“Are Markets Suffering A Moment Of Madness?”

Tyler Durden

Wed, 06/03/2020 – 17:00

Authored by Dana El Baltaji, Bloomberg macro/FX strategist

Are Markets Suffering A Moment Of Madness

It’s worth asking the question of whether markets have gone crazy, considering that U.S. stocks are up 40% from a low in March, the dollar is close to losing its 2020 gains, and emerging-market assets are in demand for no good reason – unless you’re a yield hunter.

Some market watchers point to excitement of finally being able to meet up with friends for drinks. But without a vaccine, we’re all at risk of a second wave of the virus, and the economic fallout of the lockdowns will probably reverberate for years to come.

Second-quarter earnings announcements are just around the corner, bankruptcies are on the rise, unemployment is astronomical, and banks are in for a world of pain. And the weakest links in Europe are entering their biggest tourist season on a hope and a prayer that families would be comfortable enough to put their kids on a flight for a much needed holiday (I probably won’t).

My colleague, Vassilis Karamanis, has warned that currencies are headed for a painful reality check, and this rally is the eye of the storm.

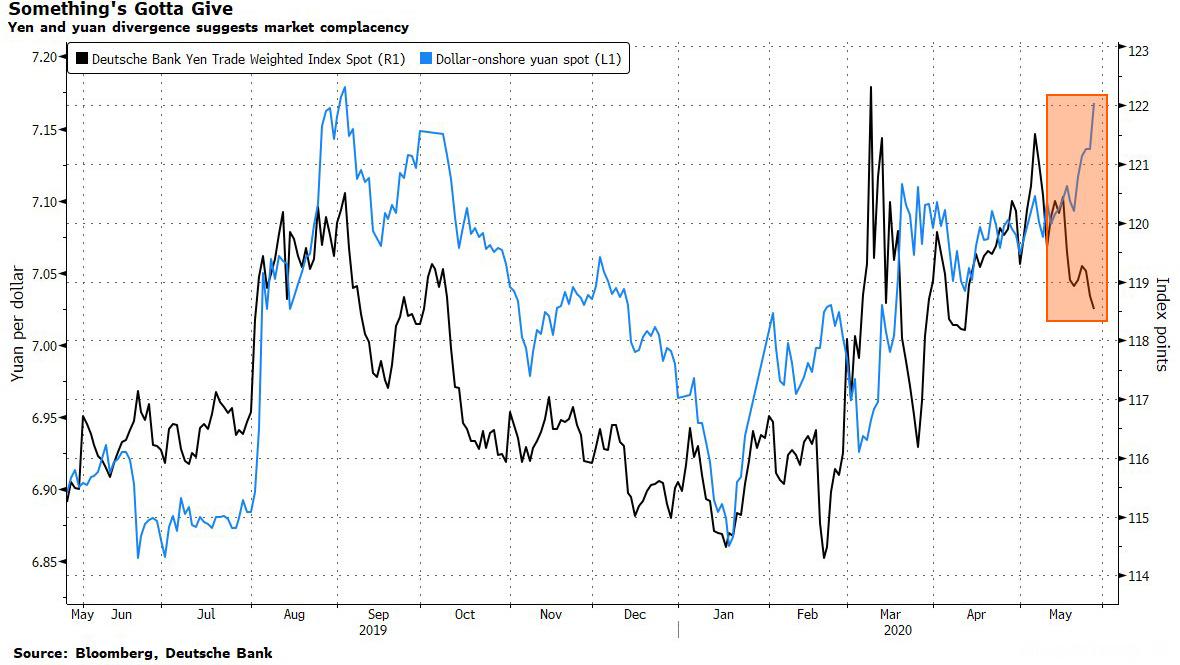

Investors have turned away from currency havens lately, in defiance of a plethora of risk-negative headlines. The chances are this combination of challenging news and sanguine market positioning won’t last. Even with China’s offshore yuan near a record low amid flaring tensions between the Washington and Beijing, the yen –a haven currency of choice– was lower versus most Group-of-10 peers.

And a divergence between the onshore yuan and the trade-weighted yen is only getting stronger, increasing the risk of a rally for the Japanese currency should a new Cold War become the market’s main focus.

They’re signs of complacency in some corners of the market. So is the Bloomberg Dollar Spot Index’s decline to a more than two-month low on Tuesday, mainly as lockdown restrictions eased and coronavirus infections showed no sign of a resurgence.

Frankly, the exuberance of even contemplating a V-shaped recovery is baffling. It all reminds me of a poem by Lewis Carroll titled The Mad Gardener’s Song:

He thought he saw an Argument

That proved he was the Pope

He looked again, and found it was

A Bar of Mottled Soap.

”A fact so dread,” he faintly said,

”Extinguishes all hope!”