- Most Districts noted wage increases in high-demand and essential sectors, while wages were flat or declining in other sectors.

- A payment processing firm reported that job applications for current openings soared, though many candidates did not have the stated requirements.

While there was no outright deflation, the report cited pricing pressures which “were steady to down modestly on balance.”

- Weak demand weighed on selling prices, with some contacts noting discounting for apparel, hotel rooms, and airfare.

- Several Districts also reported low commodity prices, including oil, steel, and several agricultural commodities.

- Supply chain disruptions and strong demand led to higher prices for some grocery items including meat and fresh fruit.

- One District reported that firms faced additional costs related to safety protocols and social distancing compliance, while another District noted that the costs of personal protective equipment had risen due to strong demand.

Firms also reported finding ways to cope with the challenges brought on by COVID-19, with new business strategies or new sales people in some cases. All contacts who were eligible for the Payroll Protection Program received funding, which they regarded as vital support; businesses were also lining up other credit lines and resources in the face of uncertainty. The majority of contacts reported no major structural or compensation changes within their organizations due to COVID-19. Overall, there was some hope with contacts expressing optimism, “excited” (as one put it) to facilitate hiring during the upcoming recovery.

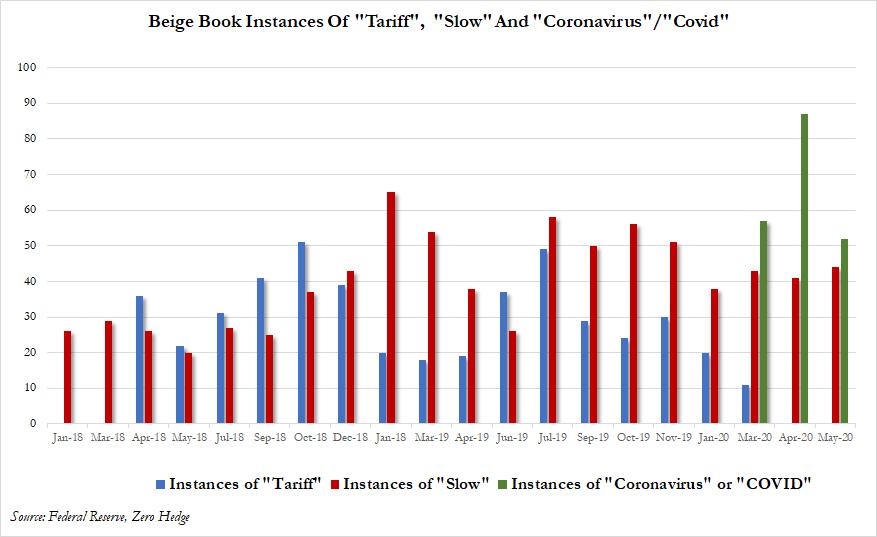

Amusingly, the biggest bogeyman of the Beige Book for much of 2019 – tariffs – was gone and forgotten, without a single mention of the term in the entire report for the second month in a row. That however, was been replaced by mentions of “coronavirus” and/or “Covid” which however saw a notable decline from 87 instance in April to just 52 instances in May when the terms made their first ever appearance. Finally, slowness prevailed, literally, with no less than 44 mentions of the “slow” in the Beige Book.