Bill Dudley: “The Fed Is Basically Creating A Little Bit Of Moral Hazard”

Tyler Durden

Wed, 06/03/2020 – 11:25

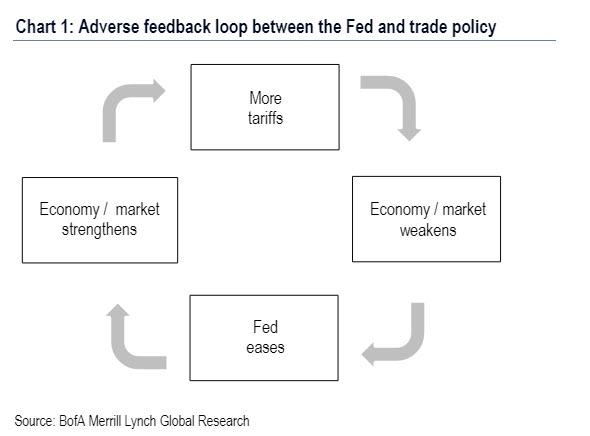

Last August, former NY Fed president Bill Dudley sparked outrage across both ideological camps when he published a Bloomberg op-ed in which he said the Fed should not only not get involved by providing stimulus during the then-raging trade war between the US and China but implicitly admitted that the it is Fed that decides who is – or isn’t – president, as it “could go much further” beyond merely warning, as Powell did, that the Fed’s tools are not suited to mitigating the damage from trade war, but “could state explicitly that the central bank won’t bail out an administration that keeps making bad choices on trade policy, making it abundantly clear that Trump will own the consequences of his actions.”

This was ironic for several reasons, the first of which is that it was Powell’s own justification for easing that enabled Trump to immediate escalate the trade war.

The second reason Dudley’s warning ended up being one giant farce is that just one month later the Fed launched “NOT QE” (which we now know was well and truly QE) to bail out various banks (mostly JPMorgan) and countless hedge funds that had gotten caught offside by the repo crisis.

In effect, Trump read the Dudley op-ed and flipped it on its head, forcing the Fed to engage in ever escalating stimulus to avoid undoing a decade of interventions which had put the central bank “all in” in preserving the fake market it had created in the aftermath of the financial crisis.

Which brings us to today when Dudley, realizing any Fed gambit of the kind he proposed would never again work, spoke on Bloomberg TV and confirmed what “conspiracy websites” have been saying for the past decade, namely that the Fed’s actions could have the “unintended consequence of encouraging more risky behavior.”

“People who have high-yield debt that’s outstanding, a lot of times that’s happened by choice,” he told Bloomberg Television. “So for the Federal Reserve to intervene and support those asset prices, is basically creating a little bit of moral hazard in the sense you’re encouraging people to take on more debt.”

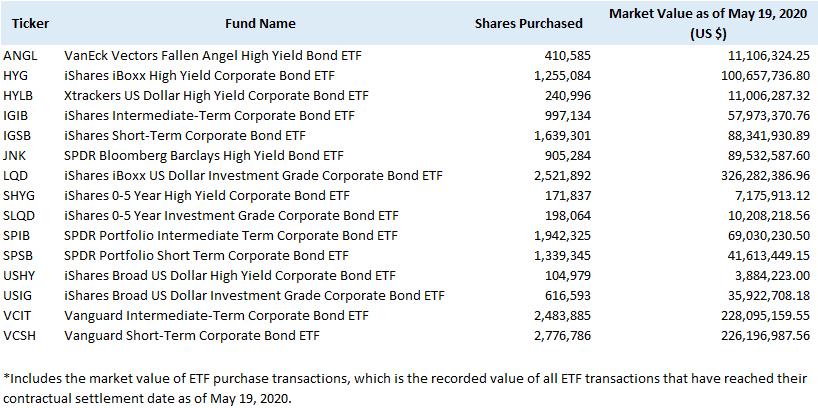

Dudley was referring to the following chart which was published by the Fed last week, and which shows which corporate bond ETFs, among them junk bond focused ones, the Fed has been – and will be – purchasing.

Realizing that by saying so he opened a can of worms that will be used at the next Congressional dog and pony show featuring Chair Powell, Dudley, who stepped down from the New York Fed in 2018, said the Fed’s intention was not to bail out individual borrowers, but ensure “that people actually can access that market and raise high-yield debt. And I think they’ve been quite successful in those efforts.’”

Here we will make some corrections to Dudley’s comment, who until last year was best known for espousing the lack of inflation by highlighting how cheap iPads are: the Fed is creating, not “basically”, an unlimited amount, not “a little bit” of moral hazard, which is why retail investors are now flooding into stocks, comfortable that even if there is another crash the Fed will always bail them out.

Commenting on this, Bloomberg macro commentator Richard Breslow this morning said that “as a fan of Fed Chairman Jerome Powell, I still found it unnerving to hear him say last week that “We felt called to do what we could do.” They are meant to fulfill the dual mandate. And, yes, keep the financial system functional. But God’s work is more appropriately left to others. It’s good, at least, that he said they had crossed many “red lines.” It’s going back over them that will be the hard part.”

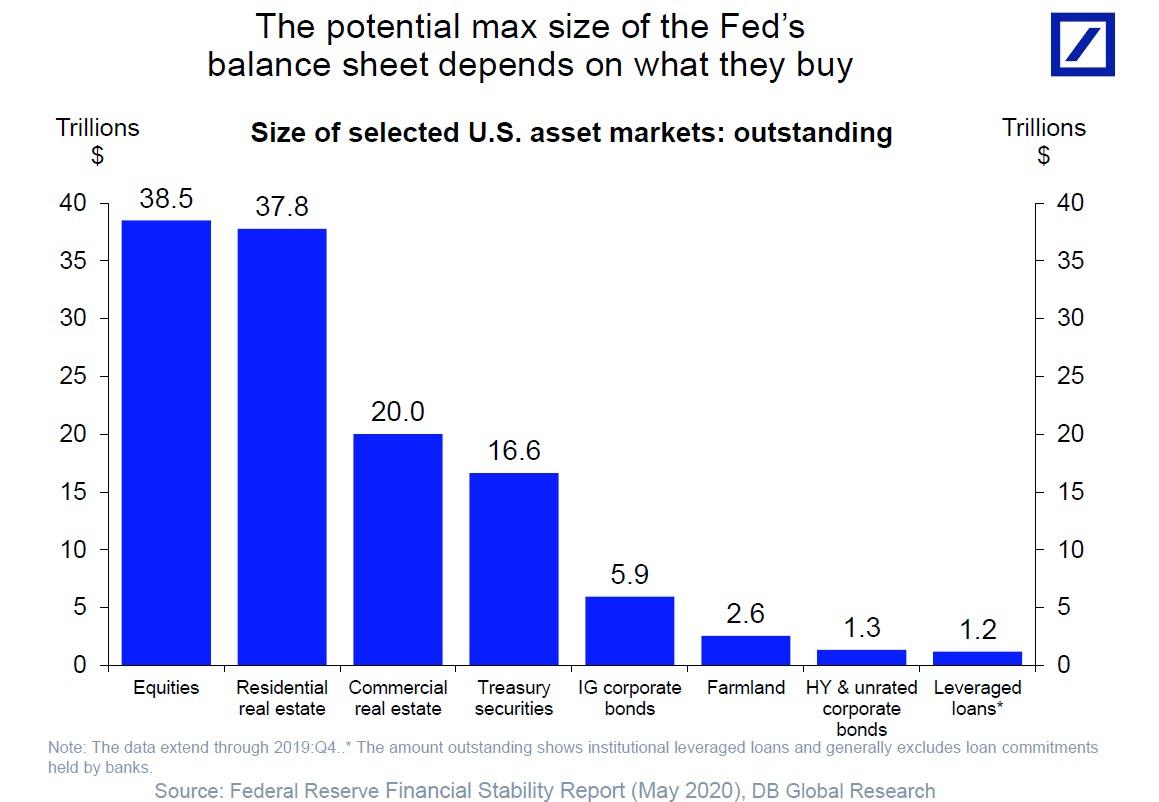

Alas, now that moral hazard is not only institutionalized, but officially admitted as Bill Dudley has now done, not only will the Fed never go back on the “red lines” but it will continue trampling them until the Fed’s ownership of assets start approaching the chart from Deutsche Bank which last month “playfully” asked just how big the Fed’s balance sheet could become.

Finally, some thoughts on this from Rabobank’s Michael Every:

Meanwhile, back in the home of the real Hollywood, nationwide street protests show few signs of abating – and markets keep going up and risk remains on. There are two equally-depressing conclusions here:

1) We no longer have actual markets due to central-bank elevation of moral hazard to the foundational pillar of financial capitalism;

2) We still have markets, but they find the idea of the US military operating on the streets to quell popular unrest to be reassuring – just as it would be in a banana republic where the asset holders are traditionally happy to do ‘whatever it takes’ to keep the peasants in line.

And while the jury is still out on the latter, we just had confirmation on the former by none other than the former head of the most important regional Fed.