Here’s How ‘Rare’ Trend Of Pay Cuts For Employed Nationwide Spells Doom For Rapid Recovery

Tyler Durden

Thu, 05/28/2020 – 19:45

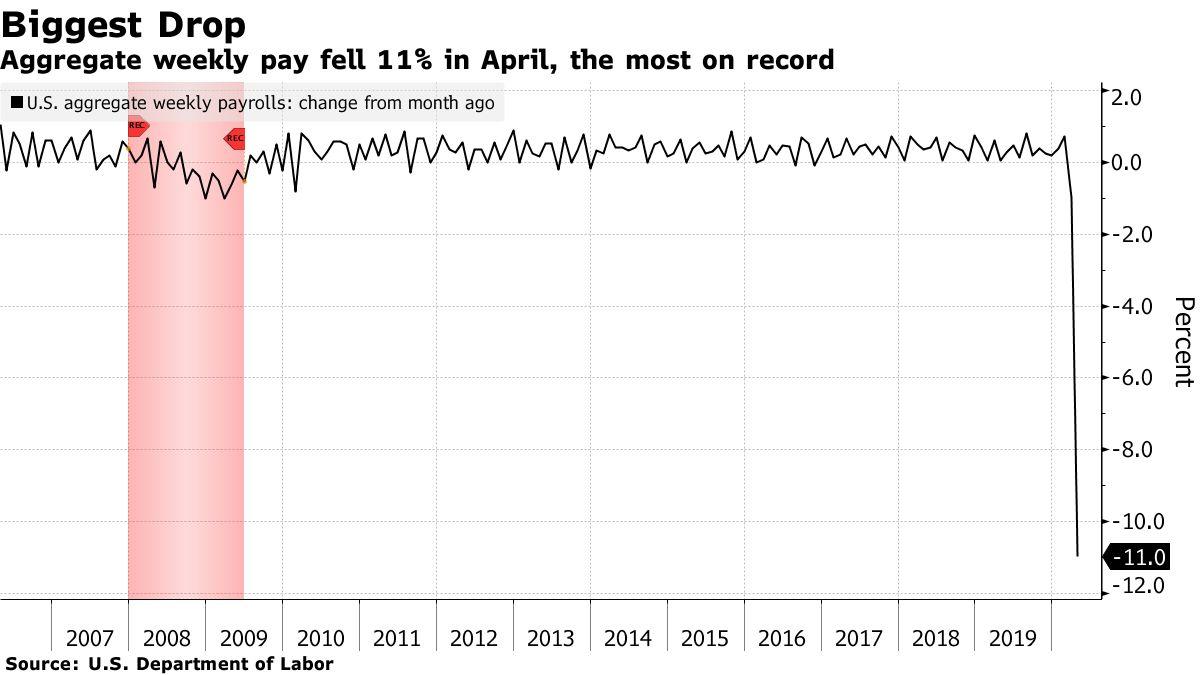

Bloomberg has issued the latest deeply pessimistic report suggesting ‘return to normal’ will be a long way off amid mounting evidence of widespread pay cuts for those Americans managing to hold on to their jobs amid Great Depression level unemployment.

Flying in the face of “sticky wages” theory — Keynes’ observation that employee pay doesn’t adjust quickly to either company performance or external economic crises — the growing body of anecdotal evidence points to widespread temporary salary reductions.

Observes Bloomberg:

Outside of “high-demand sectors such as grocery stores,” there are signs of “general wage softening and salary cuts” all over the economy, according to a Fed business survey in April. A study by Thomvest Ventures, which looked at 22 public and private technology companies, found that non-executive employees had seen pay reduced by an average of 10% to 15%.

“The hard numbers won’t be in for months, but anecdotal evidence is piling up. On earnings calls, big businesses including The Container Store Group and Lyft have cited what they say are temporary salary reductions,” the report continues.

“Federal Reserve officials also have found plenty of supporting evidence.”

The obvious concern in terms of broader recovery and its speed amid impending state re-openings is that even among those comfortably still in the workforce, more of their income will go toward fixed obligations like mortgages, car payments, or other debts — leaving them much more conservative in terms of the type of ‘outside’ retail, dining, or entertainment type spending that typically drives economic recovery.

Chief US economist at Barclays Plc in New York, Michael Gapen, told Bloomberg: “It’s one of the reasons why we don’t expect a so-called V-shaped recovery.”

Gaben underscored that employees undergoing pay cuts “might have little, and in some cases maybe nothing, left over after that for discretionary purchases.”

Even as employers let tens of millions of workers go, some companies are choosing a different path, instituting across-the-board salary reductions, especially at senior levels, avoiding layoffs. https://t.co/B51MI2GtmH

— The Seattle Times (@seattletimes) May 27, 2020

Another insight that helps explain why the traditional sticky wages trend is not holding up amid the corona-crisis is as follows:

The circumstances of a public-health crisis probably make pay cuts more palatable to workers than they’d normally be, according to Bruce Fallick, an economist at the Federal Reserve Bank of Cleveland -– at least initially.

“If the state of Ohio tells you you have to shut down, or you can only have customers if they’re spaced by this amount, and they can only come in at this rate, and all that sort of thing, it’s pretty obvious to everybody what’s going on,” he said.

The report concludes further, “And there’s no guarantee salaries will return quickly to pre-crisis levels.”

Combine this also with the potential for Americans exhibiting a slow or hesitantly reluctant return to activities like eating out, going to retail shops, or attending large entertainment venue events like concerts or movie theaters even when these things do reopen to normal capacity.