Powell Says Fed “Crossed A Lot Of Red Lines”, Dismisses Negative Rates (Again) And Market Ignores Him (Again)

Tyler Durden

Fri, 05/29/2020 – 11:51

Update (1145ET): Powell began the interview by defending The Fed’s unprecedented intervention:

“This is an emergency of a nature that we haven’t really seen before” where a 50-year low in unemployment turns to a 80-90 year high “in the space of 60 days.”

Powell says the evidence that negative rates help is pretty ambiguous.

“The evidence is mixed,” and added that “We don’t think that is an appropriate tool here in the United States.”

The evidence on whether it helps is pretty ambiguous as it interferes with credit intermediation, Powell points out.

“We have institutional arrangements here that wouldn’t work with negative rates,” he says, citing the multi-trillion dollar money funds industry in the U.S.

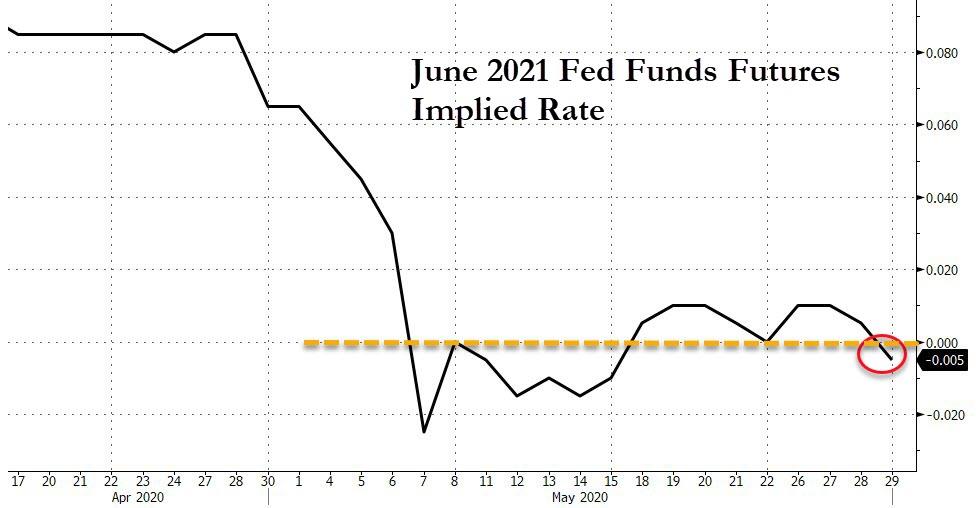

However, the market seems to believe The Fed will be forced to go there by June 2021…

Additionally, after adding over $3 trillion in the space of a few weeks, Powell reassured Blinder that the expansion of the balance sheet has limits…

“The Fed balance sheet cannot go to infinity”

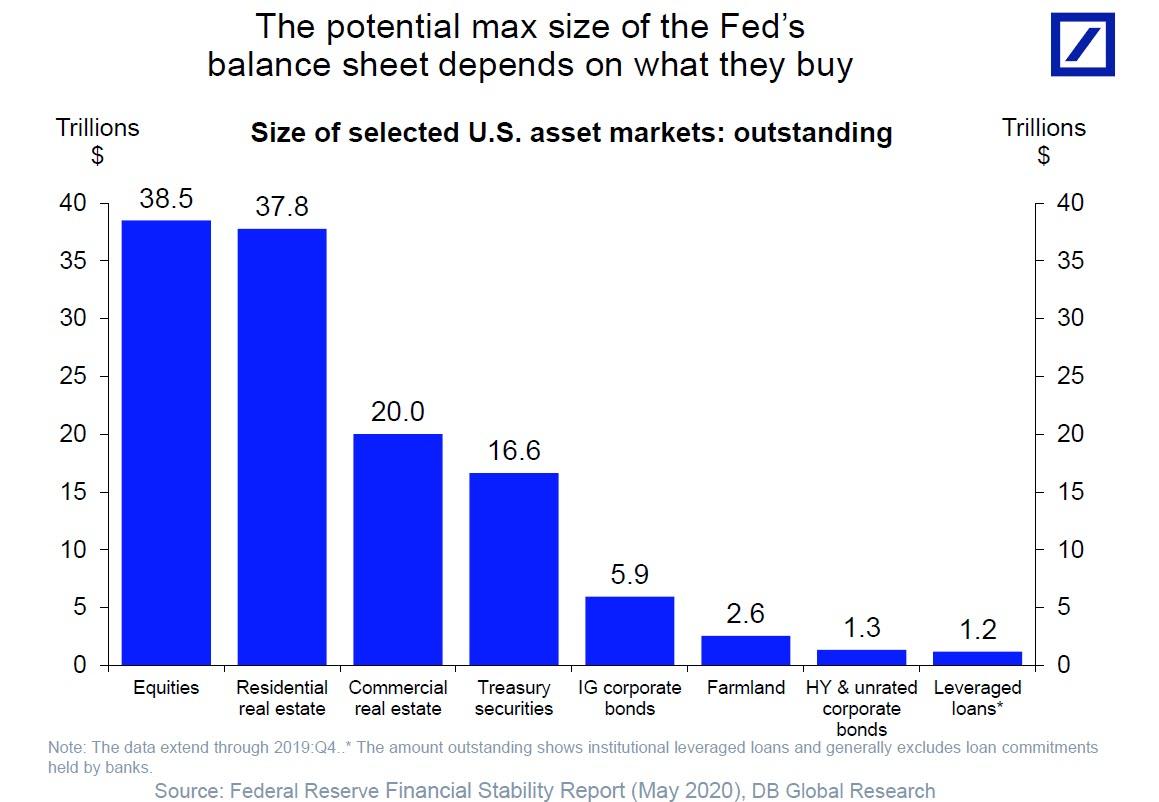

Powell’s comment was in response to a question from Alan Blinder if there is “any limit to how big you can make the balance sheet?” It also comes shortly after Deutsche Bank not so jokingly showed that the maximum size of the Fed’s balance sheet “depends on what they buy”, and hinted that should the Fed buy everything, the balance sheet could hit $130 trillion.

While there were (predictably) no questions on the Fed buying bond ETFs that hold bankrupt Hertz bonds, Powell admitted that….

“We have crossed a lot of red lines with recent actions”

… and while he didn’t mention it, the Fed will soon cross even more red lines, as well as lines of every other color. And speaking of an even bigger Fed balance sheet, Powell then had some “good news” for Main Street:

“We’re days away” from making the first lending under Main Street.

“It’s all about creating a context, a climate in which employees will have the best chance to either keep their job or go back to their old job or to find a new job.”

We can’t wait to see what happens with that.

* * *

With markets heading lower on Friday as the White House declares war on social media, riots in Minnesota spread across the country and Trump ratchets up tensions with China, Fed Chairman Jerome Powell is set to speak Friday at the Griswold Center for Economic Policy Studies at Princeton, where he will be joined by former Fed vice-chairman Alan Blinder.

The focus of the talk will likely be on the economy and the central bank’s stimulus measures during the coronavirus crisis.

The event will take place virtually, and is set to begin at 1100ET and a Q&A will be moderated by Blinder, now a member of Princeton’s faculty.

Earlier this month, Powell said policymakers may need to use’ additional tools’ to pull the country out of a devastating economic downturn, but Fed officials have also expressed wariness of negative rates, and the ability of the central bank to mitigate the impact of the crisis on ordinary Americans.

Watch it live below: