Stocks Panic-Bid After Trump-China “Nuclear Option” Headlines

Tyler Durden

Fri, 05/29/2020 – 13:00

So, headlines hint at Trump unleashing the “nuclear option” of sanctions of China’s finance sector and the US equity market (after a brief dip) goes vertical…

- TRUMP WEIGHS SANCTIONS ON CHINA FINANCE SECTOR OVER HONG KONG

- TRUMP MAY ALSO IMPOSE RESTRICTIONS ON GRADUATE STUDENT VISAS

An initial 50 point drop in The Dow was met by a wall of buying lifting it almost 300 points off the lows…

What may be behind the spike? Why the market’s natural tendency to find a silver lining in any mushroom cloud, and in this case traders are focusing on this language from Bloomberg: “The financial sanctions the White House is expected to announce Friday will be targeted in order to leave the US room for escalation if necessary, according to a fourth person familiar with the matter. Trump officials crafting the sanctions are wary of the impact on global financial markets and retaliation from Beijing, the person said.”

This was interpreted by several trading desks as suggesting that Trump is aiming to maximize his political advantage on China while minimizing the adverse economic impact on the US, and falls somewhat indirectly in the “optimist camp” laid out below.

On the other hand, the last thing Trump needs is to be seen as coming off easy on Beijing, something Biden will immediately try to capitalize on.

* * *

As a reminder, here is our preview published earlier looking at what Trump may, or may not, say:

With the market transfixed on today’s geopolitical flashbpoint, when Trump will address the recent collapse in relations with China, which are rumored to take place around 2pm (although the White House still hasn’t said what time the news conference will be), traders are scrambling for some clues on what to expect from Trump, who may or may not live-tweet his duly fact-checked speech.

Earlier today, Rabobank’s Michael Every provided a handy cheat sheet analyzing an optimistic and a pessimistic framework in which to analyze the president’s upcoming remarks:

- The optimist camp: Trump won’t want to rock markets. Trump won’t want to rattle big business. Trump needs Hong Kong. Trump needs the Chinese market. Trump is all talk and no action. Trump wants his phase one trade deal. Trump doesn’t need hassle before the election. Trump can’t win if he takes on China. Trump needs Chinese capital inflows.

- The pessimist/realist camp: Trump needs a new narrative vs. China domestically, where he is being called soft on Beijing. Trump’s phase one trade deal is finished (China is buying Brazilian soy) and phase two was never going to happen. Trump needs to send a clear message to Beijing over the red lines it has crossed. Trump won’t look good if he has the whole world watching him and produces a small water pistol and not a bazooka. Trump has finally got allies like the UK and Australia moving in his direction on China (the UK is talking about extending visa rights for hundreds of thousands of Hong Kongers), with even the EU seemingly moving against China, so he can’t afford to go soft for fear that they will falter. Trump’s ideological weather vanes like Steve Bannon are calling for aggressive actions vs. China as a si vis pacem, para bellum. Trump doesn’t really care what US businesses think about China because he wants them to focus on the US market. Trump can bail out US farmers now that federal money seems to be no object. Trump has the Fed behind him to prop up markets anyway.

According to Every, there is a “healthy risk (>50%?) that today will see significant US action vs. China in the form of sanctions beyond merely not allowing key members of the Hong Kong government to vacation in Hawaii or California from now on. If this is not the case, why hold a press conference: wouldn’t it be easier to slip a token measure out with a simple press release?”

On the other hand, the most optimistic outcome is Trump signing the recently-passed Uyghur Human Rights Policy Act imposing sanctions on some Chinese officials and entities, but then does not act on Hong Kong. The more realist case is Trump signs that Uyghur Act and revokes Hong Kong’s favoured status, and imposes separate sanctions on China over that issue. The most pessimistic case is if Trump also mentions the China-India border clash and takes India’s side and/or if he brings up the Chinese red line of Taiwan.

Leaning more toward the “pessimist camp”, AGF Investment’s chief US policy strategist, Greg Valliere, writes that President Trump may focus on the “explosive issue of financial restrictions”, especially after earlier on Friday, Trump’s top economic aide Larry Kudlow said the U.S. is “furious” with what China has done “in recent days, weeks and months.”

“De-listing Chinese companies on U.S. stock exchanges or ending U.S. Thrift Savings Plan investments in Chinese stocks are suddenly seen as insufficient,” Valliere said, while threats of U.S. penalties on foreign banks that deal with Hong Kong and the U.S. denying Federal Reserve credit lines to Chinese banks have been leaked from Washington.

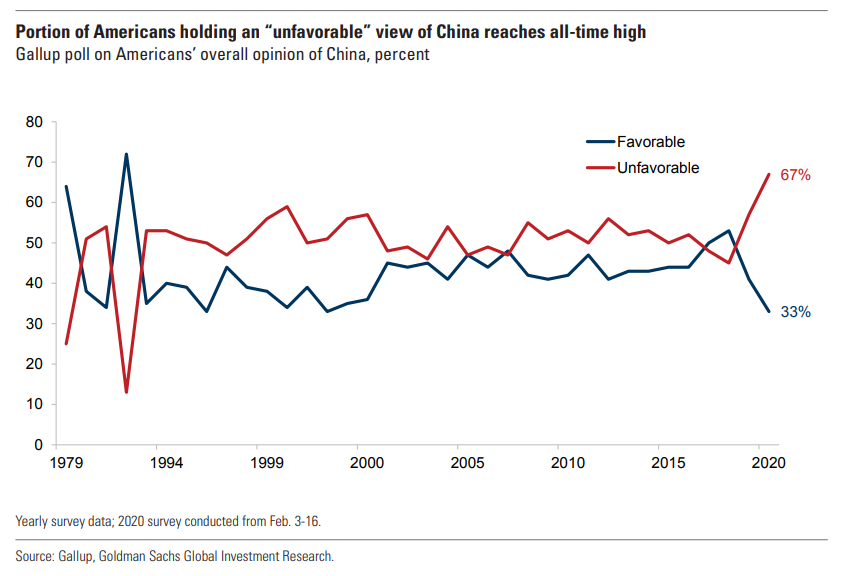

That’s triggered some warnings in China of a “financial war” that could speed up Beijing’s development of its own digital currency and, potentially, lead to sales of U.S. Treasuries, Valliere said, adding that the November election is complicating the crisis, as polls show Americans strongly disapprove of “Beijing’s role in the pandemic, its crackdown on Hong Kong, and the pervasive hacking of U.S. companies.” Indeed, as we reported last week, China is the one thing that more than two-thirds of Americans can agree on, and they agree that they simply do not like China…

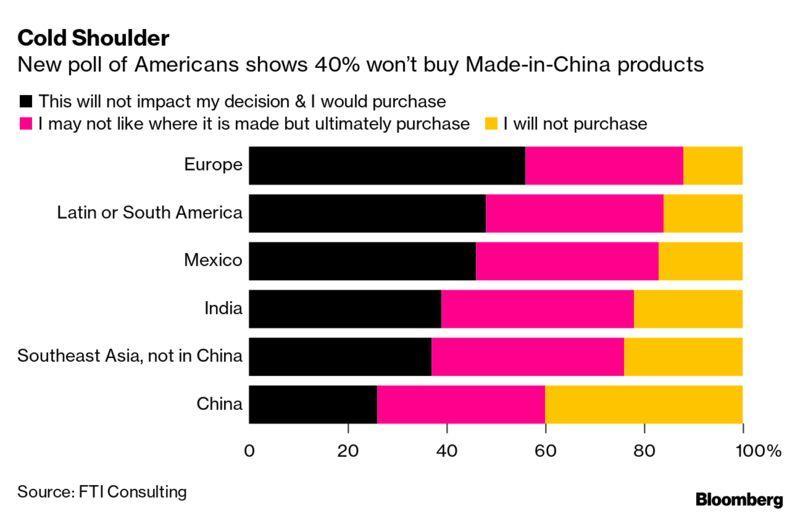

… while 40% won’t buy Made in China products.

AS a result, both Trump and Joe Biden will “compete to blast out the toughest anti-China rhetoric”, which bodes badly for those in the optimist camp.

Separately, as Bloomberg notes, Vital Knowledge founder Adam Crisafulli writes that Trump’s most likely move may be an “equalization in the Hong Kong/China economic relationship,” with the same tariffs and terms in place with China now applying to Hong Kong, instead of current preferential policies.

Crisafulli adds that markets would probably tolerate that, as it’s been speculated about in media reports, but broad sanctions against individuals or entities “would be a larger issue and not something the SPX could easily dismiss,” nor sweeping sanctions as a result of Uighur human rights abuses.

Disrupting the Phase One trade agreement, which frankly no longer exists now that China is actively seeking to buy soy from Brazil in anticipation of a relapse in the trade war, is seen by Crisafulli as unlikely (for now) and would be seen as a “large negative.”

Meanwhile, Beijing retaliating – perhaps by publishing its unreliable entities list or expressing doubt about the Phase One trade deal – would also undermine markets.

Finally, it is worth reminding readers that as we wrote last night, even Marko Kolanovic said he “dialing down” his positive outlook on US equities, warning that “a complete breakdown of supply chains and international trade, primarily between the two largest economies (US and China), would justify equities trading drastically lower.”